Wells Fargo & Co

Latest Wells Fargo & Co News and Updates

Wells Fargo Agrees to $300M Settlement in Investor Lawsuit

Wells Fargo has agreed to a $300 million settlement in a class action lawsuit that accused the bank of forcing unnecessary auto insurance on customers.

Wells Fargo Ordered to Pay $3.7 Billion for Consumer Protection Violations

On Dec. 20, Wells Fargo was ordered to pay a $3.7 billion settlement for the bank’s mismanagement of auto loans, mortgages, and deposit accounts.

N.Y. Judge Lifts Freeze on Wendy Williams' Wells Fargo Bank Accounts

A New York ruled in favor of lifting the freeze Wells Fargo put on Wendy Williams' bank accounts. A financial guardian has been assigned to help her manage her money.

Zelle Scams Target Wells Fargo, Banks Aren't Liable for Lost Money

Imaging losing money to a fraudulent attack, and your bank won't refund you any money. Why have Zelle scams been target Wells Fargo customers?

Wells Fargo Cuts Overdraft Fees After Settling a Class-Action Lawsuit

After settling a class-action lawsuit, Wells Fargo has decided to change its overdraft fee policy. Wells Fargo is a leading financial services company.

Wells Fargo Abandons Plans to Cancel Existing Personal Lines of Credit

After receiving pushback from customers, Wells Fargo has decided to abandon plans to cancel all existing personal lines of credit.

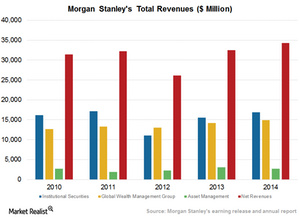

Morgan Stanley’s Strong Revenue Model

Morgan Stanley charges fixed fees and performance fees for asset management services, products and services, and administration of accounts.

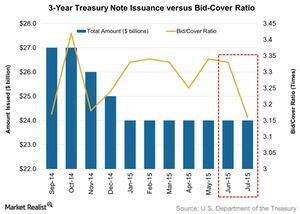

3-Year Treasury Notes’ Overall Demand Fell on July 7

The US Treasury holds monthly auctions of three-year Treasury notes. The latest auction was held on July 7.

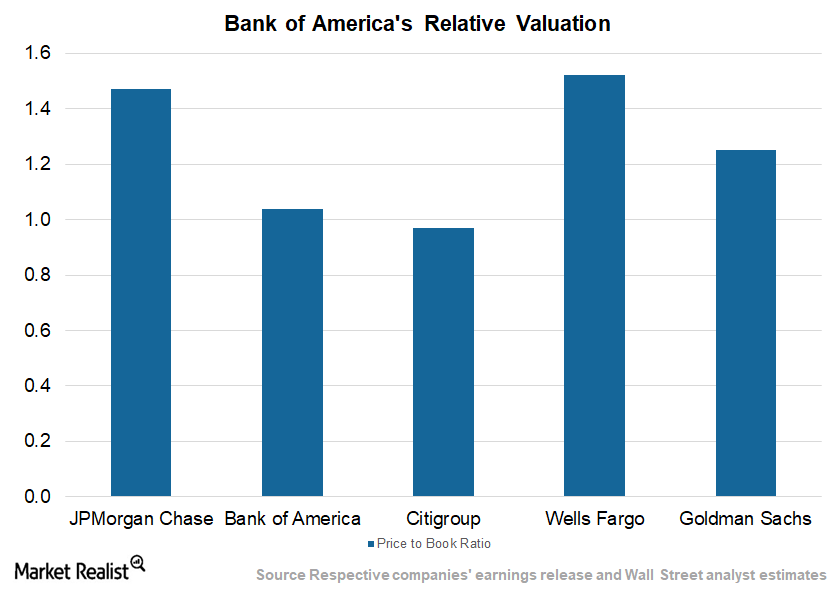

Why JPMorgan and Wells Fargo Are Trading at High Multiples

In spite of a rather weak performance, Wells Fargo (WFC) commands the highest premium due to its strong franchise, mortgage concentration, and high net interest margins.Financials Why Wells Fargo leads in loans

The bank has always focused on its bread and butter revenue-earning stream: loans. Over the years, Wells Fargo slowly realized its goal of achieving a strong market share in lending.

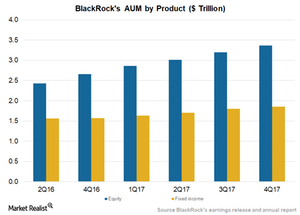

Interest Rate Expectations Have Jolted Equity and Debt Alike

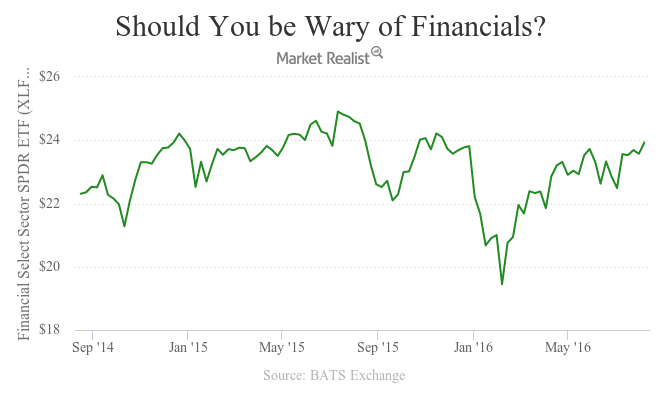

Asset managers (VFH) are seeking stability in order to attract funds toward either equity or debt offerings.

What Do Analysts Recommend for JPMorgan Chase and Wells Fargo?

In a Bloomberg survey of 37 analysts, 19 analysts (51%) have assigned a “buy” rating to Wells Fargo (WFC) while 13 (35%) have rated it as “hold.” The stock currently has five “sell” ratings.

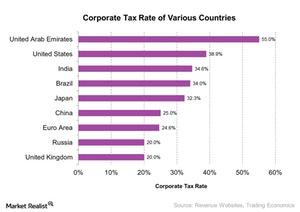

Why Buffett Believes US Businesses Aren’t Really Hurting from the US Corporate Tax

The US economy has been improving gradually, but some businesses in the US have suffered a lot over the years.

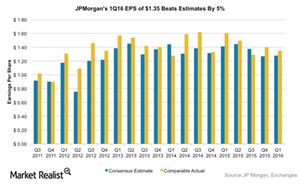

JPMorgan Chase Gained 4% after Its 1Q16 Earnings: Was It That Good?

On April 13, JPMorgan Chase reported 1Q16 earnings of $1.35 per share. It beat consensus estimates of $1.28. Its shares rallied 4.2% after the earnings beat.

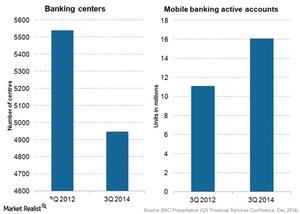

US Banking Sector: Key Trends and Outlook

Changes in technology have reshaped the banking sector. Banks are increasingly collaborating with fintech firms to improve their customer service.Financials Why Wells Fargo has the highest net interest margin

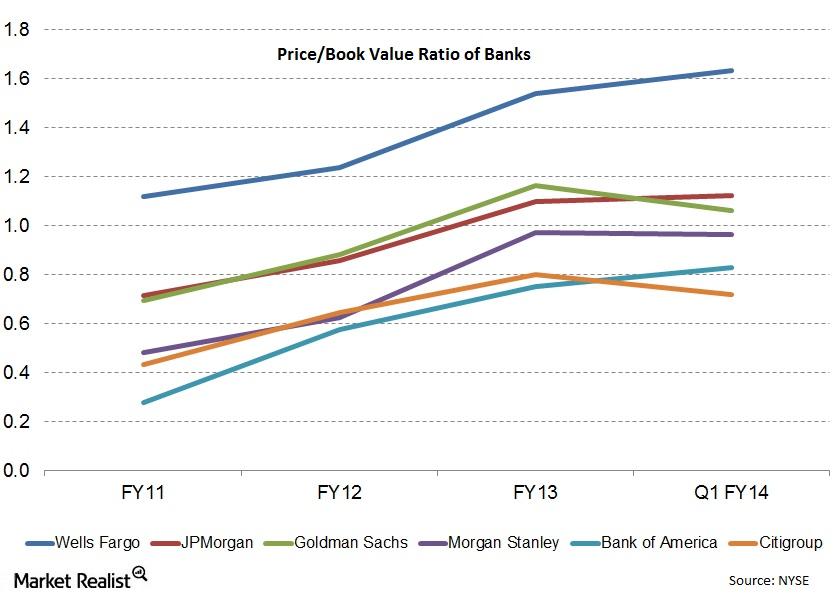

Maintaining a high net interest margin has always been part of Wells Fargo’s (WFC) strategy. Wells Fargo has consistently been better than the industry’s average net interest margin.Financials Must-know: Putting the price–to-book value ratio in perspective

We explored the most commonly used valuation metric for financial companies—the price-book value. We also understood the relation between price-book value and return on equity.

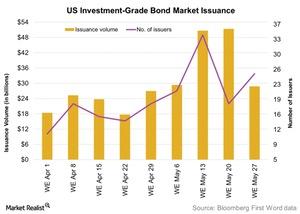

Investment-Grade Corporate Bonds’ Issuance Fell Last Week

Investment-grade corporate bonds worth $28.8 billion were issued in the primary market in the week to May 27, 2016.

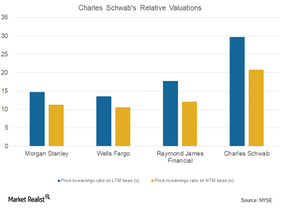

What’s Charles Schwab’s Valuation?

Charles Schwab (SCHW) has a price-to-earnings ratio of 20.80x on an NTM (next-12-month) basis.

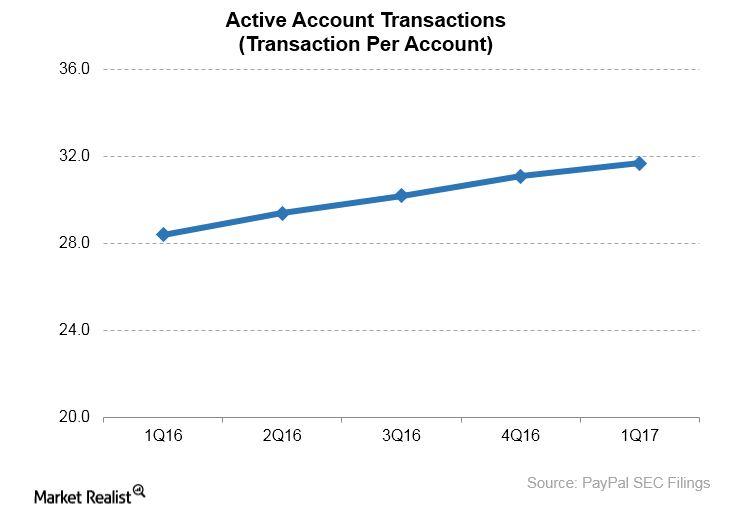

Understanding PayPal’s Choice Transition

PayPal reported that its payment transaction per active account increased 12.0% year-over-year in 1Q17.Financials Must-know: Is Wells Fargo making boring attractive for investors?

Wells Fargo’s (WFC) broad operation level strategy over the long run can be described by two words—slow and steady. It doesn’t take many risks. It’s stable and boring.Financials Why low funding cost is an advantage for Wells Fargo

If a bank is able to keep its cost of deposits low, it will have a competitive advantage. Wells Fargo has the lowest cost of deposits among its peers—despite having a very high deposit base.Financials Why Wells Fargo focuses on non-interest income

Wells Fargo wants to maintain a balance between its interest income from loans and non-interest income. Non-interest income accounts for nearly 49% of Wells Fargo’s revenues.Financials Why cross-selling is part of Wells Fargo’s strategy

Wells Fargo’s (WFC) first, and possibly the most important, operational strategy is focusing on cross-selling. It’s the most important pillar of its operational strategy.

Understanding Banks’ Market and Reputational Risks

All banks face risks. Two key areas to understand are banks’ market risk and reputational risk. Here’s a summary of each type.

Which Sectors to Avoid if Inflation Rises

Telecom services and utilities, the traditional dividend stars, have provided a fillip to US equities in 2016.

Understanding a Bank’s Operational and Business Risks

Banks experience operational risk in all daily bank activities, such as a check incorrectly cleared or a wrong order punched into a trading terminal.Financials Why Wells Fargo uses human resources as a strategic tool

Wells Fargo (WFC) believes that people are a competitive advantage source. Integrating sound human resource practices lies at the core of Wells Fargo’s strategy.

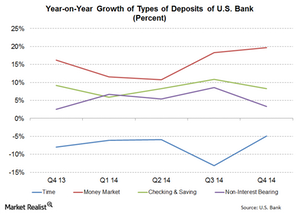

Low-cost deposit growth is a key strength for U.S. Bank

U.S. Bank does well in increasing its low-cost deposit base. In 4Q14, money market deposits grew the fastest at 19.7%—compared to 4Q13.

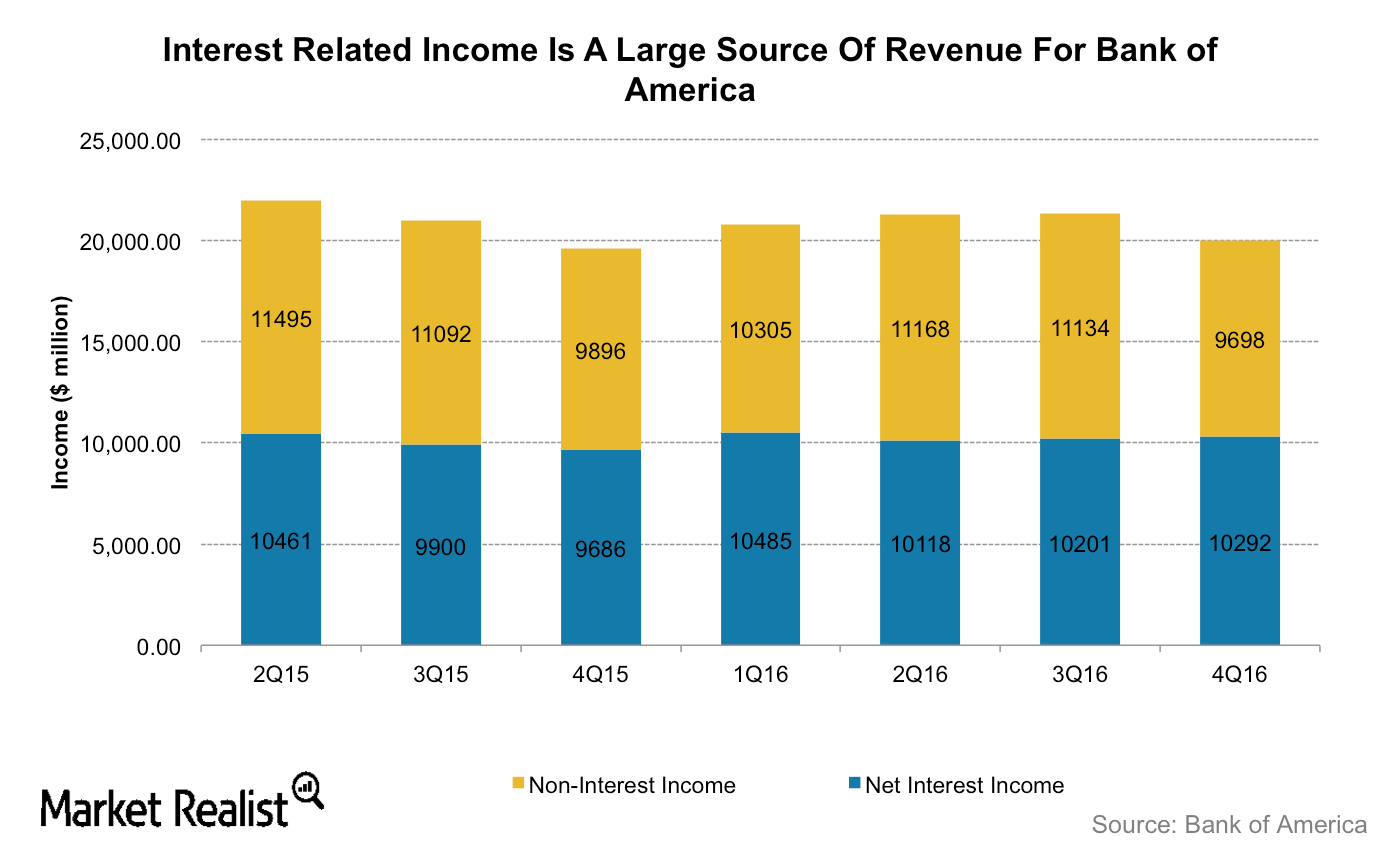

Bank of America and Wells Fargo: Comparing Interest Rate Exposure

Since Donald Trump’s presidential victory, Wall Street analysts have raised their forecasts for the major banks’ (XLF) net interest margins as they anticipate rising interest rates and economic growth.

Is It Pointless to Look at Big Banks’ Q1 Earnings?

JPMorgan Chase will announce its first-quarter results before the markets open on April 14. Analysts expect the bank to post revenues of $29.7 billion.

Ray Dalio, the Role of Credit, and the Economic Machine

Credit is the most important part of the economy, leading to increased spending, increased income levels, higher GDP, and faster productivity growth.

What Berkshire Hathaway Really Does, Says Buffett

Berkshire Hathaway is a huge conglomerate with diverse operations. The company’s operations are complex, so let’s take an easy-to-understand approach.

Citigroup globally established in emerging markets

Citigroup’s exposure in emerging markets is mainly to investment-grade global multinationals through its institutional businesses.

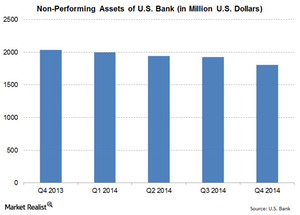

U.S. Bank’s non-performing assets declined in 4Q14

U.S. Bank’s (USB) non-performing assets were $1,808 million at the end of 4Q14. The ratio declined by 11.24%—compared to 4Q13.

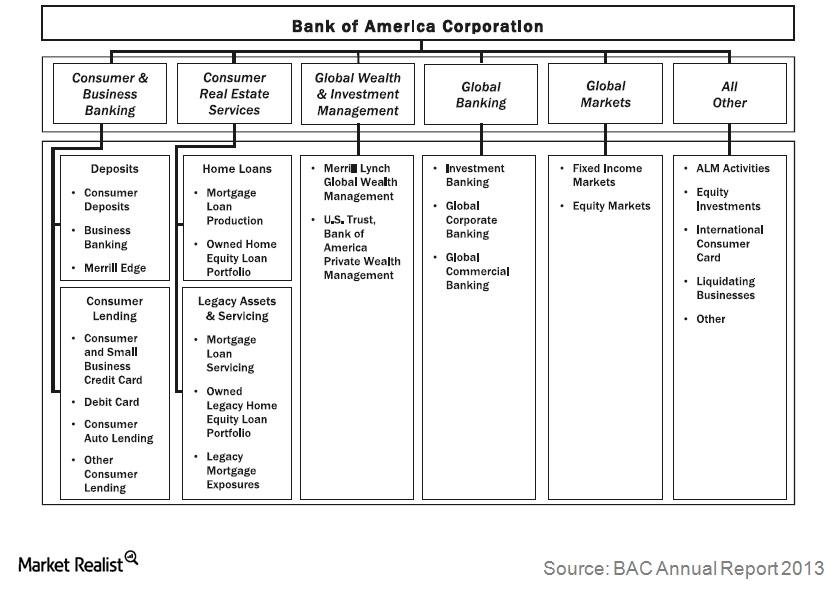

Bank of America’s six operating segments

Bank of America operates through five major segments. Its Consumer and Business Banking segment contributes a third of the bank’s total revenues.

Bank of America: The second-largest US banking operation

Bank of America Corporation’s (BAC) banking operations are the second-largest in the United States by assets.

Why consumer banking is important for Bank of America

Consumer and Business Banking is Bank of America Corporation’s (BAC) largest segment. It contributes about a third of the bank’s total revenues.

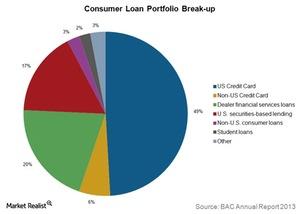

Card loans rule Bank of America’s consumer loan portfolio

Credit card loans account for more than half of Bank of America’s total consumer loan portfolio.

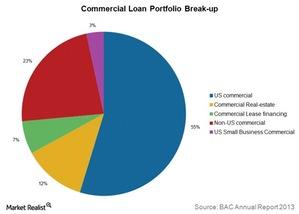

Why Bank of America’s commercial loan portfolio is diversified

In addition to assessing the credit profile of the borrower, Bank of America ensures that loans aren’t too concentrated by industry, geography, or customer.

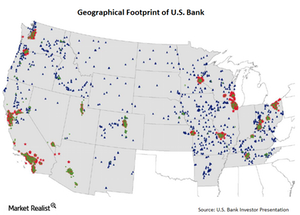

A brief overview of U.S. Bank

We’ll provide an overview of U.S. Bank. It’s the fifth largest retail bank in the US—by deposits and assets. At the end of September 2014, it held $391 billion in assets.

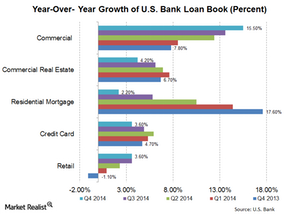

Why U.S. Bank’s loan growth showed interesting trends

You need to understand loan categories better in order to see some very interesting trends in U.S. Bank’s loan growth. Its loans are divided into five main categories.Financials Richard Fisher explains why excess reserves can create velocity

Richard Fisher also discussed the impact of quantitative easing (or QE) on excess reserve balances held by depository institutions at his speech at the London School of Economics on Monday, March 24.Financials Issuers like Wells Fargo and Verizon take advantage of low yields

Major deals included debt issues by Wells Fargo (WFC), Baidu, AT&T, and Verizon (VZ).

Why the price-to-book value ratio’s the most used valuation

The price-book value ratio is the ratio of the market value of equity to the book value of equity. Price stands for the current market price of a stock. Book value is the total assets minus liabilities, or net worth, which is the accounting measure of shareholders’ equity in the balance sheet.

Must-Know: Credit and Liquidity Risks in Banking

The top risks that every bank faces are credit risk and liquidity risk. We’ll look at the banks that managed this risk safely, and those that didn’t.

Bank of America Stock: Analysts Are Upbeat

Most of the analysts covering Bank of America stock recommend a “buy.” On Tuesday, Atlantic Equities upgraded the stock to “overweight” from “neutral.”

Verizon and Wells Fargo Are Getting on the Blockchain

Verizon (VZ) and Wells Fargo (WFC) are taking steps to integrate blockchain technology into their business models. Here’s why.

An Overview of the US Banking Sector

The banking sector plays a pivotal role in our daily lives. This series explores the sector, its driving factors, and its key indicators and latest trends.

Bank of America Posts Mixed Q2 Results Amid Rate Cut Concerns

On Wednesday, Bank of America (BAC) reported mixed second-quarter results. The bank’s profitability beat analysts’ expectation.