A Look at Recent Analyst Ratings for Kinross Gold

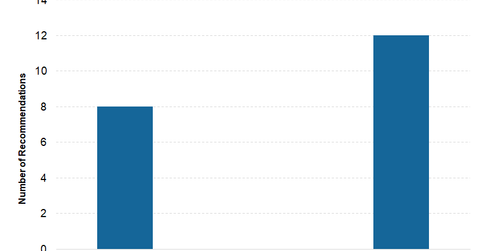

None of the analysts covering Kinross Gold (KGC) recommended a “sell” rating on the stock. 40% of them have “buy” ratings, while 60% suggest a “hold” for the stock.

Jan. 15 2018, Updated 7:31 a.m. ET

Analysts’ recommendations

None of the analysts covering Kinross Gold (KGC) recommended a “sell” rating on the stock. 40% of them have “buy” ratings, while 60% suggest a “hold” on the stock. The ratings for the stock haven’t changed much in recent months. Its target price of $5.3 suggests a potential upside of 16.8% based on its current market price.

In 2017, Kinross significantly outperformed its peers (GDX) (JNUG). While it returned 39% in 2017, Newmont Mining (NEM), Agnico Eagle Mines (AEM), and Barrick Gold (ABX) returned 10.1%, 10.0%, and -9.4%, respectively. Kinross’s outperformance was on the back of its solid operating performance in 2017.

Recent rating changes

BMO Capital Markets set a target price of $5 for Kinross’s stock on December 19, 2017. The firm currently has a “buy” rating on the stock.

On November 10, 2017, Macquarie upgraded Kinross’s stock from “neutral” to “outperform.” Macquarie analyst Michael Siperco upgraded the stock to reflect its improving operations, an organic growth pipeline, and increased mergers and acquisitions.

Citigroup (C) also upgraded KGC from “sell” to “hold” on September 1, 2017, and lifted its target price from $3.25 to $4.75. Citi’s view is that amid the geopolitical tensions, gold prices could remain supported in the range of $1,260–$1,360 per ounce with an upward bias for the remainder of 3Q17.