Legacy Reserves LP

Latest Legacy Reserves LP News and Updates

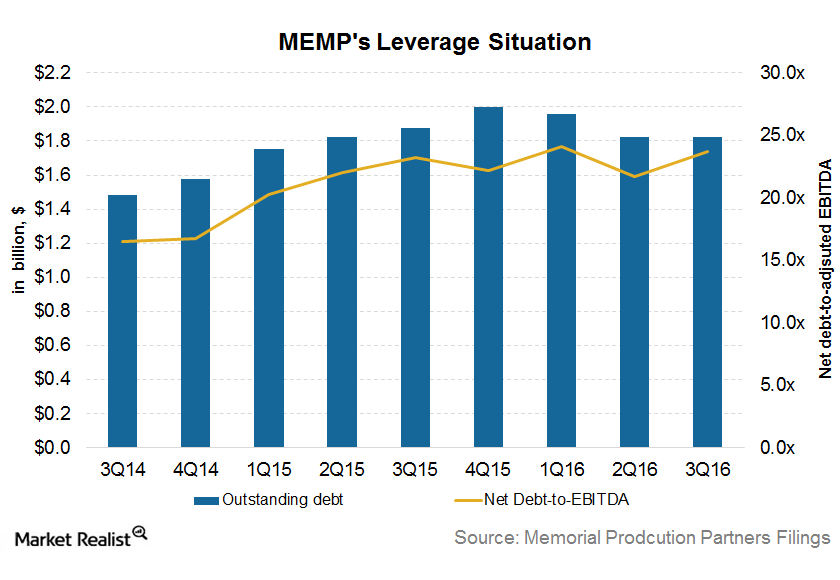

What Led to Memorial Production Partners’ Bankruptcy?

MEMP’s earnings improved in the recent quarter, but prior shortfalls were high and couldn’t be covered without a restructuring under Chapter 11 bankruptcy.

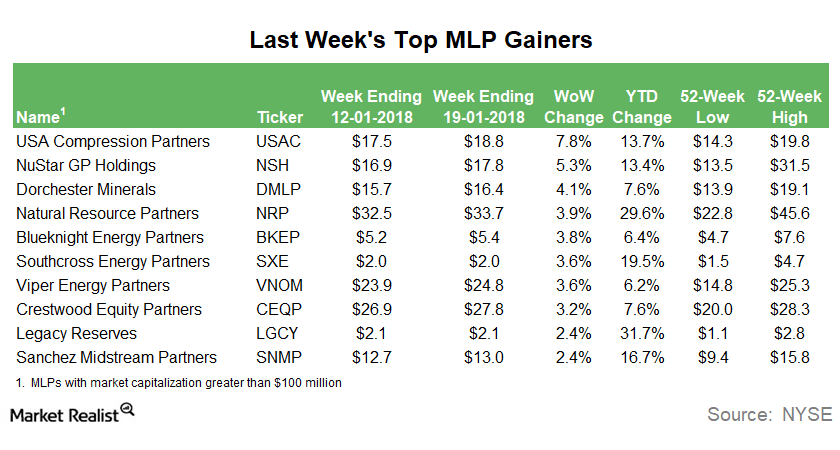

Why USAC Was the Top MLP Last Week

USA Compression Partners (USAC), a midstream MLP involved in natural gas contract compression services, was the top MLP gainer last week with WoW (week-over-week) gains of 7.8%.

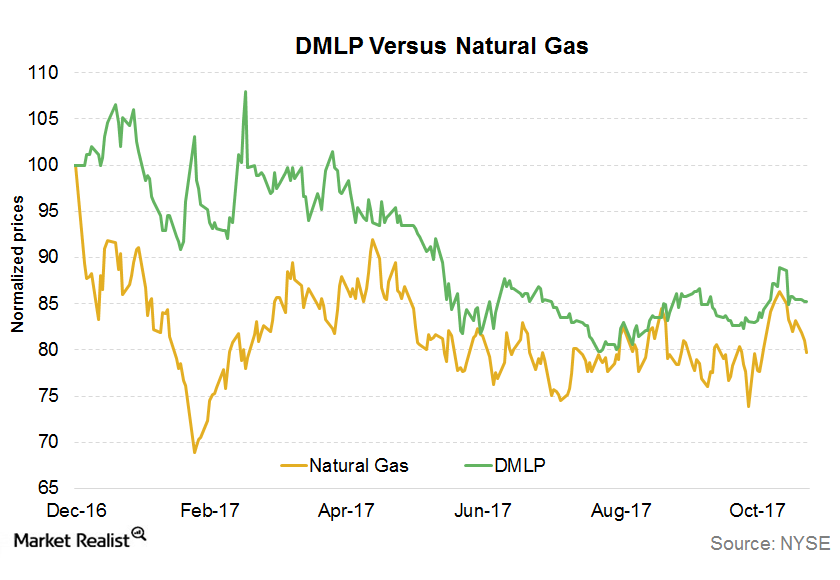

What’s Driving DMLP’s Correlation with Natural Gas?

Dorchester Minerals (DMLP), a royalty interest owner MLP, is in third place in terms of its correlation with natural gas.