Williams Partners LP

Latest Williams Partners LP News and Updates

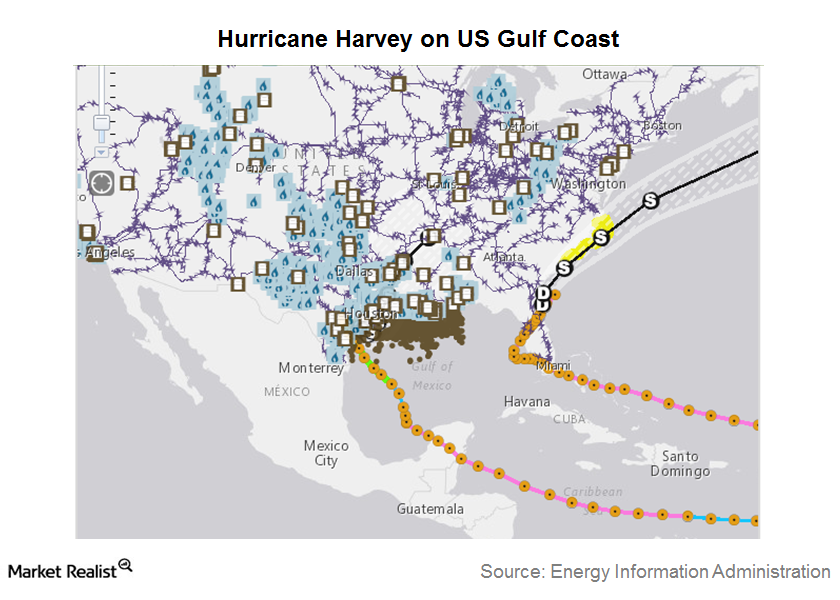

Hurricane Harvey Impacted Energy MLPs

Hurricane Harvey hit the US Gulf Coast last week. The US Gulf Coast is a major destination for US refineries and energy infrastructure.

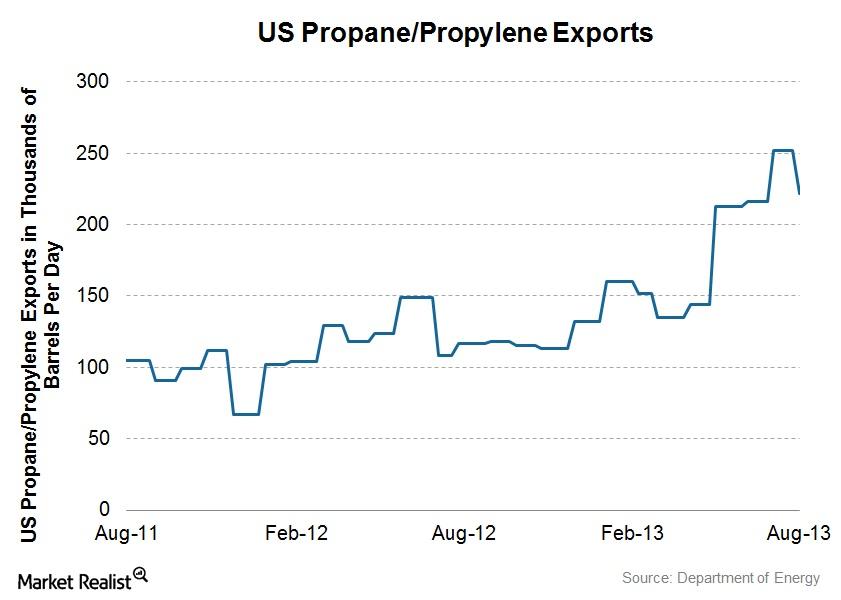

Why some MLPs are benefitting from increased propane exports

Significantly higher rates of propane exports have helped to boost propane prices—and the margins of some MLP names.

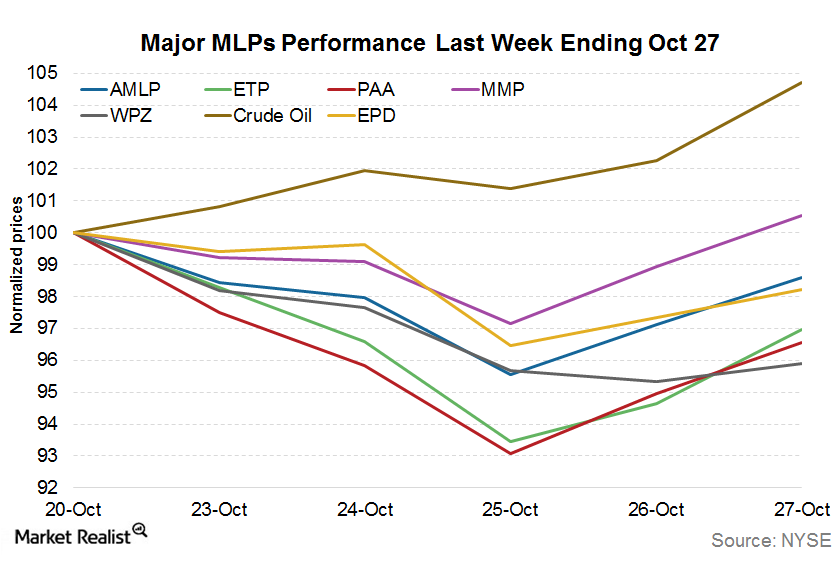

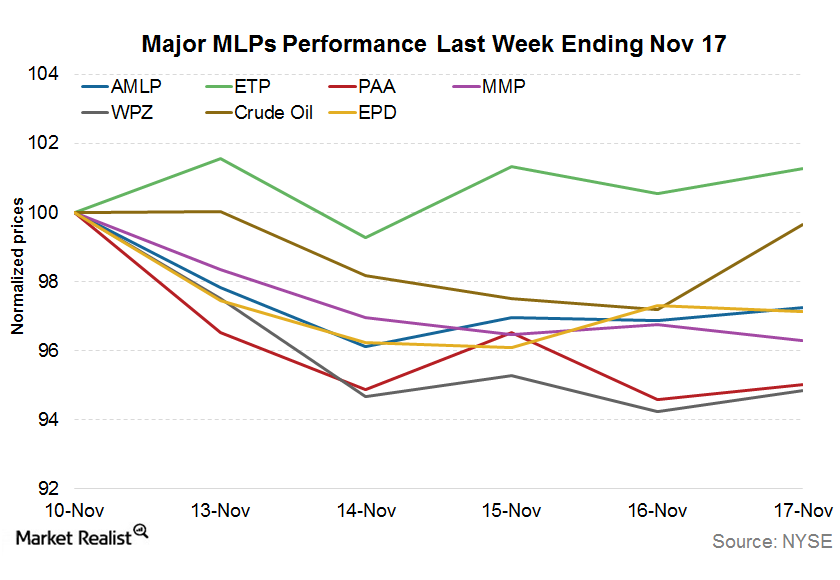

Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

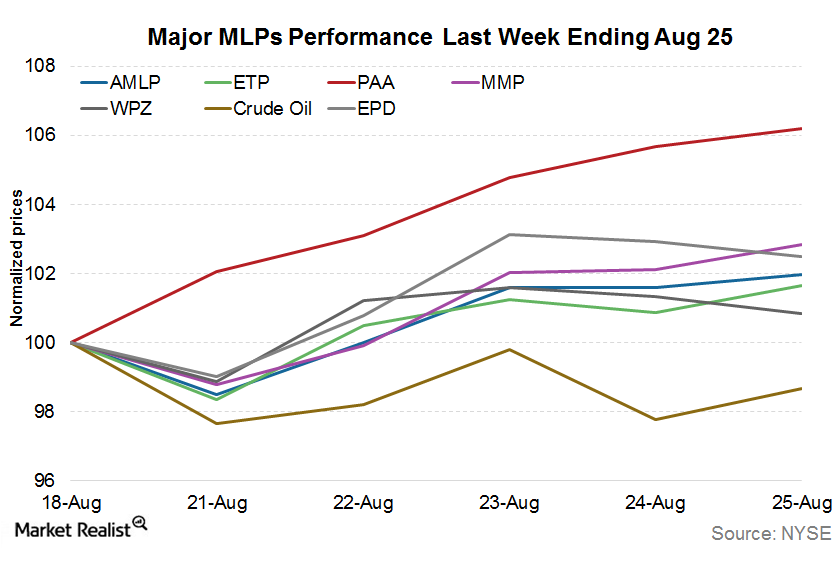

MLPs Recovered Slightly in the Week Ending August 25

MLPs recovered slightly in the week ending August 25—possibly due to an overcorrection in the first three weeks of the month.

Why Frac Spreads Affect Some MLP Stocks

Companies in the natural gas processing space—many of which are MLPS—keep an eye on the fractionation or “frac” spread. Here’s why.

Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.

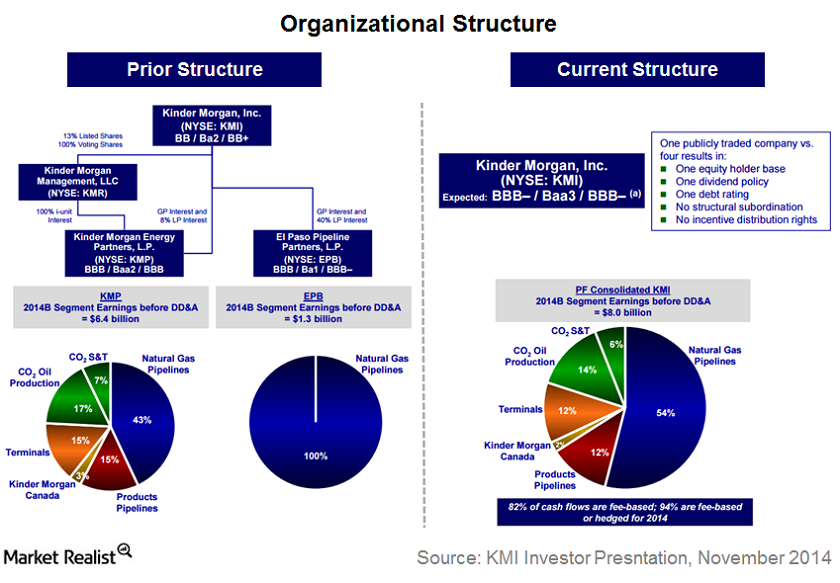

Kinder Morgan Consolidation: What It Means for the MLP Market

On November 26, 2014, Kinder Morgan acquired all of its equity interests in Kinder Morgan Partners, El Paso, and Kinder Morgan Management.

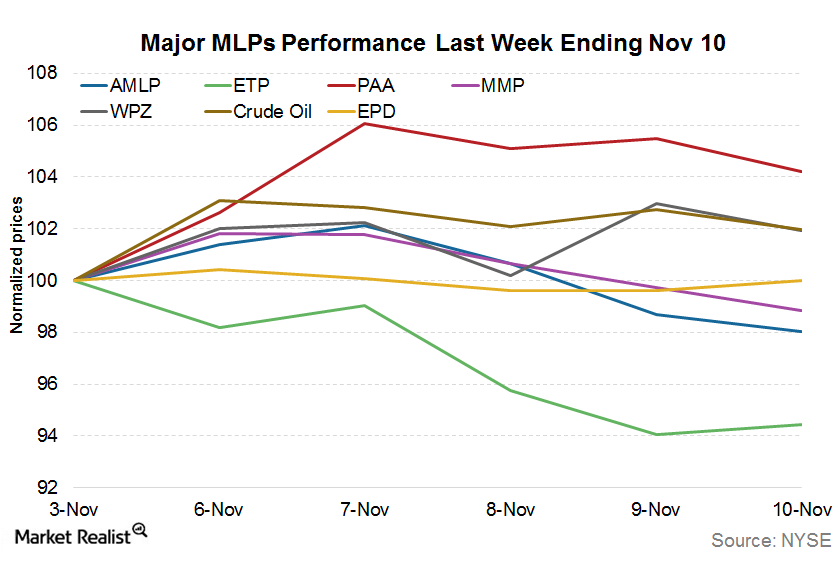

What’s behind MLP Performances for the Week Ended November 10?

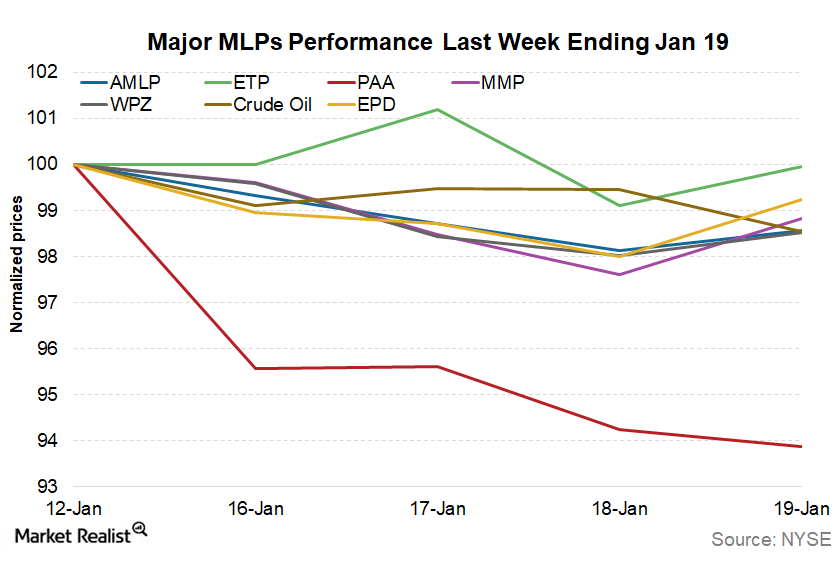

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.

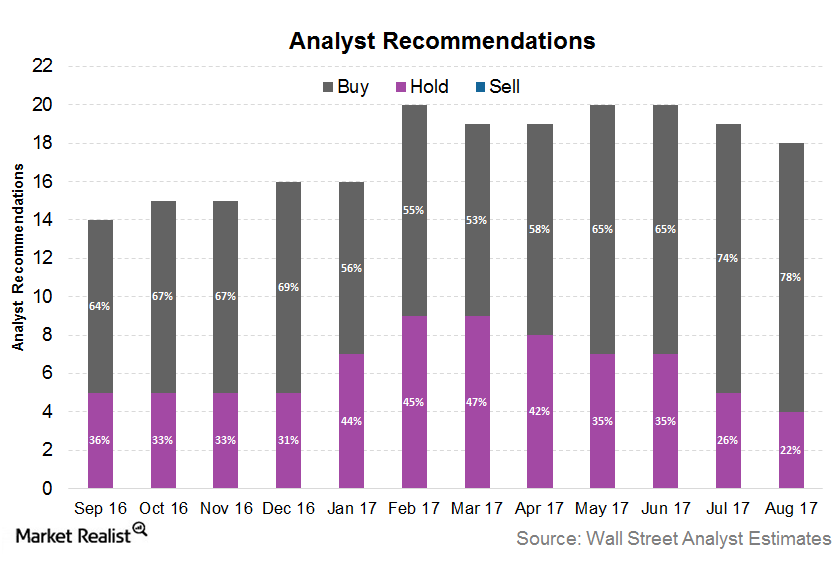

Are Analysts Bullish on Williams Companies?

About 78.0% of analysts rate Williams Companies (WMB) a “buy,” while the remaining 22.0% rate it a “hold” as of August 21, 2017.

These Midstream Players Have Created Maximum Wealth for Investors

In this series, we’ll look at the historical outliers in midstream energy, which have generated massive wealth amid turbulent times.

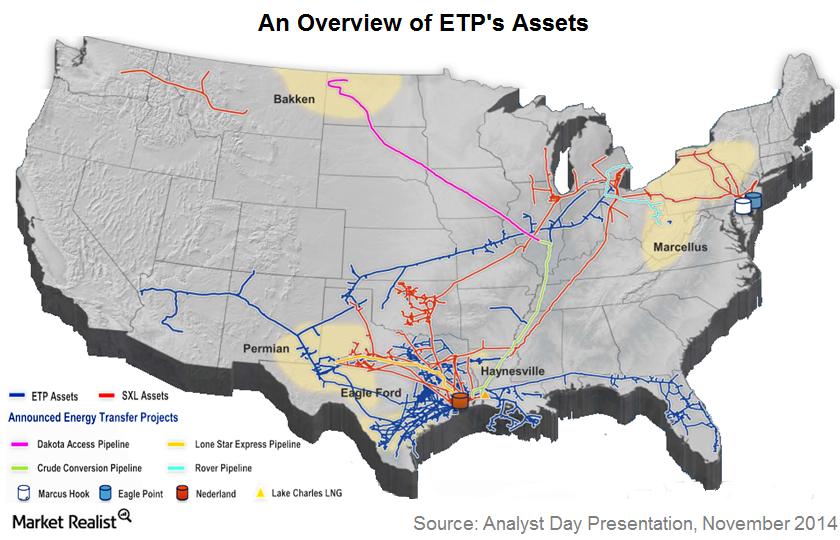

A Review of Energy Transfer Partners’ Business Segments

ETP operates primarily through its six business segments by leveraging its huge asset base.

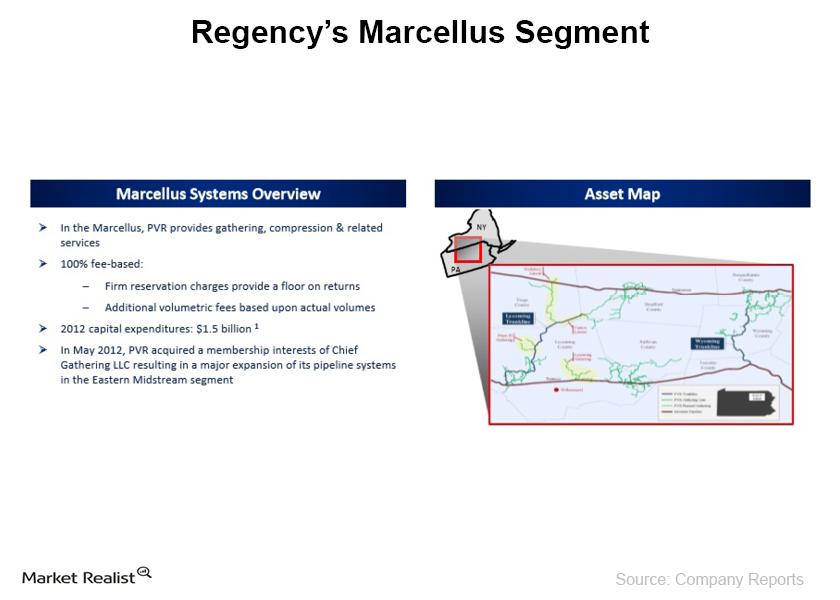

Regency’s PVR Midstream acquisition means Marcellus Shale exposure

Regency recently acquired a foothold in the Marcellus by buying PVR Partners LP in March this year in a deal worth $5.6 billion, specifically to boost its footprint in the Appalachian Basin.

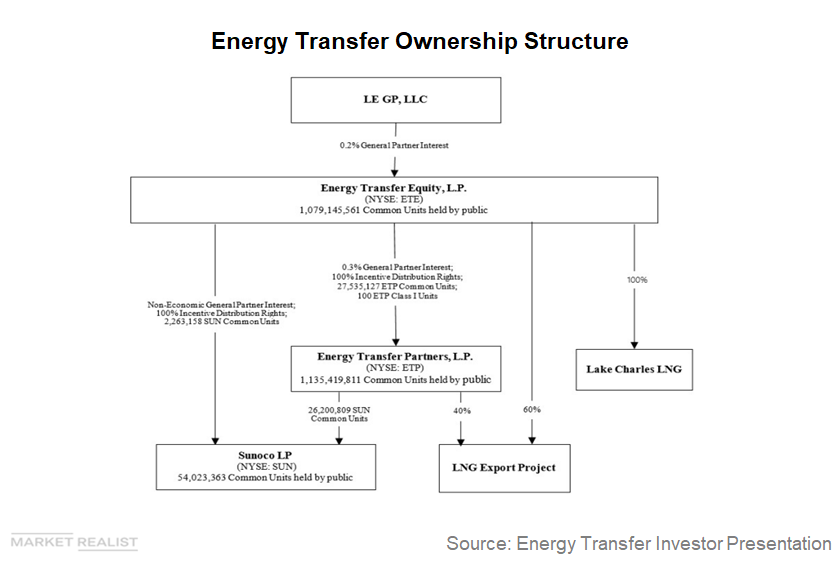

Is Energy Transfer Partners Exploring a C Corporation Structure?

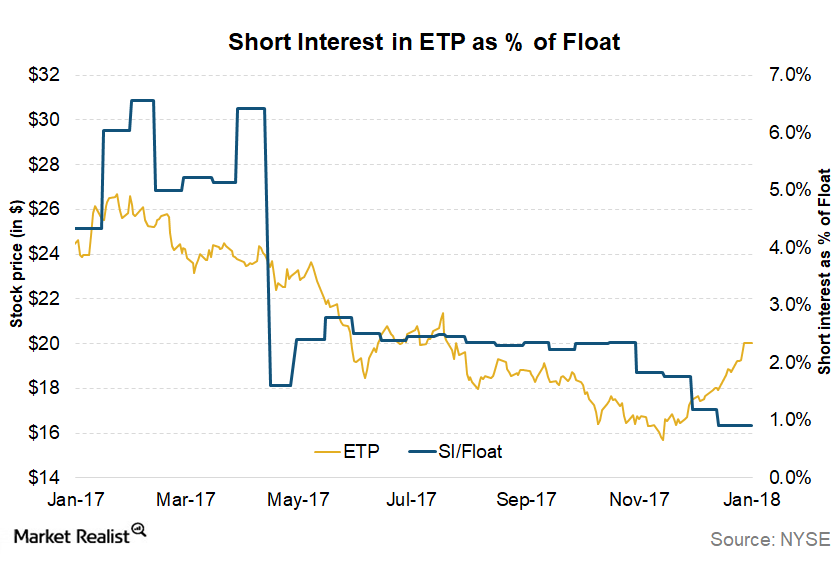

High leverage and a complex capital structure have been a drag on Energy Transfer Partners’ market performance.

Why MLPs Underperformed the Energy Sector Last Week

MLPs underperformed the energy sector and the broader US markets last week. Let’s take a look.

MLPs Cool Off after a Strong 2-Week Rally

MLPs (master limited partnerships) cooled off last week, which ended on January 19, after two weeks of a strong rally.

Williams Partners’ Distribution Growth Plans

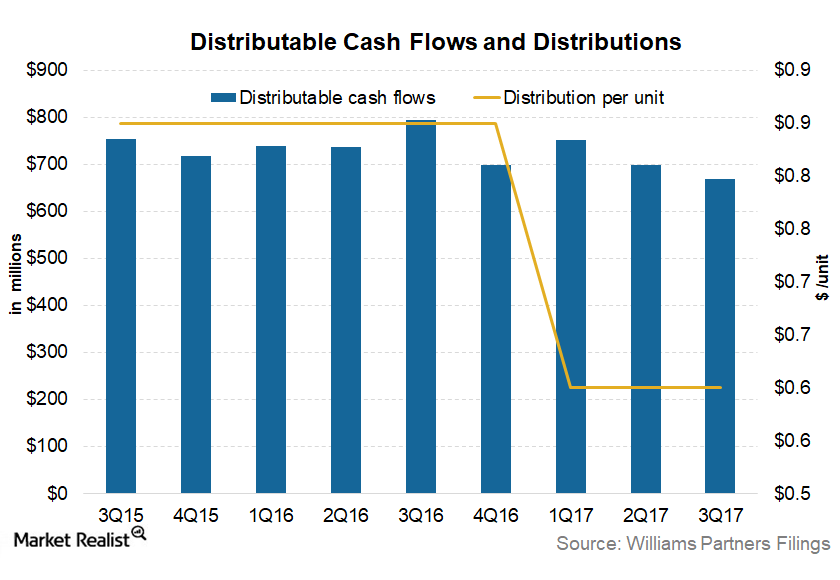

Williams Partners (WPZ) expects its 2017 distributable cash flow to lie between $2.6 and $2.8 billion. At the midpoint, this range represents a ~9.0% YoY (year-over-year) decline.

How USAC Deal Could Boost ETP’s Market Performance

Energy Transfer Partners (ETP) had a strong start to the year with a rise of ~6.5% in 2018 YTD (year-to-date).

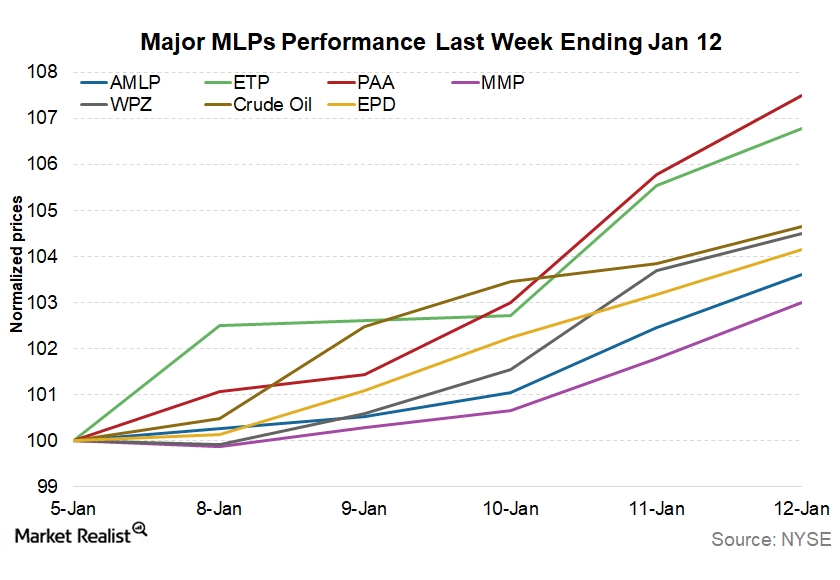

MLPs Continue to Outperform Broader US Markets in 2018

MLPs maintained their winning streak in the second week of 2018. The Alerian MLP Index (^AMZ) rose 4.6% last week and ended at 300.5.

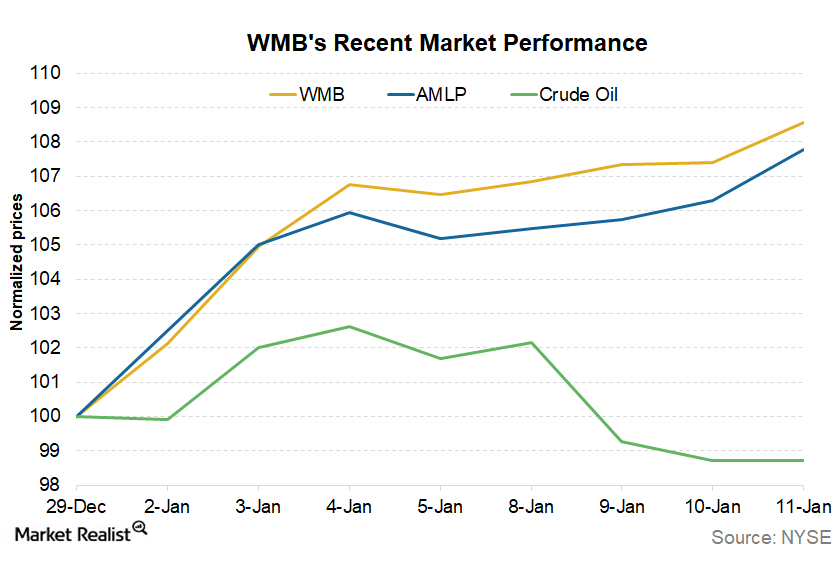

WMB Has Risen ~9% in 2018 So Far: Can the Gains Continue?

Williams Companies (WMB) has had a massive start to the year. It’s risen nearly 9% in seven trading sessions in 2018. Overall, the C corporation GP (general partner) has risen ~14% since the start of December 2017.

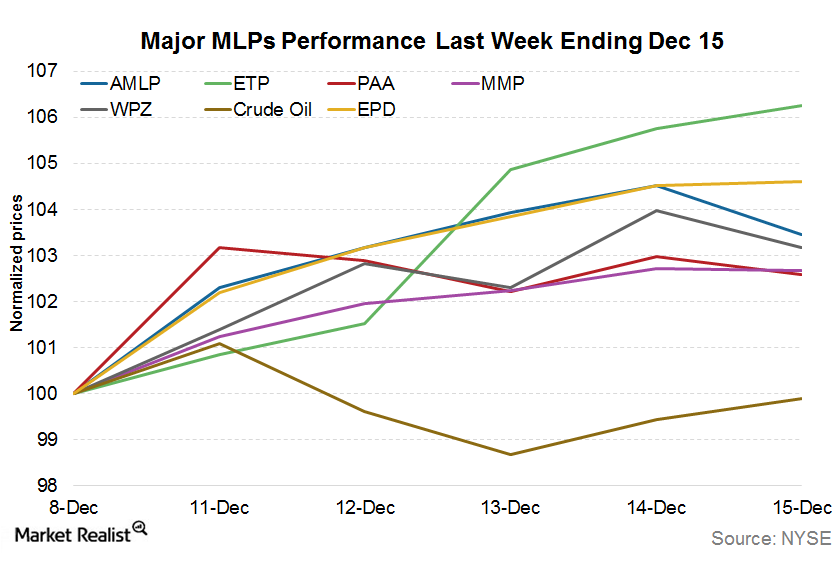

What Drove MLPs in the Week Ending December 15?

MLPs were strong in the week ending December 15, 2017. The Alerian MLP Index (^AMZ) had a strong start last week although it fell slightly on Friday.

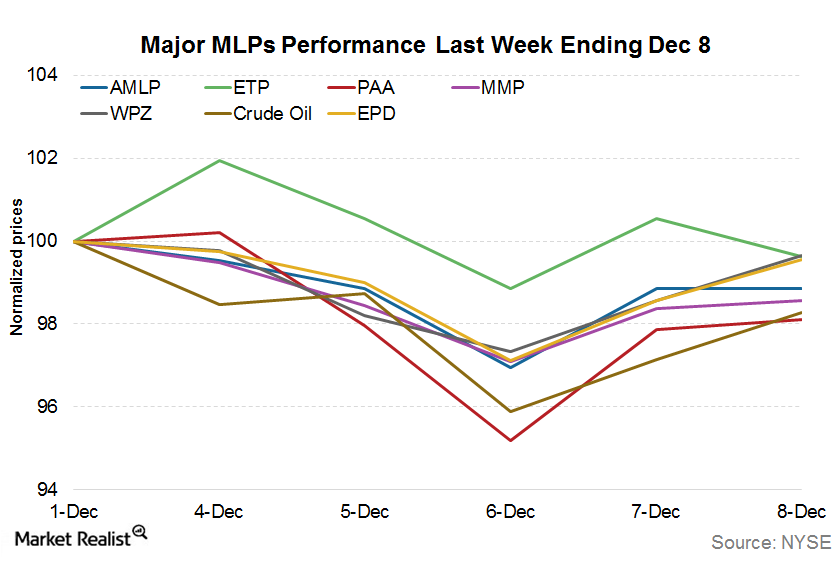

What’s Been Impacting MLP Performances as of December 8?

Most MLPs (master limited partnerships) closed the week ended December 1 in the red, after seeing some gains earlier in the week.

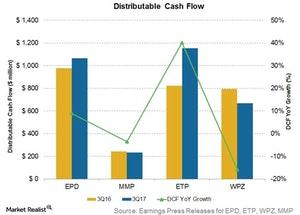

What’s behind ETP’s Strong Distributable Cash Flow Growth?

Energy Transfer Partners’ DCF rose 27.5% YoY to $1,049 million in 3Q17 compared to $823 million in 3Q16.

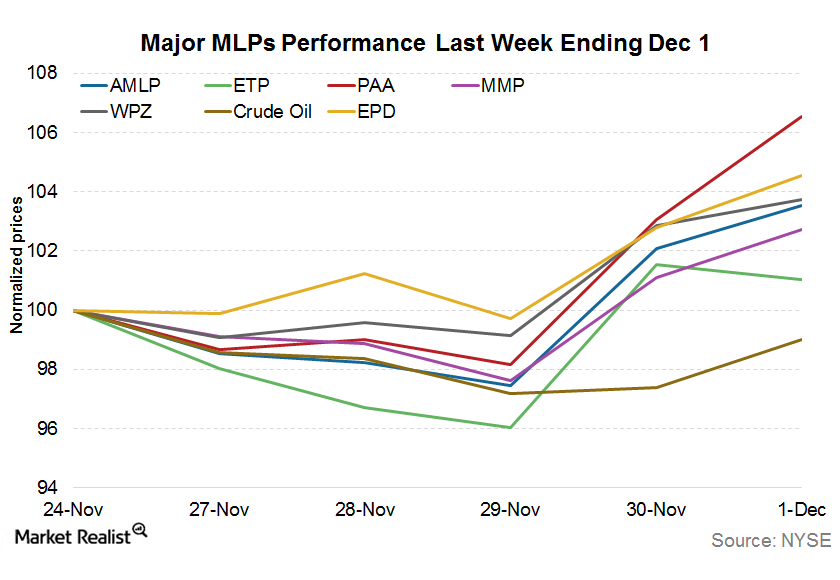

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

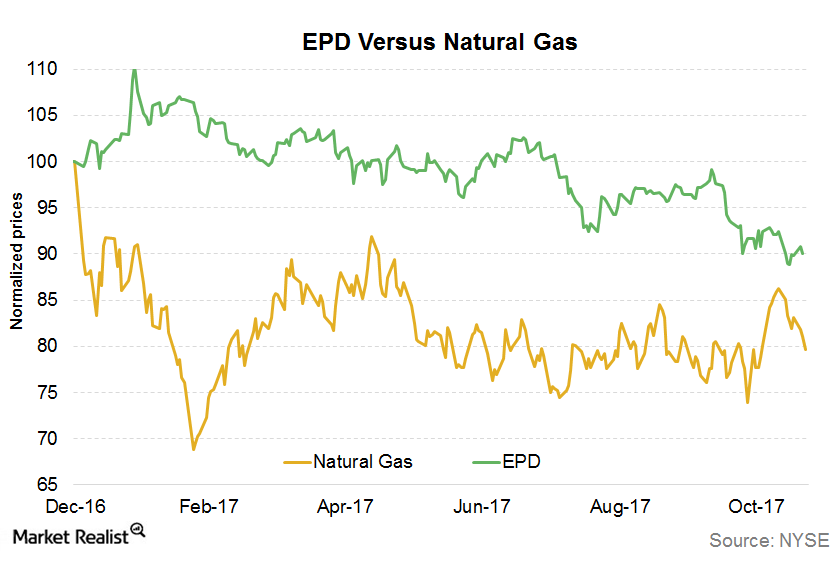

What’s EPD’s Correlation with Natural Gas?

In this article, we’ll look into the commodity price exposure of the MLP at the seventh spot, Enterprise Products Partners (EPD).

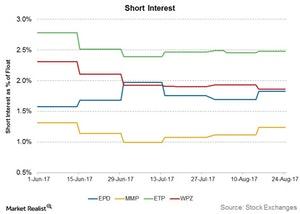

Short Interest in Enterprise Products and Magellan Rose Recently

The short interest as a percentage of float in Enterprise Products Partners’ (EPD) stock is 1.8%—higher than the 1.7% in mid-August.

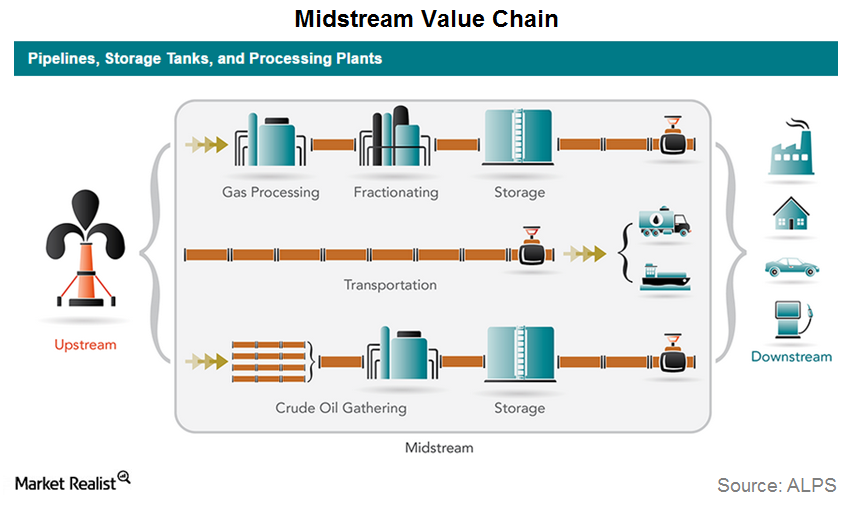

A Look at the Midstream Energy Value Chain

Liquids pipelines and terminaling MLPs, as the name suggests, are involved in crude oil, refined product, and NGLs (natural gas liquids) transportation and storage.

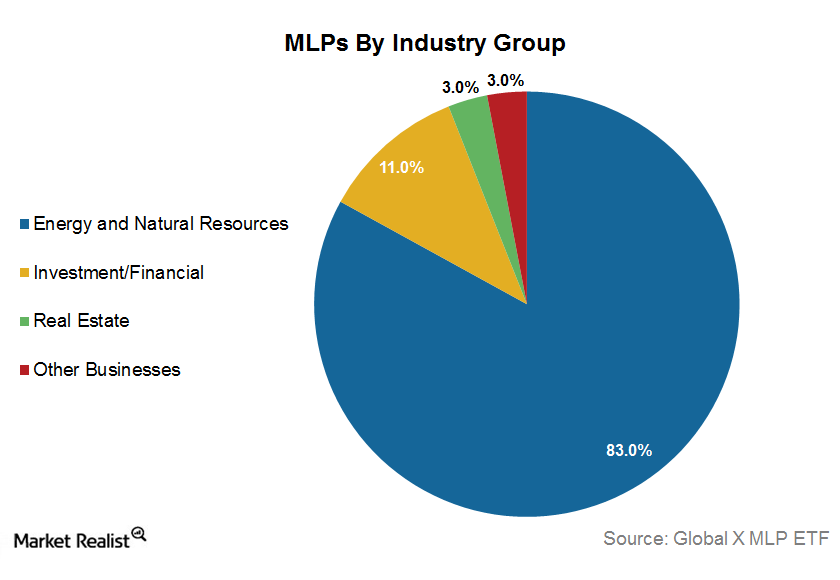

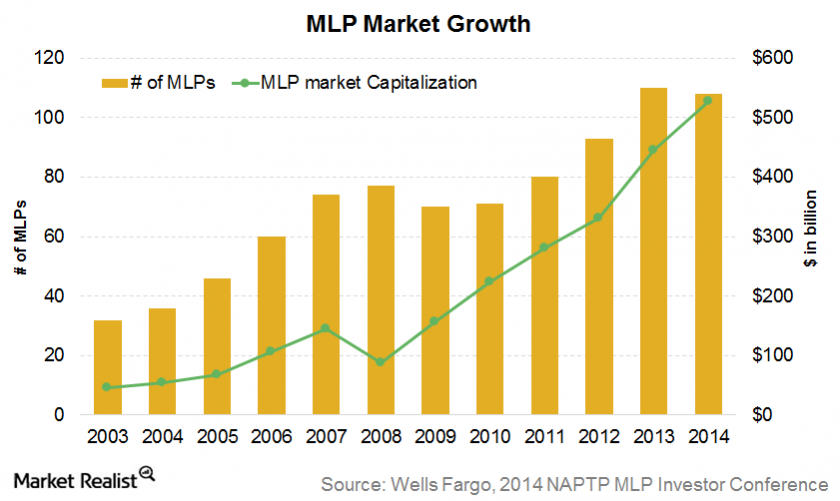

What You Should Know about Master Limited Partnerships

The number of MLPs has risen from a mere 32 in 2003 to 117 as of November 2016. 83% of total MLPs are energy and natural resources–related.

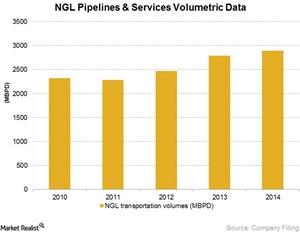

EPD’s Most Profitable Segment: NGL Pipelines & Services

EPD’s Natural Gas Liquid Pipelines & Services segment involves natural gas processing plants and NGL marketing activities.

The Advantages and Disadvantages of Investing in MLPs

MLPs clearly stand out when compared to other asset classes because of their structure, yields as compared to other asset classes, and stability of cash distribution.

What Investors Need to Know about MLPs

MLPs are engaged in the production, transportation, storage, and processing of natural resources like oil, natural gas, and NGLs. They’re public companies.

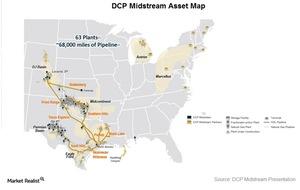

DCP Midstream Partners and Its Three Operating Segments

Unit price for DCP Midstream decreased 24% in the past year. The fall is particularly sharp since the end of October when its unit price crashed 32%.

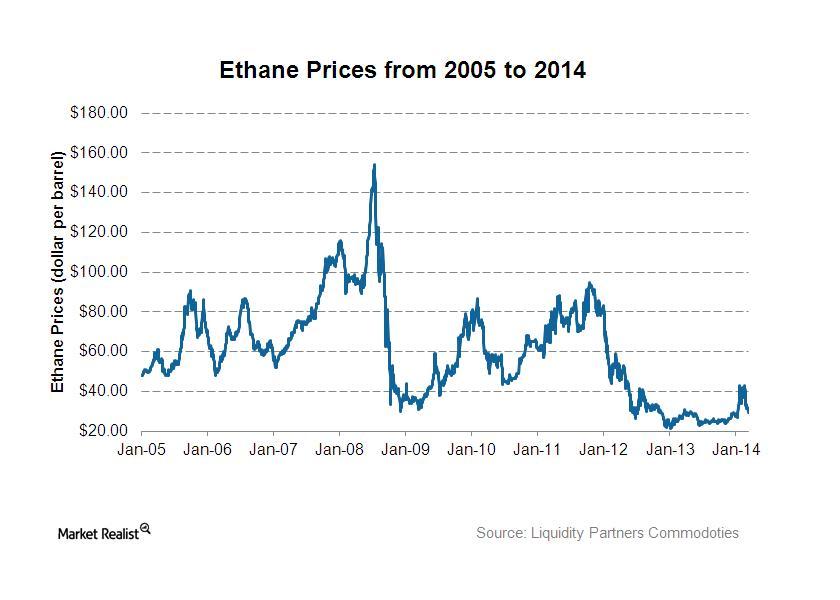

Ethane production and its effects on natural gas processors

With attractive NGL pricing relative to naphtha refinery streams, the feedstock percentage of NGLs has been increasing, with ethane taking a disproportionate share of the total.