Analyzing Cheniere Energy’s Commodity Price Exposure

The correlation between Cheniere Energy’s stock price and crude oil (USO) resulted in a correlation coefficient of 0.87 during the past year.

Nov. 20 2020, Updated 4:41 p.m. ET

Cheniere Energy’s commodity exposure

The midstream companies’ earnings—including those of larger ones such as Energy Transfer Partners (ETP) and Cheniere Energy (LNG) as well as smaller ones like EQT Midstream Partners (EQM) and Antero Midstream Partners (AM)—don’t have much direct commodity price exposure. Cheniere Energy is exposed to natural gas prices through domestic marketing of natural gas imported into the Sabine Pass LNG terminal.

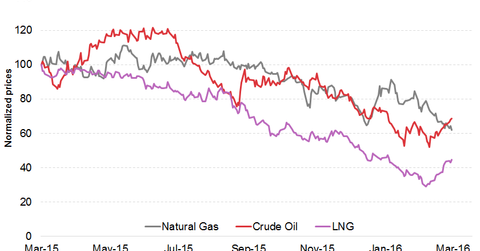

The correlation between Cheniere Energy’s stock price and crude oil (USO) resulted in a correlation coefficient of 0.87 during the past year. Natural gas (UNG) and Cheniere Energy had a correlation coefficient of 0.84 for the same period. A correlation coefficient close to one might indicate a strong relation between two variables. However, Cheniere Energy shouldn’t have a strong correlation with crude oil considering that it has limited direct exposure to crude oil.

Cheniere Energy’s LNG export contract

With the narrowing of spreads between the US Henry Hub and global spot gas markets over the past year, Cheniere Energy’s third-party export contracts would be linked to Henry Hub spot prices.

SPL (Sabine Pass Liquefaction) is Cheniere Energy’s subsidiary. It “has entered into six fixed price, 20-year SPAs with third parties that in the aggregate equate to approximately 19.75 mtpa of LNG.” Under these SPAs (sale and purchase agreements), “the customers will purchase LNG from SPL for a price consisting of a fixed fee plus 115% of Henry Hub per MMBtu of LNG. In certain circumstances, the customers may elect to cancel or suspend deliveries of LNG cargoes, in which case the customers would still be required to pay the fixed fee with respect to the contracted volumes that are not delivered.” If natural gas prices continue to stay low, Cheniere Energy’s earnings would be impacted negatively. However, Henry Hub prices are expected to increase slightly with the rise in US natural gas exports.

For more company overviews and indicator analyses on MLPs, visit Market Realist’s Master Limited Partnerships page.