DCP Midstream LP

Latest DCP Midstream LP News and Updates

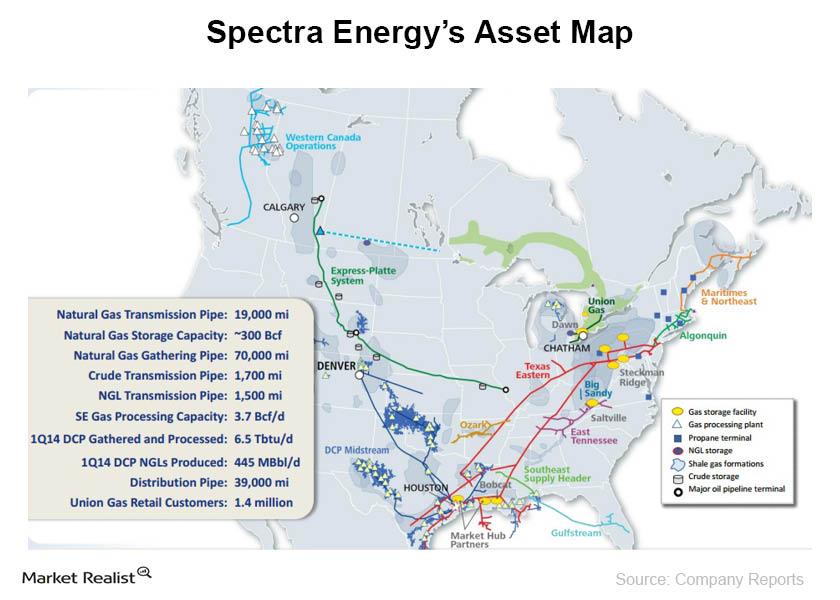

An investor’s guide to Spectra Energy Corp. and its earnings

Spectra Energy Corp. (SE), headquartered in Houston, Texas, owns and operates a large and diversified portfolio of natural gas–related assets in North America.

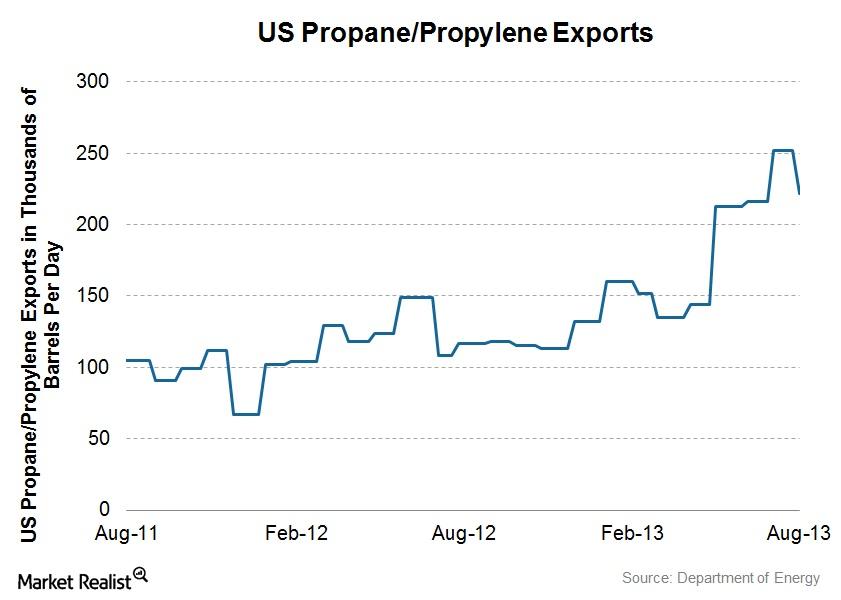

Why some MLPs are benefitting from increased propane exports

Significantly higher rates of propane exports have helped to boost propane prices—and the margins of some MLP names.

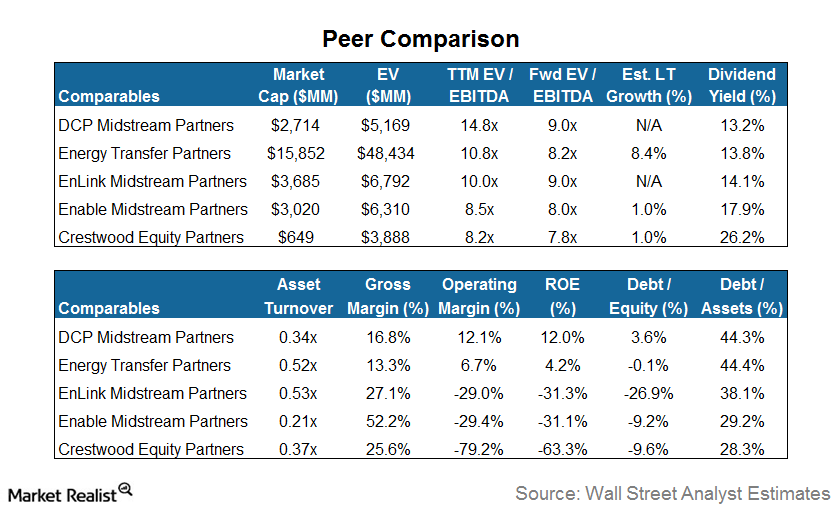

Where Does DCP Midstream Stand Compared to Its Peers?

DCP Midstream Partners (DPM) has an enterprise value of $2.7 billion.

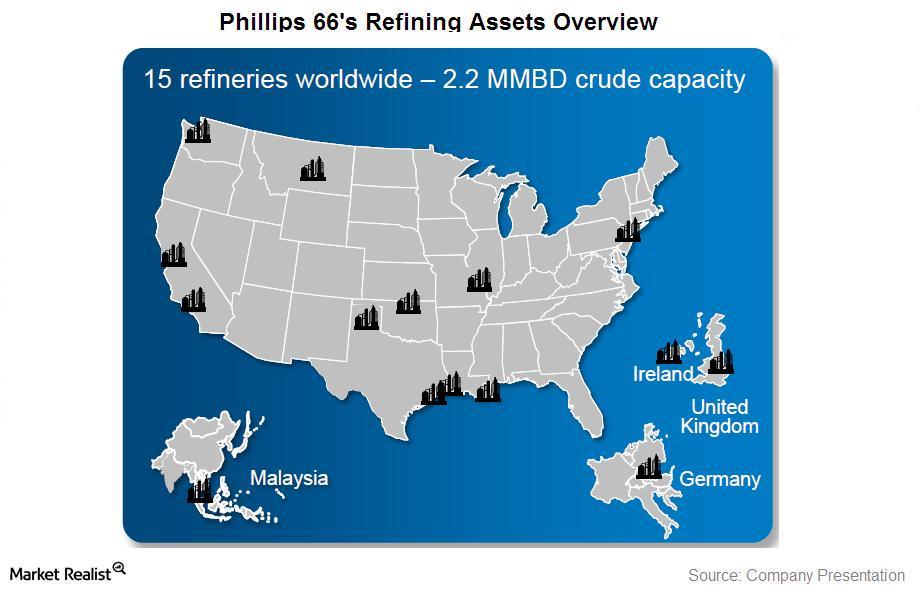

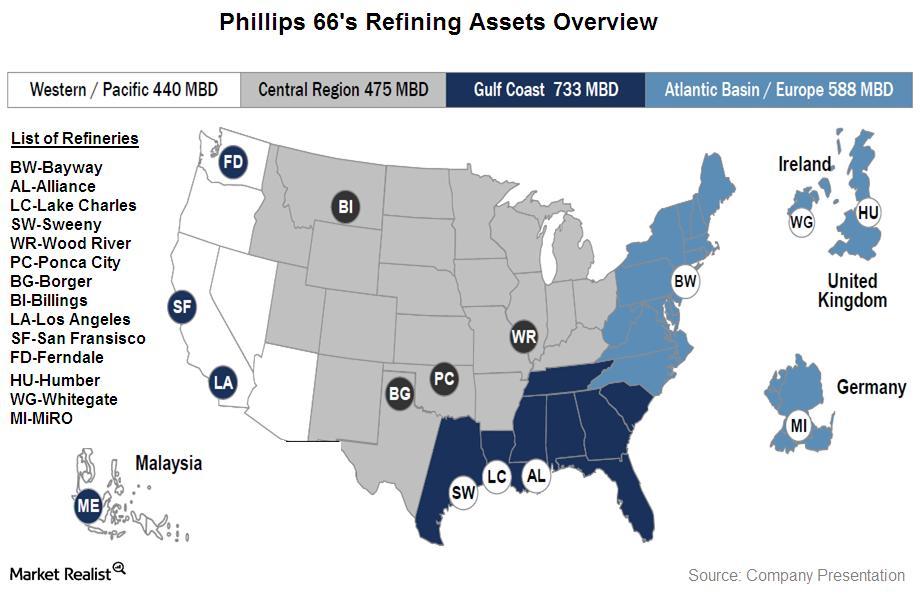

Phillips 66: An overview

In 2013, Phillips 66 generated 67%, 13%, and 6% of its revenues from the United States, the United Kingdom, and Germany, respectively. The company’s other foreign operations contributed ~16%.

Why Frac Spreads Affect Some MLP Stocks

Companies in the natural gas processing space—many of which are MLPS—keep an eye on the fractionation or “frac” spread. Here’s why.

Must-know: An introduction to Phillips 66

Phillips 66 (PSX) is an energy company. It’s based in Texas. Phillips 66 started operating independently as a publicly-traded company on April 4, 2012, when it separated from ConocoPhillips (or COP).

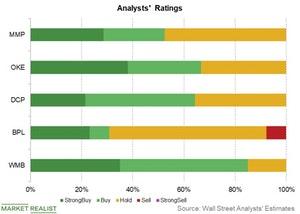

Key MLP and Midstream Rating Updates Last Week

On January 16, Barclays raised its rating for Williams Companies (WMB) from “equal weight” to “overweight.”

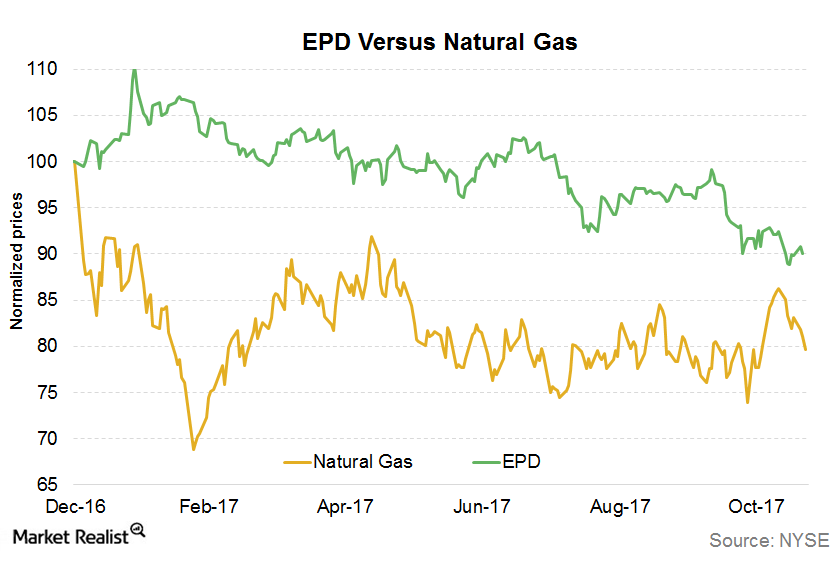

What’s EPD’s Correlation with Natural Gas?

In this article, we’ll look into the commodity price exposure of the MLP at the seventh spot, Enterprise Products Partners (EPD).

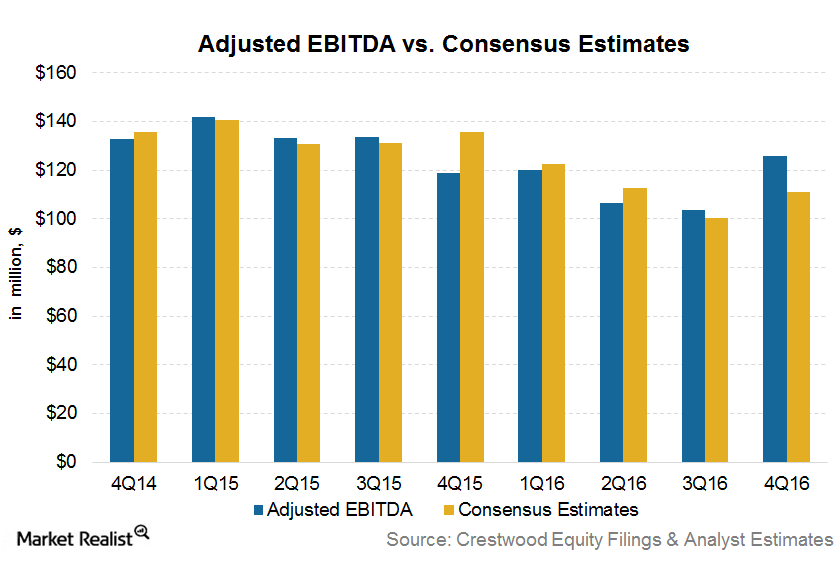

What Drove Crestwood Equity Partners’s 4Q16 EBITDA Growth?

Crestwood Equity Partners (CEQP) reported its 4Q16 earnings on February 21, 2017. Its 4Q16 adjusted EBITDA increased to $125.6 million from $118.9 million in 4Q15, a year-over-year increase of 5.6%.

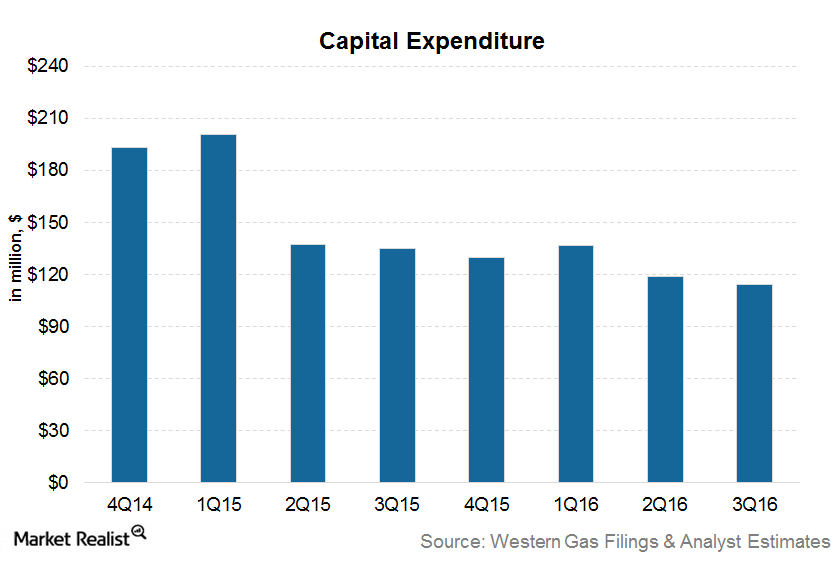

Why Western Gas’s Capital Spending Could Recover in 2017

Western Gas Partners’ (WES) growth capital spending started to decline at the beginning of the rout in energy prices.

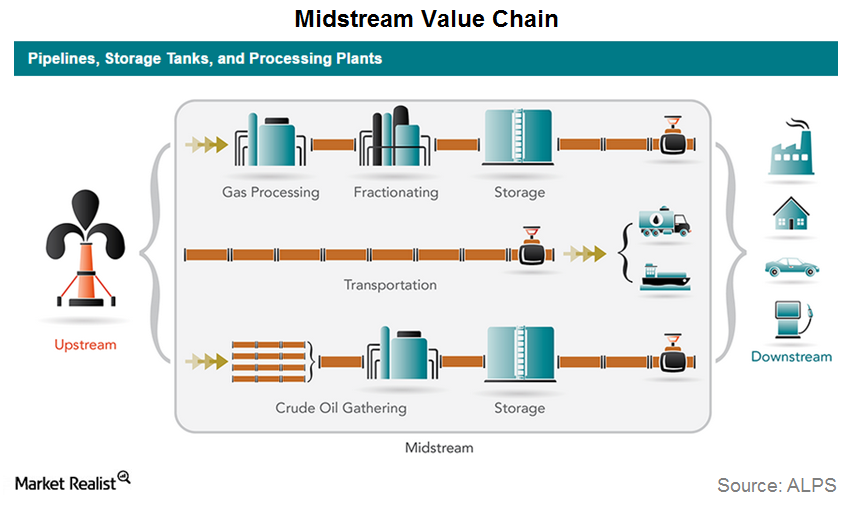

A Look at the Midstream Energy Value Chain

Liquids pipelines and terminaling MLPs, as the name suggests, are involved in crude oil, refined product, and NGLs (natural gas liquids) transportation and storage.

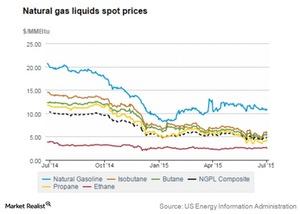

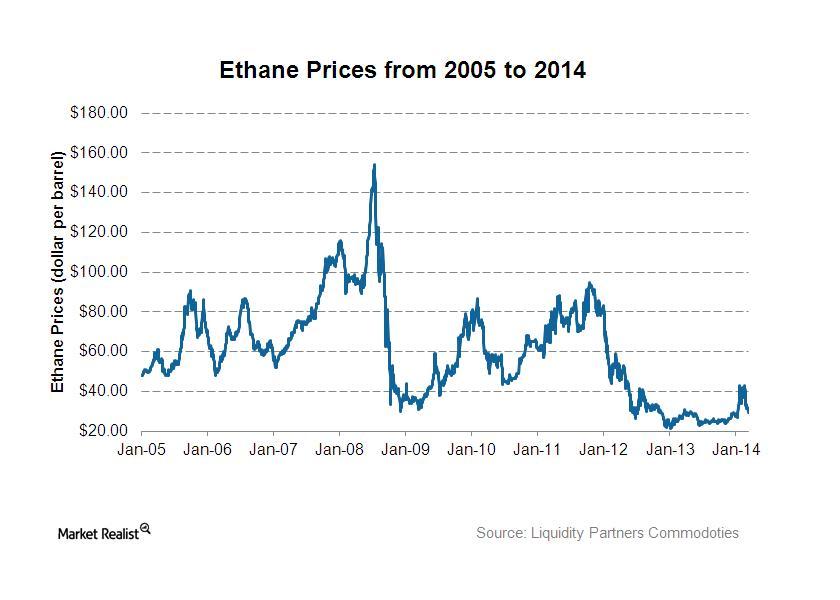

Why the Natural Gas-NGL Price Spread Impacts Energy MLPs

Natural gas processing MLPs typically benefit when the price of NGLs is high relative to natural gas.

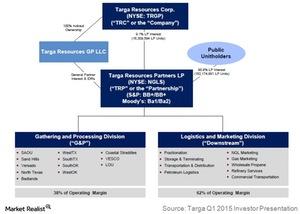

Targa Resources: A Midstream Energy MLP

Targa Resources Partners is a midstream energy MLP formed in 2006. The company is expanding its operations into gathering crude oil and transporting petroleum products.

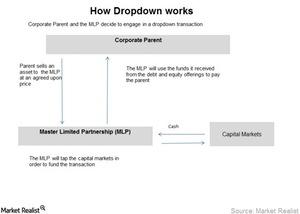

How Do Master Limited Partnerships Grow?

MLPs normally pay out all the available cash to the unit holders in the form of quarterly cash distribution. They hold only the maintenance capital expenditure.

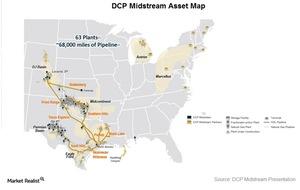

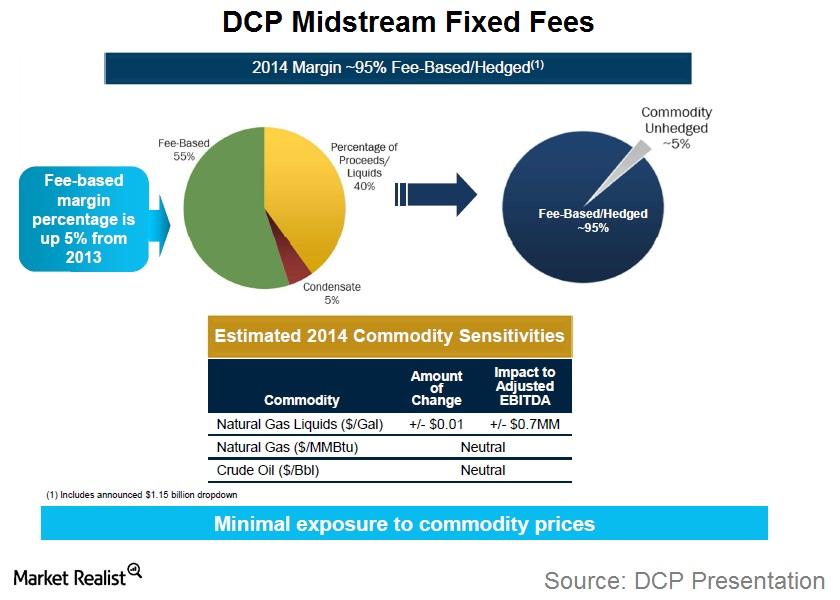

DCP Midstream Partners and Its Three Operating Segments

Unit price for DCP Midstream decreased 24% in the past year. The fall is particularly sharp since the end of October when its unit price crashed 32%.

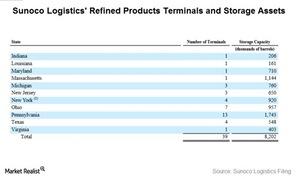

An Overview of Sunoco’s Terminals Facilities

Sunoco’s terminals facilities business operates crude oil, refined products, and natural gas liquids (or NGL) terminals.

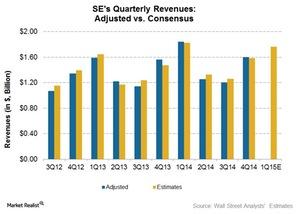

Spectra Energy 4Q14 earnings beat estimates

Spectra Energy 4Q14 adjusted earnings beat estimates by 46%. On average, adjusted EPS has exceeded consensus EPS by ~9% in the past ten quarters.

Ethane production and its effects on natural gas processors

With attractive NGL pricing relative to naphtha refinery streams, the feedstock percentage of NGLs has been increasing, with ethane taking a disproportionate share of the total.

How MLPs profit from natural gas gathering and processing

Natural gas gathering and processing are a significant part of the operations of many midstream master limited partnerships.