Spectra Energy Partners LP

Latest Spectra Energy Partners LP News and Updates

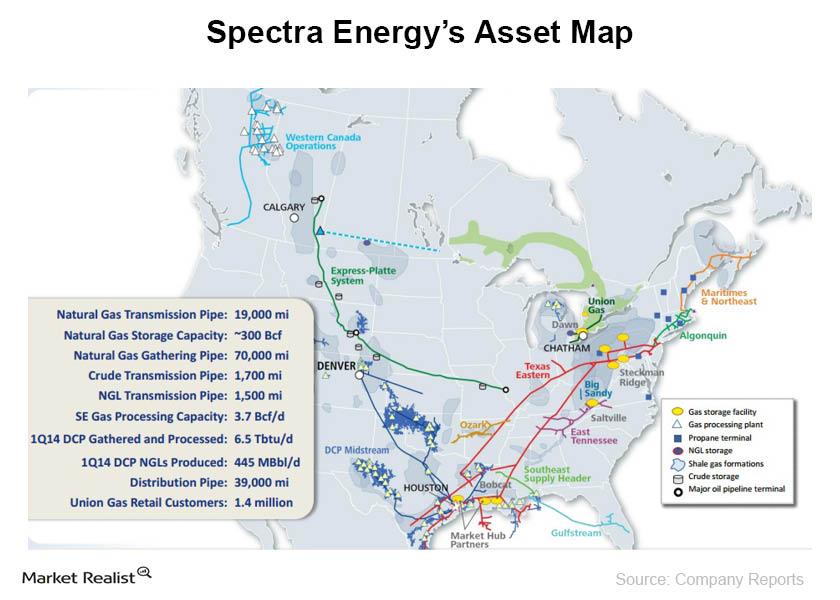

An investor’s guide to Spectra Energy Corp. and its earnings

Spectra Energy Corp. (SE), headquartered in Houston, Texas, owns and operates a large and diversified portfolio of natural gas–related assets in North America.

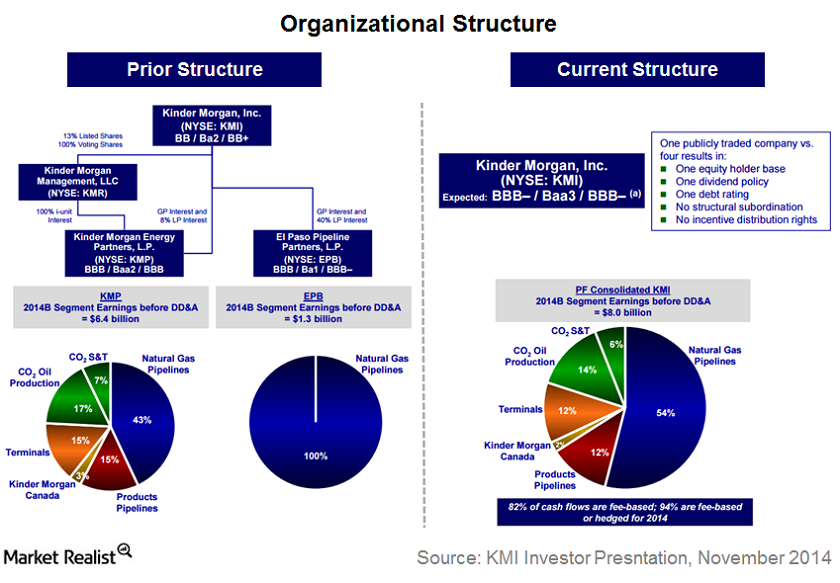

Kinder Morgan Consolidation: What It Means for the MLP Market

On November 26, 2014, Kinder Morgan acquired all of its equity interests in Kinder Morgan Partners, El Paso, and Kinder Morgan Management.

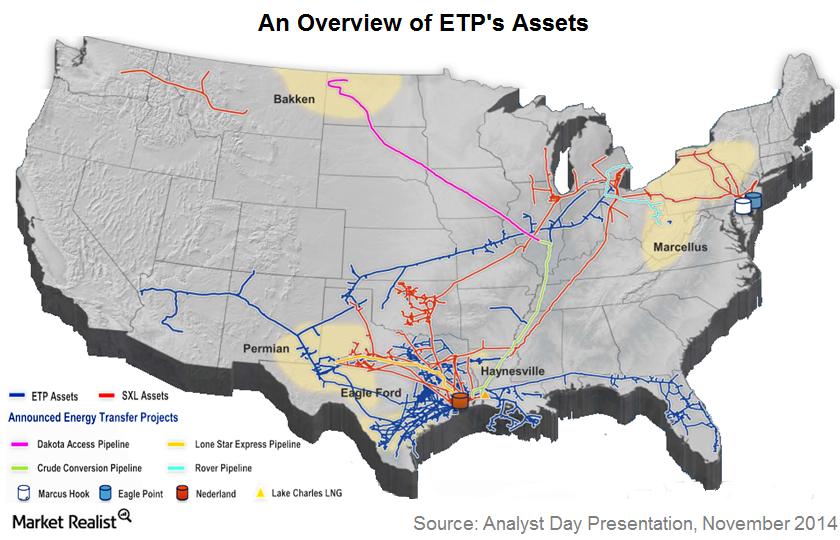

A Review of Energy Transfer Partners’ Business Segments

ETP operates primarily through its six business segments by leveraging its huge asset base.

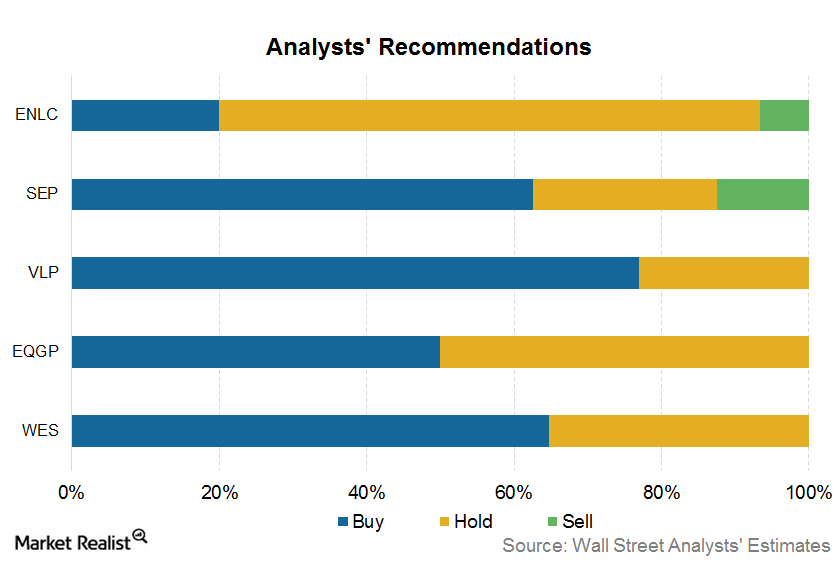

MLP Rating Updates Last Week

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”

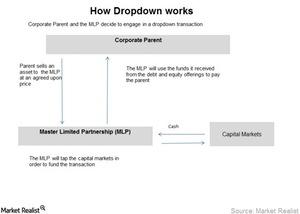

How Do Master Limited Partnerships Grow?

MLPs normally pay out all the available cash to the unit holders in the form of quarterly cash distribution. They hold only the maintenance capital expenditure.

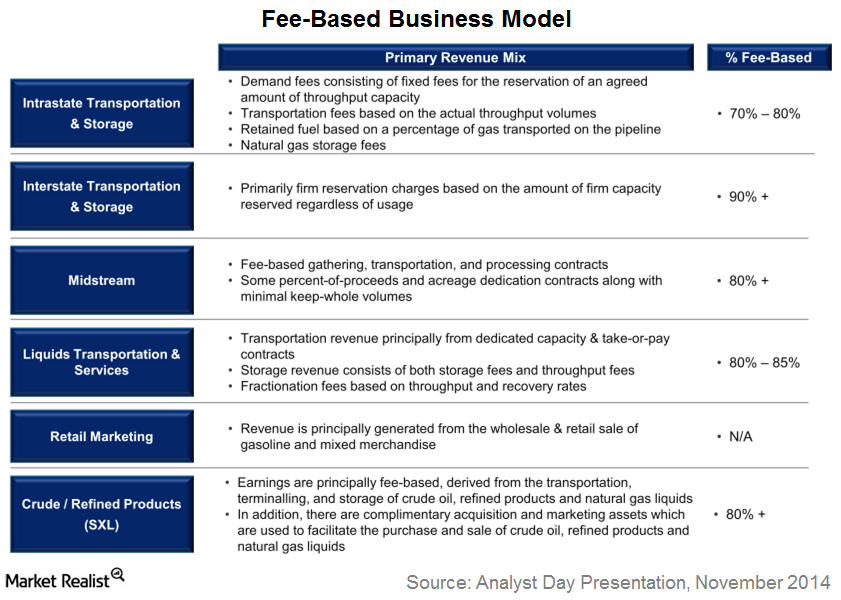

Energy Transfer Partners’ Fee-Based Model Drives Performance

Considering the rock solid performance of ETP during the slump in energy prices, it is clear that ETP has more fee-based contracts.