Antero Midstream Corp

Latest Antero Midstream Corp News and Updates

Must-know: A quick look into the Antero Midstream IPO

On October 27, Antero Resources Corporation announced the initial public offering of Antero Midstream Partners LP.

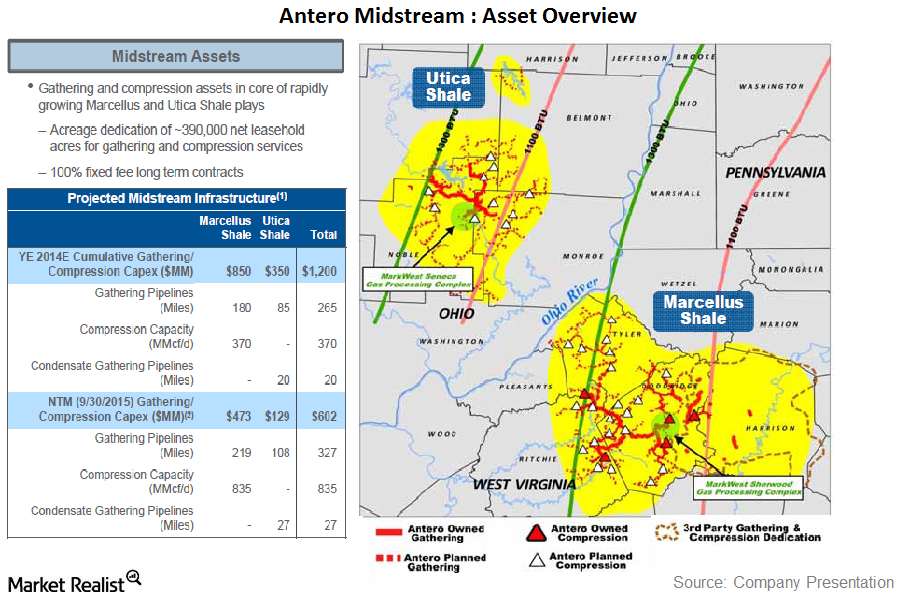

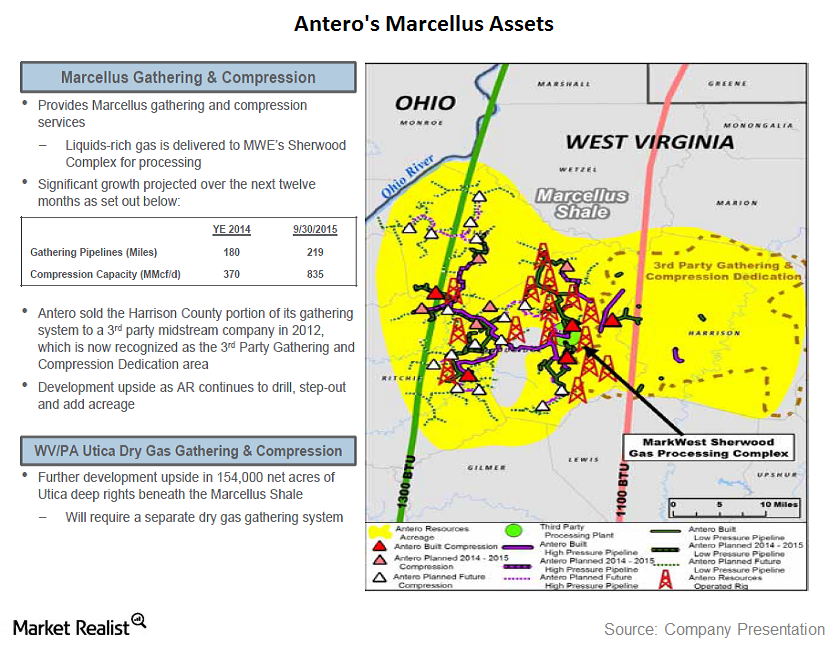

Key update on Antero Midstream’s assets

Antero Resources’ current acreage is focused in the Marcellus Shale in West Virginia and the Utica Shale in Ohio.

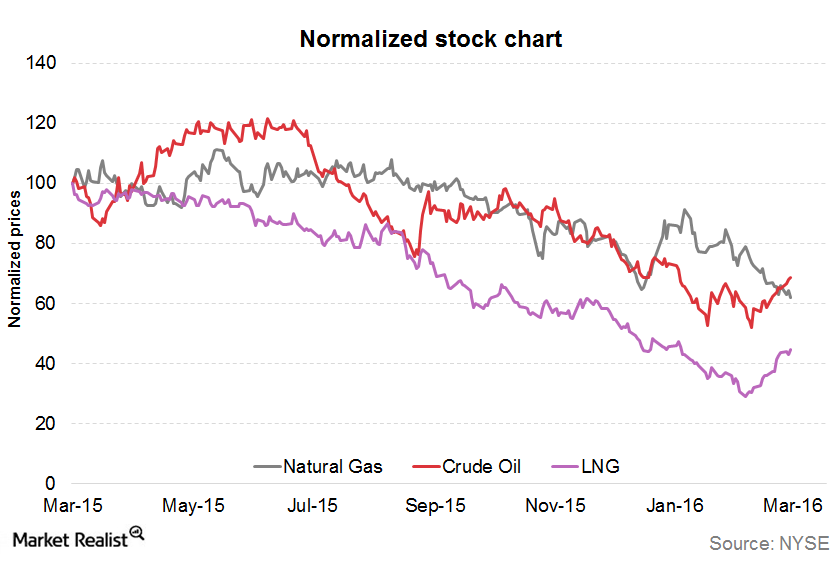

Analyzing Cheniere Energy’s Commodity Price Exposure

The correlation between Cheniere Energy’s stock price and crude oil (USO) resulted in a correlation coefficient of 0.87 during the past year.

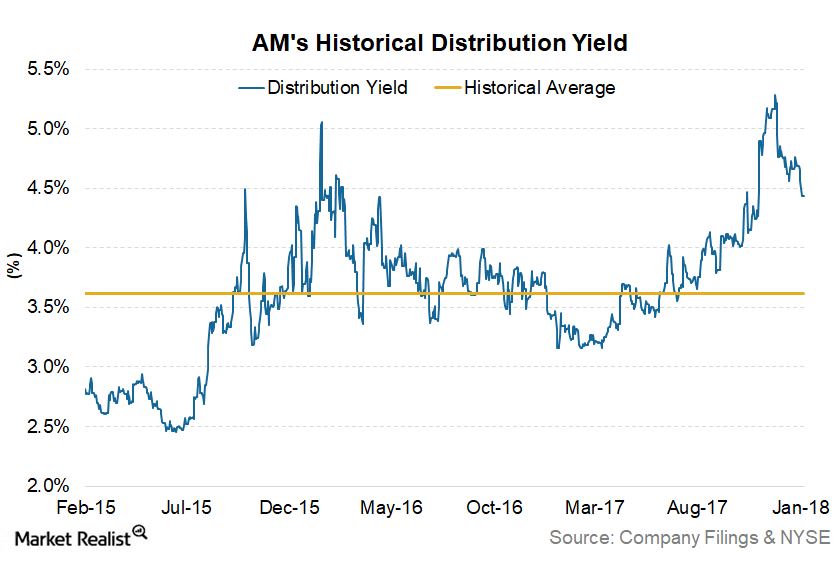

Could Antero Midstream Partners Benefit from Strong Earnings?

Antero Midstream Partners fell 6% last year. However, it had a strong start to the new year. It has risen 6.8% in 2018.

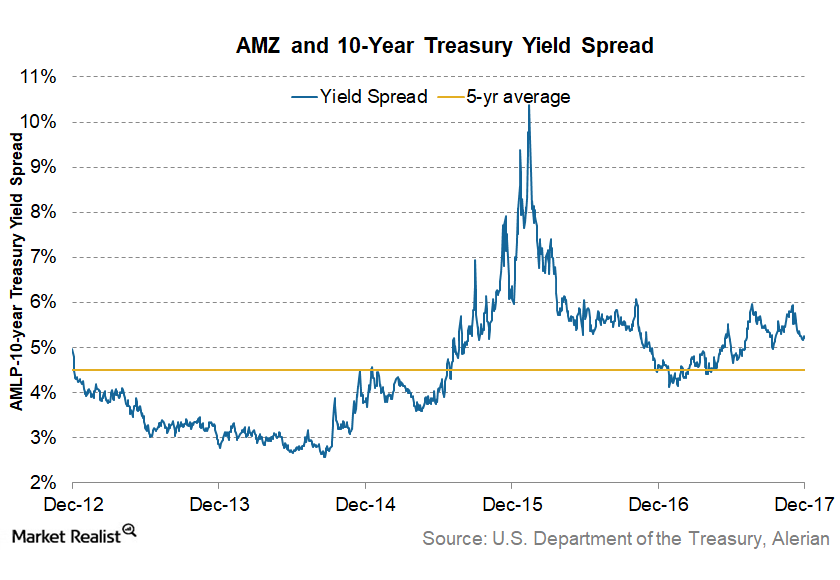

How Do These MLPs Look in 2018?

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

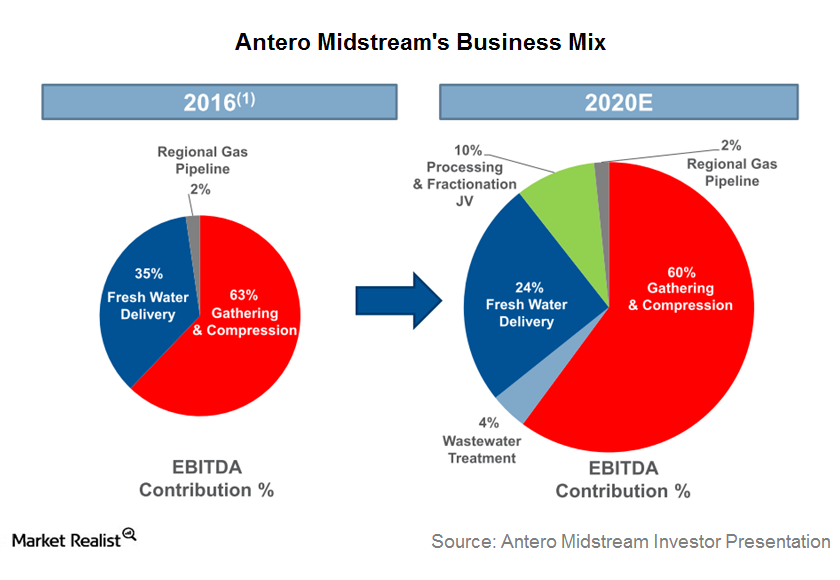

How Antero Midstream’s Business Mix Could Evolve

Antero Midstream Partners (AM) expects its business mix to evolve from current gathering and compression activities to the inclusion of natural gas processing and fractionation activities over the coming years.