MarkWest Energy Partners LP

Latest MarkWest Energy Partners LP News and Updates

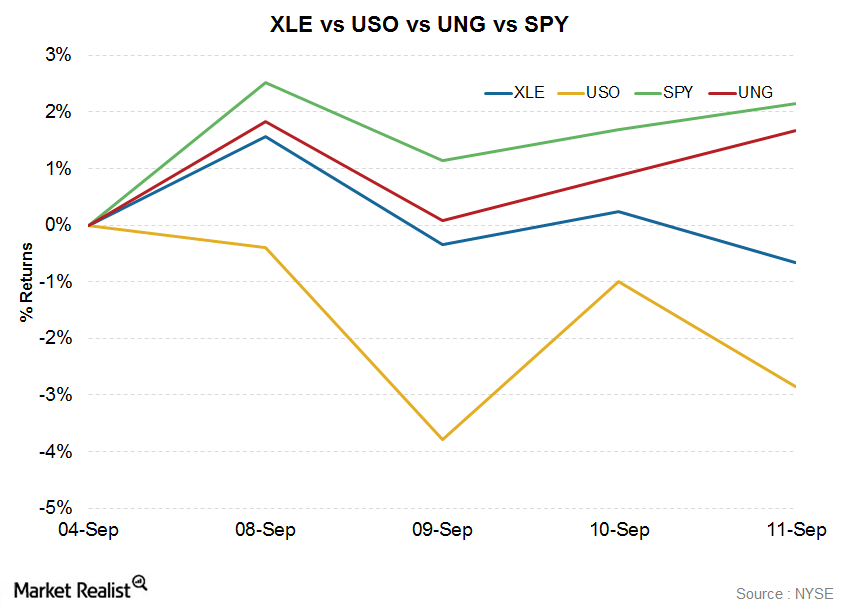

XLE Outperforms USO Last Week

The Energy Select Sector SPDR ETF (XLE) fell 0.66% in the week ended September 11. XLE tracks a diverse group of 45 of the largest American energy stocks in the S&P 500 Index (SPX).

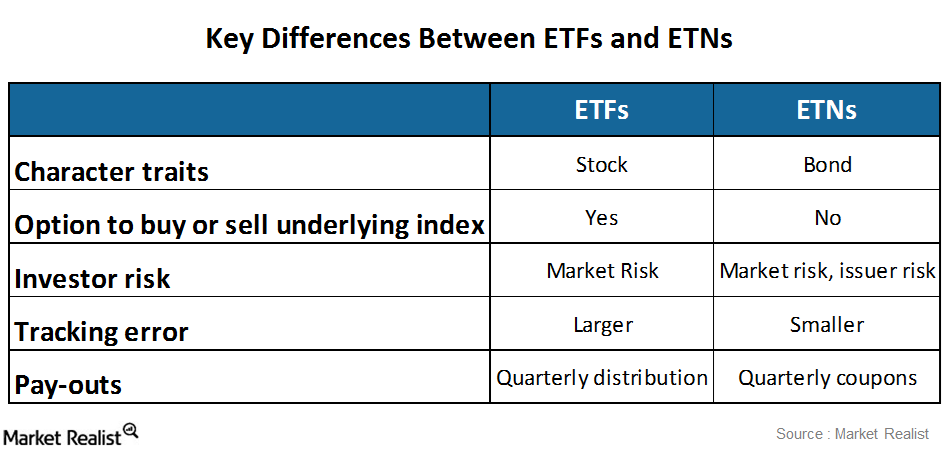

Comparison of exchange-traded funds and exchange-traded notes

ETFs (exchange-traded funds) have stock-like characteristics, while ETNs (exchange-traded notes) possess bond-like traits.

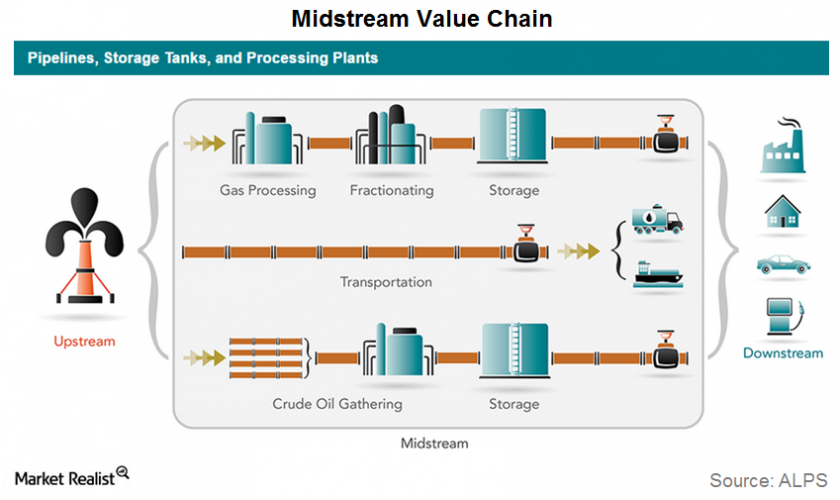

MLPs: How They Operate in the Midstream Energy Industry

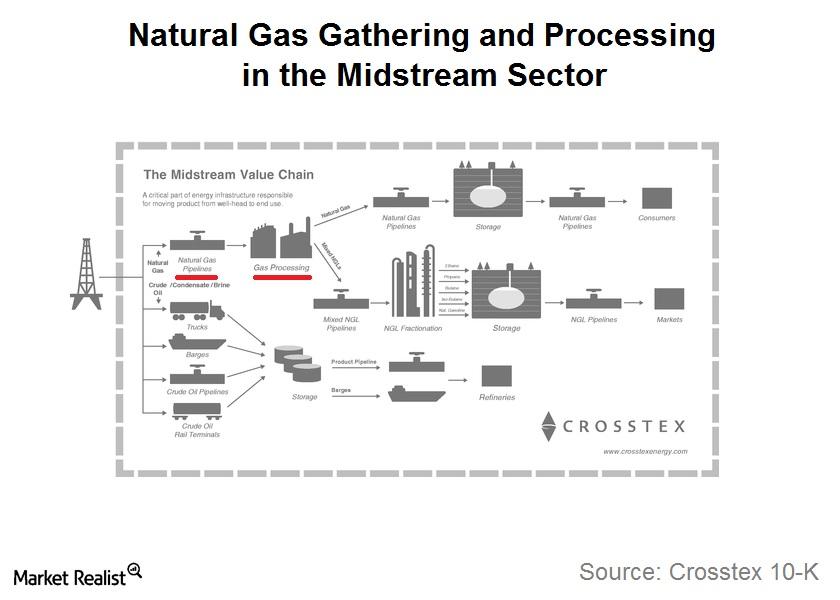

Most MLPs operate in the midstream energy industry. They’re mainly involved in gathering, processing, storing, and transporting energy commodities.

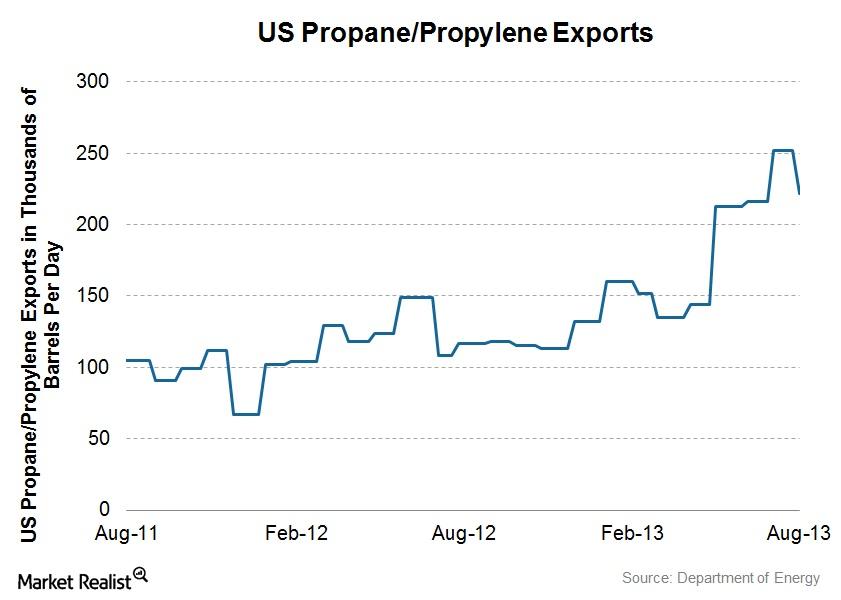

Why some MLPs are benefitting from increased propane exports

Significantly higher rates of propane exports have helped to boost propane prices—and the margins of some MLP names.

Why natural gas gathering and processing are important for MLPs

Natural gas gathering and processing is a significant part of the operations of many midstream master limited partnerships.

Introducing the UBS ETRACS Alerian MLP Infrastructure ETN AMZIX

The UBS ETRACS 1x Monthly Short Alerian MLP Infrastructure Total Return Index ETN (MLPS) tracks the Alerian MLP Infrastructure Total Return Index (AMZIX).

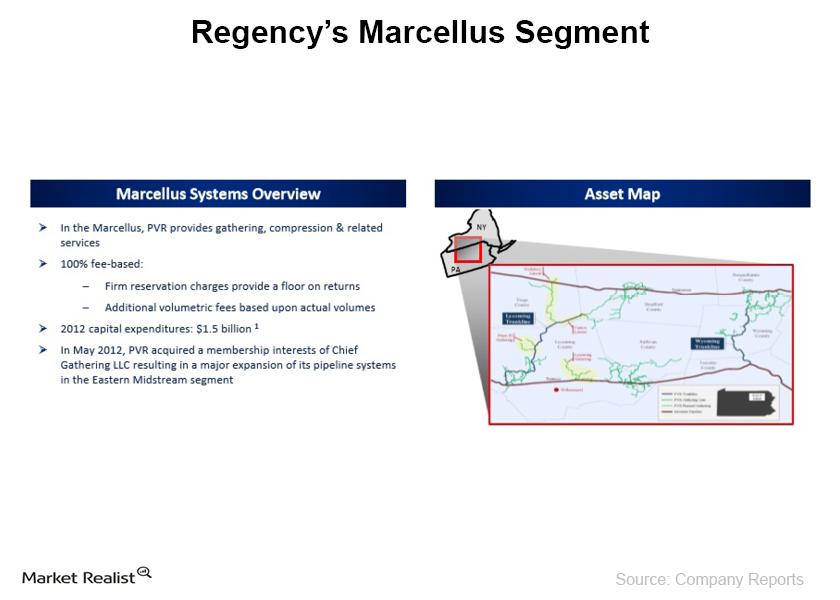

Regency’s PVR Midstream acquisition means Marcellus Shale exposure

Regency recently acquired a foothold in the Marcellus by buying PVR Partners LP in March this year in a deal worth $5.6 billion, specifically to boost its footprint in the Appalachian Basin.

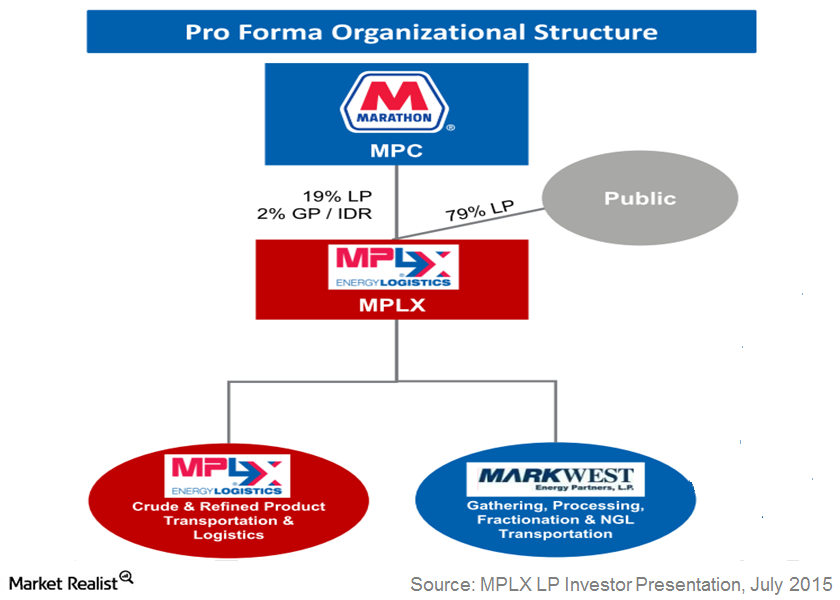

MarkWest-MPLX Merger: Big News for the Midstream Energy Sector

In a press release published on July 13, 2015, MarkWest Energy Partners (MWE) and MPLX LP (MPLX) announced that the two MLPs have agreed to merge.

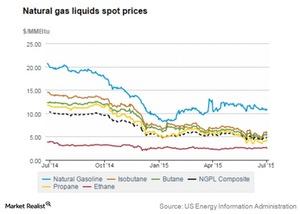

Why the Natural Gas-NGL Price Spread Impacts Energy MLPs

Natural gas processing MLPs typically benefit when the price of NGLs is high relative to natural gas.

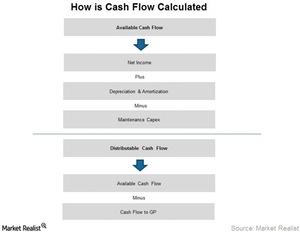

The Importance of the Distribution Coverage Ratio

The distribution coverage ratio is the most important ratio for MLPs, as it highlights the cash available to the LP unit holders divided by the cash distributed to LP unit holders.

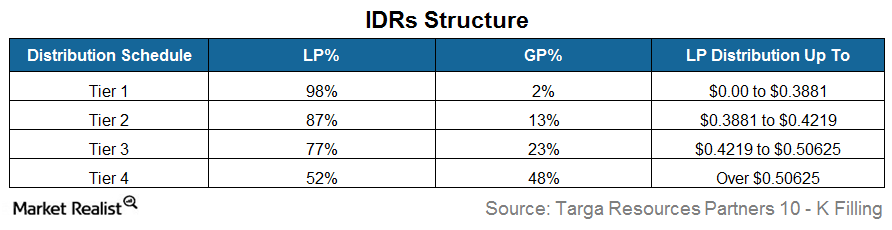

IDRs: How Do They Impact MLPs?

IDRs entitle the GP to receive a higher percentage of incremental cash distributions after certain target distribution levels have been achieved for the LP unitholders.