Could Antero Midstream Partners Benefit from Strong Earnings?

Antero Midstream Partners fell 6% last year. However, it had a strong start to the new year. It has risen 6.8% in 2018.

Nov. 20 2020, Updated 3:12 p.m. ET

Antero Midstream Partners

Antero Midstream Partners (AM) is an MLP involved in natural gas gathering, natural gas compression, and water-related midstream services in the Appalachian region. The partnership entered into the natural gas processing business through a JV (joint venture) with MPLX (MPLX).

Antero Midstream Partners fell 6% last year. However, it had a strong start to the new year. It has risen 6.8% in 2018. In comparison, its peers EQT Midstream Partners (EQM), CNX Midstream Partners (CNXM), and Rice Midstream Partners (RMP) have risen 5.5%, 6%, and 0.9%, respectively, in 2018.

Valuations

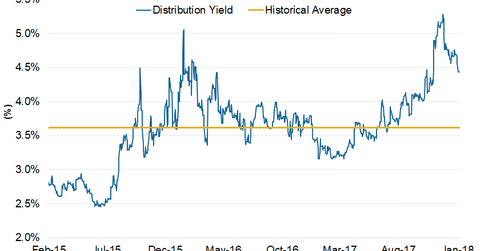

Antero Midstream was trading at a forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 9.2x as of January 5, 2018. That’s significantly below the historical average of 13.8x. Its current distribution yield of 4.4% is also higher than the historical average of 3.6%.

Leverage

Antero Midstream Partners’ debt-to-EBITDA ratio was 2.4x as of January 5, 2018. Its leverage has increased slightly over the past year, considering its strong expansion capital spending. However, its current leverage is well within the industry standards.

Earnings growth

Antero Midstream Partners is expected to post 51.8% YoY (year-over-year) growth in 2017 compared to 2016. That’s significantly higher than the industry median of 19.2%. It’s expected to post EBITDA CAGR (compound annual growth rate) of 29.5% during the 2018–2020 period. Its strong EBITDA growth is expected to be translated into strong distribution growth. Wall Street analysts expect distribution CAGR of 28.4% during 2018–2020.

Analyst recommendations

Antero Midstream Partners has “buy” ratings from 100% of analysts surveyed by Reuters. AM is the only Alerain MLP ETF (AMLP) constituent with “buy” ratings from 100% of the analysts. Antero Midstream is currently trading significantly below the low range ($34) of analysts’ target prices. Its average target price of $38.20 implies a ~23% upside potential from the current price levels.