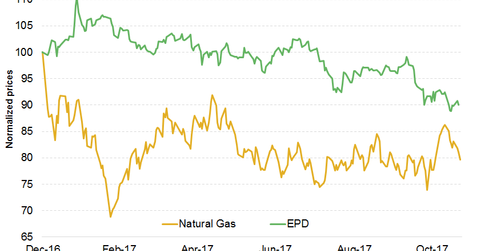

What’s EPD’s Correlation with Natural Gas?

In this article, we’ll look into the commodity price exposure of the MLP at the seventh spot, Enterprise Products Partners (EPD).

Dec. 4 2017, Updated 10:32 a.m. ET

EPD versus natural gas

So far in this series, we’ve looked into the top six MLPs in terms of correlation with natural gas including Golar LNG Partners (GMLP), Boardwalk Pipeline Partners (BWP), Dorchester Minerals (DMLP), Legacy Reserves (LGCY), DCP Midstream (DCP), and Black Stone Minerals (BSM). In this article, we’ll look into the commodity price exposure of the MLP in the seventh spot, Enterprise Products Partners (EPD).

Enterprise Products Partners, the largest MLP in terms of market capitalization, had a six-month correlation of 0.23 as of November 27. However, EPD’s three-month correlation with crude oil of 0.18 is lower compared to natural gas, which could be due to the partnership’s low crude oil exposure.

EPD’s correlation with natural gas might reflect its involvement in natural gas processing and natural gas transportation. EPD has low direct natural gas exposure. However, the fluctuation in natural gas prices impacts drilling activity, which might impact EPD’s throughput volumes.

Analysts’ recommendations

91.7% of analysts surveyed by Reuters rate Enterprise Products Partners a “buy” as of November 27, 2017, and the remaining 8.3% rate it as a “hold.” Seaport Global last initiated coverage on EPD with a “neutral” rating, which is equivalent to “hold.” Overall, EPD has seen three rating updates in 2017 including two new coverages and one upgrade. EPD is currently trading below the low end ($26) of analysts’ consensus target range. EPD’s average target price of $31.8 implies ~31% upside potential from the current price levels.

In the next article, we’ll look at the correlation between Williams Partners (WPZ) and natural gas.