What’s behind MLP Performances for the Week Ended November 10?

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.

Nov. 20 2020, Updated 10:57 a.m. ET

AMZ fell 2.3% last week

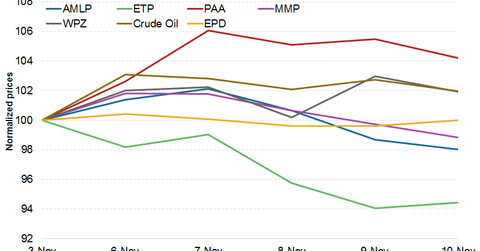

MLPs were weak last week, which ended November 10, 2017. The Alerian MLP Index (or AMZ), which tracks the performance of 50 energy MLPs, fell 2.3%. Last week’s weakness could be attributed to the slight correction in crude oil prices during the second half of the week. Overall, US crude oil rose 2% last week and ended at $56.74 per barrel. For recent updates and the outlook for crude oil prices, read Why Doubts Linger about Sustainability of Crude Oil Bull Market.

The weakness indicates that MLPs could be reacting negatively to a fall in crude oil prices but not positively to any upward movement in crude oil. That might be due to the slight weakness in US drilling activity.

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Among the top MLPs by market capitalization, Energy Transfer Partners (ETP) fell 5.5%, while Plains All American Pipeline (PAA) and Williams Partners (WPZ) rose 4.2% and 1.9%, respectively. We’ll look at the performance drivers for the top MLP losers and gainers in the rest of this series.

The Alerian MLP ETF (AMLP), which is comprised of 25 energy MLPs, fell 1.9% last week. AMLP underperformed both the SPDR S&P 500 ETF (SPY) (SPX-INDEX) and the Energy Select Sector SPDR ETF (XLE). XLE rose 1.4%, and SPY fell 0.1%.

Fund flows

Despite the recent sluggishness, a few MLP funds continue to see a net inflow of funds. The Alerian MLP ETF and the JPMorgan Alerian MLP ETN (AMJ) saw net inflows of $43.4 million and $115.8 million, respectively, last week.