EQT Midstream Partners LP

Latest EQT Midstream Partners LP News and Updates

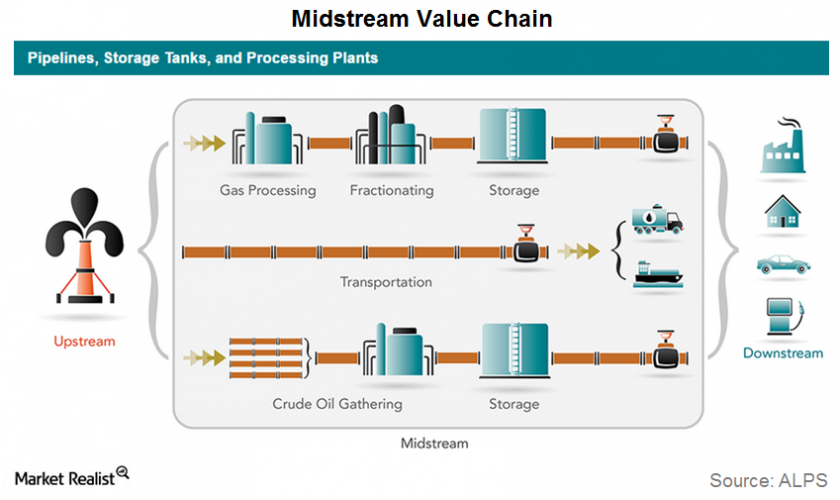

MLPs: How They Operate in the Midstream Energy Industry

Most MLPs operate in the midstream energy industry. They’re mainly involved in gathering, processing, storing, and transporting energy commodities.

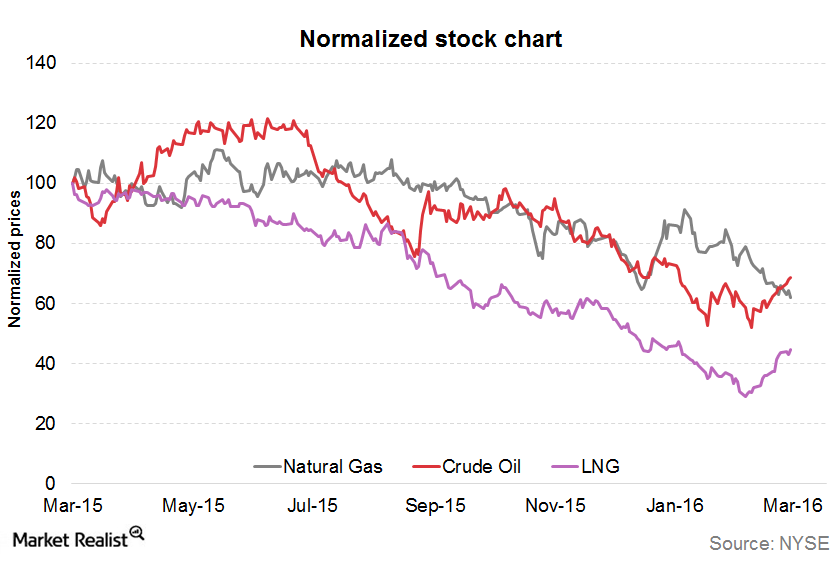

Analyzing Cheniere Energy’s Commodity Price Exposure

The correlation between Cheniere Energy’s stock price and crude oil (USO) resulted in a correlation coefficient of 0.87 during the past year.

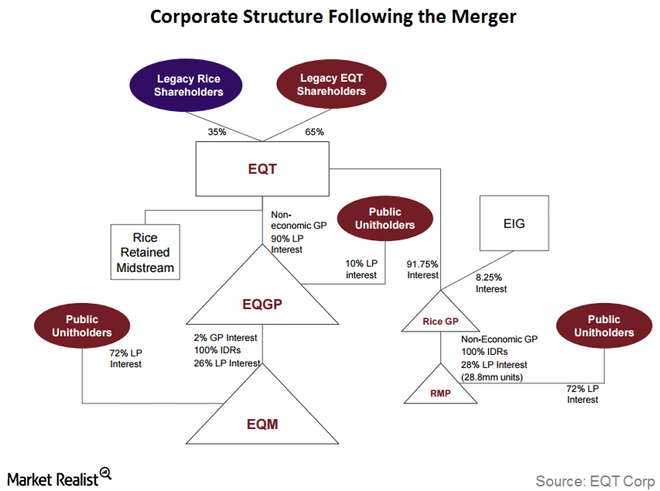

Key Updates on the EQT-RICE Merger

Under EQT Corporation’s (EQT) existing ownership, the company owns a 90% limited partner interest and non-economic general partner interest in EQT GP Holdings (EQGP).

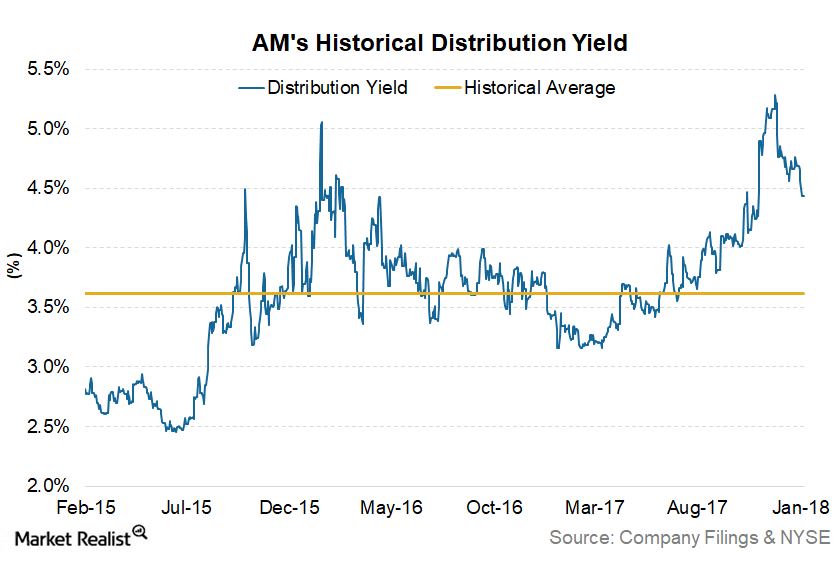

Could Antero Midstream Partners Benefit from Strong Earnings?

Antero Midstream Partners fell 6% last year. However, it had a strong start to the new year. It has risen 6.8% in 2018.

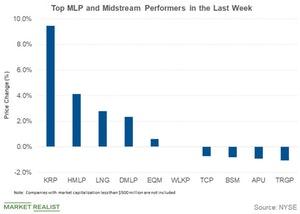

LNG and EQM: Which Midstream Companies Outperformed Last Week?

Cheniere Energy (LNG) was among the top midstream gainers last week. The stock rose 2.8% during the week.

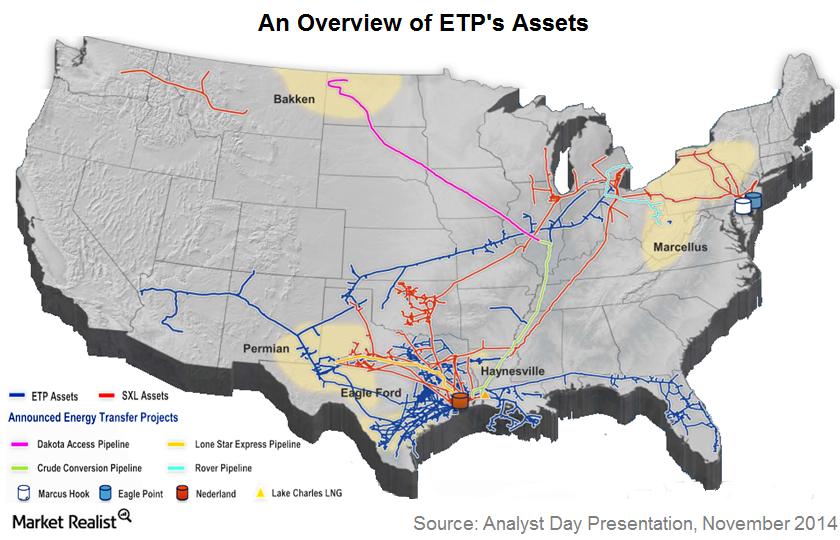

A Review of Energy Transfer Partners’ Business Segments

ETP operates primarily through its six business segments by leveraging its huge asset base.

How Do These MLPs Look in 2018?

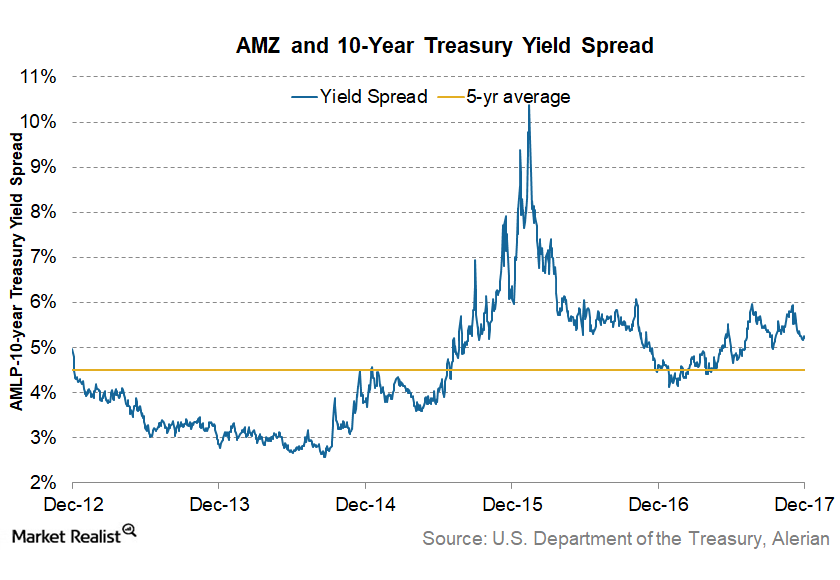

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

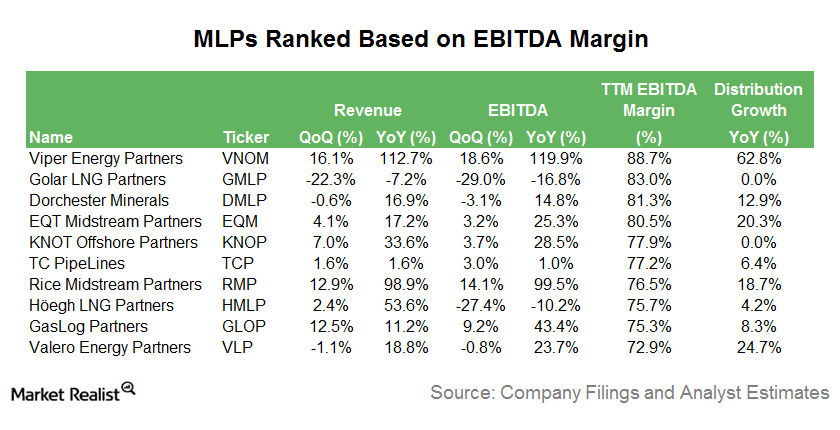

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

MLP Rating Updates Last Week

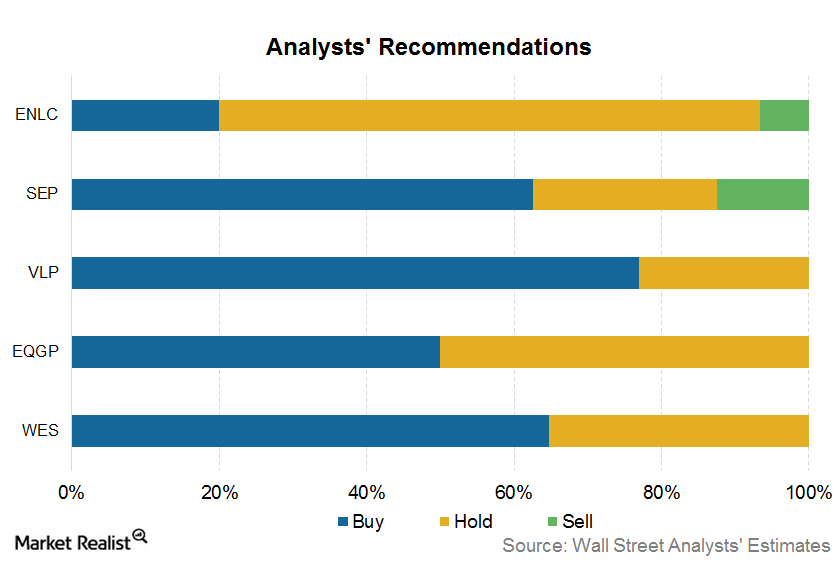

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”

MarkWest-MPLX Merger: Big News for the Midstream Energy Sector

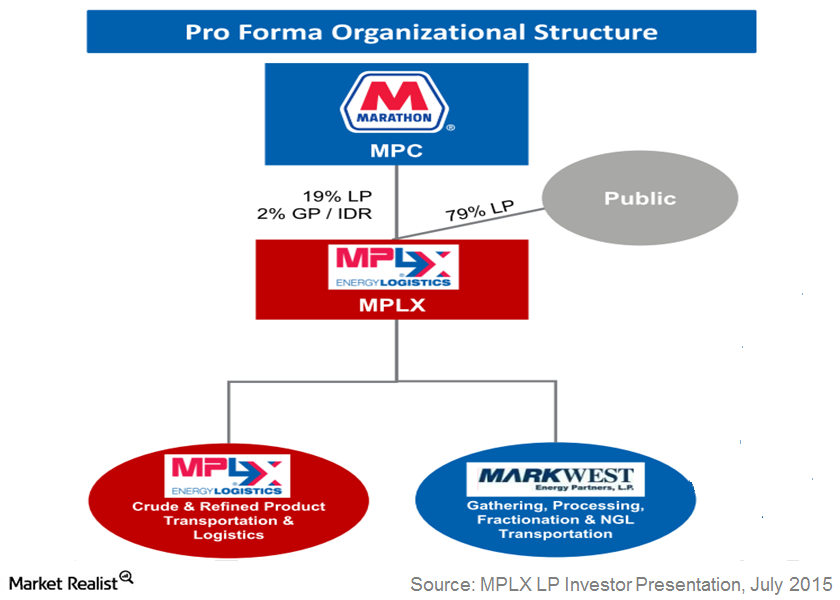

In a press release published on July 13, 2015, MarkWest Energy Partners (MWE) and MPLX LP (MPLX) announced that the two MLPs have agreed to merge.

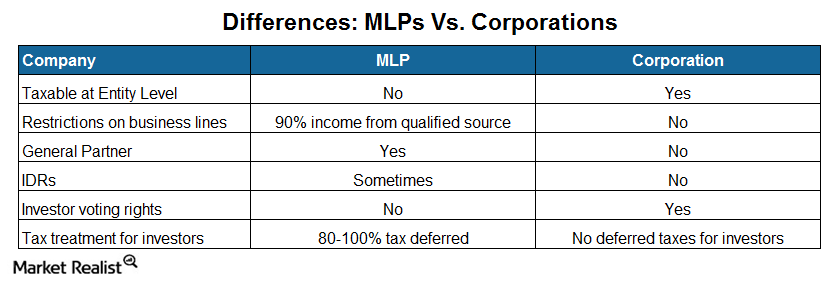

Analyzing the Differences: MLPs versus C Corporations

MLPs’ tax structure is the major difference that separates them from C Corps. MLPs’ earnings aren’t taxed at the partnership level. The taxes are passed to the unitholders.