Kinder Morgan, Inc.

Latest Kinder Morgan, Inc. News and Updates

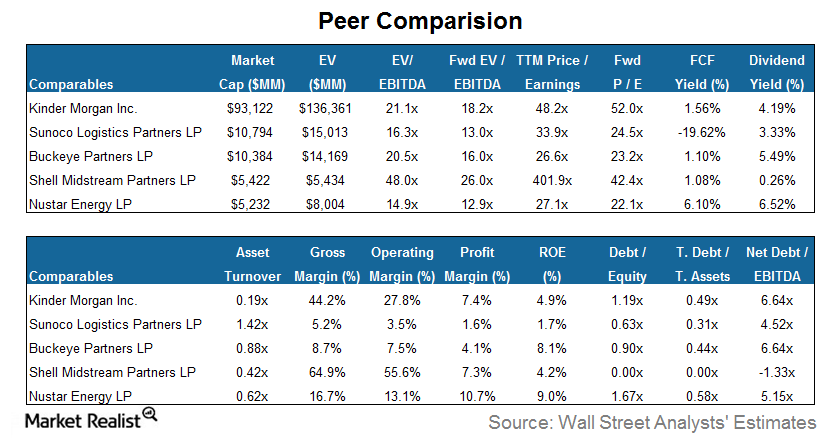

Why Sunoco Logistics Has the Lowest Profit Margins

Sunoco Logistics has the lowest profit margin and ROE among its peers. Its profit margin and ROE of 1.6% and 1.7%, respectively, are well below the group average.

What is XLE? Exploring Midstream Energy Company Exposure

Companies in the midstream sector that are included in the XLE portfolio include Kinder Morgan, Oneok, the Williams Company, and Spectra Energy.

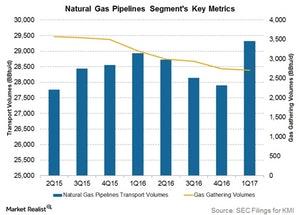

What to Expect from Kinder Morgan’s Gas Transport Volumes

Kinder Morgan’s (KMI) natural gas transport volumes grew 1.4% YoY (year-over-year) in 1Q17. The growth was driven by throughput on new projects.

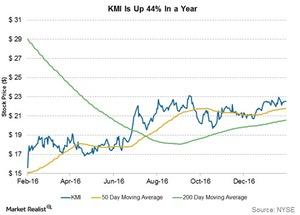

Will Kinder Morgan Stock Continue to Surge in 2017?

Kinder Morgan stock has risen 44% in the past year, as compared to Enterprise Products Partners’ 32% rise and ONEOK’s 162% rise.

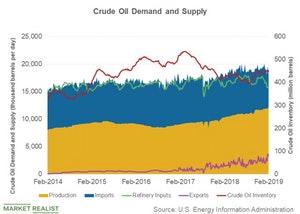

What Might Cap Rising Crude Oil Prices?

The US crude oil (USO) supply includes domestic production and imports. The supply gets consumed as inputs to refineries and exports.

An Overview of US LNG Production and Exports

Investors may be seeing a lot of reports about rising US LNG (liquefied natural gas) exports. Let’s review the basics of LNG.

Why Frac Spreads Affect Some MLP Stocks

Companies in the natural gas processing space—many of which are MLPS—keep an eye on the fractionation or “frac” spread. Here’s why.

KMI, WMB, and OKE: Understanding Their Key Business Focus

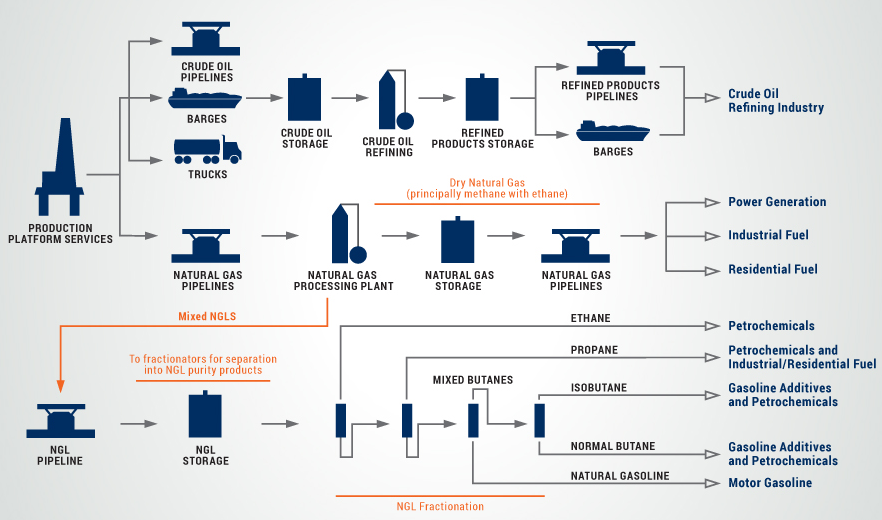

Kinder Morgan transports natural gas, refined petroleum, crude oil, condensate, CO2, and other products through its network of pipelines.

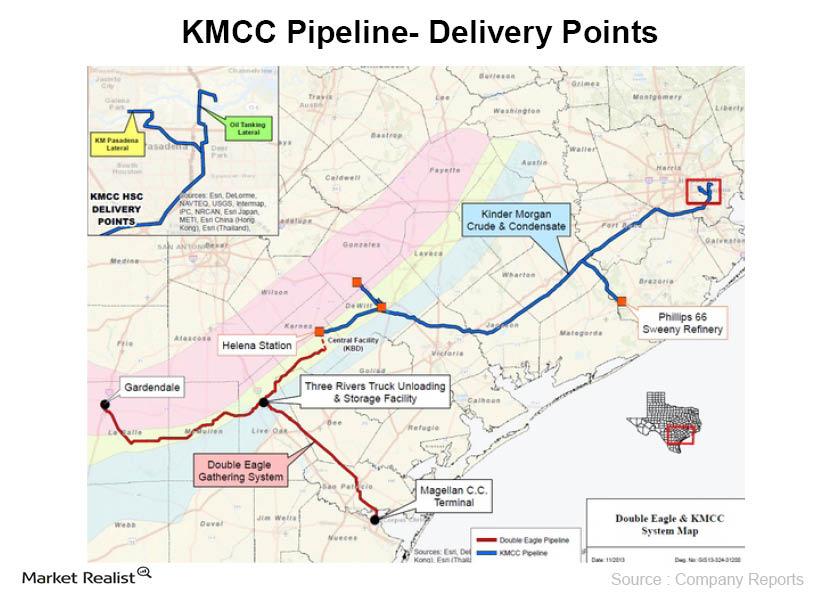

Must-know: Why the Kinder Morgan Eagle Ford expansion is positive

Kinder Morgan Energy Partners plans several major Eagle Ford joint ventures and projects that could reach almost $900 million in expenditures if company reports are to be believed.

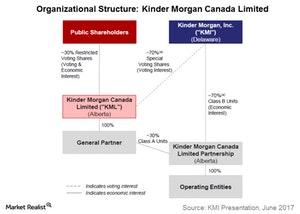

Must-Know: Kinder Morgan’s Canada Segment’s Structure

After KML’s IPO (initial public offering), Kinder Morgan retains ownership of nearly 70% of KML, with the remaining 30% owned by the public.

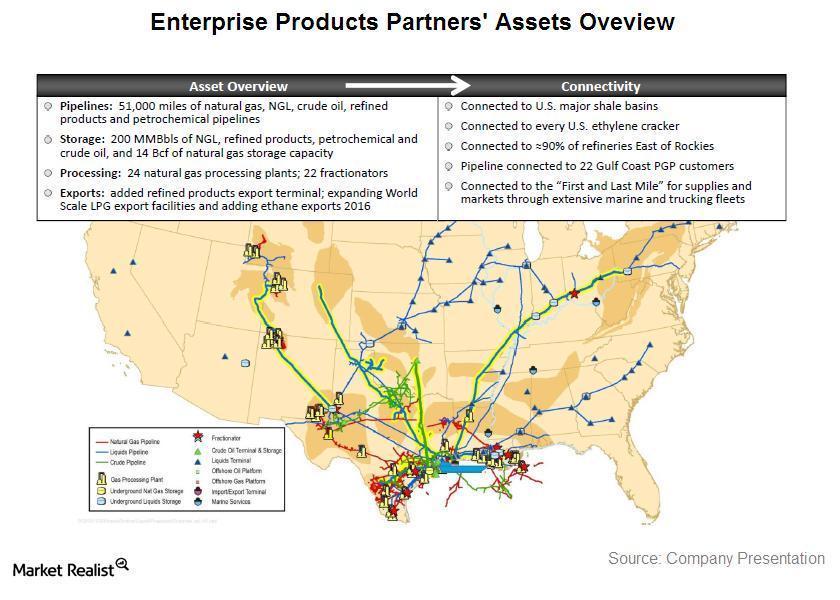

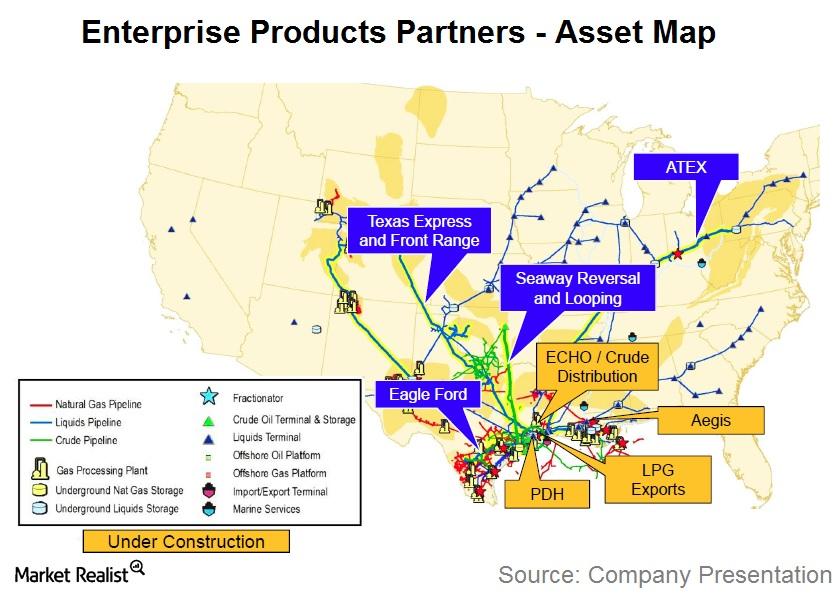

Why Enterprise Products Partners is important to investors

EPD is a leading midstream service provider in the natural gas, natural gas liquids (or NGLs), crude oil, petrochemicals, and refined products sectors.

Why ONEOK Has Outperformed Its Peers in 2018

ONEOK (OKE) stock has risen ~21% so far in 2018, outperforming its peers in the midstream sector.

Get Real: New Targets and Turnaround Hopes

In this morning’s edition of our daily market newsletter, Get Real, we looked at Trump’s new tariff targets, a 5G network launch, and turnaround hopes.

2019 Oil and Gas Bankruptcies Paint Bleak Outlook

Haynes and Boone reported that 50 energy companies filed for bankruptcy in the first nine months of 2019, including 33 oil and gas producers.

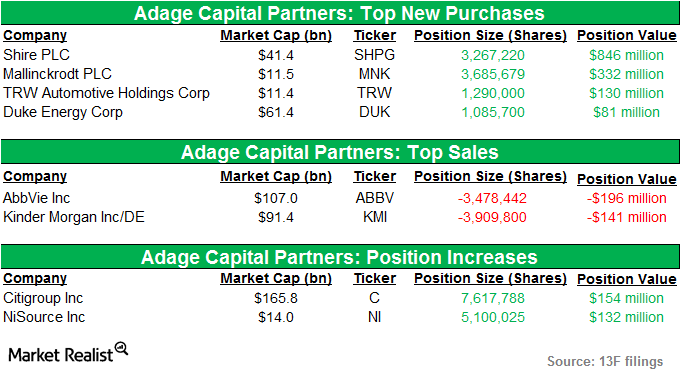

A key overview of Adage Capital’s holdings in 3Q14

Adage Capital’s US long portfolio grew from $38.69 billion in 2Q14 to $40.2 billion in 3Q14. The portfolio comprised around 699 stocks.

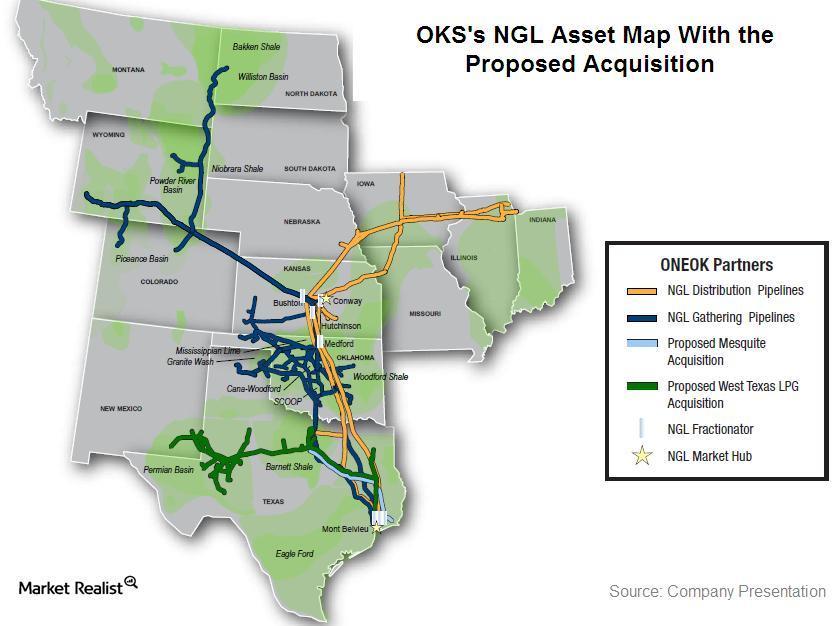

Why ONEOK Partners acquires Permian assets from Chevron

On October 27, ONEOK Partners (OKS) announced that it agreed to acquire Chevron Corporation’s (CVX) natural gas liquids (or NGLs) pipeline assets.

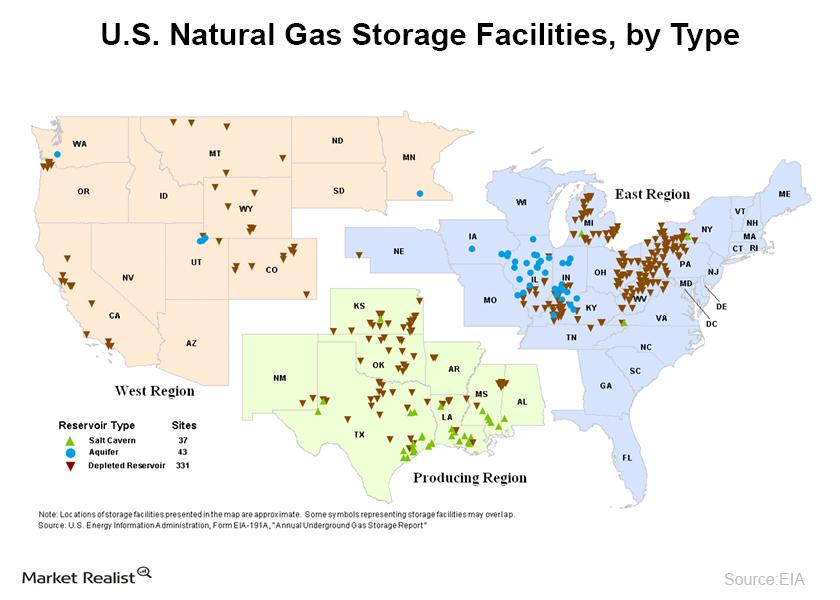

Must-know: Natural gas storage in the U.S.

Natural gas can be stored for an indefinite period of time for later consumption.

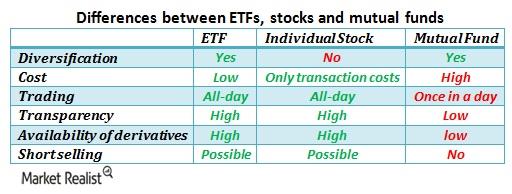

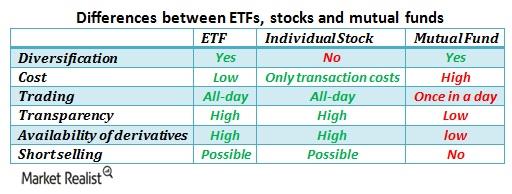

A closer look at the difference between ETFs and mutual funds

Before moving to inverse and leveraged ETFs in the next part of this series, we’d like to quickly discuss the differences between ETFs and mutual funds.

Williams Companies: What Could Lift Its Ailing Stock?

Williams Companies stock fell for the seventh consecutive day on Wednesday and closed almost at an 11-month low. Midstream stocks are trading weak.

Key points from Enterprise Products Partners’ analyst day meeting

Enterprise Products Partners (EPD) is one of the largest master limited partnerships operating in the midstream energy space.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

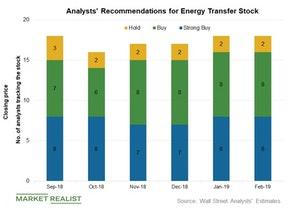

ET, EPD, and KMI: Analysts’ Views and Target Prices

According to analysts’ estimates, Energy Transfer (ET) stock has a median target price of $21.24—compared to its current market price of $14.82.

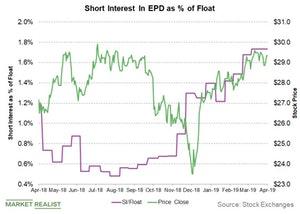

Recent Changes in Enterprise Products Partners’ Short Interest

The short interest in Enterprise Products Partners (EPD) stock rose from 24.9 million shares on March 15 to 25.7 million shares on March 29.

Natural Gas Prices: What to Expect in 2019

The EIA expects US natural gas prices to average $2.89 per MMBtu in 2019. For 2020, the forecast is $2.92 per MMBtu.

Enbridge’s Line 3 Replacement Project Gets Delayed

On March 1, after the markets closed, Enbridge announced that it received a timeline for the permits for its Line 3 Replacement project.

Richard Kinder: From Enron to Kinder Morgan

Currently, Richard Kinder owns nearly 11% of Kinder Morgan’s outstanding shares. The stock has underperformed the midstream sector.

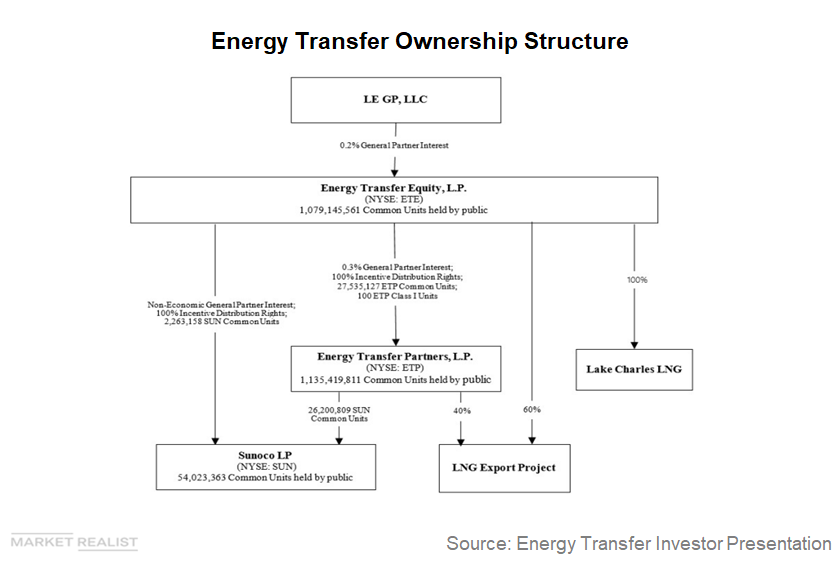

Is Energy Transfer Partners Exploring a C Corporation Structure?

High leverage and a complex capital structure have been a drag on Energy Transfer Partners’ market performance.

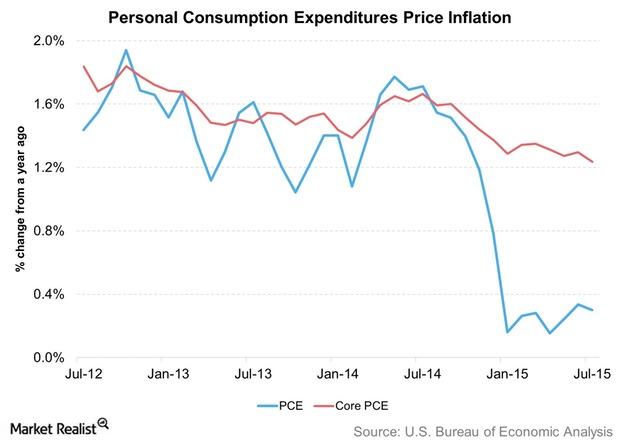

Import Prices and Crude Oil Keep US PCE Inflation Down

When the Fed refers to “inflation,” it’s talking about the rate of change in PCE (personal consumption expenditure) inflation. This is the price index for PCE.

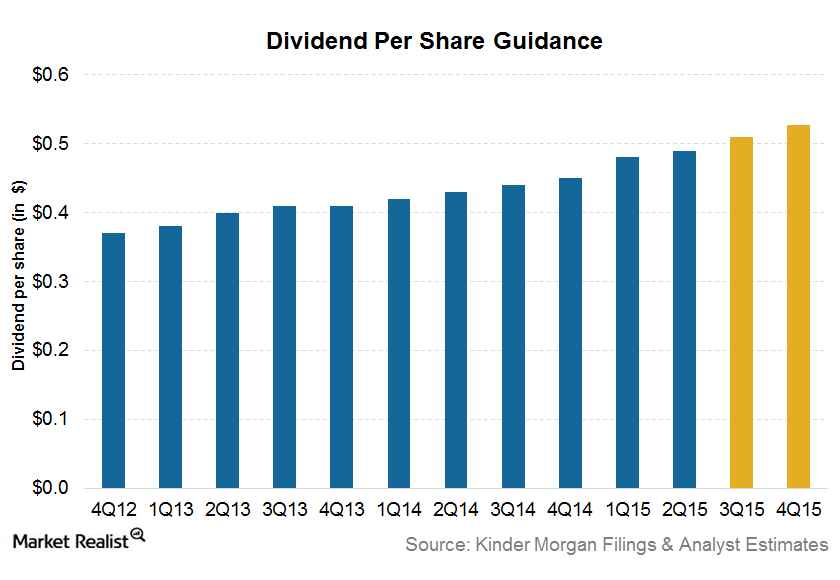

Kinder Morgan’s Outlook for the Rest of 2015

According to Wall Street analysts’ consensus outlook, Kinder Morgan’s (KMI) dividend is expected to grow by ~15.3% year-over-year by the end of 2015.

US Crude Production Dropped in Week Ended July 24, but Why?

According to data from the U.S. Energy Information Administration, US crude production dropped to 9.4 million barrels per day in the week ended July 24.

A summary of Caxton Associates’ key 4Q14 holdings

Caxton Associates’ portfolio fell from $3.04 billion in 3Q14 to $1.29 billion in 4Q14.

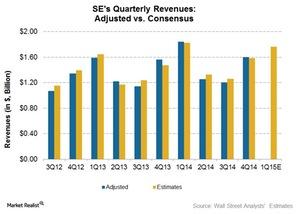

Spectra Energy 4Q14 earnings beat estimates

Spectra Energy 4Q14 adjusted earnings beat estimates by 46%. On average, adjusted EPS has exceeded consensus EPS by ~9% in the past ten quarters.

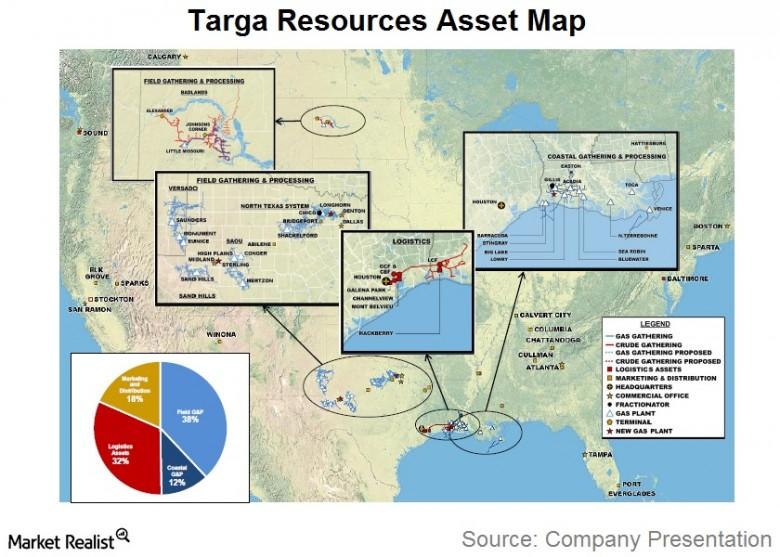

Must-know business overview: Targa Resources Partners

Targa Resources Partners LP (NGLS) is a master limited partnership operating in the midstream energy space. Targa Resources Corp. (TRGP) is the general partner of NGLS.

Overview: Key difference between ETFs and mutual funds

While actively managed ETFs are more expensive than passively managed ETFs, they tend to be less expensive than mutual funds due to structural differences between these two products. In the case of mutual funds, the investor interacts with the company while buying and selling mutual fund units.