JPMorgan Chase Gained 4% after Its 1Q16 Earnings: Was It That Good?

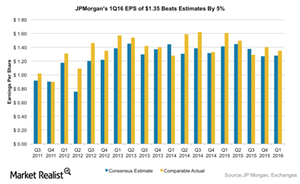

On April 13, JPMorgan Chase reported 1Q16 earnings of $1.35 per share. It beat consensus estimates of $1.28. Its shares rallied 4.2% after the earnings beat.

Dec. 4 2020, Updated 10:43 a.m. ET

EPS of $1.35 beat consensus estimates

On April 13, JPMorgan Chase (JPM) reported 1Q16 earnings of $1.35 per share. It beat consensus estimates of $1.28. The company’s shares rallied 4.2% after the earnings beat.

On an adjusted basis, the company reported EPS (earnings per share) of $1.41. The revenues for the quarter were $24.1 billion—above consensus estimates of $23.9 billion. While the earnings beat the forecasts, they were still lower than 1Q15 at the top line and bottom line. Analysts call this a perfect example of “under promising but over delivering.” Last month, JPMorgan Chase expressed concerns regarding low client activity and volatility in financial markets hampering trading related revenue.

Management’s commentary

Jamie Dimon, JPMorgan Chase’s chairman and CEO, commented on the financial results. He said that “We delivered solid results this quarter with strong underlying drivers. The consumer businesses continue to grow loans and deposits impressively, attracting deposits faster than the industry. The U.S. consumer remains healthy and consumer credit trends are favorable.” He added that “While challenging markets impacted the industry, we maintained our leadership positions and market share in the Corporate & Investment Bank and Asset Management, reflecting the strength of our platform. Even in a challenging environment, clients continue to turn to us in the global markets and we saw positive net long-term asset flows in Asset Management.”

JPMorgan Chase is the first major bank to report its 1Q16 earnings. It has a weight of 8.1% in the Financial Select Sector SPDR ETF (XLF). Its peers such as Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C) will report their earnings this week.