Do Goldcorp’s Earnings Estimates Reflect Analysts’ Increasing Optimism?

Goldcorp (GG) has given negative returns in 2017. Its stock has lost 6.1% of its value as compared to a gain of 12.8% in the iShares Gold Trust (GLD) and 11.1% in the VanEck Vectors Gold Miners ETF (GDX).

Nov. 20 2020, Updated 1:57 p.m. ET

Factors impacting Goldcorp’s estimates

Goldcorp (GG) has given negative returns in 2017. Its stock has lost 6.1% of its value as compared to a gain of 12.8% in the iShares Gold Trust (GLD) and 11.1% in the VanEck Vectors Gold Miners ETF (GDX). After the arrival of the new CEO, the company reset its projections, which were below market expectations. Secondly, operational issues at several of its mines led to the stock’s underperformance in 2017. The outlook for 2018 and beyond, however, seems to be brighter. You can read These Factors Could Help Goldcorp Outperform Peers in 2018. The management announced a five-year plan in 2017 to create value for the company by improving its production, reserves, and unit costs by 20%. These moves could drive the company’s stock going forward.

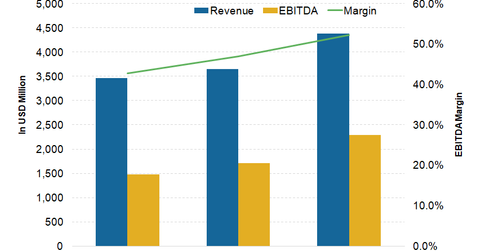

Analysts’ revenue estimates

Analysts are projecting revenues of $3.5 billion for Goldcorp in 2017, implying a decline of 1.2% year-over-year (or YoY). The company has guided for 13% lower production YoY in 2017 at the midpoint. Analysts are projecting growth of 5.2% and 20.1% YoY in GG’s revenues for 2018 and 2019, respectively. These increases are mainly attributable to the company’s growth projects, which should be up and running in the medium term.

Earnings estimates

Despite the expectation of a decline in revenues for Goldcorp for 2017, analysts are projecting higher EBITDA (earnings before interest, tax, depreciation, and amortization) margins of 42.7% compared with 30.0% for 2016.

As Goldcorp’s production base increases, its costs are expected to fall, which is the driving force behind analysts’ expectations of higher margin estimates for the company for 2018 and 2019. The margins are expected to improve to 46.9% and 52.3%, respectively. Goldcorp aspires to achieve all-in sustaining costs of $700 per ounce over the next five years compared to $850 per ounce in 2017.

Peers (SGDM) Agnico Eagle Mines (AEM), Newmont Mining (NEM), and Barrick Gold (ABX) have also shown better-than-expected cost controls.