Kinder Morgan Consolidation: What It Means for the MLP Market

On November 26, 2014, Kinder Morgan acquired all of its equity interests in Kinder Morgan Partners, El Paso, and Kinder Morgan Management.

Nov. 20 2020, Updated 11:36 a.m. ET

Kinder Morgan consolidation

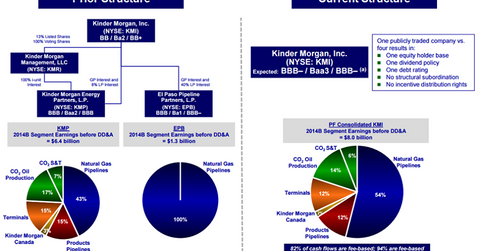

One of the biggest events in MLP (master limited partnership) history took place on November 26, 2014. Kinder Morgan (KMI) acquired all of its equity interests in Kinder Morgan Partners, El Paso, and Kinder Morgan Management.

Benefits to the company

Kinder Morgan abandoned the MLP structure in favor of the C Corporation structure. It consolidated its group in order to lower its cost of capital for funding its massive expansion projects and acquisitions.

Specifically, by eliminating the IDR (incentive distribution rights) structure of Kinder Morgan Partners and El Paso cash flows, the company expected to significantly reduce its cost of capital. For more information on how IDRs affect the cost of equity capital, refer to Part 4 in this series.

After the Kinder Morgan consolidation, Kinder Morgan Partners and El Paso would start driving the tax shield benefit. This could lower the after tax cost of debt more.

Apart from lowering the cost of capital, the simplified public structure was expected to eliminate complexities—including incentive distribution rights and structural subordination. Also, having one publicly traded security results in one equity holder base, one dividend policy, and one debt rating.

How were investors affected?

Investors who planned to hold units for very long periods, sometimes until death—to avoid deferred taxes—didn’t find the merger decision to be friendly for investors from a tax perspective. These investors had to pay taxes that they wouldn’t have had to pay otherwise. As far as taxes on dividends are concerned, the investors only used to pay taxes on dividends at their marginal tax rate. Under the new corporation structure, the dividend would be taxed twice both at the corporate and investor level.

Key ETFs and stocks

After the exit of Kinder Morgan Partners and El Paso, investors long on energy transportation can look at other companies in the business like Enterprise Products Partners (EPD), Energy Transfer Partners (ETP), Williams Partners (WPZ), and Spectra Energy Partners (SEP). The first three securities listed here are part of the top ten holdings of the Alerian MLP ETF (AMLP).

For the latest updates, visit Market Realist’s Energy MLPs page.