MPLX LP

Latest MPLX LP News and Updates

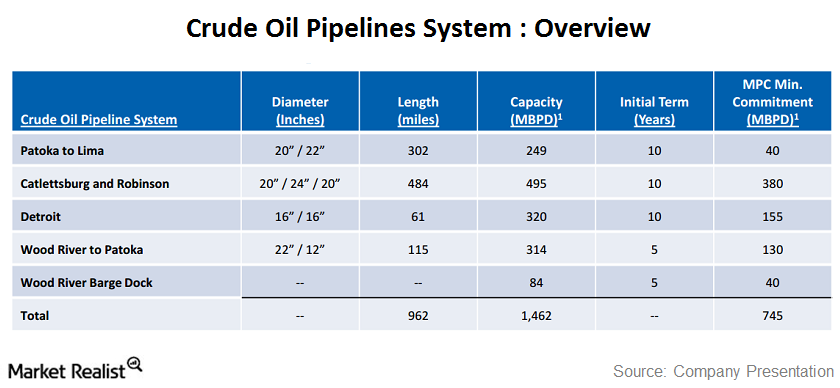

The MPLX crude oil pipeline system

MPLX crude pipelines are connected to supply hubs, and transport crude oil to Marathon Petroleum Corporation’s, or MPC’s, refineries and third parties.

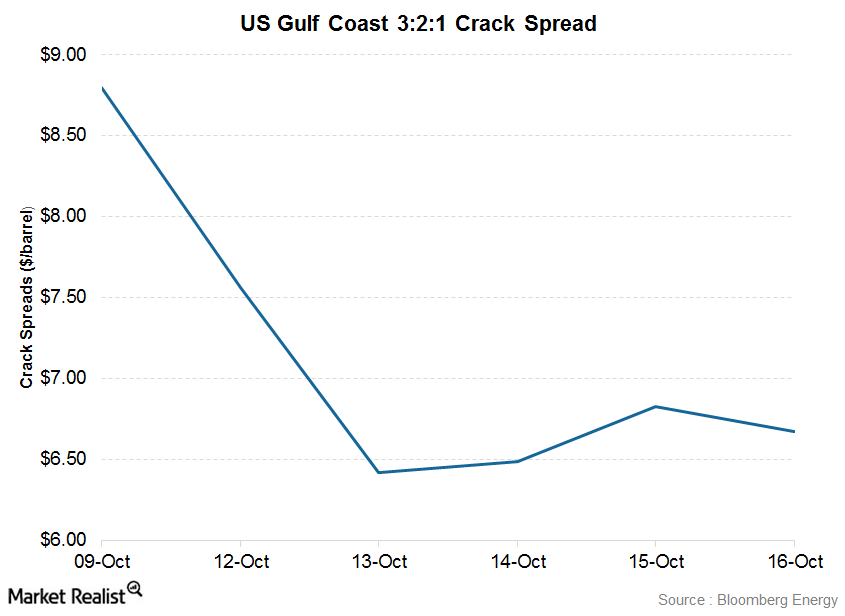

Overview of US Gulf Coast 3:2:1 Crack Spread

Crack spreads usually fall when crude oil prices (USO) increase by more than product prices, or when product prices fall more than crude oil prices.

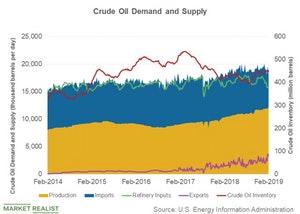

What Might Cap Rising Crude Oil Prices?

The US crude oil (USO) supply includes domestic production and imports. The supply gets consumed as inputs to refineries and exports.

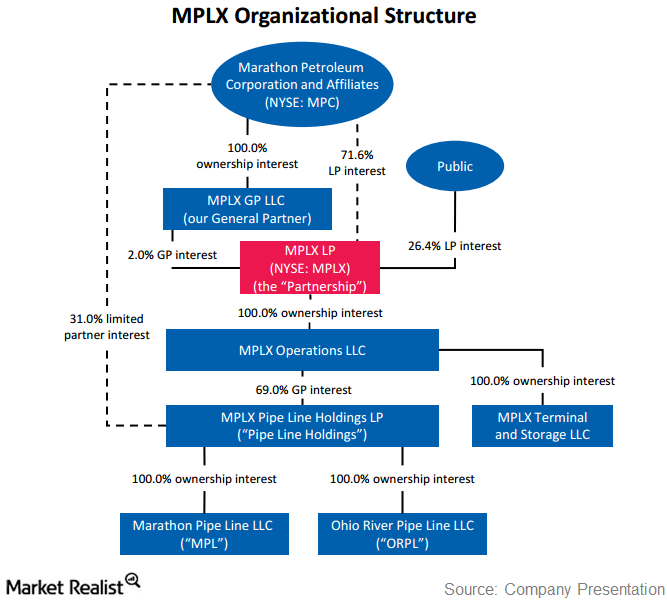

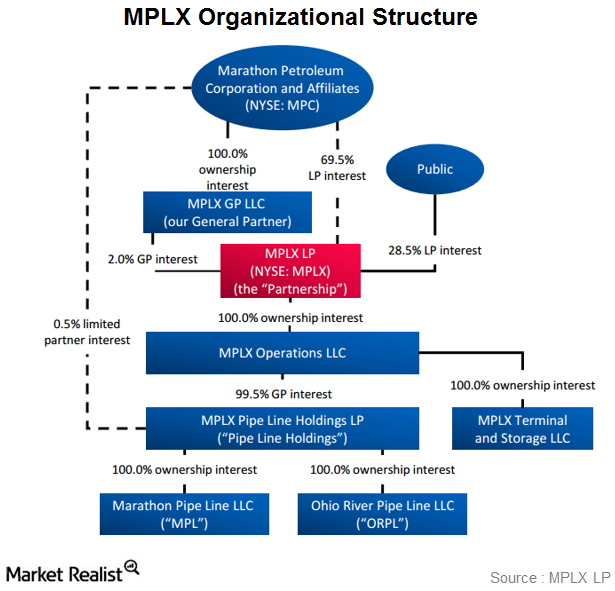

MPLX LP: The infrastructure link in Marathon Petroleum’s chain

Marathon Petroleum Corporation, or MPC, owns 100% of the MPLX general partnership, or GP, interests, as well as the incentive distribution rights.

These 5 Refiners Make Half the Crude Oil in the US

The total refiners capacity in the US is around 18.8 million barrels per calendar day. The refinery utilization rate in 2018 was 93%.

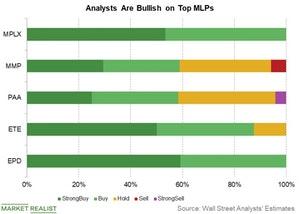

EPD, ETE, PAA, and MMP: What Do Analysts Recommend?

All of the analysts surveyed by Reuters covering Enterprise Products Partners (EPD) and MPLX (MPLX) rated the stocks as “buy.”

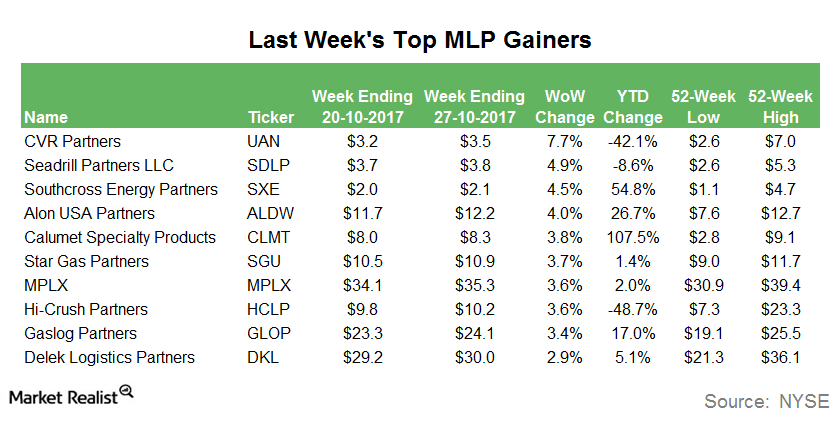

Last Week’s Top MLP Gainers

CVR Partners (UAN), the MLP mainly involved in the production of nitrogen fertilizers, was the top MLP gainer last week. CVR Partners rose 7.7%.

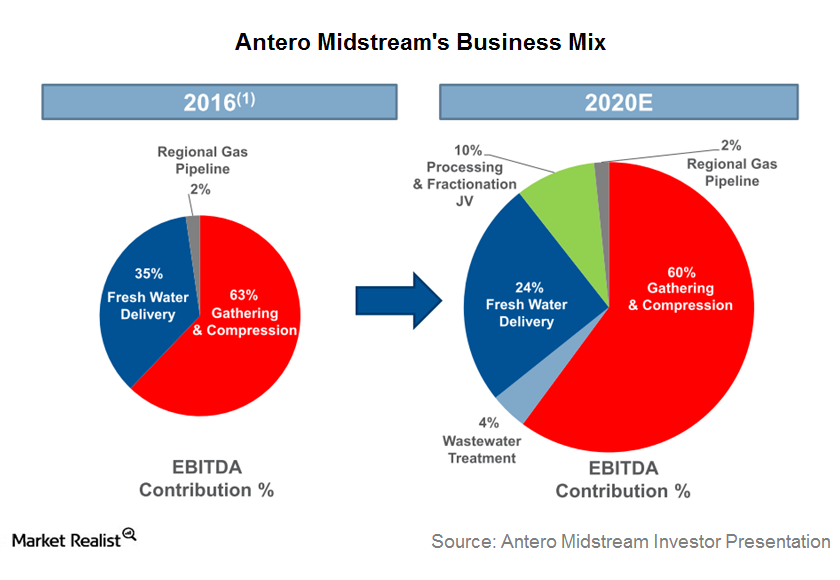

How Antero Midstream’s Business Mix Could Evolve

Antero Midstream Partners (AM) expects its business mix to evolve from current gathering and compression activities to the inclusion of natural gas processing and fractionation activities over the coming years.

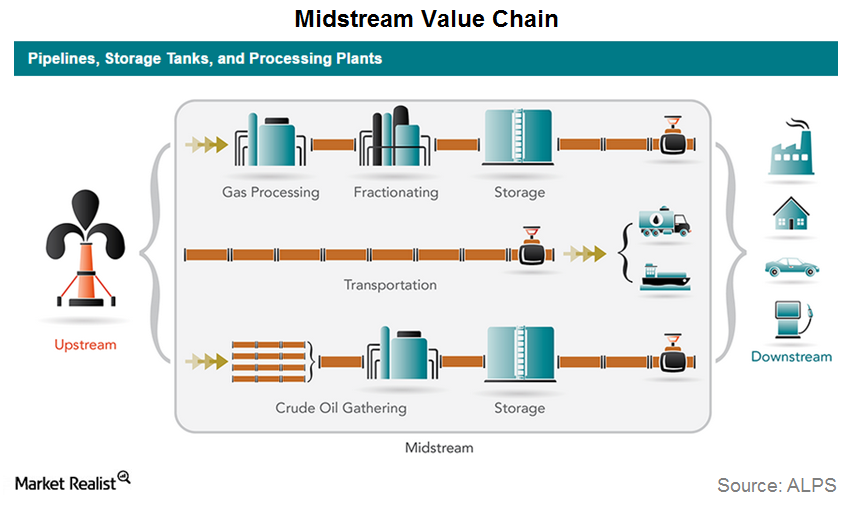

A Look at the Midstream Energy Value Chain

Liquids pipelines and terminaling MLPs, as the name suggests, are involved in crude oil, refined product, and NGLs (natural gas liquids) transportation and storage.

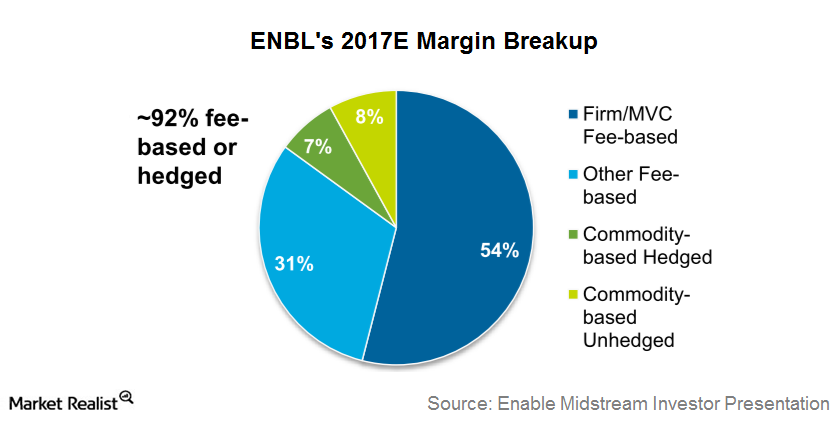

Getting Familiar with MLP Contracts

In this article, we’ll look at types of MLP contracts for midstream MLPs. Midstream MLPs generally have fixed-fee contracts.

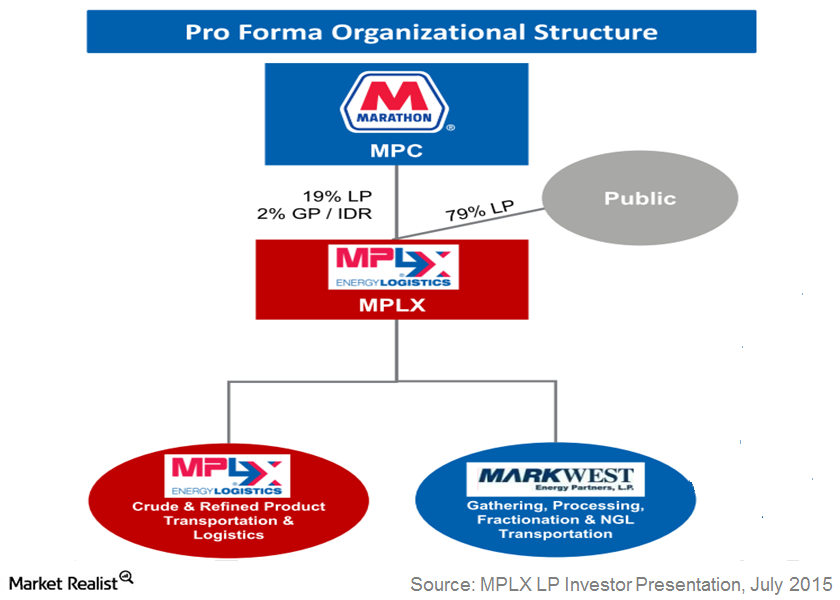

MarkWest-MPLX Merger: Big News for the Midstream Energy Sector

In a press release published on July 13, 2015, MarkWest Energy Partners (MWE) and MPLX LP (MPLX) announced that the two MLPs have agreed to merge.

MPLX LP: The Midstream Link in Marathon Petroleum’s Chain

MPLX LP (MPLX) is a master limited partnership, or MLP. It was formed by independent refiner Marathon Petroleum Corporation (MPC).

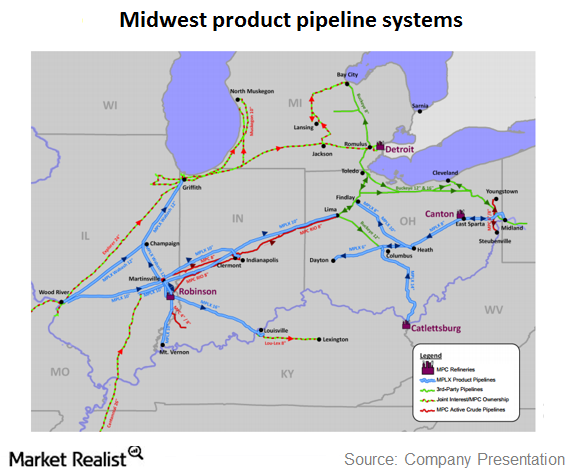

The MPLX Midwest product pipeline systems

Canton to East Sparta consists of two parallel pipelines that connect MPC’s Canton refinery with the MPLX East Sparta, Ohio, breakout tankage and station.