MLPs: How They Operate in the Midstream Energy Industry

Most MLPs operate in the midstream energy industry. They’re mainly involved in gathering, processing, storing, and transporting energy commodities.

May 3 2021, Updated 10:59 a.m. ET

MLP business overview

Most MLPs (master limited partnerships) operate in the midstream energy industry. The companies in this industry are mostly involved in gathering, processing, storing, and transporting energy commodities. Currently, few upstream and downstream companies operate as MLPs.

Upstream companies are mostly involved in the exploration, recovery, and production of energy commodities. In contrast, downstream companies are mostly involved in refining, distributing, and marketing energy products.

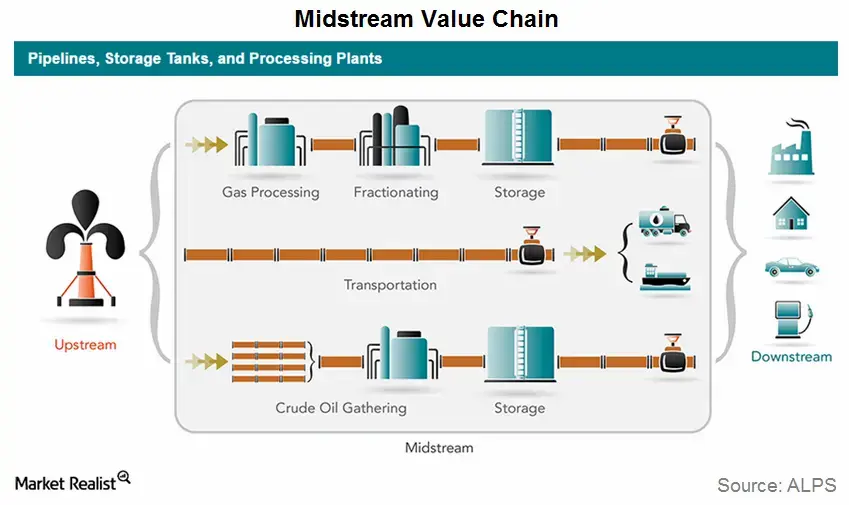

The above graph depicts the midstream value chain, according to ALPS—the company behind the Alerian MLP ETF (AMLP)

Midstream activities explained

- Gathering and processing – As the name suggests, “gathering” involves moving the raw commodity from the fields through smaller pipelines to the processing units. In contrast, “processing” involves converting the commodities into usable forms. Companies that perform gathering generally also perform processing. The services are closely linked.

- Storage – Storage MLPs store energy—either in its raw state or post-processing. Energy storage can take many forms ranging from tanks to wells. Storage MLPs provide energy companies with economic flexibility. They allow energy companies to control the supply of such commodities in order to maintain equilibrium, or close to equilibrium, with the demand.

- Transportation – Transportation MLPs move energy commodities from one place to another. Often this is done through pipelines from the wells to the processing facilities. After processing, the refined energy commodities must be moved to a storage facility or sold on the market.

Most MLPs provide more than one service. Examples include:

- MarkWest Energy Partners (MWE) – operations include gathering, processing, and transporting natural gas and other services

- EQT Midstream Partners (EQM) – provides transmission, storage, and gathering services

- Targa Resources Partners (NGLS) – involved in gathering, processing, and transporting natural gas and other services

Targa Resources and EQT Midstream are both part of AMLP and the First Trust North American Energy Infrastructure Fund (EMLP).