UBS ETRACS Alerian MLP Infras ETN

Latest UBS ETRACS Alerian MLP Infras ETN News and Updates

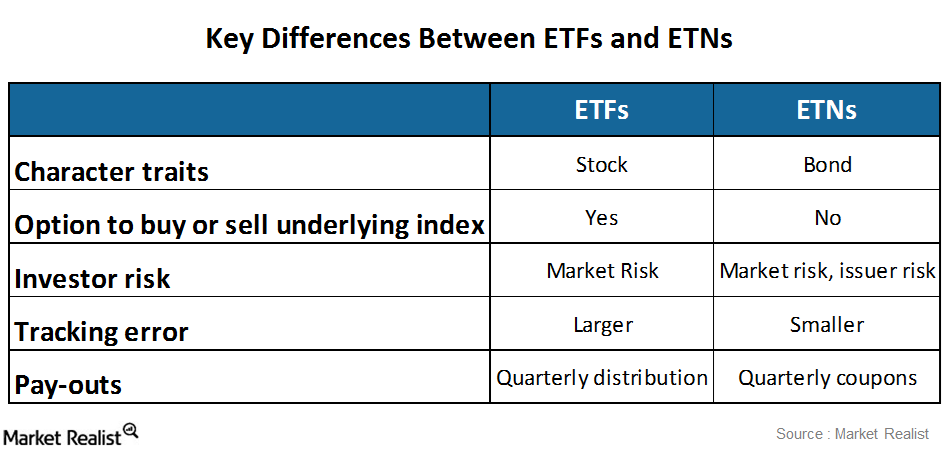

Comparison of exchange-traded funds and exchange-traded notes

ETFs (exchange-traded funds) have stock-like characteristics, while ETNs (exchange-traded notes) possess bond-like traits.

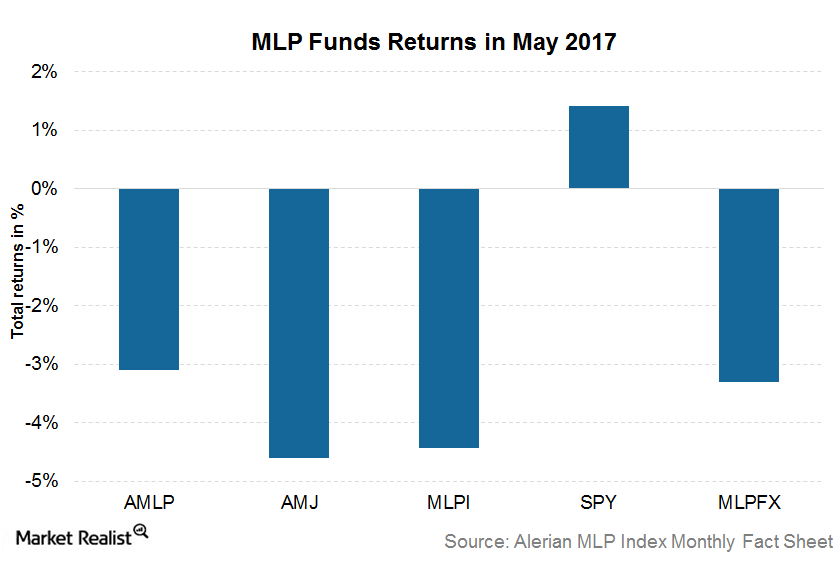

How MLP-Focused Funds Performed in May 2017

Among MLP funds, exchange-traded notes fell the most while the exchange-traded funds declined the least.

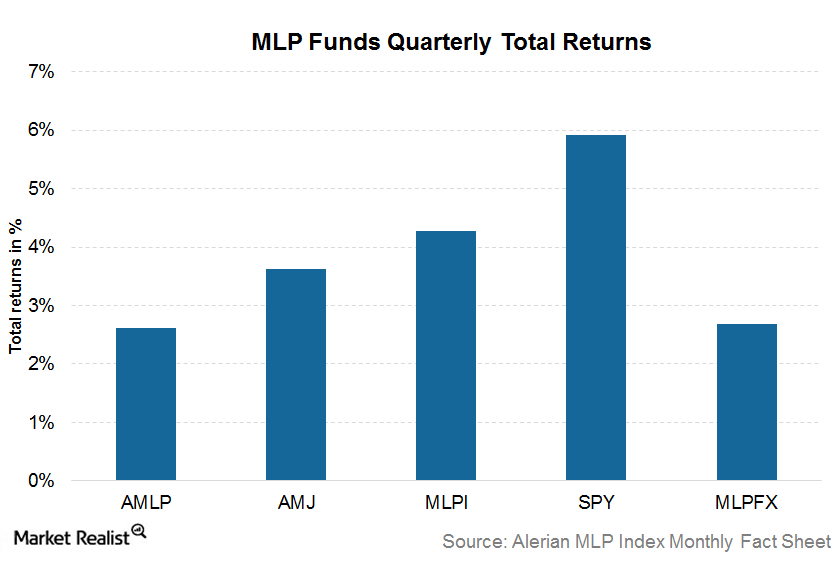

How MLP-Focused ETNs Performed in 1Q17

MLP-focused funds underperformed the SPDR S&P 500 ETF (SPY) in the recent quarter.

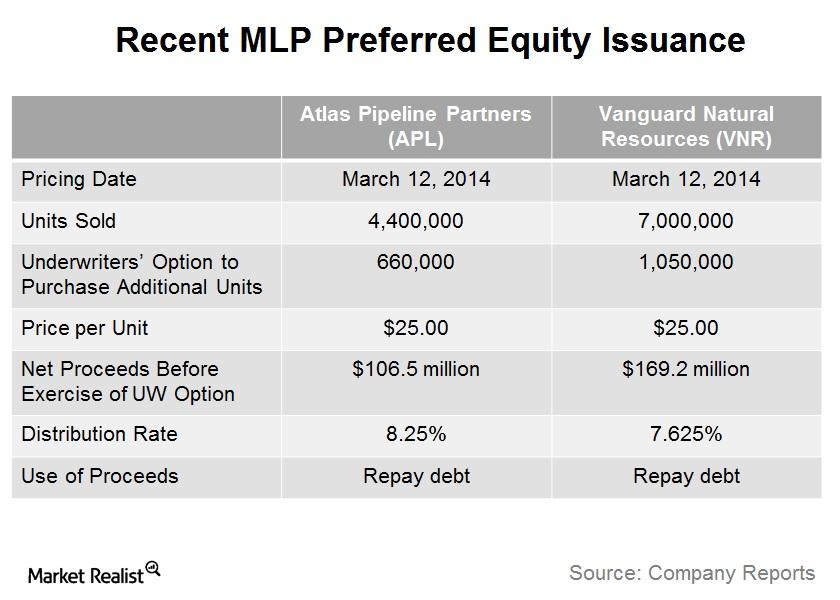

Is preferred equity a trend for master limited partnerships?

Recently, two master limited partnerships issued preferred equity, which is a relatively rare avenue of financing for MLPs.

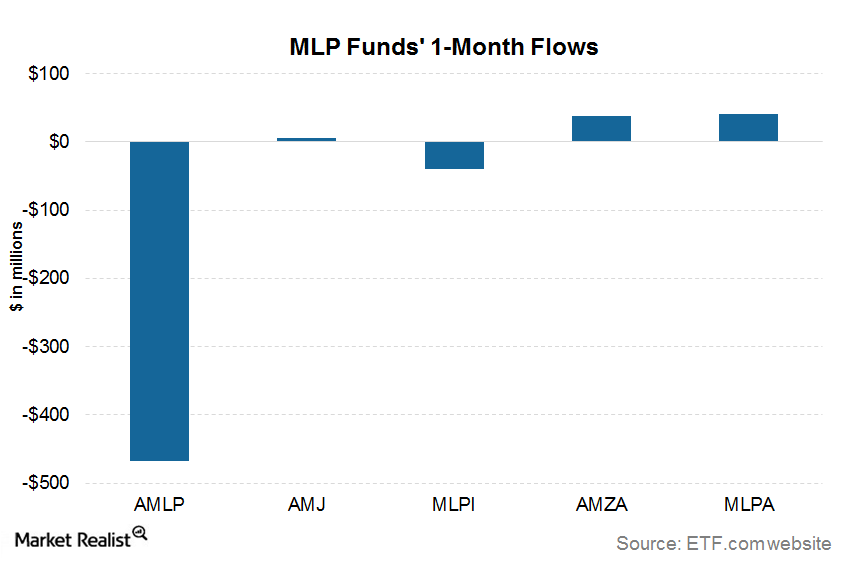

What Do the MLP Funds Flows Indicate?

AMLP has seen a net outflow of $467.8 million over the past one-month period ended March 16, 2018.

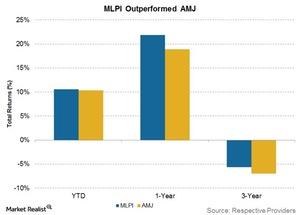

Why Did MLPI Outperform AMJ?

The ETRACS Alerian MLP Infrastructure Index ETN (MLPI) and the JPMorgan Chase Alerian MLP Index ETN (AMJ) are two of the largest MLP ETNs.