MLPs Cool Off after a Strong 2-Week Rally

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally.

Jan. 22 2018, Published 3:16 p.m. ET

AMZ fell 1.5% last week

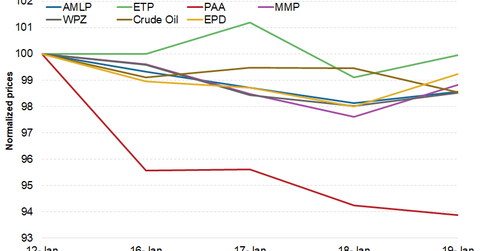

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally. The Alerian MLP Index (^AMZ), which includes 50 energy MLPs, fell 1.5% last week to end at 296.0. Overall, the index has risen 5.5% since the start of this year. AMZ is still outperforming the S&P 500 Index (^GSPC)(SPX-INDEX), which represents the broader US markets. GSPC has gained 5.1% in 2018 to date.

Out of the total 93 MLPs, 66 ended in the red, two remained unchanged, and the remaining 25 ended in the green. Among the top MLPs, Plains All American Pipelines (PAA), Williams Partners (WPZ), Enterprise Products Partners (EPD), and Energy Transfer Partners (ETP) fell 6.1%, 1.5%, 0.8%, and 0.1%, respectively. We’ll look into performance drivers for the top MLP losers and gainers in later parts of this series. The Alerian MLP ETF (AMLP) ended the week 1.4% lower.

MLPs weakness last week could be due to a mild correction in crude oil prices and several negative rating downgrades. Crude oil fell 1.4% last week to end at $63.4 per barrel. For recent updates on crude oil, read Why Oil Prices Have Been Relatively Flat.

Fund flows

The Alerian MLP ETF saw a net inflow of $54.9 million funds despite midstream MLPs’ sluggishness last week. This number might indicate bullish sentiment in the sector. On the other hand, the JP Morgan Alerian MLP Index ETN (AMJ) saw a net inflow of $1.2 million funds.

In the next part of this series, we’ll look into last week’s biggest MLP losers.