Golar LNG Partners LP

Latest Golar LNG Partners LP News and Updates

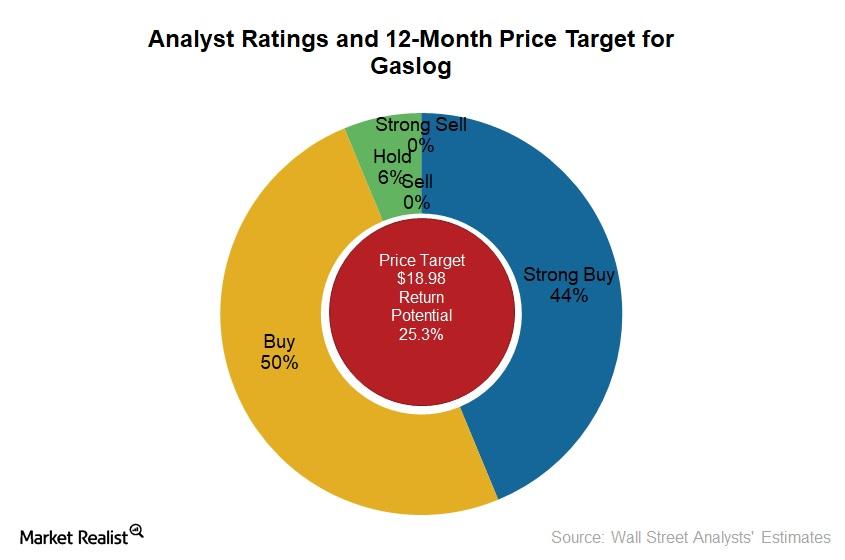

Morgan Stanley Upgrades GasLog

In June 2017, Morgan Stanley upgraded GasLog (GLOG) to “overweight” from “equal weight.”

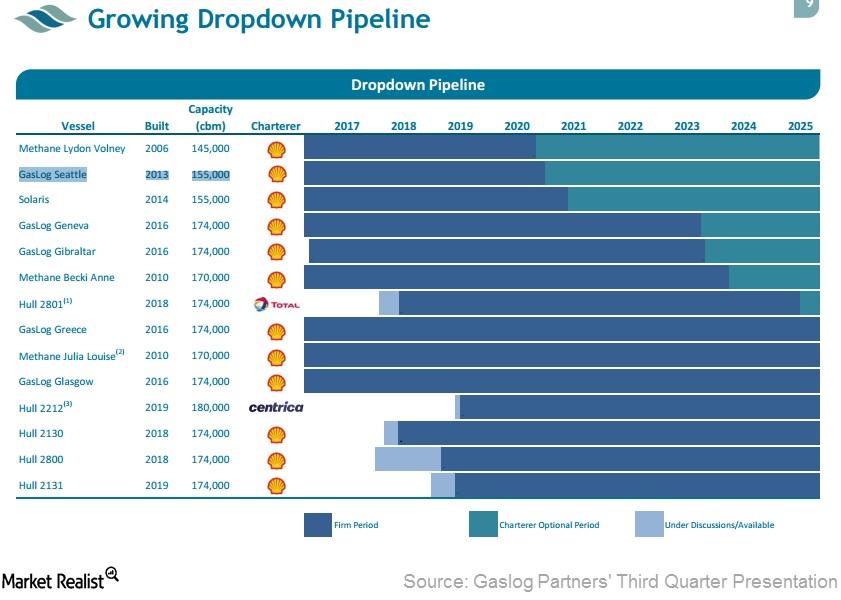

What Are GasLog Partners’ Asset Dropdown and Dropdown Options?

GasLog, GasLog Partners’ general partner (or GP), has entered into a seven-year time charter contract with Total, which will commence in mid-2018.

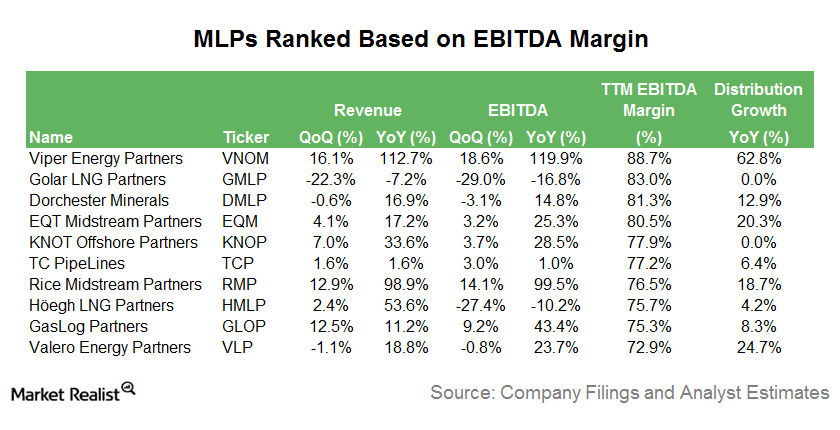

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

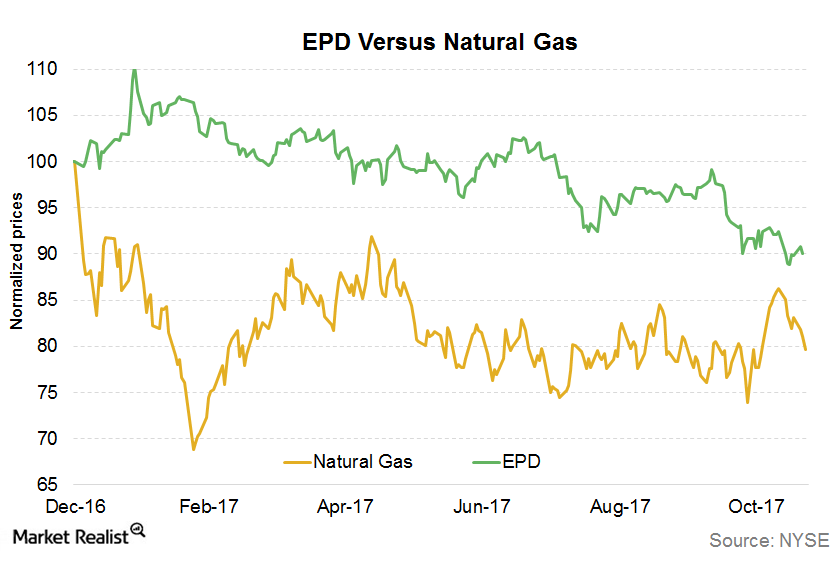

What’s EPD’s Correlation with Natural Gas?

In this article, we’ll look into the commodity price exposure of the MLP at the seventh spot, Enterprise Products Partners (EPD).Energy & Utilities Liquefaction capacity is key to liquefied natural gas carriers

Whether more proposals will get approval and more liquefaction capacity will come online will depend on the economic feasibility of the liquefaction plants.Energy & Utilities A guide to liquefied natural gas carriers and key shipping costs

While there are a few different types of LNG vessels, the two dominant containment systems, Moss (nicknamed “dinosaur egg”) and Membrane systems are employed today.Energy & Utilities Investing in liquefied natural gas carriers: The future of natural gas

Global energy demand will continue to increase, driven by population growth and improved standards of living. At the same time, emphasis on sustainability becomes more critical.