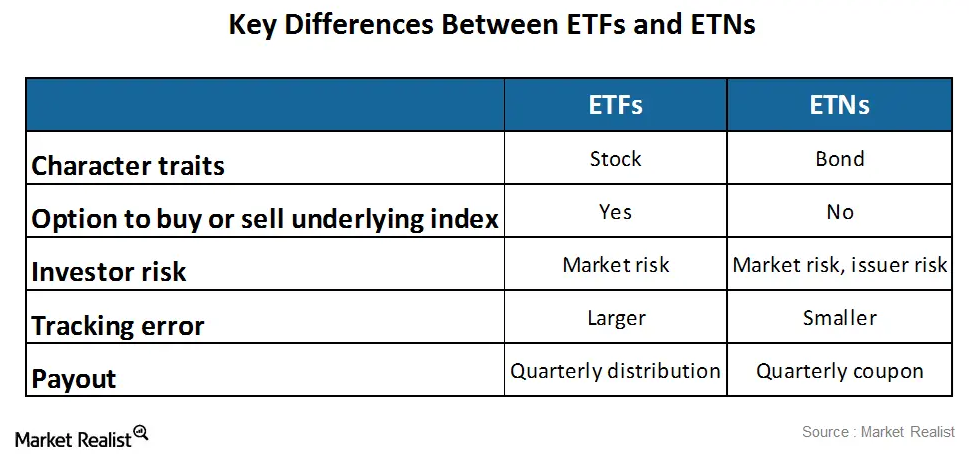

Comparison of exchange-traded funds and exchange-traded notes

ETFs (exchange-traded funds) have stock-like characteristics, while ETNs (exchange-traded notes) possess bond-like traits.

May 3 2021, Updated 11:09 a.m. ET

Basic differences

ETFs (exchange-traded funds) and ETNs (exchange-traded notes) offer great ways to gain diversified exposure to the energy MLP (master limited partnership) sector. An ETF has stock-like characteristics, while an ETN possesses bond-like traits.

ETFs pay out distributions, much like the MLP securities that they hold. ETNs, being bond-like instruments, issue quarterly coupons or interest payments.

While both ETFs and ETNs carry market risks that are tied to the securities they hold, ETNs have an additional issuer risk. If the ETN issuer goes bankrupt, the investor might lose invested principal.

For example, both the Alerian MLP ETF (AMLP) and its ETN equivalent, the UBS ETRACS Alerian MLP Infrastructure Index ETN (MLPI), track the Alerian MLP Infrastructure Index (AMZI). Top constituents include Enterprise Product Partners (EPD), Plains All American Pipelines (PAA), and MarkWest Energy Partners (MWE).

Also, the JPMorgan Alerian MLP Index ETN (AMJ) tracks the broader Alerian MLP Index (AMZ).

Tracking Errors

With regard to ETFs, a fund might underperform the underlying index. This “tracking error” results from the cost of managing an ETF or other expenses.

An ETN’s tracking error is smaller than that of an ETF. ETNs simply pay investors once the instruments have matured, as is the case with bonds. The index price determines the payment amount.

Keep reading to learn about another key difference between ETFs and ETNs.