Citigroup Inc

Latest Citigroup Inc News and Updates

What Goldman Sachs Thinks about Bank of America

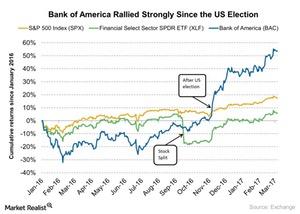

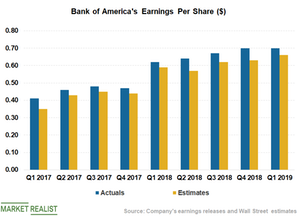

Bank of America (BAC) is currently trading at $25.26. Its 52-week high is $25.80 and 52-week low is $12.05.

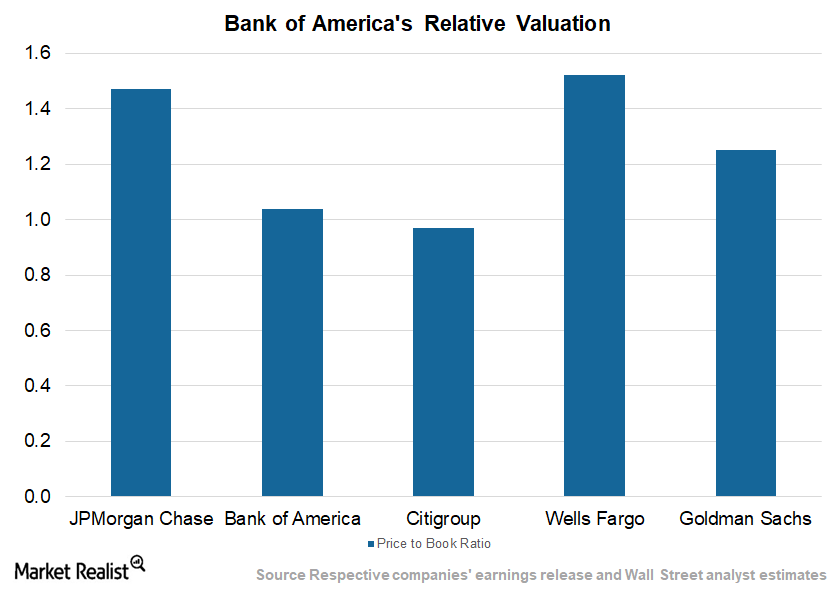

Why JPMorgan and Wells Fargo Are Trading at High Multiples

In spite of a rather weak performance, Wells Fargo (WFC) commands the highest premium due to its strong franchise, mortgage concentration, and high net interest margins.

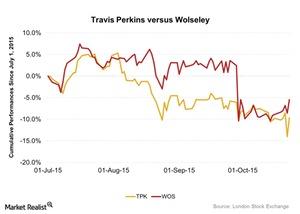

Travis Perkins Rebounded, Led EWU by 5.09%

Travis Perkins was at the top of the iShares MSCI United Kingdom ETF on October 23, 2015, as analysts showed positivity toward the construction industry.

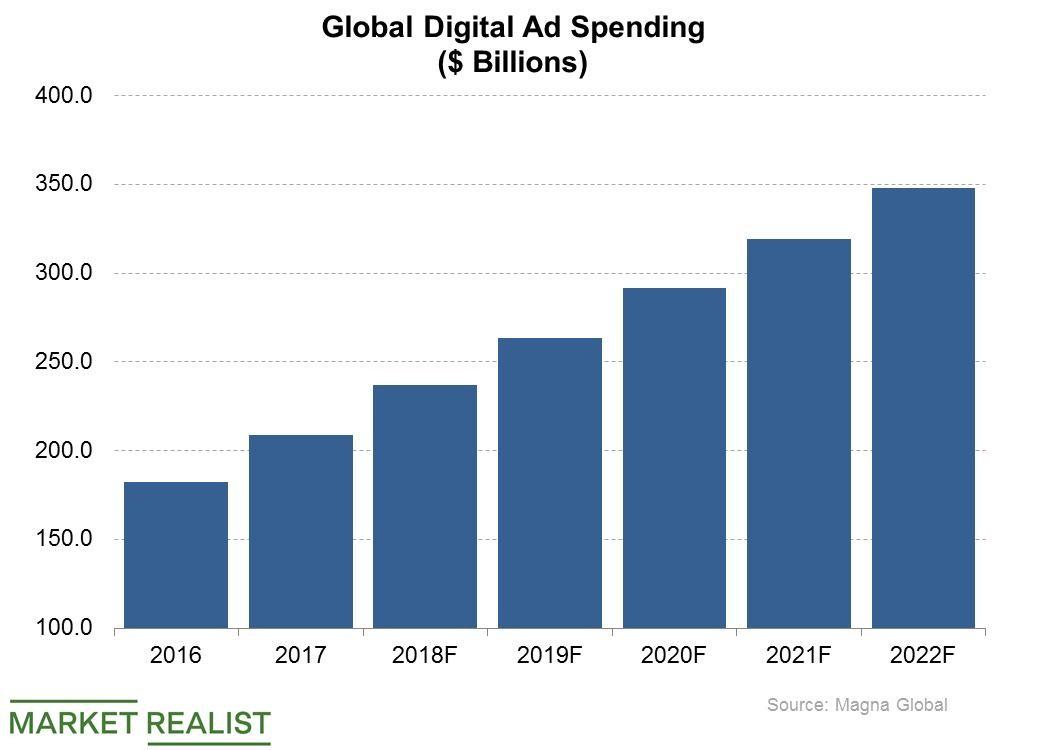

Why Facebook Has Been in Talks with Banks Lately

According to Reuters, Facebook (FB) is currently in discussions with banks about improving customer service through its apps.Financials Why Wells Fargo leads in loans

The bank has always focused on its bread and butter revenue-earning stream: loans. Over the years, Wells Fargo slowly realized its goal of achieving a strong market share in lending.

What Do Analysts Recommend for JPMorgan Chase and Wells Fargo?

In a Bloomberg survey of 37 analysts, 19 analysts (51%) have assigned a “buy” rating to Wells Fargo (WFC) while 13 (35%) have rated it as “hold.” The stock currently has five “sell” ratings.Financials Moore Capital lowers its stakes in JPMorgan Chase

JPMorgan’s latest 2Q14 results beat estimates. Meanwhile, net income was down to $6 billion from $6.5 billion in 2Q13. The earnings per share (or EPS) was $1.46, compared to $1.60 in 2Q13.

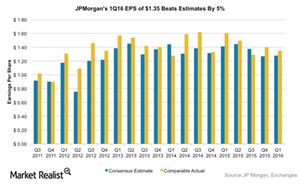

JPMorgan Chase Gained 4% after Its 1Q16 Earnings: Was It That Good?

On April 13, JPMorgan Chase reported 1Q16 earnings of $1.35 per share. It beat consensus estimates of $1.28. Its shares rallied 4.2% after the earnings beat.

US Banking Sector: Key Trends and Outlook

Changes in technology have reshaped the banking sector. Banks are increasingly collaborating with fintech firms to improve their customer service.

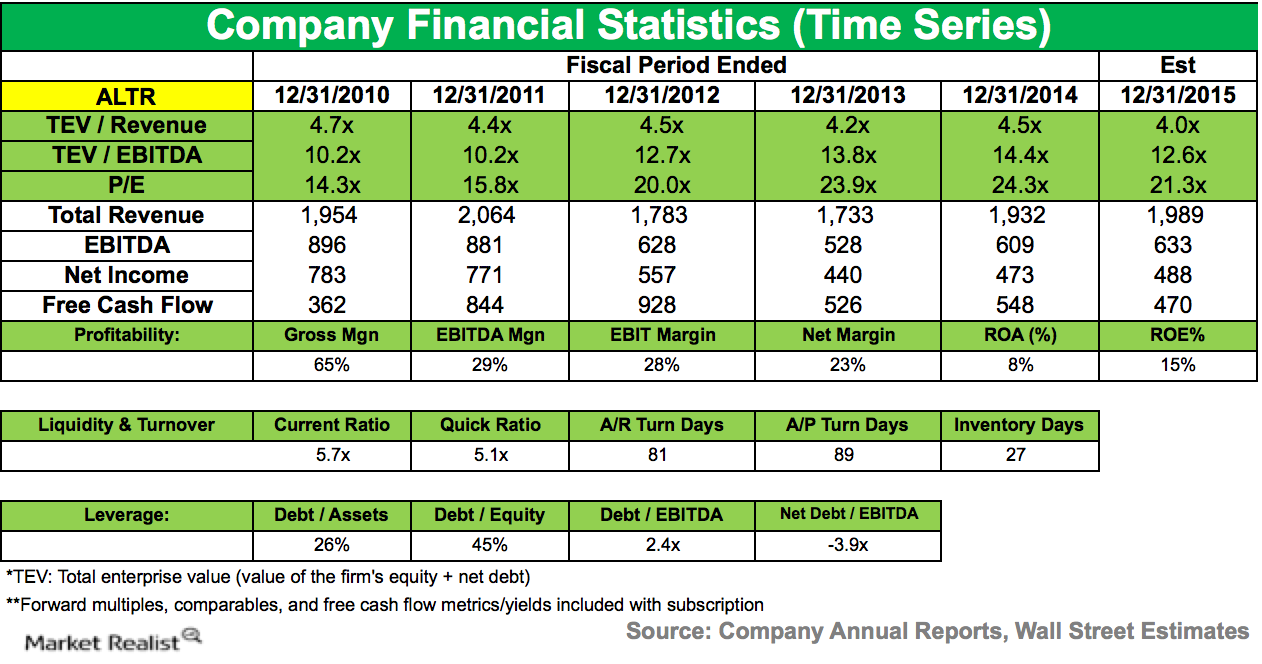

Citadel Advisors Starts a New Position in Altera Corporation

During 4Q14, Citadel Advisors started a new position in Altera Corporation (ALTR).Financials Must-know: Is Wells Fargo making boring attractive for investors?

Wells Fargo’s (WFC) broad operation level strategy over the long run can be described by two words—slow and steady. It doesn’t take many risks. It’s stable and boring.

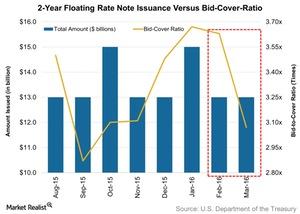

Why Overall Demand Tanked for 2-Year Floating-Rate Notes

Overall, $13 billion worth of floating-rate notes were auctioned, the same as in February’s auction.

Morgan Stanley and Goldman have bigger bond exposure than Bank of America and Citi

Bond underwriting exposure could be risky for investment banking departments, as interest rates begin to rise and refinancing slows.Financials Why low funding cost is an advantage for Wells Fargo

If a bank is able to keep its cost of deposits low, it will have a competitive advantage. Wells Fargo has the lowest cost of deposits among its peers—despite having a very high deposit base.Financials Why Wells Fargo focuses on non-interest income

Wells Fargo wants to maintain a balance between its interest income from loans and non-interest income. Non-interest income accounts for nearly 49% of Wells Fargo’s revenues.Financials Why cross-selling is part of Wells Fargo’s strategy

Wells Fargo’s (WFC) first, and possibly the most important, operational strategy is focusing on cross-selling. It’s the most important pillar of its operational strategy.

Get Real: Breaking Down and Bouncing Back

In this morning’s edition of Get Real, we saw that WeWork’s layoffs are taking a toll. Meanwhile, the cannabis industry could be bouncing back.Financials Why Wells Fargo uses human resources as a strategic tool

Wells Fargo (WFC) believes that people are a competitive advantage source. Integrating sound human resource practices lies at the core of Wells Fargo’s strategy.

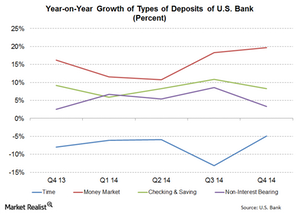

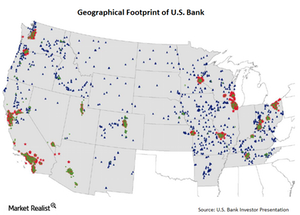

Low-cost deposit growth is a key strength for U.S. Bank

U.S. Bank does well in increasing its low-cost deposit base. In 4Q14, money market deposits grew the fastest at 19.7%—compared to 4Q13.

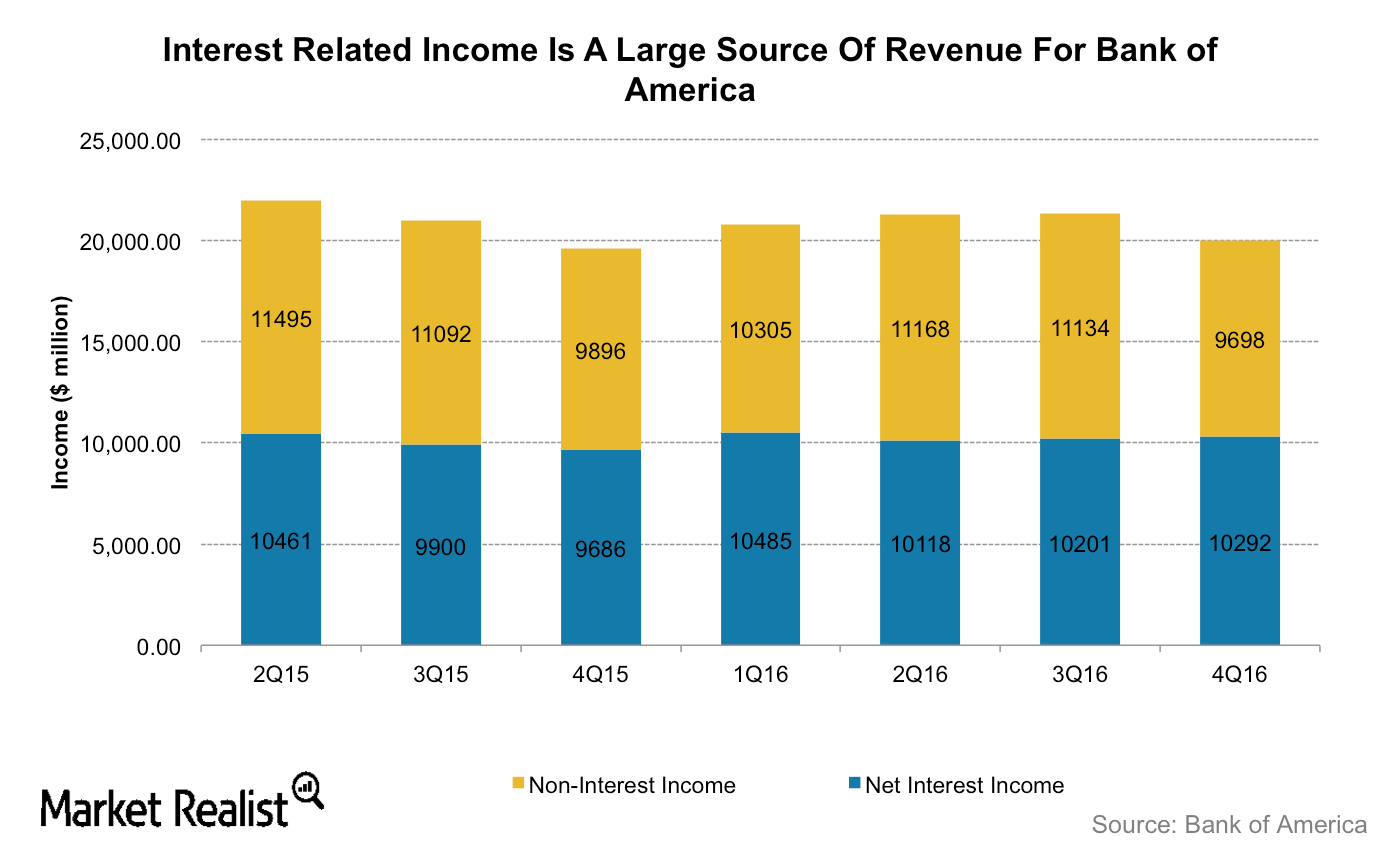

Bank of America and Wells Fargo: Comparing Interest Rate Exposure

Since Donald Trump’s presidential victory, Wall Street analysts have raised their forecasts for the major banks’ (XLF) net interest margins as they anticipate rising interest rates and economic growth.

Is It Pointless to Look at Big Banks’ Q1 Earnings?

JPMorgan Chase will announce its first-quarter results before the markets open on April 14. Analysts expect the bank to post revenues of $29.7 billion.

Goldman Sachs’ Best Stock Picks for 2020

Strategists at Goldman Sachs (GS) project Netflix (NFLX), T-Mobile (TMUS), and Coca-Cola (KO) to be among the best stock picks for 2020.

Ray Dalio, the Role of Credit, and the Economic Machine

Credit is the most important part of the economy, leading to increased spending, increased income levels, higher GDP, and faster productivity growth.

Get Real: Tesla Bears and the ‘Tariff Man’

The Dow Jones Index needs a Santa Claus rally this year. Instead, the Dow Jones might have to contend with the “Tariff Man.”

Citigroup globally established in emerging markets

Citigroup’s exposure in emerging markets is mainly to investment-grade global multinationals through its institutional businesses.

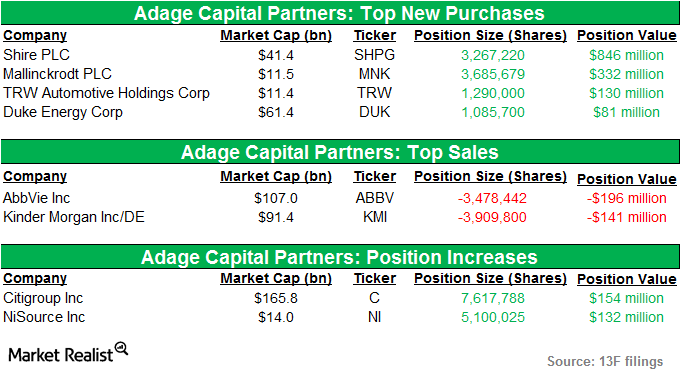

A key overview of Adage Capital’s holdings in 3Q14

Adage Capital’s US long portfolio grew from $38.69 billion in 2Q14 to $40.2 billion in 3Q14. The portfolio comprised around 699 stocks.Financials How close is the FOMC to achieving its dual mandate?

We’ve talked about the dual mandate and factors constraining the Federal Reserve from achieving this mandate. Let’s now assess how close the Fed has come to achieving its macroeconomic objectives.

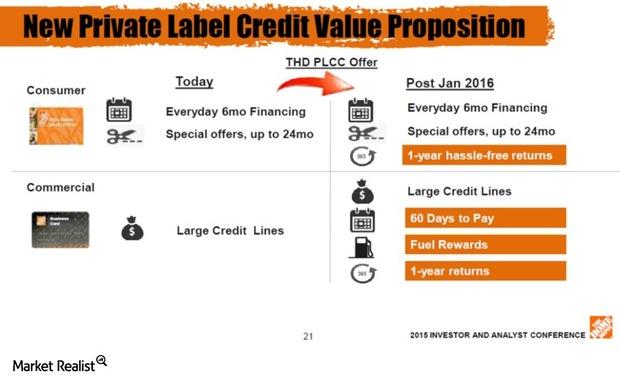

How Home Depot Drives Membership Loyalty With Pro Customers

The Home Depot’s (HD) focus on the pro customer allows the retailer to compete in the installations market and the product demand the services create.

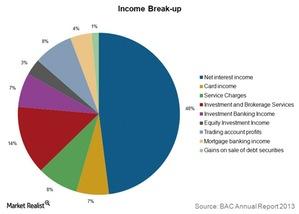

How does Bank of America make money?

Net interest income contributes about half of Bank of America’s total income. Investment and brokerage services contribute the most to noninterest income.

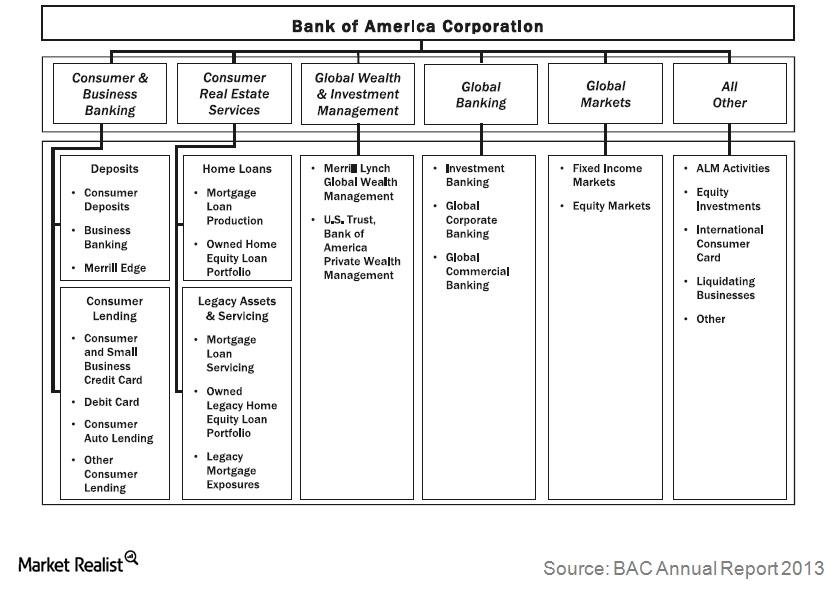

Bank of America’s six operating segments

Bank of America operates through five major segments. Its Consumer and Business Banking segment contributes a third of the bank’s total revenues.

Bank of America: The second-largest US banking operation

Bank of America Corporation’s (BAC) banking operations are the second-largest in the United States by assets.

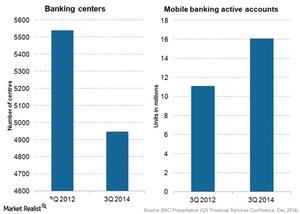

Why consumer banking is important for Bank of America

Consumer and Business Banking is Bank of America Corporation’s (BAC) largest segment. It contributes about a third of the bank’s total revenues.

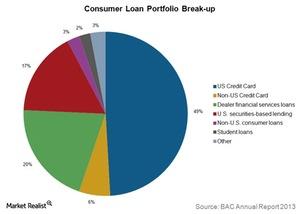

Card loans rule Bank of America’s consumer loan portfolio

Credit card loans account for more than half of Bank of America’s total consumer loan portfolio.

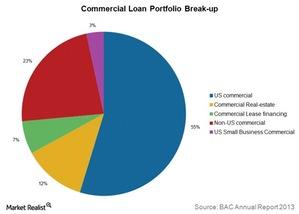

Why Bank of America’s commercial loan portfolio is diversified

In addition to assessing the credit profile of the borrower, Bank of America ensures that loans aren’t too concentrated by industry, geography, or customer.

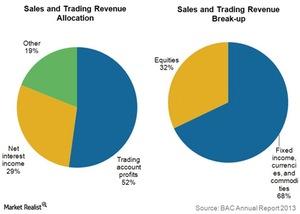

Bank of America’s Global Markets operations

Bank of America’s (BAC) Global Markets segment offers sales and trading services across asset classes to institutional clients.

A brief overview of U.S. Bank

We’ll provide an overview of U.S. Bank. It’s the fifth largest retail bank in the US—by deposits and assets. At the end of September 2014, it held $391 billion in assets.

Get Real: Big Tech Companies Dominate

In today’s Get Real, we saw updates on big tech companies’ latest happenings. Plus, more earnings results, projections, and expectations.Financials Richard Fisher explains why excess reserves can create velocity

Richard Fisher also discussed the impact of quantitative easing (or QE) on excess reserve balances held by depository institutions at his speech at the London School of Economics on Monday, March 24.

Bank of America Stock: Analysts Are Upbeat

Most of the analysts covering Bank of America stock recommend a “buy.” On Tuesday, Atlantic Equities upgraded the stock to “overweight” from “neutral.”

Adobe, Workday, and ServiceNow Fall Due to Downgrades

Adobe (ADBE), Workday (WDAY), and ServiceNow shares have lost significant market value in early-market trading today. Adobe stock has fallen close to 4%.

Get Real: Misunderstood and Undervalued?

In today’s Get Real, we focused on Bill Ackman’s Berkshire Hathaway comments, Mexico’s major cannabis milestone, earnings season, and much more.

An Overview of the US Banking Sector

The banking sector plays a pivotal role in our daily lives. This series explores the sector, its driving factors, and its key indicators and latest trends.

Investors’ Obsession with Yield Curve Inversion

You’ve likely heard about it in the financial press recently: this ominous, notorious thing called the “yield curve inversion.”

Kudlow Doesn’t See a Recession, Trump Might Fear One

White House economic advisor Larry Kudlow doesn’t see a looming recession. However, recession fears grew as the yield curve inverted last week.

JPMorgan and BofA: Don’t Buy the Market Dip Just Yet

JPMorgan Chase suggests waiting until September before returning to stocks. The markets will likely make new all-time highs in the first half of 2020.

Bank of America Posts Mixed Q2 Results Amid Rate Cut Concerns

On Wednesday, Bank of America (BAC) reported mixed second-quarter results. The bank’s profitability beat analysts’ expectation.

Bank of America’s Asset Quality, Efficiency, and Earnings

Bank of America’s (BAC) credit quality across its consumer and commercial portfolios remained stable at the end of the first quarter.

Which Senior Gold Miners Are Analysts Loving Lately and Why?

In this series, we’ll consider recommendations, target prices, estimates, and potential upsides and downsides for senior gold miners.

Bank of America Stock: Analyzing the Uptrend

Bank of America (BAC) has impressed investors with its financial performance. We expect Bank of America to sustain the momentum in 2019.

Can IBM’s Blockchain Retain Its Market Share?

According to a report by the IDC, total spending on the blockchain platform is expected to climb by 122% to $2.1 billion.