Plains All American Pipeline LP

Latest Plains All American Pipeline LP News and Updates

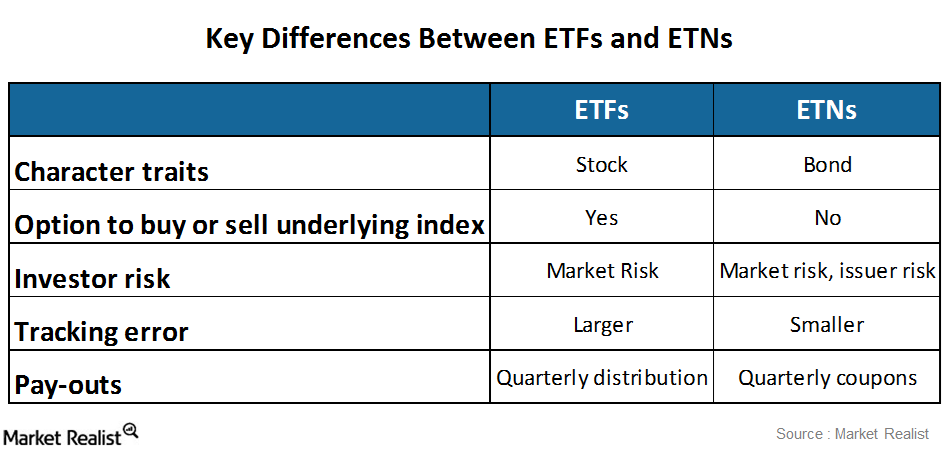

Comparison of exchange-traded funds and exchange-traded notes

ETFs (exchange-traded funds) have stock-like characteristics, while ETNs (exchange-traded notes) possess bond-like traits.

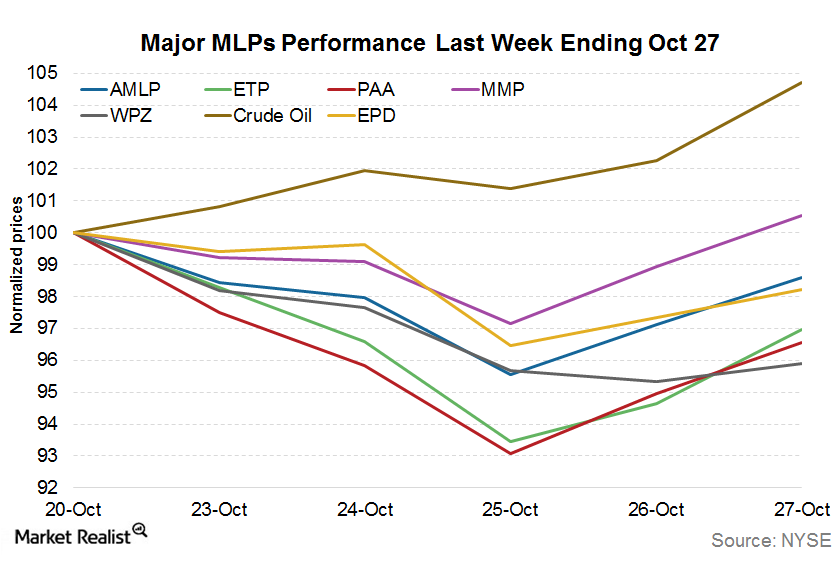

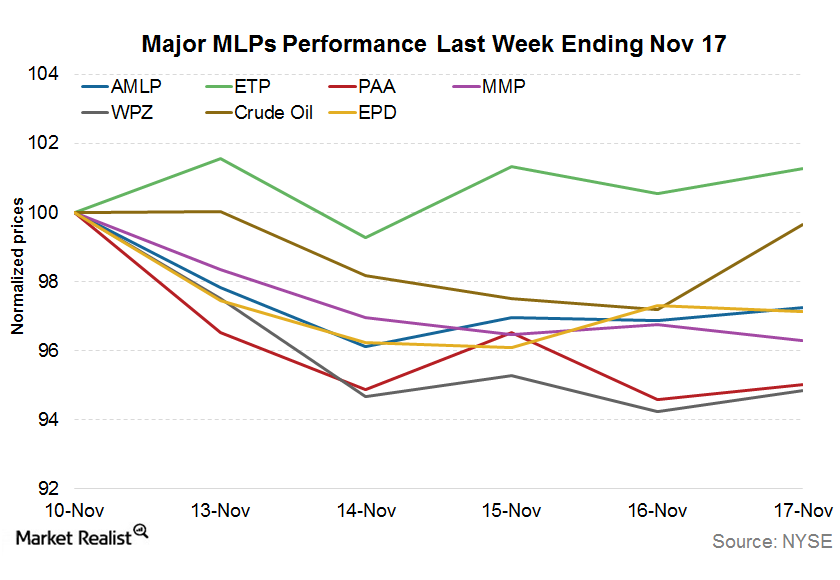

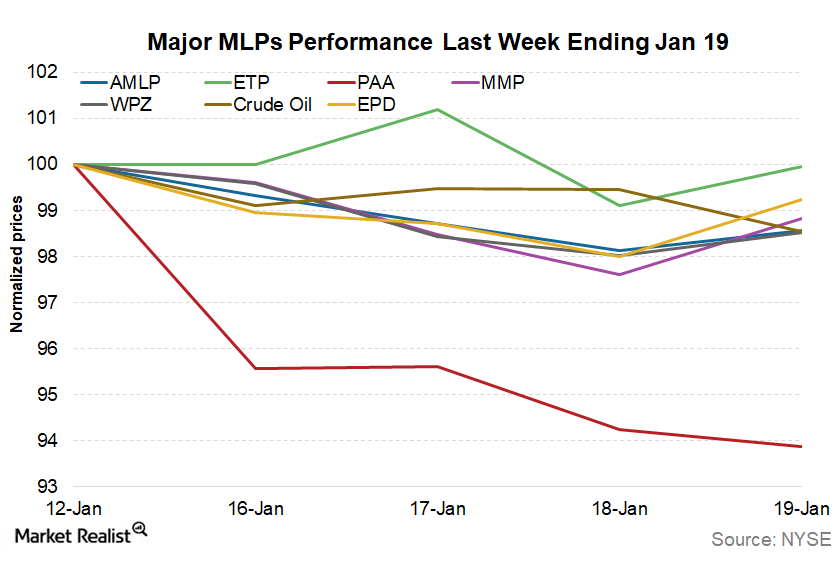

Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

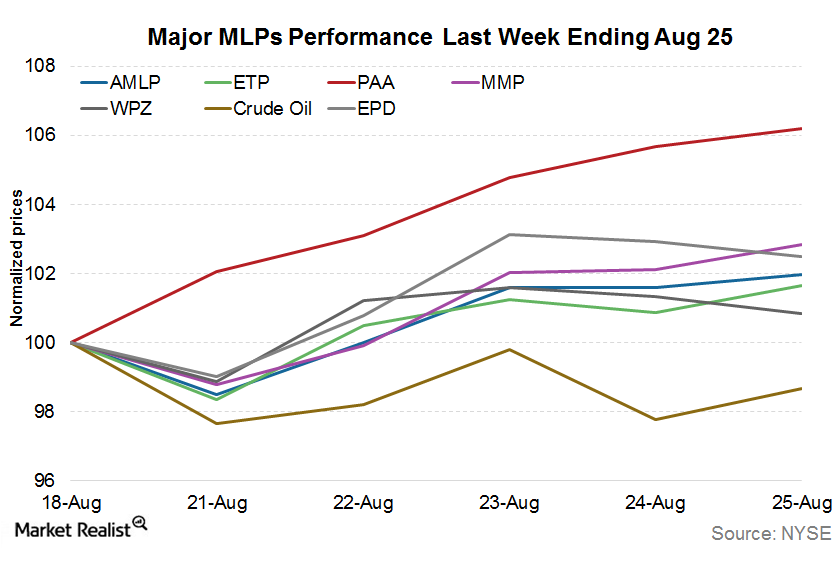

MLPs Recovered Slightly in the Week Ending August 25

MLPs recovered slightly in the week ending August 25—possibly due to an overcorrection in the first three weeks of the month.

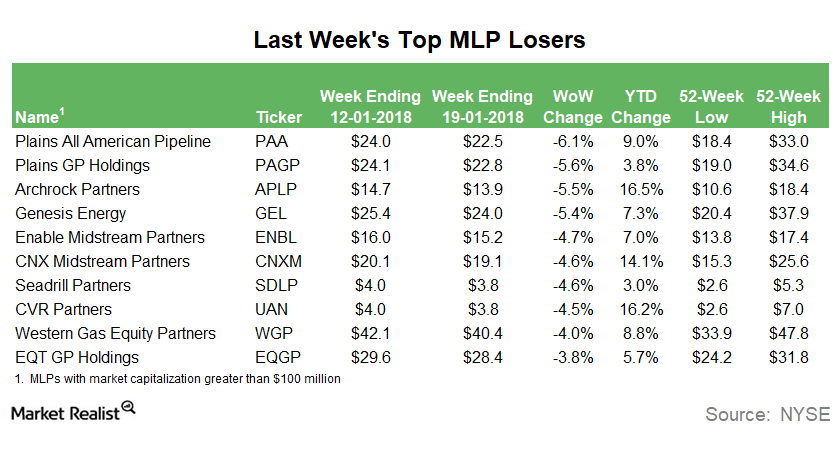

Why PAA Was the Biggest MLP Loser Last Week

Plains All American Pipeline (PAA) was the biggest MLP loser last week, which ended on January 19, 2018. The partnership ended the week 6.1% lower.

Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.

Introducing the UBS ETRACS Alerian MLP Infrastructure ETN AMZIX

The UBS ETRACS 1x Monthly Short Alerian MLP Infrastructure Total Return Index ETN (MLPS) tracks the Alerian MLP Infrastructure Total Return Index (AMZIX).

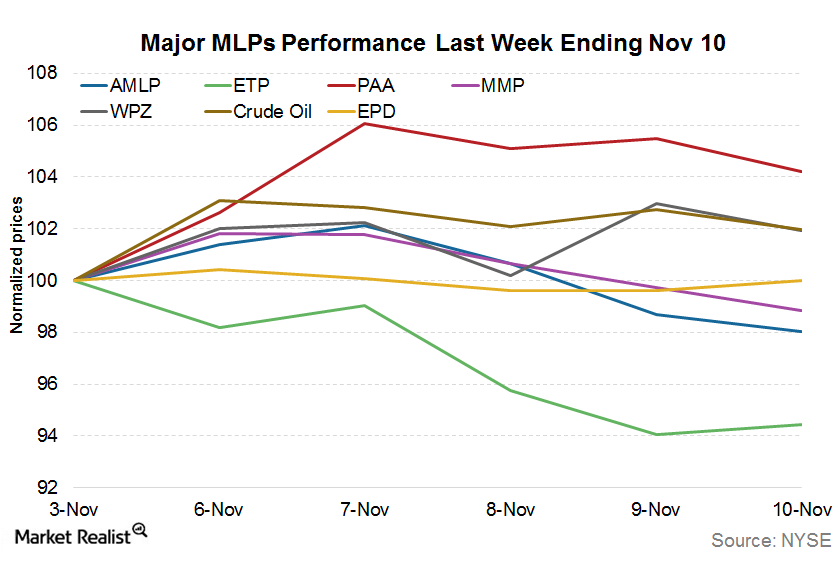

What’s behind MLP Performances for the Week Ended November 10?

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.

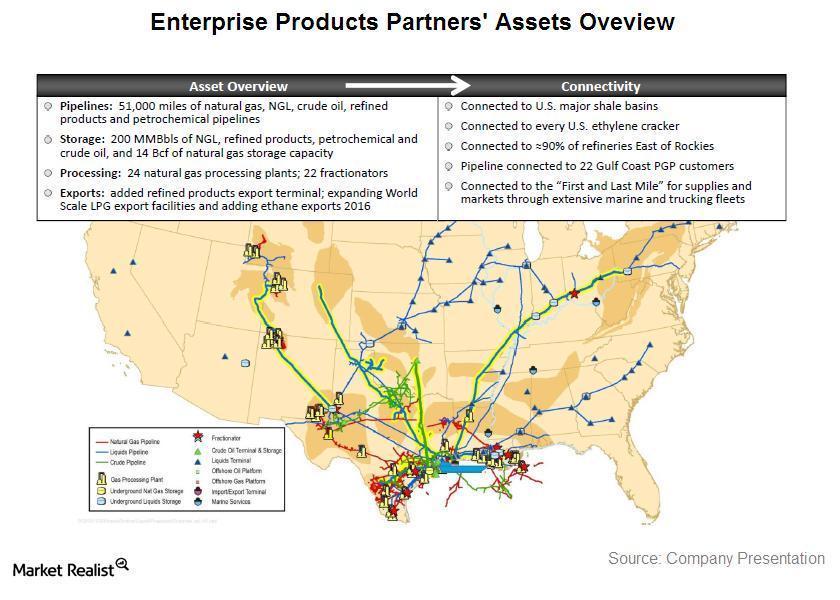

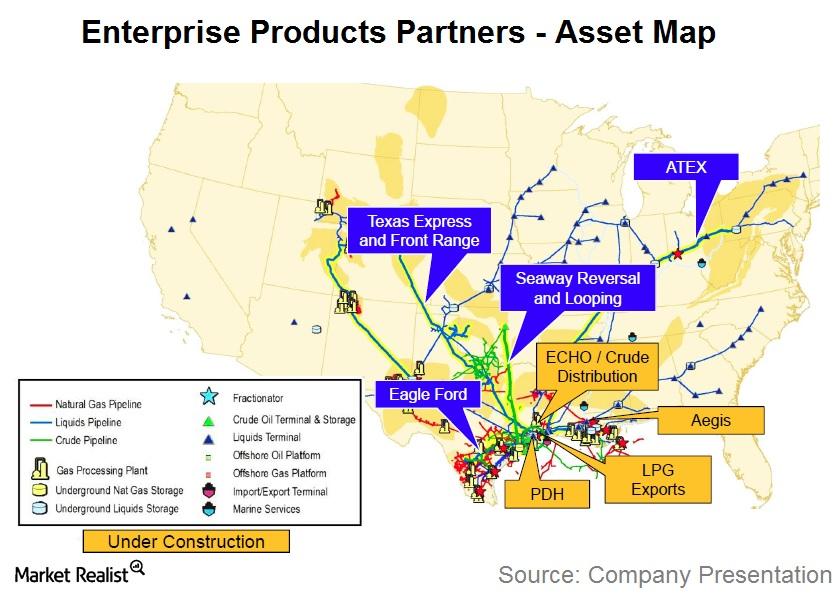

Why Enterprise Products Partners is important to investors

EPD is a leading midstream service provider in the natural gas, natural gas liquids (or NGLs), crude oil, petrochemicals, and refined products sectors.

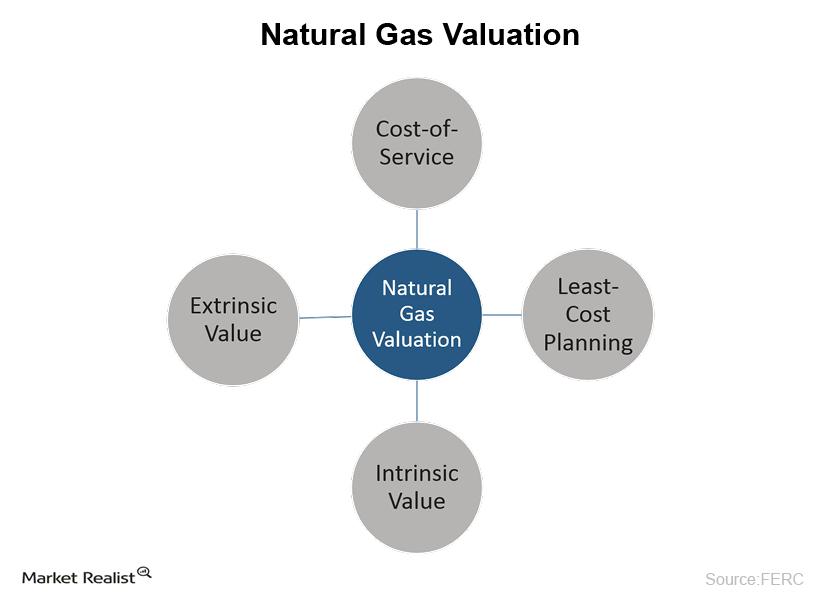

Must-know : A brief overview of natural gas storage contracts

High volatilities in prices increase the extrinsic value of storage assets because it creates more opportunities for profitable storage optimization.

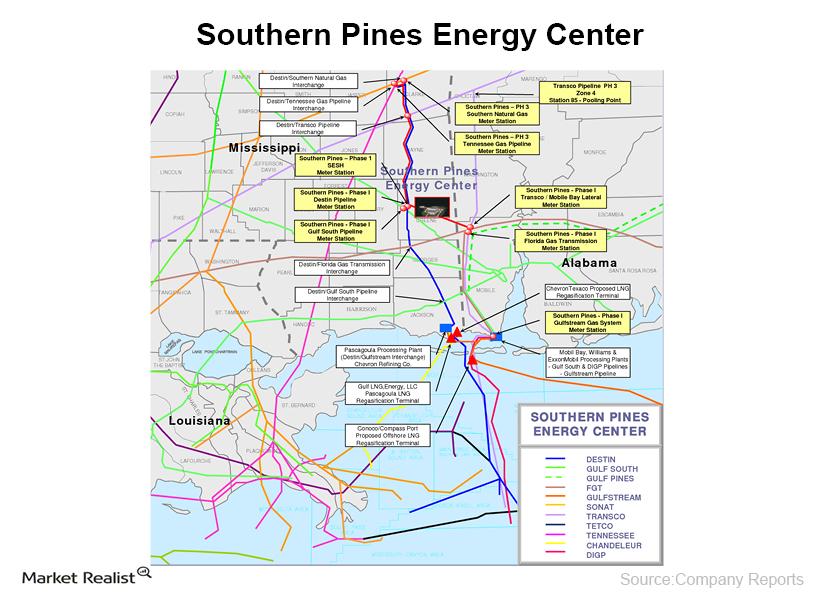

Overview: Plains All American Pipeline’s gas storage services

PAA’s storage facility falls under its supply and logistics segment, which is primarily a margin based segment, which makes it more volatile.

Key points from Enterprise Products Partners’ analyst day meeting

Enterprise Products Partners (EPD) is one of the largest master limited partnerships operating in the midstream energy space.

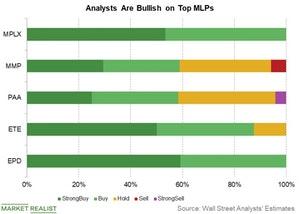

EPD, ETE, PAA, and MMP: What Do Analysts Recommend?

All of the analysts surveyed by Reuters covering Enterprise Products Partners (EPD) and MPLX (MPLX) rated the stocks as “buy.”

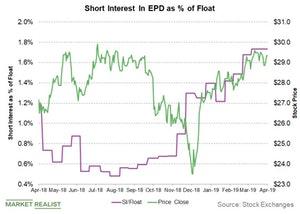

Recent Changes in Enterprise Products Partners’ Short Interest

The short interest in Enterprise Products Partners (EPD) stock rose from 24.9 million shares on March 15 to 25.7 million shares on March 29.

Is Energy Transfer Partners Exploring a C Corporation Structure?

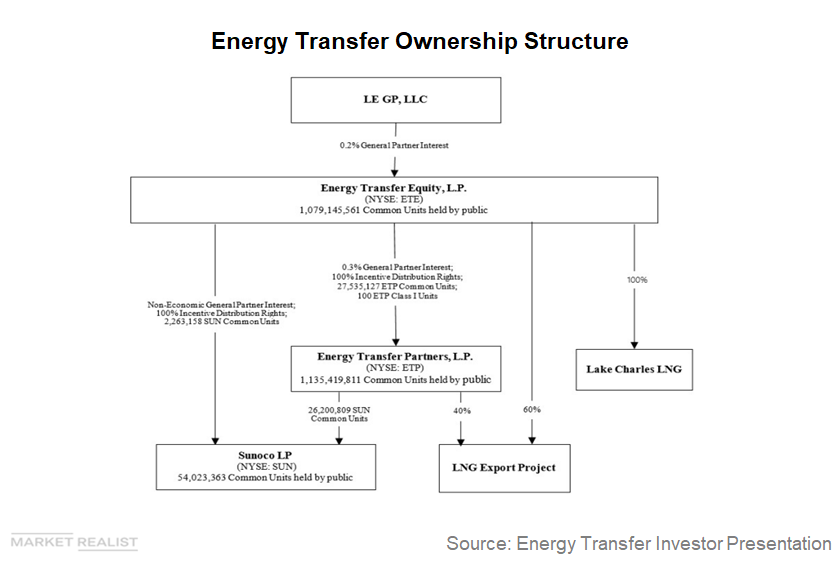

High leverage and a complex capital structure have been a drag on Energy Transfer Partners’ market performance.

Why MLPs Underperformed the Energy Sector Last Week

MLPs underperformed the energy sector and the broader US markets last week. Let’s take a look.

MLPs Cool Off after a Strong 2-Week Rally

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally.

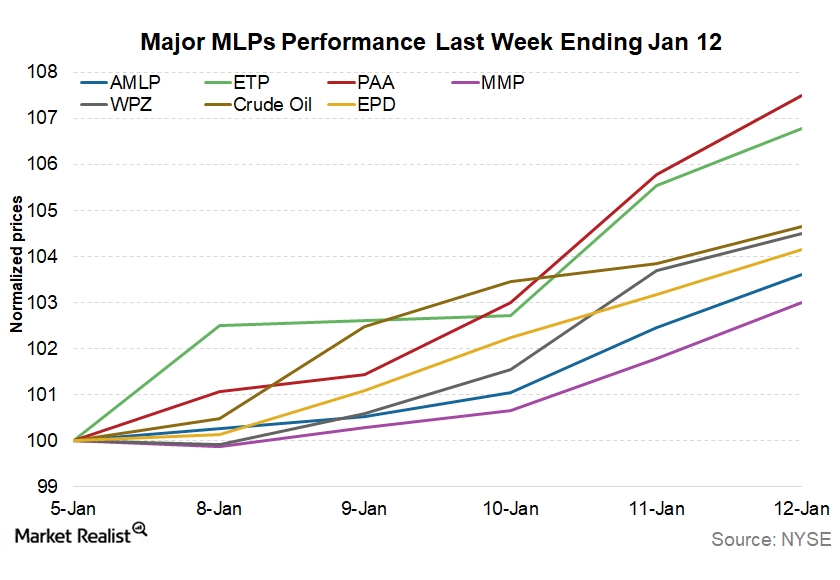

MLPs Continue to Outperform Broader US Markets in 2018

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ) rose 4.6% last week and ended at 300.5.

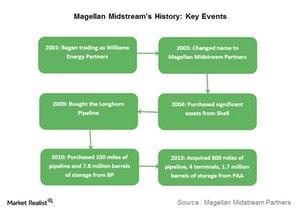

Magellan Midstream Partners: A Brief History

Magellan’s history Magellan Midstream Partners (MMP), which began trading in 2001, has grown through various asset acquisitions and expansion projects over the years. Magellan was formerly a part of Williams Companies (WMB). The company started trading as Williams Energy Partners in 2001, and changed its name to Magellan Midstream Partners in 2003. In 2004, the […]

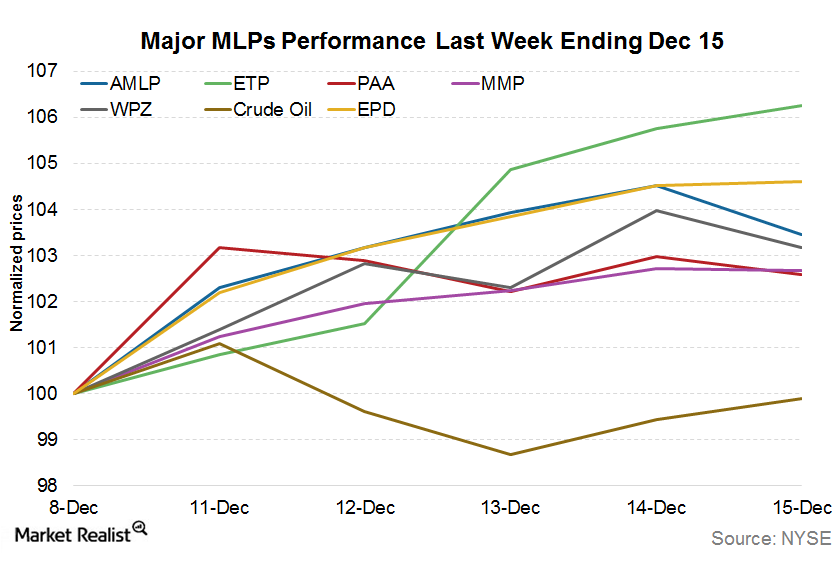

What Drove MLPs in the Week Ending December 15?

MLPs were strong in the week ending December 15, 2017. The Alerian MLP Index (^AMZ) had a strong start last week although it fell slightly on Friday.

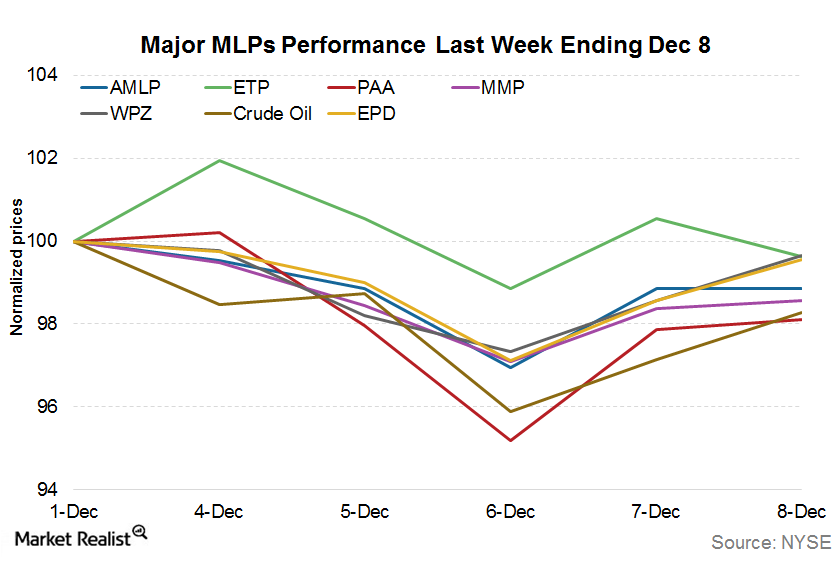

What’s Been Impacting MLP Performances as of December 8?

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

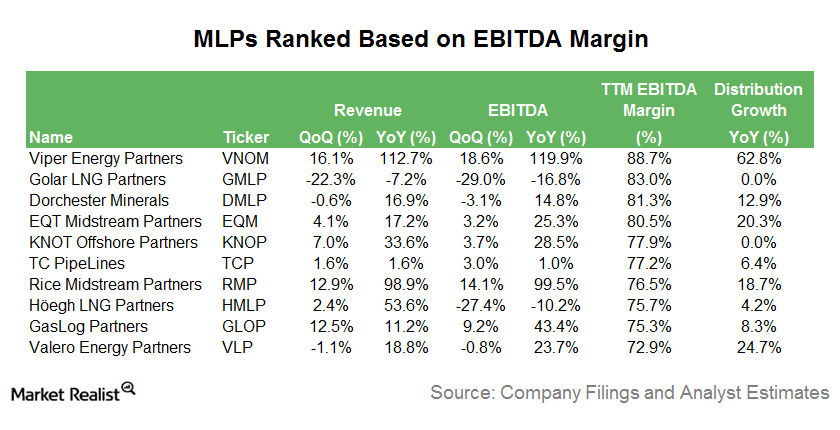

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

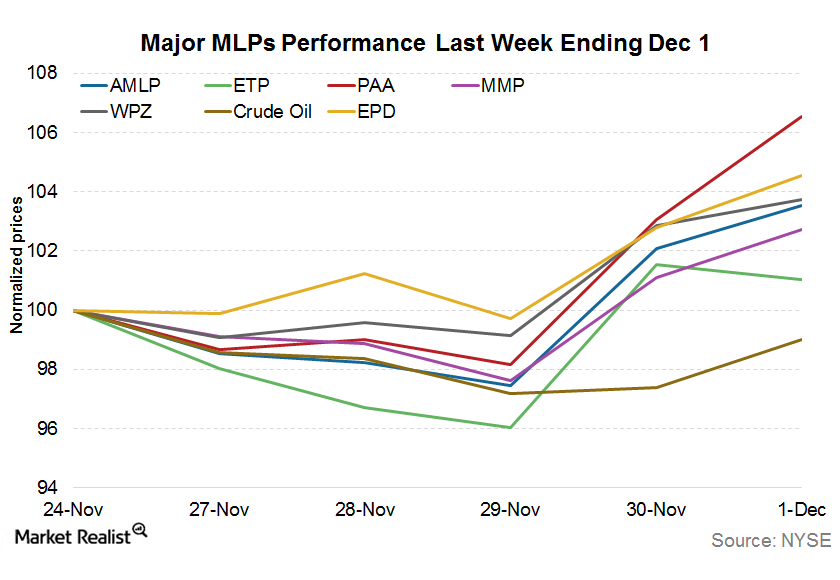

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

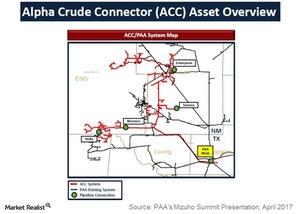

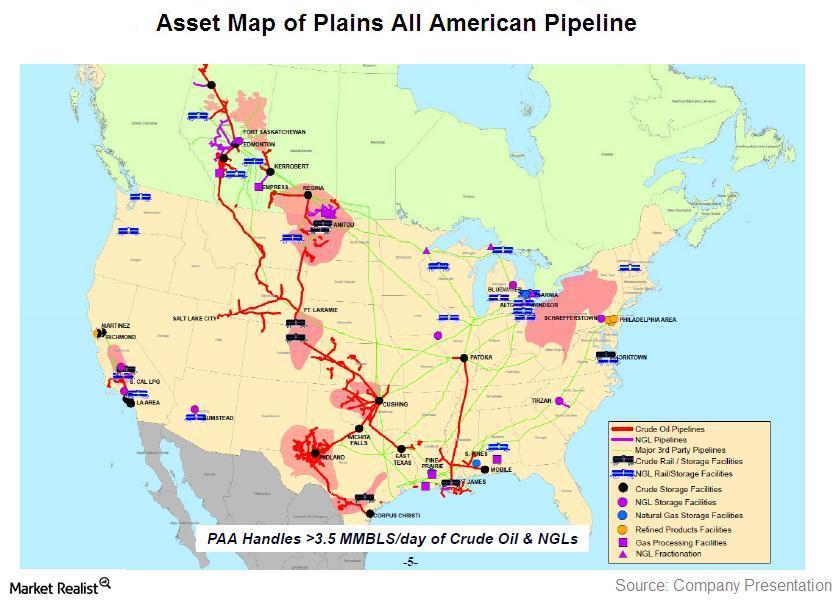

How Recent Acquisitions Have Enhanced PAA’s Permian Footprint

In February 2017, Plains All American Pipeline (PAA) closed the acquisition of a Permian Basin crude oil gathering system for $1.2 billion.

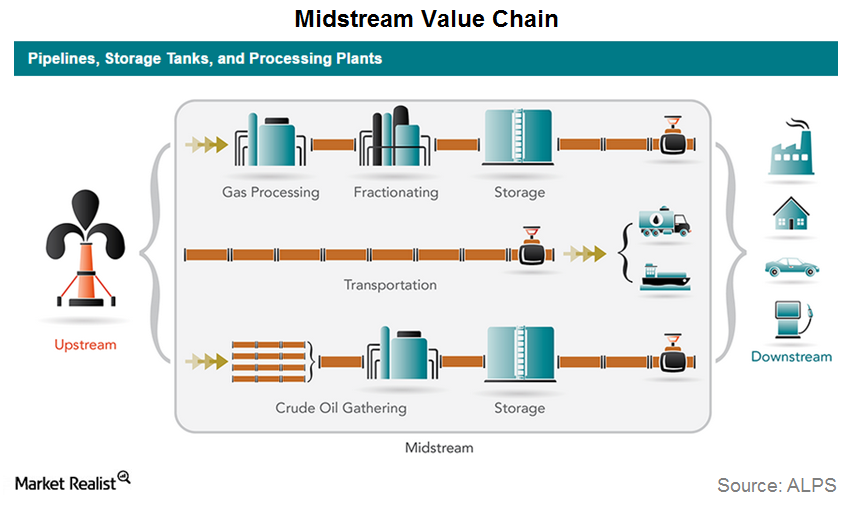

A Look at the Midstream Energy Value Chain

Liquids pipelines and terminaling MLPs, as the name suggests, are involved in crude oil, refined product, and NGLs (natural gas liquids) transportation and storage.

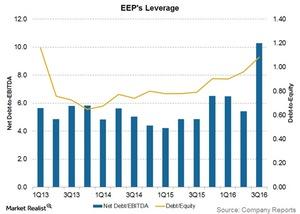

Is Enbridge Energy Partners’ Leverage a Concern?

Enbridge Energy Partners’ (EEP) debt-to-equity ratio is 1.1x. How do other midstream companies compare?

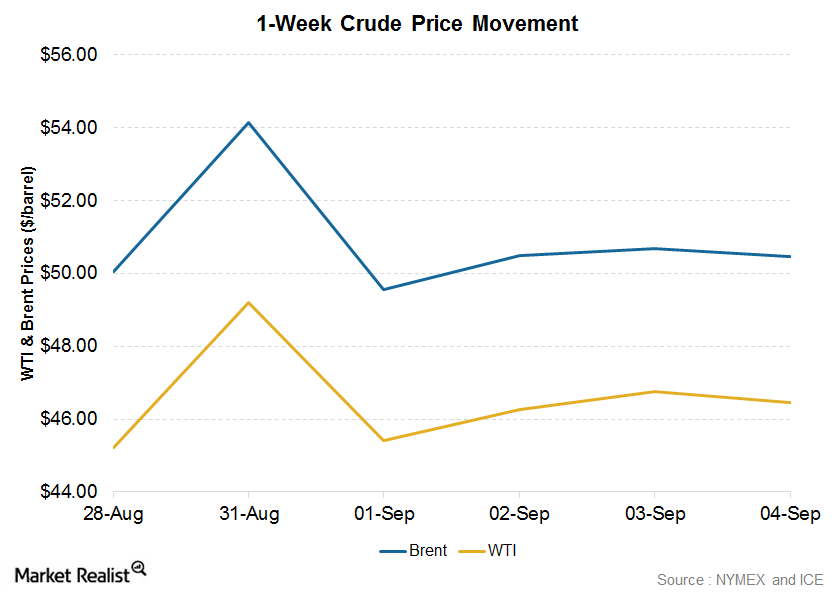

A Volatile Week for Crude Oil Prices: Analyzing the Key Reasons

WTI crude oil prices closed 1.83% higher on a weekly basis at $46.05 per barrel in the week ended September 4. Brent crude fell by 0.87% on a weekly basis, closing at $49.61 on September 4.

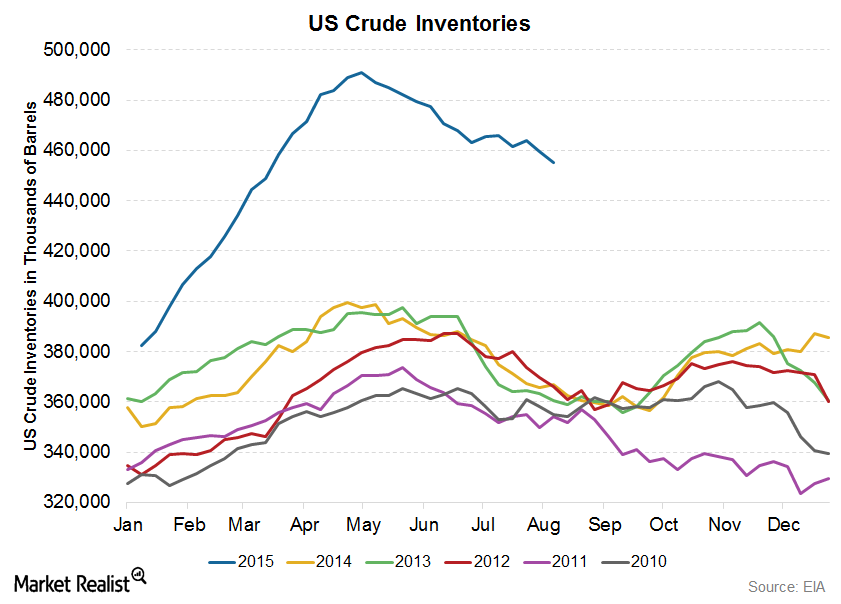

Crude Oil Inventories Fell, but Why Did WTI Crude Prices Slump?

The U.S. Energy Information Administration reported a decrease of 4.4 million barrels in crude oil inventories for the week ended July 31.

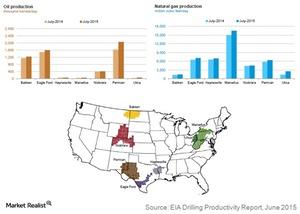

Must-Know: The 7 Regions for Oil and Gas Production in the US

The EIA (Energy Information Administration) monitors seven key tight oil and gas regions in the US.

The Advantages and Disadvantages of Investing in MLPs

MLPs clearly stand out when compared to other asset classes because of their structure, yields as compared to other asset classes, and stability of cash distribution.

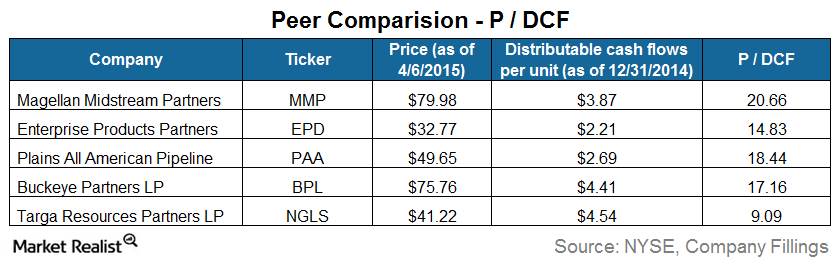

Valuing MLPs: Price-to-Distributable Cash Flow Ratio

MLPs’ valuations are different from other stocks. To value MLPs, the widely used PE ratio isn’t as useful as the PDCF ratio.

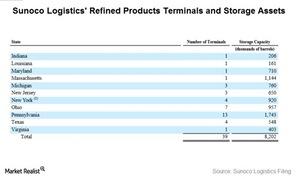

An Overview of Sunoco’s Terminals Facilities

Sunoco’s terminals facilities business operates crude oil, refined products, and natural gas liquids (or NGL) terminals.

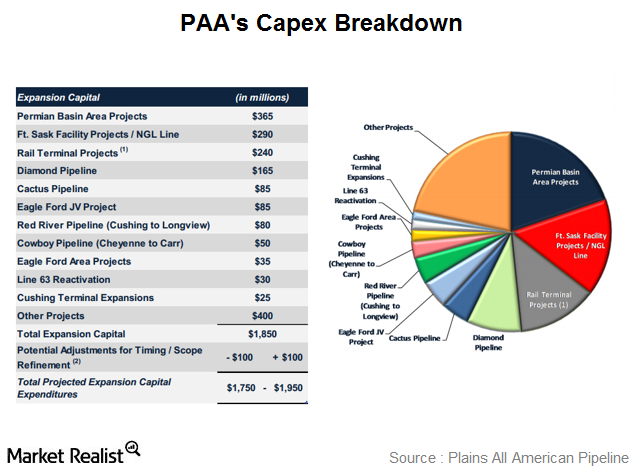

Plains All American Pipeline’s capex plan for 2015

Plains All American Pipeline expects to spend $1.85 in capex in 2015, highlighted by several projects in multiple geographic regions or resource plays.

Overview: Plains All American Pipeline’s gas storage facilities

Currently, there are three major publicly traded independent storage firms, Plains All American Pipeline’s (PAA) natural gas storage subsidiary (PAA Natural Gas Storage), Niska Gas Storage Partners (NKA), and Crestwood Equity Partners (CEQP). PAA is part of the Alerian MLP (or master limited partnership) ETF (AMLP), while CEQP is part of the Global X MLP ETF (MLPA).

Must-know: An introduction to Plains All American Pipeline

Plains All American Pipeline L.P. (PAA) is a master limited partnership that operates in the midstream energy business.