Bank of America’s Asset Quality, Efficiency, and Earnings

Bank of America’s (BAC) credit quality across its consumer and commercial portfolios remained stable at the end of the first quarter.

April 17 2019, Published 9:58 a.m. ET

Asset quality

Bank of America’s (BAC) credit quality across its consumer and commercial portfolios remained stable at the end of the first quarter. The net charge-offs increased slightly to $0.99 billion due to higher losses in the consumer credit card portfolio. However, the net charge-off ratio stayed low at 0.43% at the end of the first quarter. The ratio increased by four and three basis points on a sequential and YoY (year-over-year) basis, respectively.

Bank of America’s provision for credit losses increased by $0.18 billion to $1.0 billion. However, non-performing assets decreased by $1.5 billion to $5.1 billion, which reflected an improvement in the consumer portfolio.

Improved efficiency

Bank of America’s efficiency ratio improved by 250 basis points to 57% in the first quarter, which is impressive. The bank’s non-interest expenses decreased 4% to $13.2 billion, which reflected efficiency savings, lower amortization of intangibles, and decline in FDIC insurance costs.

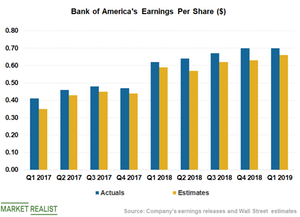

Earnings beat the expectations

Bank of America posted stronger-than-expected earnings in the first quarter. Higher interest rates, increased loans and deposits, and lower costs drove the bank’s bottom line. Meanwhile, share repurchases cushioned the earnings.

Bank of America posted an EPS of $0.70, which increased 13% on a YoY basis and beat analysts’ estimate of $0.66. In comparison, JPMorgan Chase (JPM), Citigroup (C), Wells Fargo (WFC), and Goldman Sachs (GS) posted better-than-expected EPS in the first quarter.