Boardwalk Pipeline Partners LP

Latest Boardwalk Pipeline Partners LP News and Updates

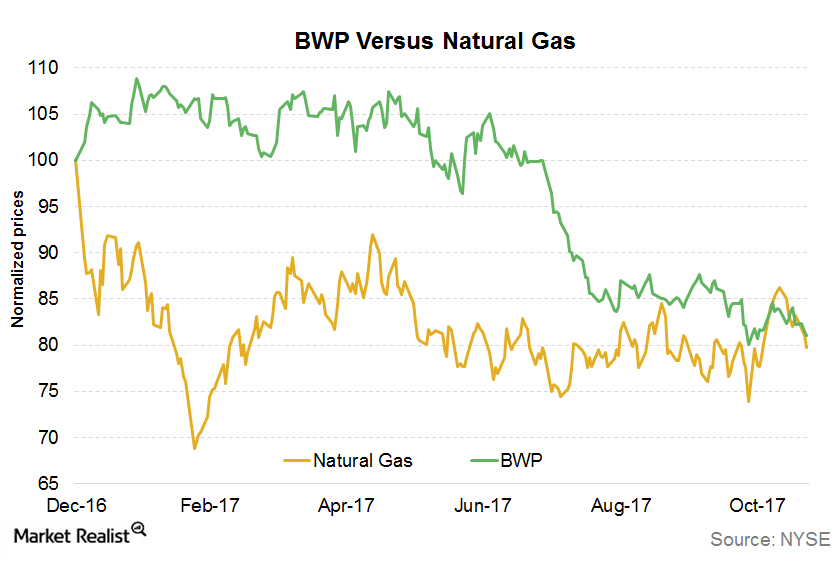

How BWP Correlates with Natural Gas

Boardwalk Pipeline Partners (BWP), a midstream MLP mainly involved in natural gas and NGLs transportation and storage, ranks second among MLPs in terms of correlation with natural gas.

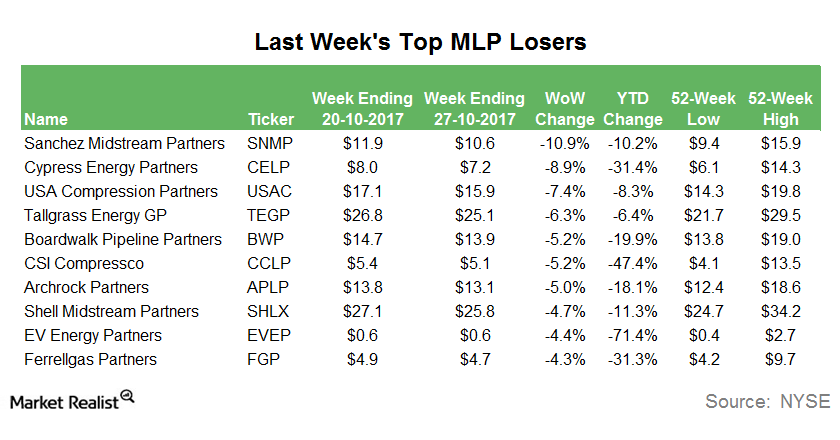

Last Week’s Biggest MLP Losers

Sanchez Production Partners (SNMP), the midstream MLP involved mainly in natural gas gathering, compression, and processing, was the biggest MLP loser last week.

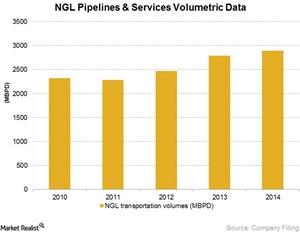

EPD’s Most Profitable Segment: NGL Pipelines & Services

EPD’s Natural Gas Liquid Pipelines & Services segment involves natural gas processing plants and NGL marketing activities.

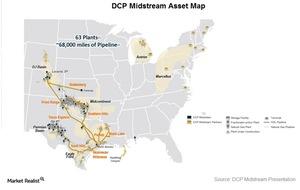

DCP Midstream Partners and Its Three Operating Segments

Unit price for DCP Midstream decreased 24% in the past year. The fall is particularly sharp since the end of October when its unit price crashed 32%.

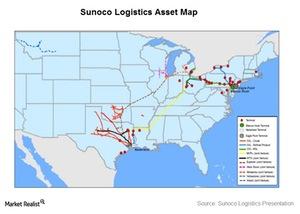

An Overview of Sunoco Logistics Partners

Sunoco Logistics Partners (SXL) is an energy midstream master limited partnership. It operates crude oil, natural gas, refined products, and natural gas liquids pipeline and terminal assets.