JPMorgan Chase & Co

Latest JPMorgan Chase & Co News and Updates

JPMorgan CEO Jamie Dimon's Salary History — How He Climbed the Financial Ladder

Jamie Dimon’s salary history clearly shows why he's considered one of the richest CEOs in the U.S. Dimon joined the billionaires club in 2015.

Disney’s Credit Cards Offer Loyal Customers Some Great Perks

A Disney credit card can offer loyal customers exclusive perks and discounts. Is the credit card worth it?

Michael Cembalest: JPMorgan Asset Manager Talks Crypto

High-profile JPMorgan asset manager Michael Cembalest talks crypto. Here are his personal views, plus a peek into his net worth and more.

JPMorgan Ventures Into the Metaverse, Buys Land on Decentraland

The largest bank in the U.S. is venturing into the metaverse. JPMorgan is the first U.S. bank to purchase land in the metaverse to launch its financial suite.

Why Did JPMorgan Close Uniswap Founder Hayden Adams' Bank Accounts?

JPMorgan Chase closed Hayden Adams' bank accounts. He's the founder of Uniswap, which is the largest decentralized exchange (DEX). Why did the bank cancel his accounts?

JPMorgan Suing Tesla Over Stock Warrant Incident

JPMorgan has opened a lawsuit against Tesla over a stock warrant incident that resulted in Elon Musk being charged with securities fraud.

JPMorgan Chase Clients Can Invest in Crypto Now—Just Not Directly

JPMorgan Chase & Co., has announced that it will provide all wealth management clients access to invest in digital assets.

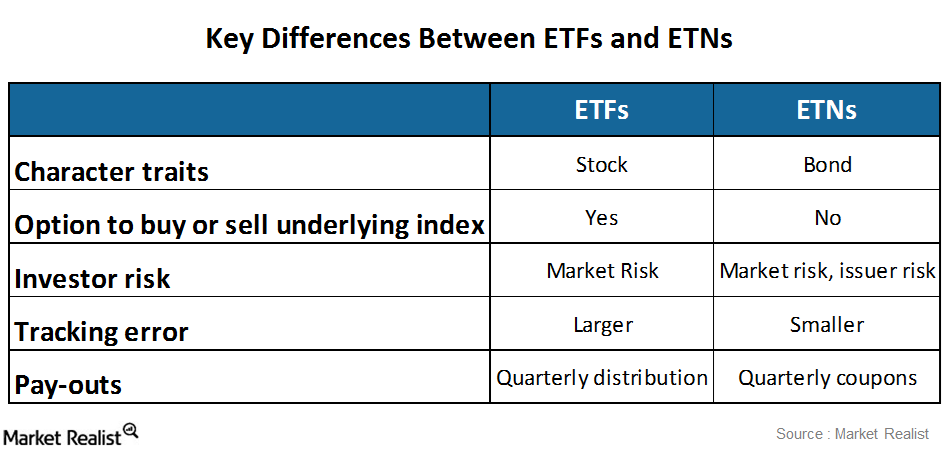

Comparison of exchange-traded funds and exchange-traded notes

ETFs (exchange-traded funds) have stock-like characteristics, while ETNs (exchange-traded notes) possess bond-like traits.

Does Jamie Dimon Still Think That Bitcoin Is a Fraud?

Jamie Dimon denies being the spokesperson for bitcoin critics, but he would fire JPMorgan Chase traders for touching bitcoin. What does Dimon think about bitcoin right now?

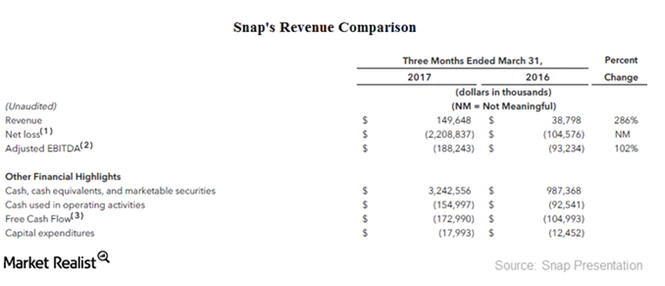

Here’s What Impacted Snap Shares Last Month

The stock for social media company Snap (SNAP) fell 16.0% last month to close at $17.77. It’s now trading just above its IPO price of $17.

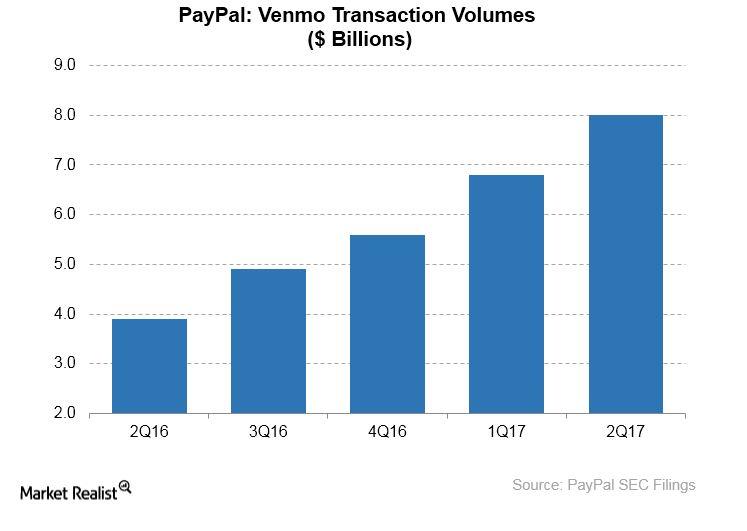

Why BTIG Is Bullish on PayPal

PayPal (PYPL) could have bright prospects despite the competitive threat it faces from Square and Apple in the online payment market, according to equity research firm BTIG.

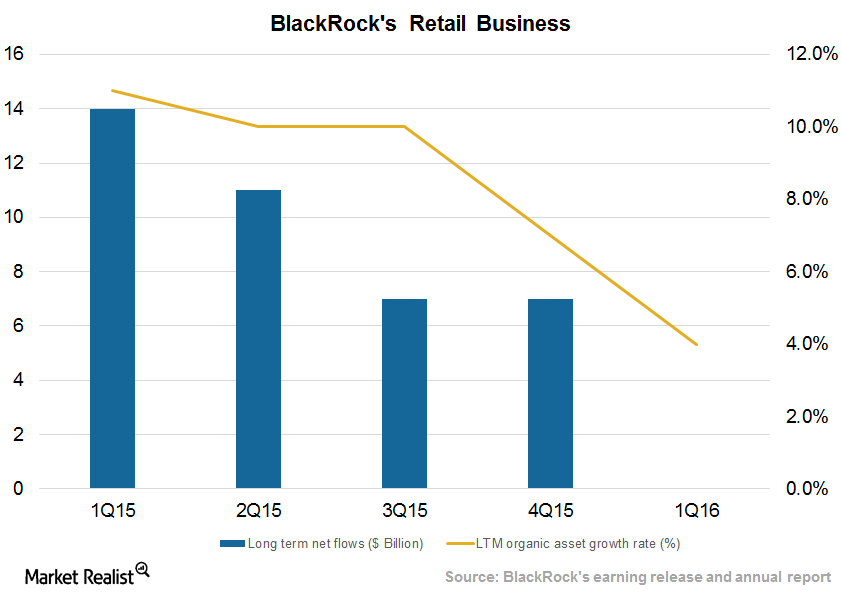

BlackRock’s Retail Continues to Attract New Clients across Classes

BlackRock’s (BLK) retail business had assets under management (or AUM) of $542 billion as of March 31, 2016.

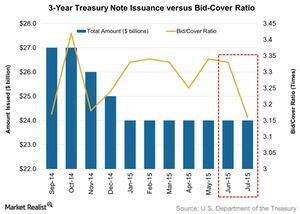

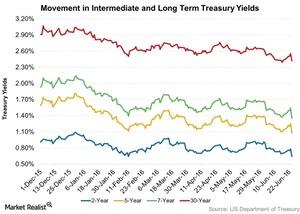

3-Year Treasury Notes’ Overall Demand Fell on July 7

The US Treasury holds monthly auctions of three-year Treasury notes. The latest auction was held on July 7.

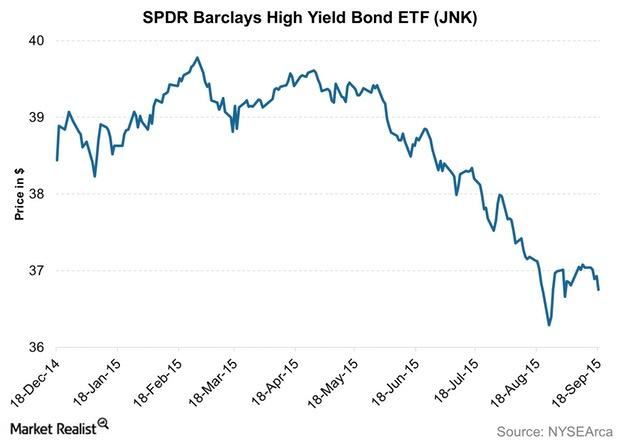

Lack of Rate Hike in September Leads US Stocks Down

The US Federal Reserve met on September 16 and 17 in one of the most anticipated monetary policy meetings in recent memory.

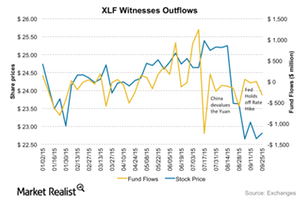

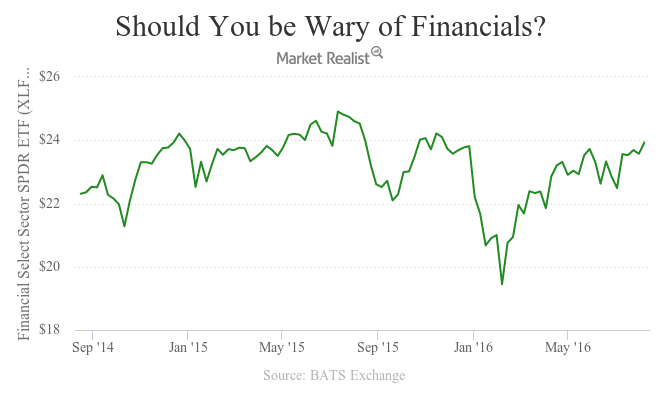

Fund Flows to XLF Have Been Declining

Exchange-traded fund investors added almost $552.6 million on average to the Financial Select Sector SPDR ETF (XLF) in the last quarter. During the week ending September 25, the ETF witnessed outflows of $318.3 million.

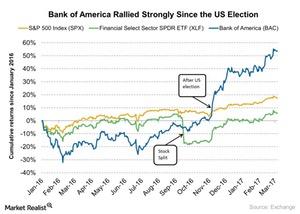

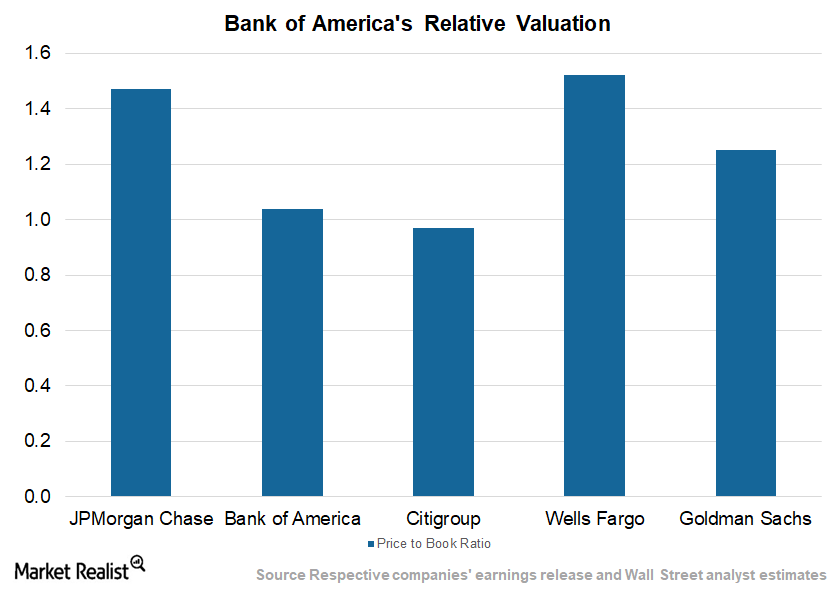

What Goldman Sachs Thinks about Bank of America

Bank of America (BAC) is currently trading at $25.26. Its 52-week high is $25.80 and 52-week low is $12.05.

Why JPMorgan and Wells Fargo Are Trading at High Multiples

In spite of a rather weak performance, Wells Fargo (WFC) commands the highest premium due to its strong franchise, mortgage concentration, and high net interest margins.

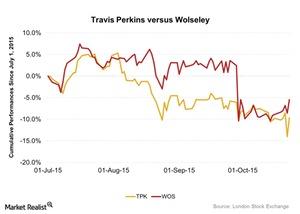

Travis Perkins Rebounded, Led EWU by 5.09%

Travis Perkins was at the top of the iShares MSCI United Kingdom ETF on October 23, 2015, as analysts showed positivity toward the construction industry.Financials Why Wells Fargo leads in loans

The bank has always focused on its bread and butter revenue-earning stream: loans. Over the years, Wells Fargo slowly realized its goal of achieving a strong market share in lending.

What Do Analysts Recommend for JPMorgan Chase and Wells Fargo?

In a Bloomberg survey of 37 analysts, 19 analysts (51%) have assigned a “buy” rating to Wells Fargo (WFC) while 13 (35%) have rated it as “hold.” The stock currently has five “sell” ratings.Financials Moore Capital lowers its stakes in JPMorgan Chase

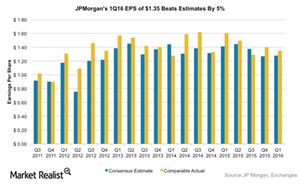

JPMorgan’s latest 2Q14 results beat estimates. Meanwhile, net income was down to $6 billion from $6.5 billion in 2Q13. The earnings per share (or EPS) was $1.46, compared to $1.60 in 2Q13.

JPMorgan Chase Gained 4% after Its 1Q16 Earnings: Was It That Good?

On April 13, JPMorgan Chase reported 1Q16 earnings of $1.35 per share. It beat consensus estimates of $1.28. Its shares rallied 4.2% after the earnings beat.

US Banking Sector: Key Trends and Outlook

Changes in technology have reshaped the banking sector. Banks are increasingly collaborating with fintech firms to improve their customer service.Financials Why Wells Fargo has the highest net interest margin

Maintaining a high net interest margin has always been part of Wells Fargo’s (WFC) strategy. Wells Fargo has consistently been better than the industry’s average net interest margin.Financials Must-know: Putting the price–to-book value ratio in perspective

We explored the most commonly used valuation metric for financial companies—the price-book value. We also understood the relation between price-book value and return on equity.

Dimensional Fund Advisors’ Major Holdings in Q3

Dimensional Fund Advisors’ top buys are Apple (AAPL), AT&T (T), Microsoft (MSFT), L3Harris Technologies (LHX), and Verizon Communications (VZ).Financials Must-know: Is Wells Fargo making boring attractive for investors?

Wells Fargo’s (WFC) broad operation level strategy over the long run can be described by two words—slow and steady. It doesn’t take many risks. It’s stable and boring.

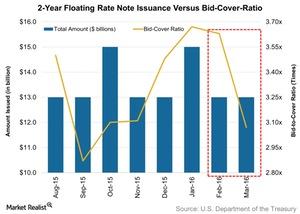

Why Overall Demand Tanked for 2-Year Floating-Rate Notes

Overall, $13 billion worth of floating-rate notes were auctioned, the same as in February’s auction.

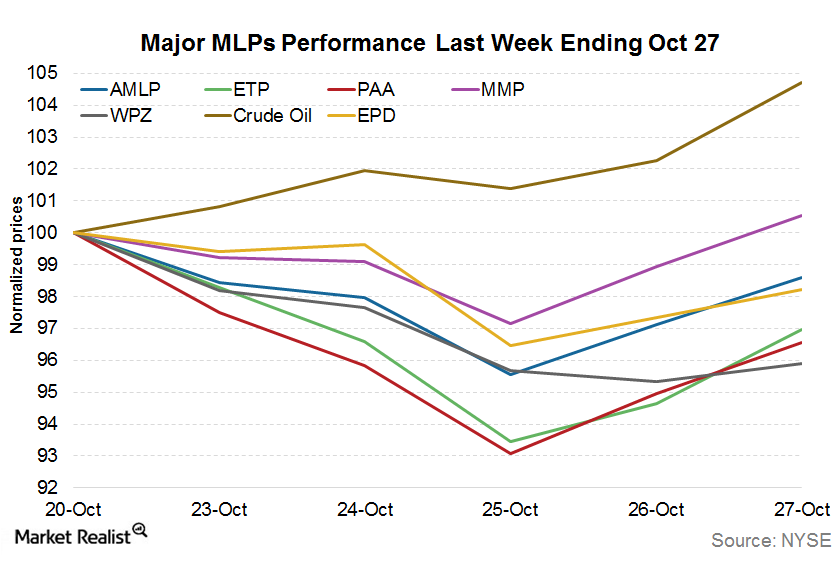

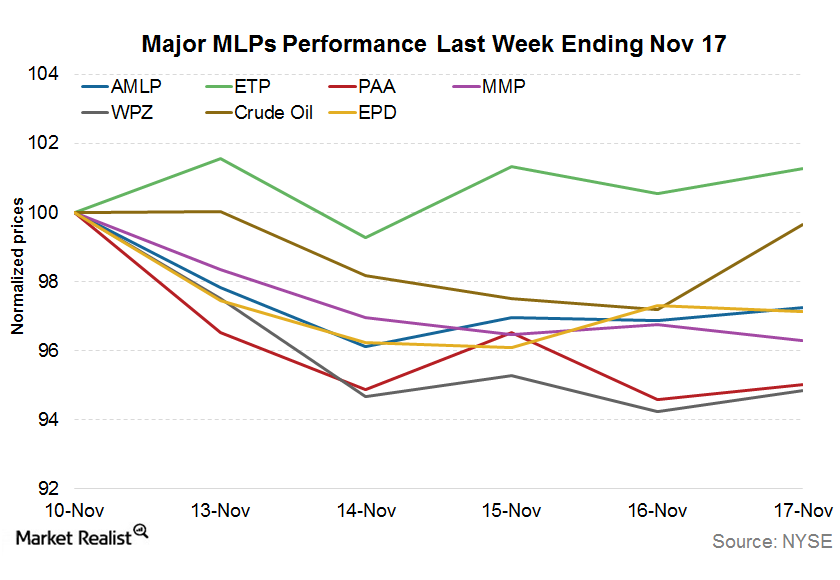

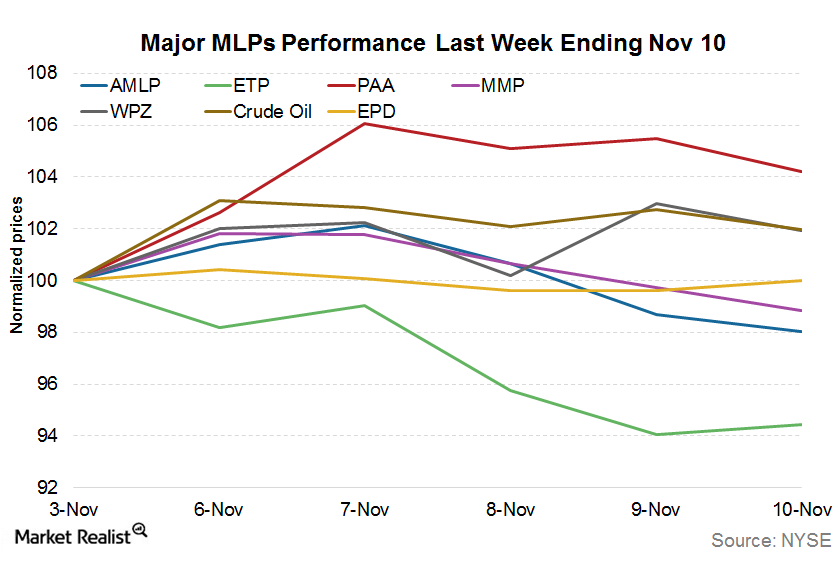

Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

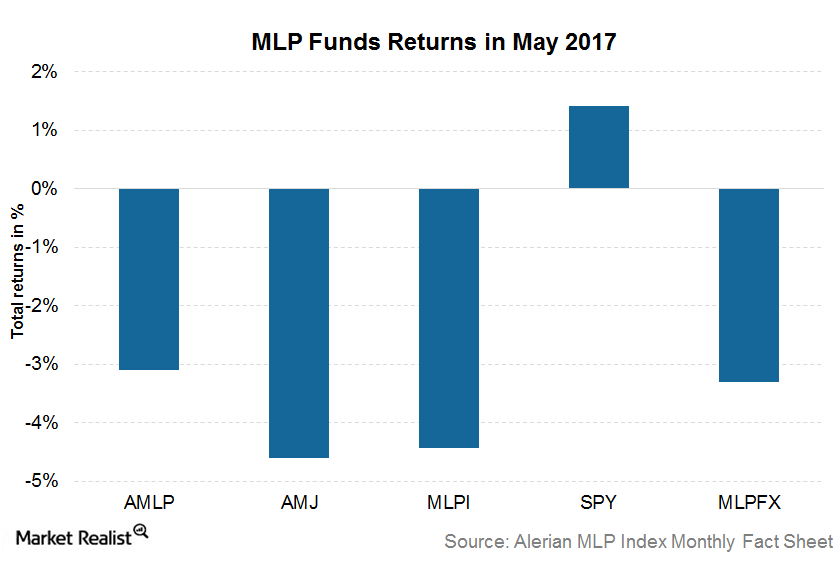

How MLP-Focused Funds Performed in May 2017

Among MLP funds, exchange-traded notes fell the most while the exchange-traded funds declined the least.

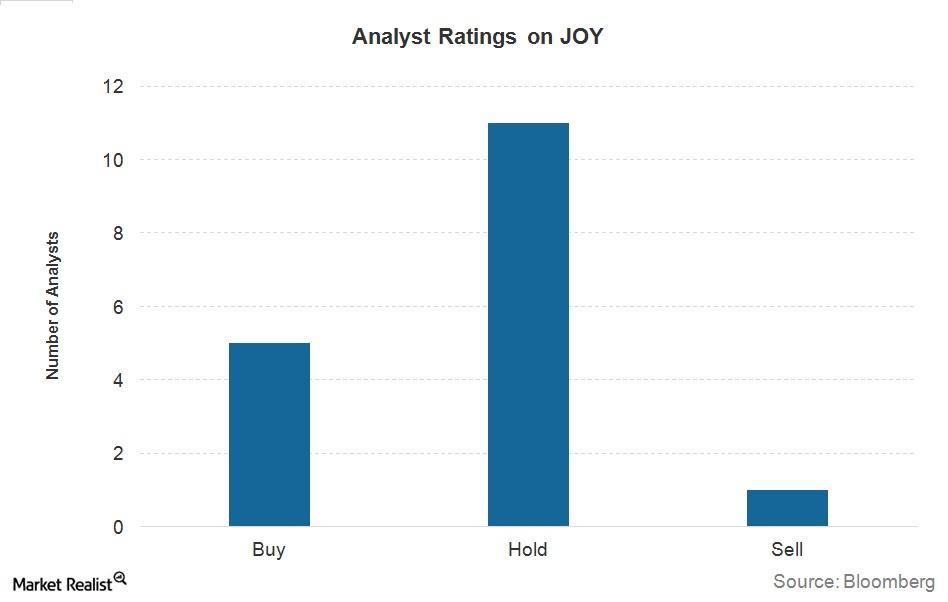

The Word on the Street: What Analysts Are Recommending for Joy Global Now

Of the 17 analysts surveyed by Bloomberg, only five issued “buy” recommendations for Joy Global, while 11 issued “holds,” and one issued a “sell.”

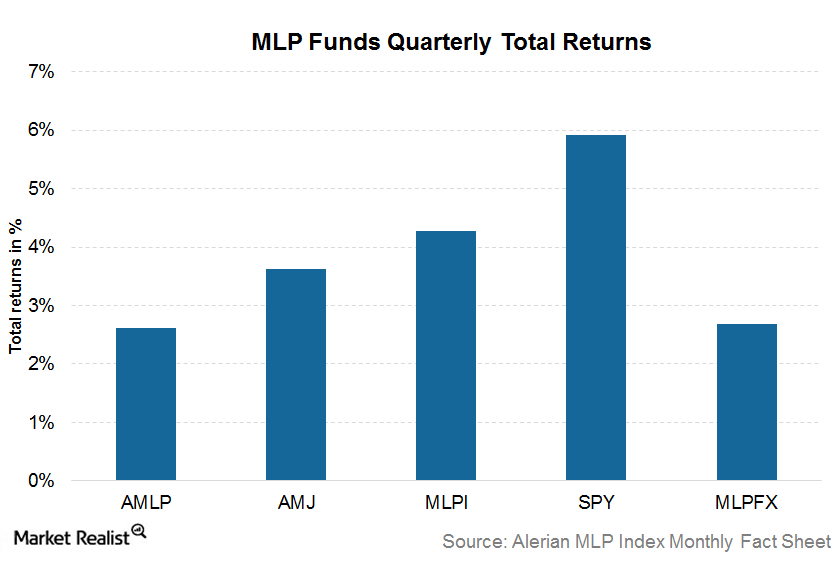

How MLP-Focused ETNs Performed in 1Q17

MLP-focused funds underperformed the SPDR S&P 500 ETF (SPY) in the recent quarter.

Morgan Stanley and Goldman have bigger bond exposure than Bank of America and Citi

Bond underwriting exposure could be risky for investment banking departments, as interest rates begin to rise and refinancing slows.

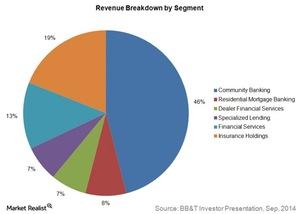

Analyzing BB&T Corporation’s 6 Operating Segments

BB&T Corporation’s (BBT) operations are divided into six business segments. Community Banking contributes 46% to the total revenue.

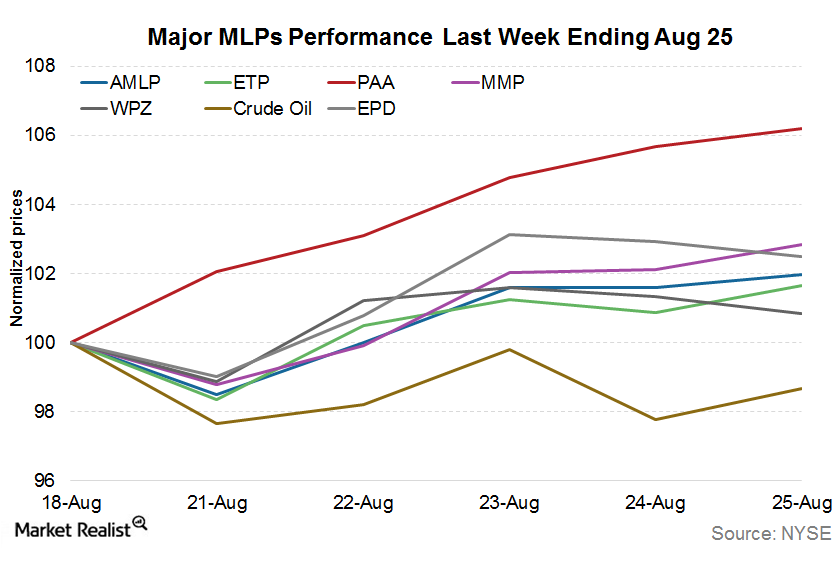

MLPs Recovered Slightly in the Week Ending August 25

MLPs recovered slightly in the week ending August 25—possibly due to an overcorrection in the first three weeks of the month.

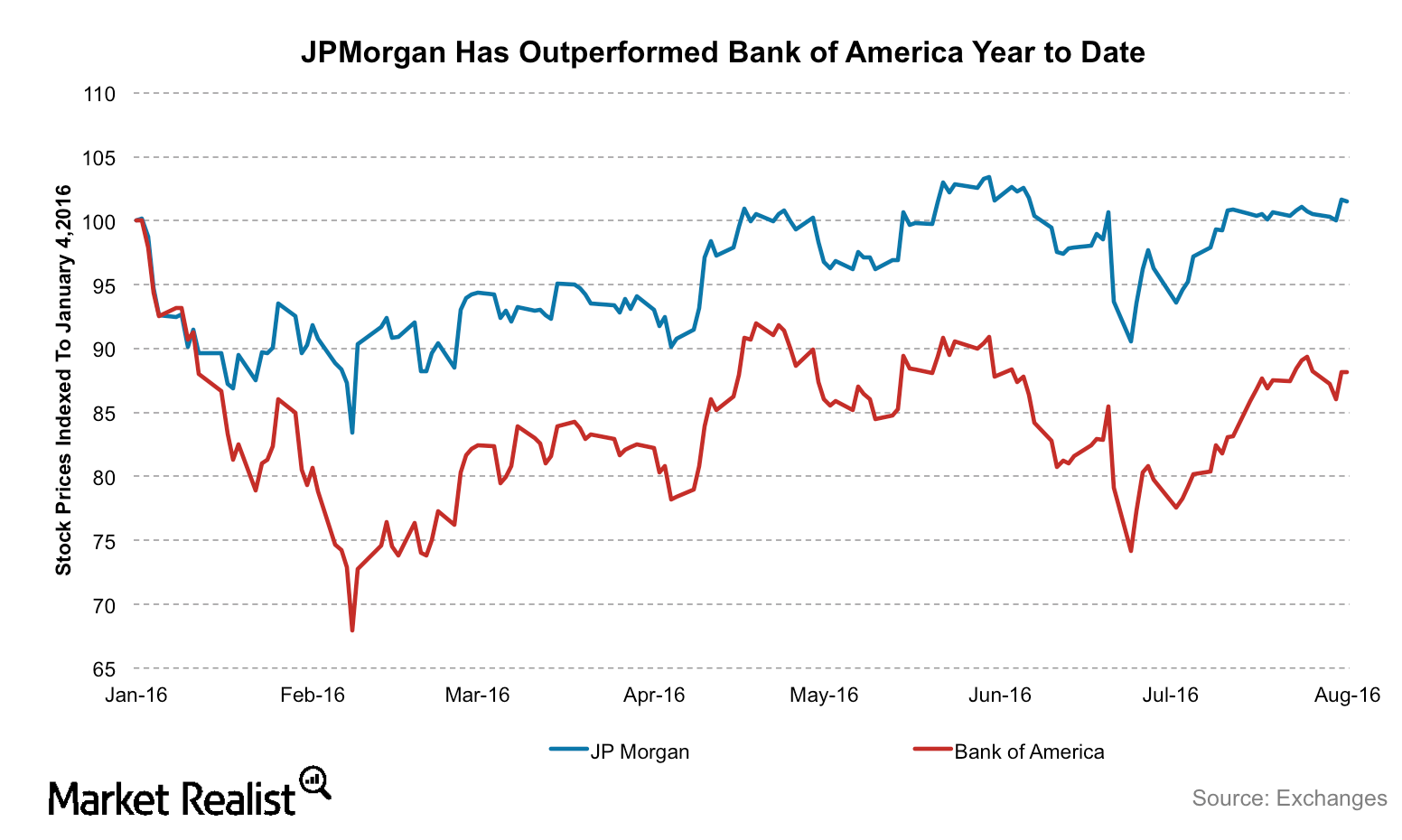

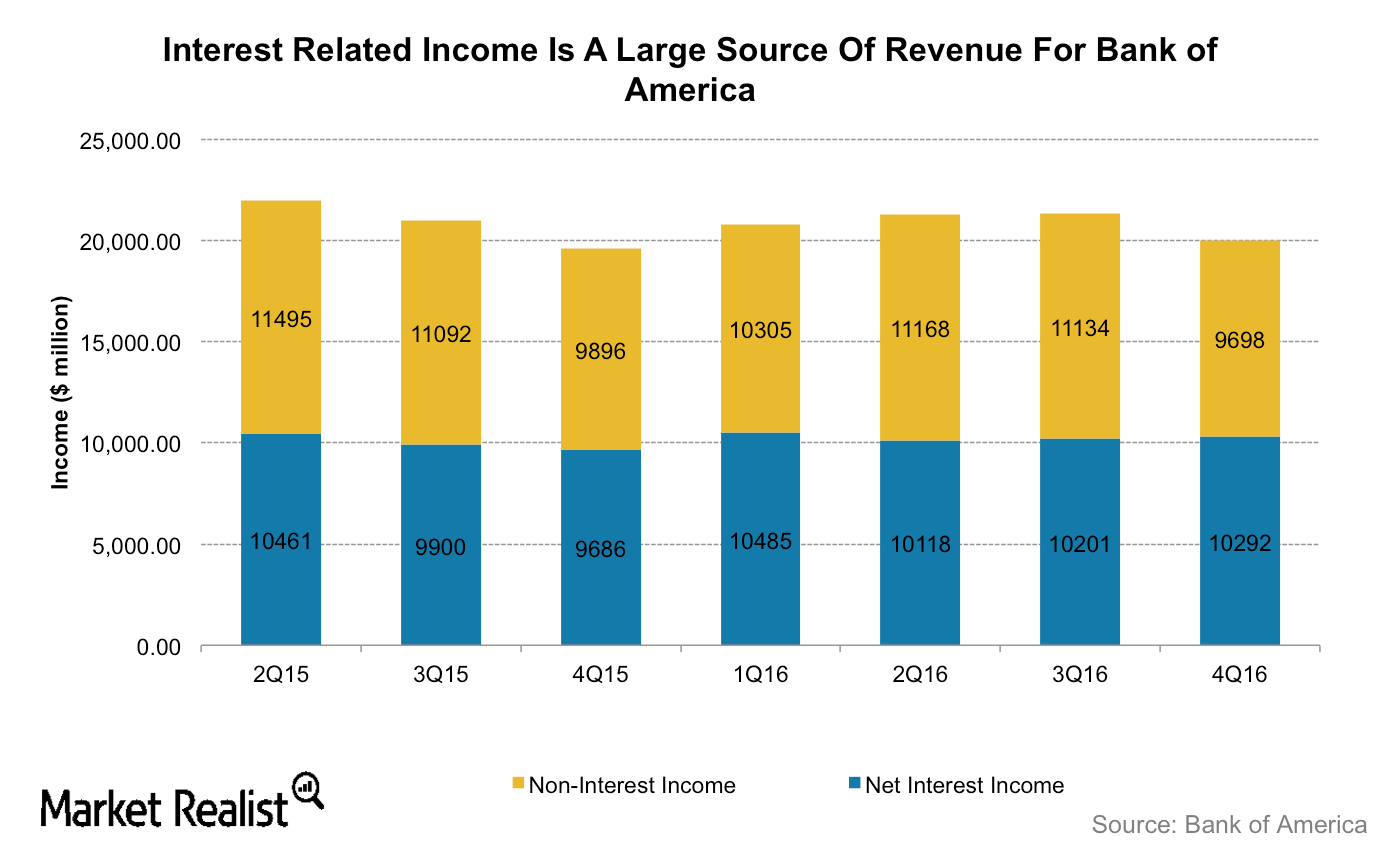

Why Deutsche Bank Prefers Bank of America over J.P. Morgan

In this series, we’ll compare Bank of America and J.P. Morgan on the basis of their 2Q earnings, profitability, cost-cutting initiatives, and interest rate sensitivities.

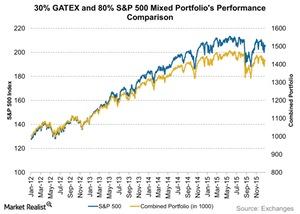

How Investing in GATEX Could Impact Your Portfolio

GATEX could increase the exposure of an investor’s portfolio in the equity market. It has less volatility risk than the equity markets.

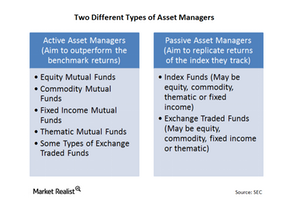

Traditional assets: Defining active and passive management

Active asset management refers to those asset managers that essentially try to outperform the average market return, a benchmark, or a hurdle rate that may have been set internally.Financials Why low funding cost is an advantage for Wells Fargo

If a bank is able to keep its cost of deposits low, it will have a competitive advantage. Wells Fargo has the lowest cost of deposits among its peers—despite having a very high deposit base.

Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.Financials Why Wells Fargo focuses on non-interest income

Wells Fargo wants to maintain a balance between its interest income from loans and non-interest income. Non-interest income accounts for nearly 49% of Wells Fargo’s revenues.Financials Why cross-selling is part of Wells Fargo’s strategy

Wells Fargo’s (WFC) first, and possibly the most important, operational strategy is focusing on cross-selling. It’s the most important pillar of its operational strategy.

Which Sectors to Avoid if Inflation Rises

Telecom services and utilities, the traditional dividend stars, have provided a fillip to US equities in 2016.

Brexit Vote: How Did US Treasury Auctions React?

The US Treasury auctioned 30-year TIPS (VIPSX)(LTPZ) worth $5 billion on June 22.

Understanding a Bank’s Operational and Business Risks

Banks experience operational risk in all daily bank activities, such as a check incorrectly cleared or a wrong order punched into a trading terminal.

What’s behind MLP Performances for the Week Ended November 10?

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.Financials Why Wells Fargo uses human resources as a strategic tool

Wells Fargo (WFC) believes that people are a competitive advantage source. Integrating sound human resource practices lies at the core of Wells Fargo’s strategy.

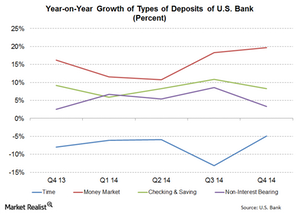

Low-cost deposit growth is a key strength for U.S. Bank

U.S. Bank does well in increasing its low-cost deposit base. In 4Q14, money market deposits grew the fastest at 19.7%—compared to 4Q13.

Bank of America and Wells Fargo: Comparing Interest Rate Exposure

Since Donald Trump’s presidential victory, Wall Street analysts have raised their forecasts for the major banks’ (XLF) net interest margins as they anticipate rising interest rates and economic growth.

Is It Pointless to Look at Big Banks’ Q1 Earnings?

JPMorgan Chase will announce its first-quarter results before the markets open on April 14. Analysts expect the bank to post revenues of $29.7 billion.