Energy Select Sector SPDR® ETF

Latest Energy Select Sector SPDR® ETF News and Updates

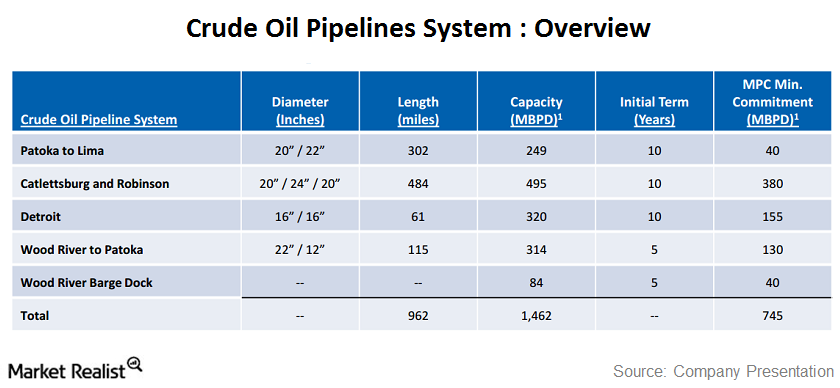

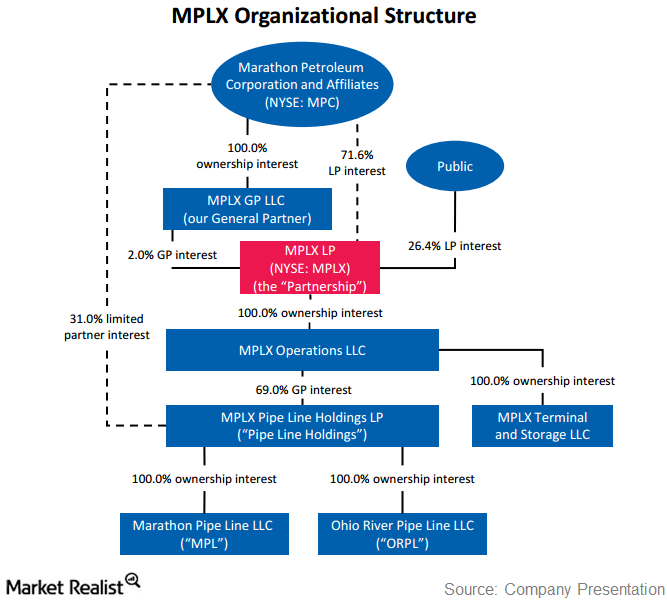

The MPLX crude oil pipeline system

MPLX crude pipelines are connected to supply hubs, and transport crude oil to Marathon Petroleum Corporation’s, or MPC’s, refineries and third parties.

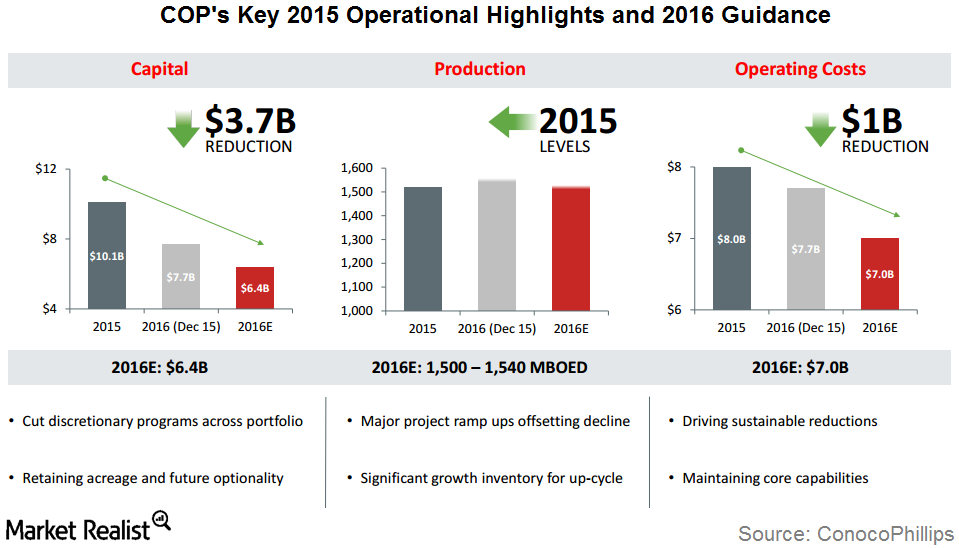

ConocoPhillips: 2015 Operational Highlights, 2016 Guidance

ConocoPhillips’s (COP) total production volume in 2015 was 1,589 Mboe/d excluding Libya. This represents a 5% year-over-year growth after adjusting for asset dispositions and downtime.

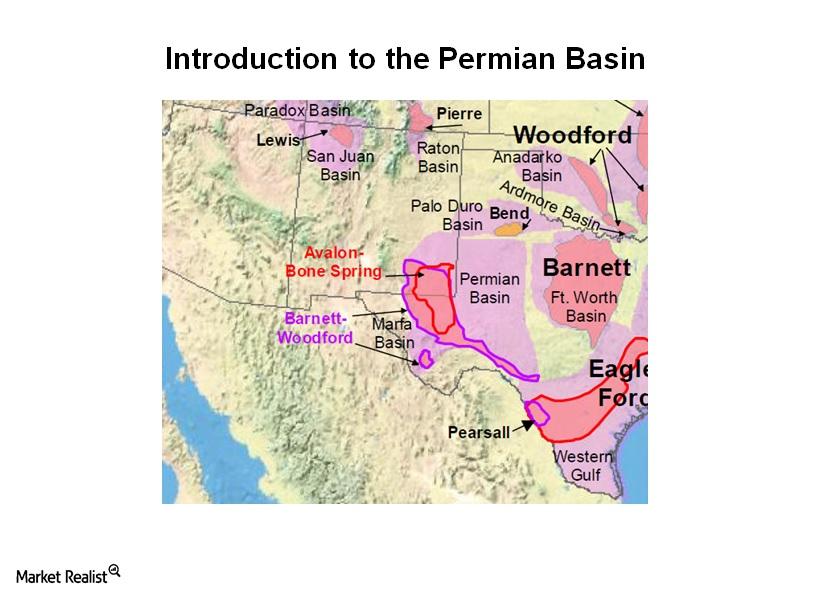

Introduction to the Permian Basin — Part 2: Geography of the Permian Basin

The Permian Basin is one of the US’s primary drivers of oil production growth. Market Realist provides an overview of this prolific hydrocarbon asset with a primer piece: “Introduction to the Permian Basin”.

What is XLE? Exploring Midstream Energy Company Exposure

Companies in the midstream sector that are included in the XLE portfolio include Kinder Morgan, Oneok, the Williams Company, and Spectra Energy.

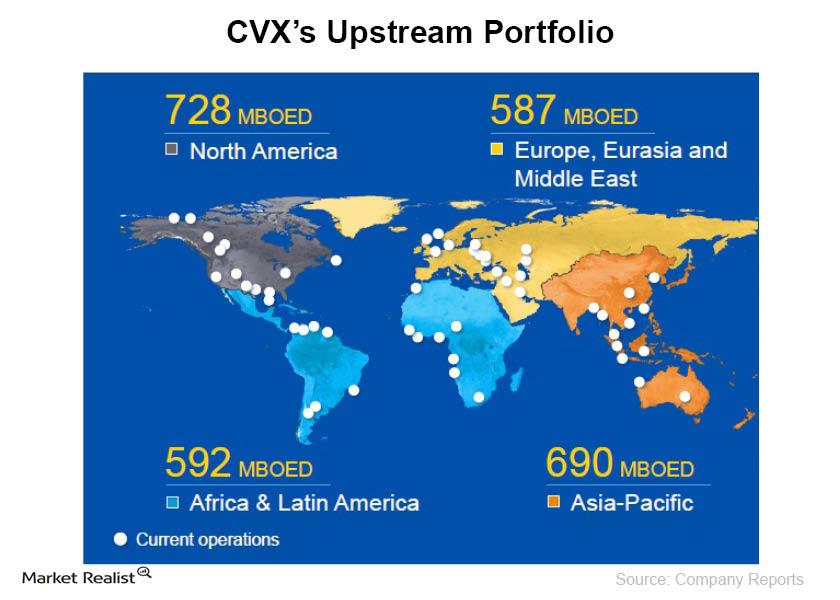

Chevron Corporation: A must-know brief overview

Chevron Corporation is currently trading at EV-to-2014E EBITDA of 5x, has an approximately $239 billion market cap, and ~$245 billion enterprise value.

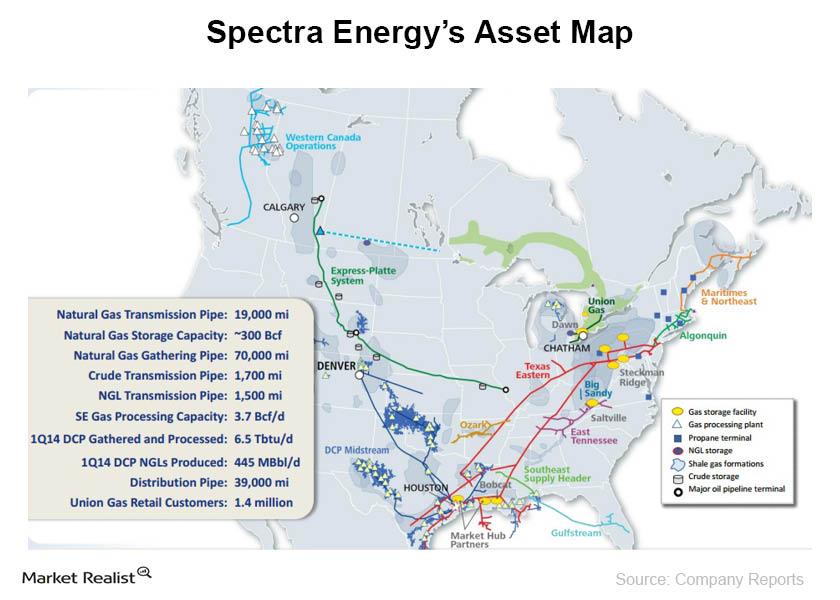

An investor’s guide to Spectra Energy Corp. and its earnings

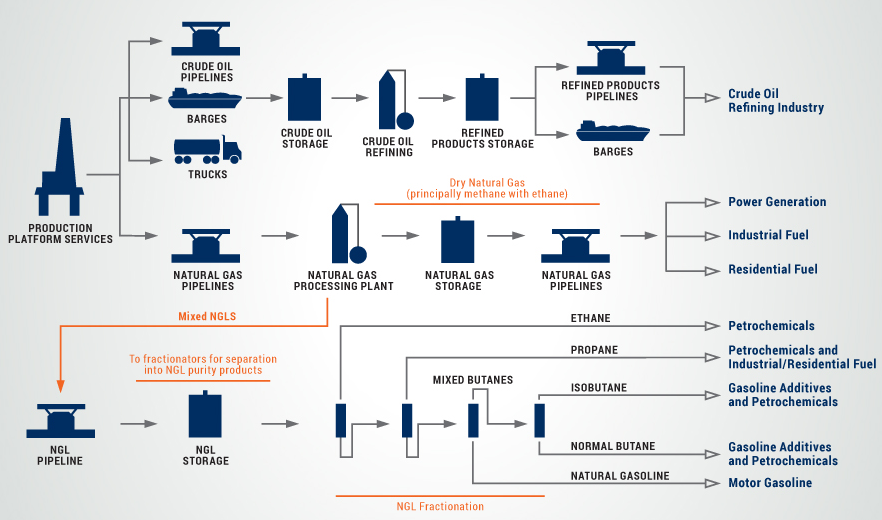

Spectra Energy Corp. (SE), headquartered in Houston, Texas, owns and operates a large and diversified portfolio of natural gas–related assets in North America.

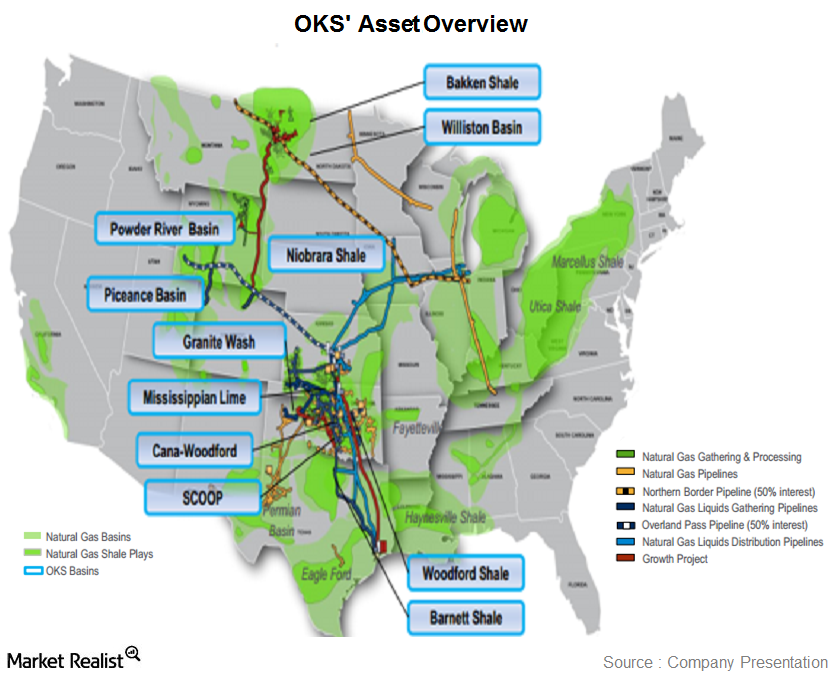

Overview: ONEOK Partners and its 3 operating segments

ONEOK Partners (OKS) is a master limited partnership (or MLP) engaged in gathering, processing, storing, and transporting natural gas and natural gas liquids (or NGLs) in the U.S.

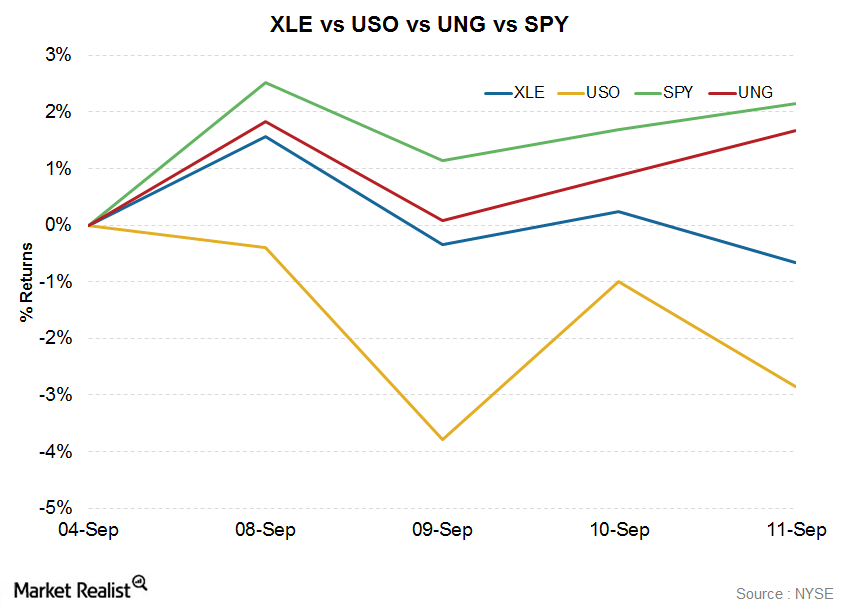

XLE Outperforms USO Last Week

The Energy Select Sector SPDR ETF (XLE) fell 0.66% in the week ended September 11. XLE tracks a diverse group of 45 of the largest American energy stocks in the S&P 500 Index (SPX).

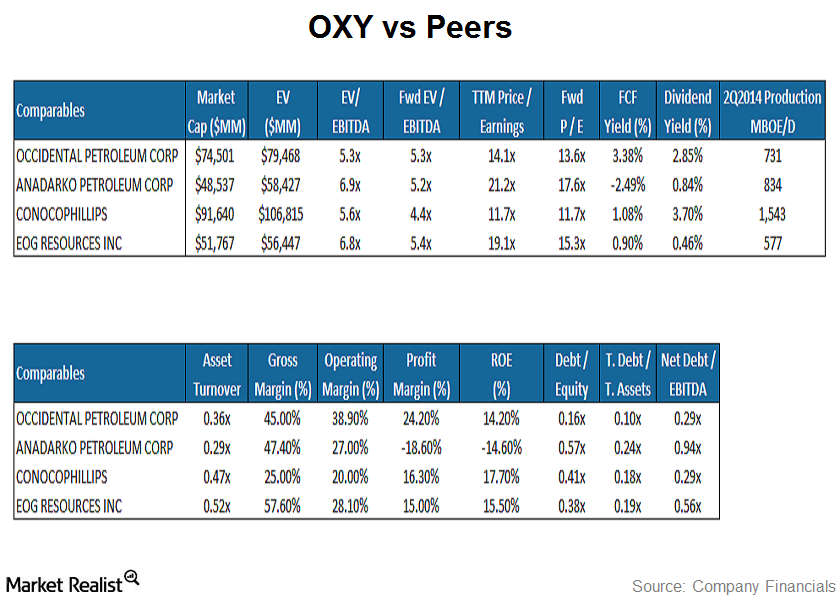

How does Occidental Petroleum compare to industry peers?

In terms of profitability, OXY has the highest profit margins amongst its peers at 24.2%. OXY also has one of the highest dividend yields at 2.85%.

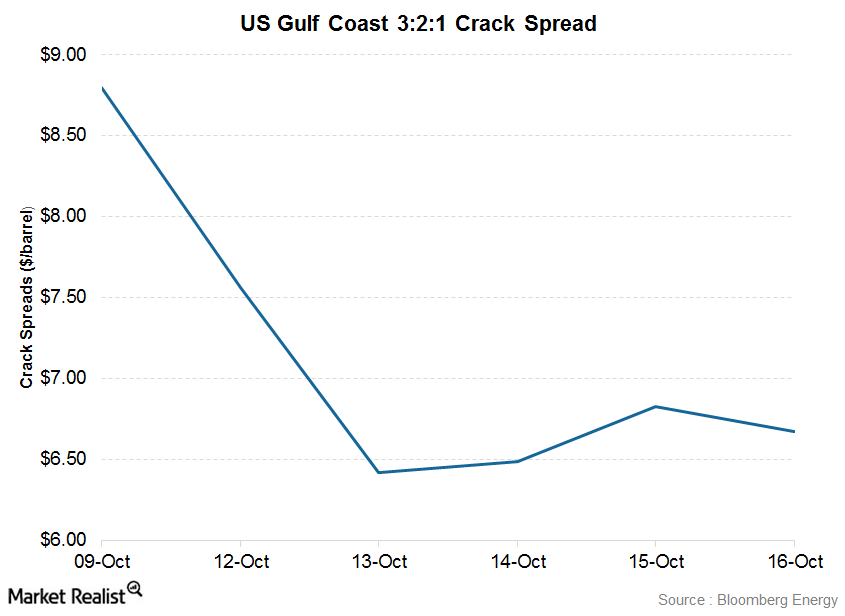

Overview of US Gulf Coast 3:2:1 Crack Spread

Crack spreads usually fall when crude oil prices (USO) increase by more than product prices, or when product prices fall more than crude oil prices.

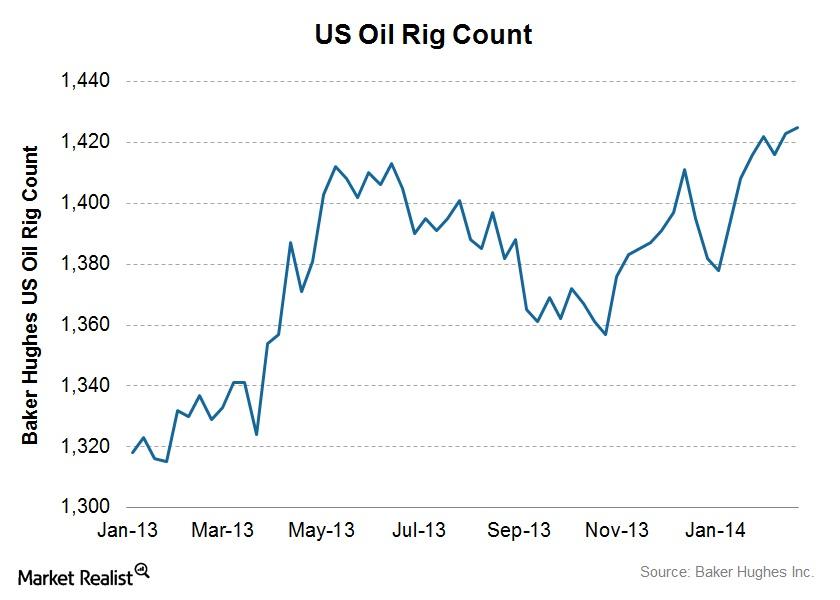

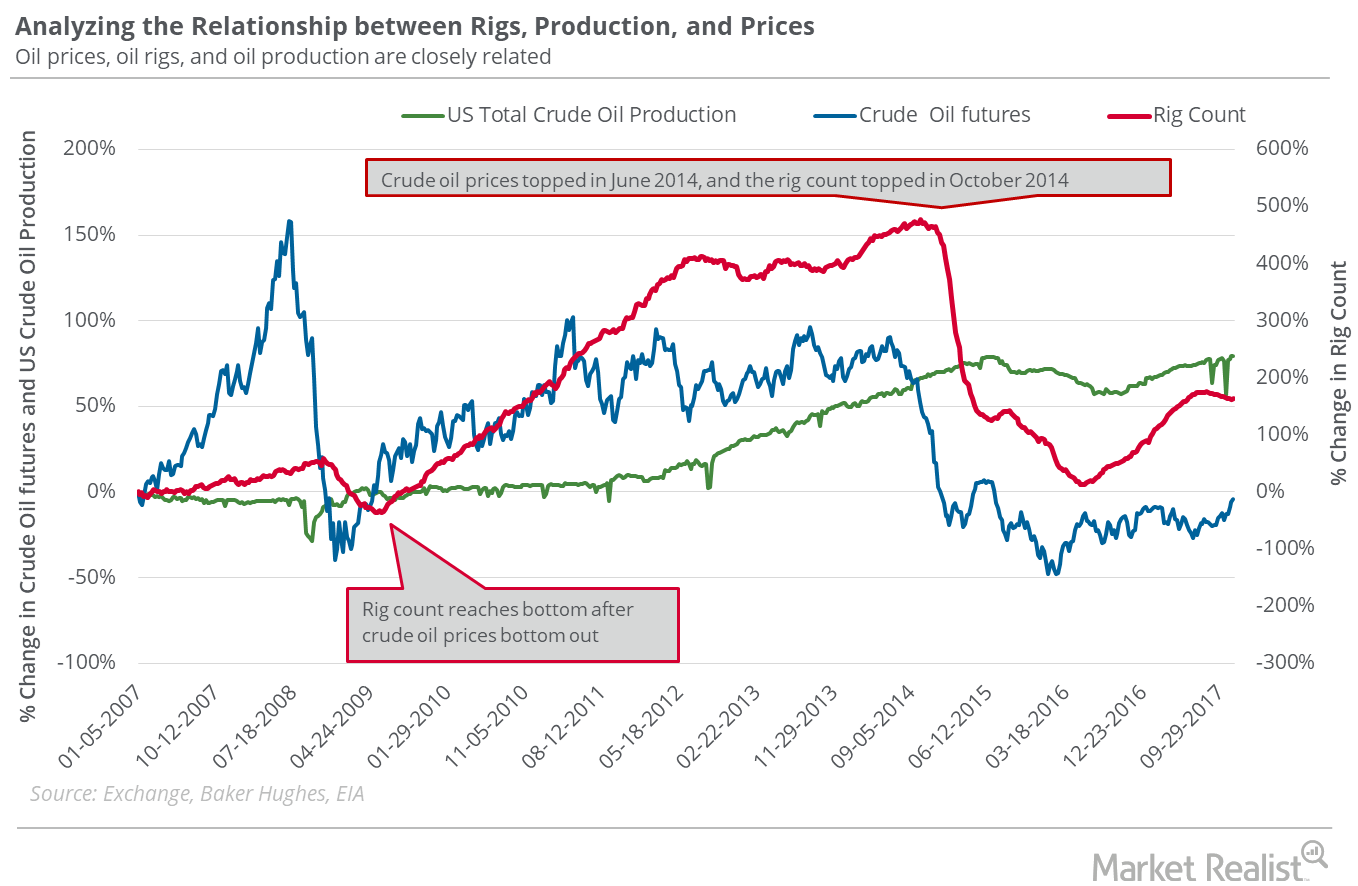

US oil rig counts continue to rally, reaching a year-to-date high

Last week, the Baker Hughes oil rig count increased from 1,423 to 1,425, reaching the highest level since 2014 began.Materials Must-know: Why onshore rig counts are at a 2-year high

The U.S. onshore, or land-based, rig count increased by four rigs—from 1,865 to 1,869—during the week ending September 19. Land-based rigs include 13 inland water rigs. This is the highest onshore rig count in the past two years. It’s the highest rig count since August 17, 2012. This marks the eighth increase in the past ten weeks.Energy & Utilities Why improvement in Libya pushed down the crude price last week

For most of the last two years, WTI crude oil has been range-bound between ~$85 per barrel and ~$110 per barrel.

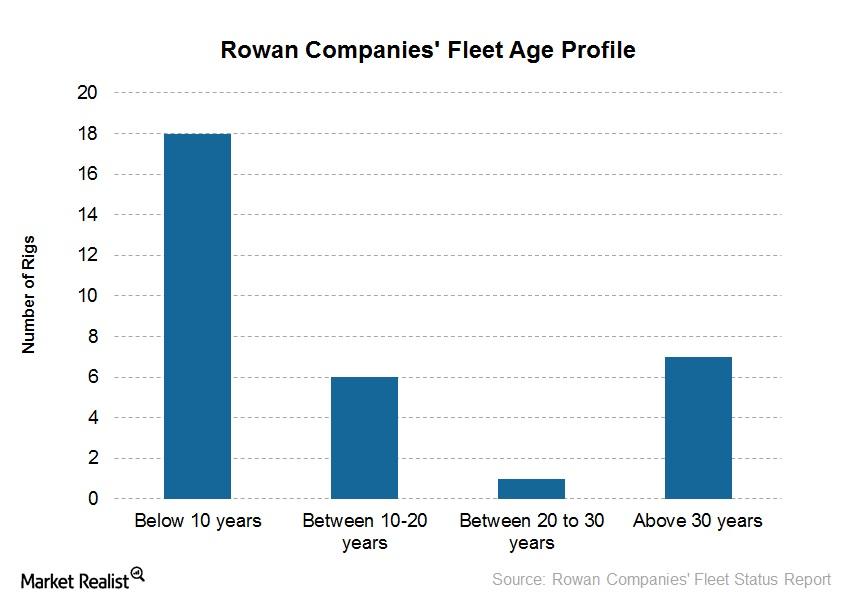

Analyzing Rowan’s Rig Scrapping and Stacking Activity in 3Q15

Offshore drilling (XLE) (IYE) is a capital-intensive industry requiring a large amount of money to keep rigs active and well-maintained.

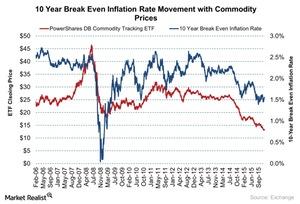

Where Will Commodities Head during Trump’s Term?

Donald Trump’s policies are aimed at strengthening job markets in the United States (VFINX) (IVV).

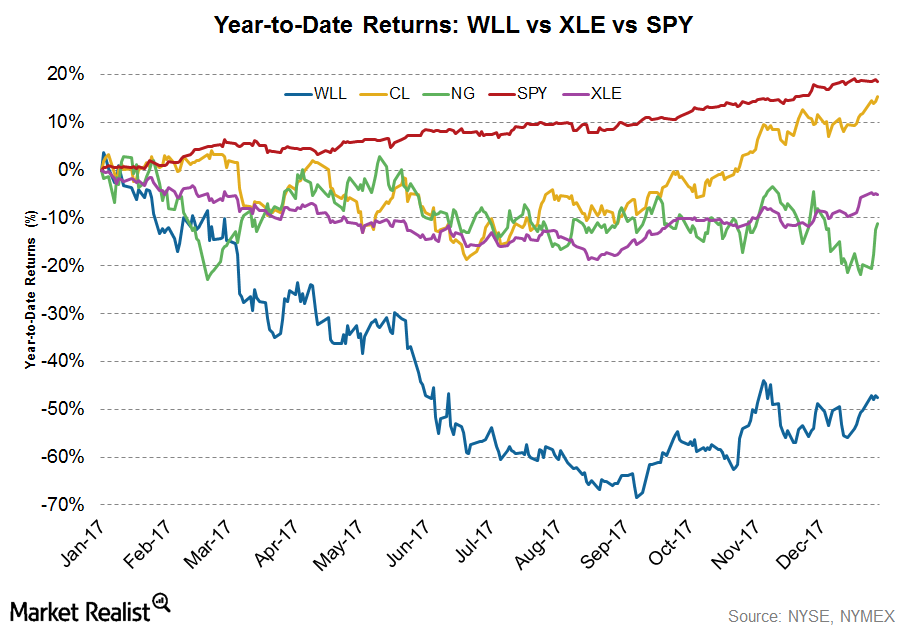

What Drove Whiting Petroleum Stock in 2017?

Whiting Petroleum (WLL) stock rose 5.3% in the week ending December 29 from the previous week. However, the stock fell ~47.6% by the end of 2017.

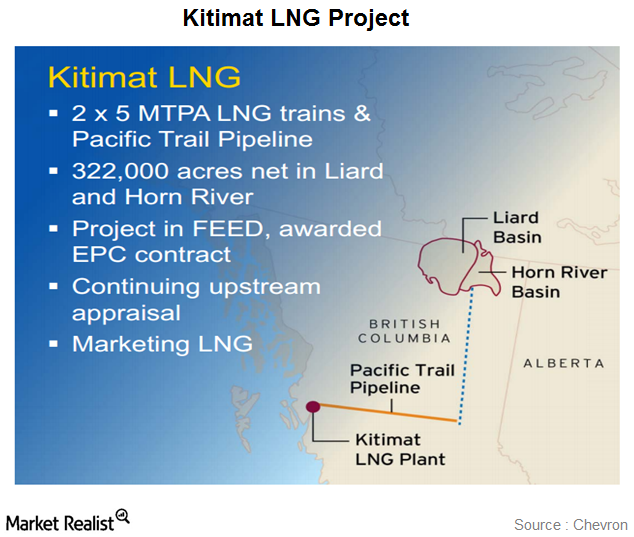

Why Chevron is cutting spending on some projects

Chevron has cut spending on the Kitimat liquefied natural gas project (or LNG) in Canada due to falling crude prices.

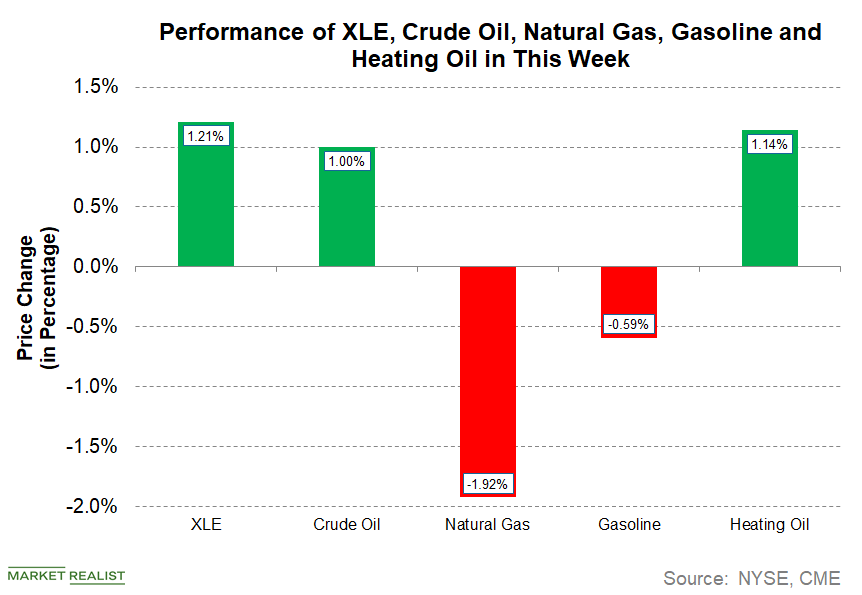

How Energy Commodities Performed from June 18–20

Energy stocks are rising this week. The Energy Select Sector SPDR ETF (XLE) has risen 1.2% from June 18–20.

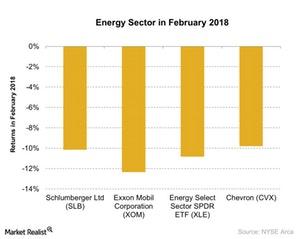

What Put Pressure on the Energy Sector in February 2018?

The US energy sector was badly affected by the recent market sell-off in February 2018.

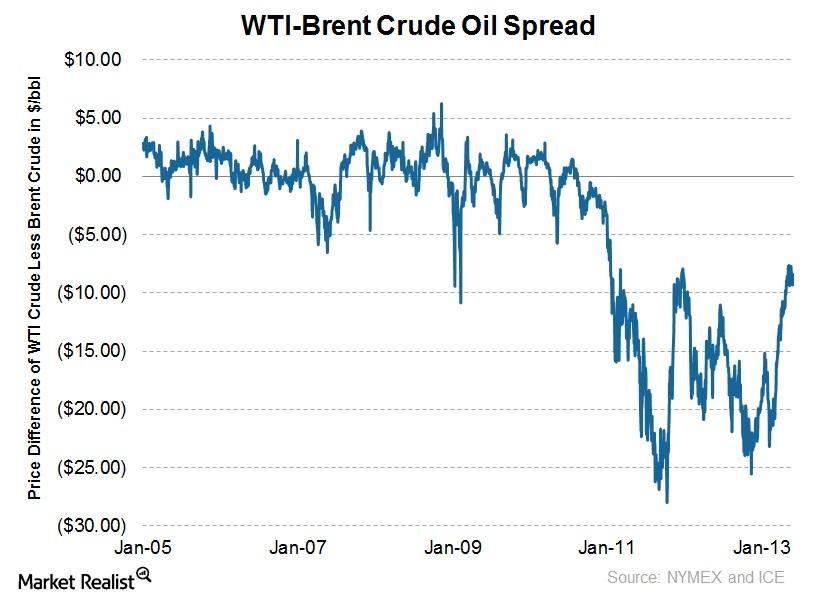

Spread between WTI crude oil and Brent oil has closed in significantly since YE2012

The WTI-Brent spread remained relatively unchanged last week, but has closed in significantly since year-end 2012.

Why oil prices spiked on tensions in Gaza and Ukraine

Early last week, WTI crude oil had eased to close to $99 following Libya’s restarting exports from major ports and abating fears over supply disruptions in Iraq.

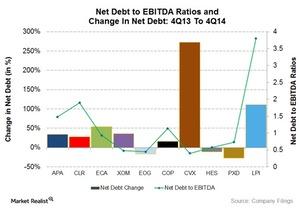

Who’s the energy company achiever, and who are the laggards?

Let’s see which energy company stands out as the most efficient in reducing debt loads and improving leverage ratios and which ones are laggards.

Russia’s GDP Is Back to Positive Territory

The recovery of oil prices in the second half of 2016 has helped the Russian economy recover from negative growth in 4Q16.

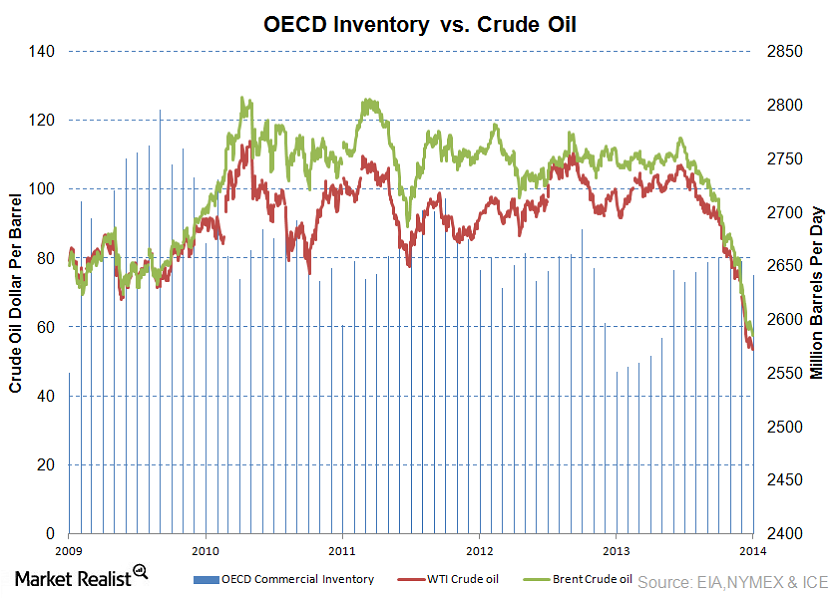

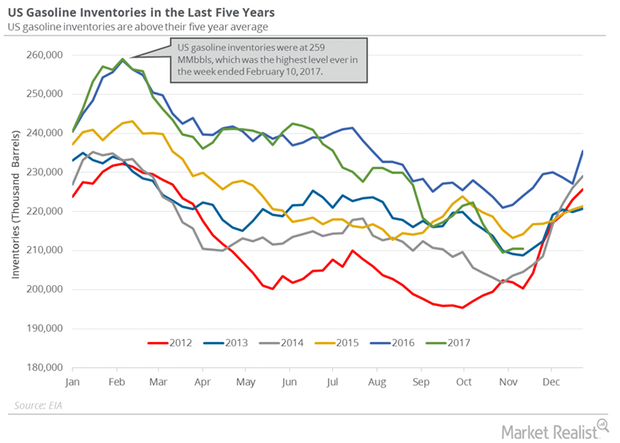

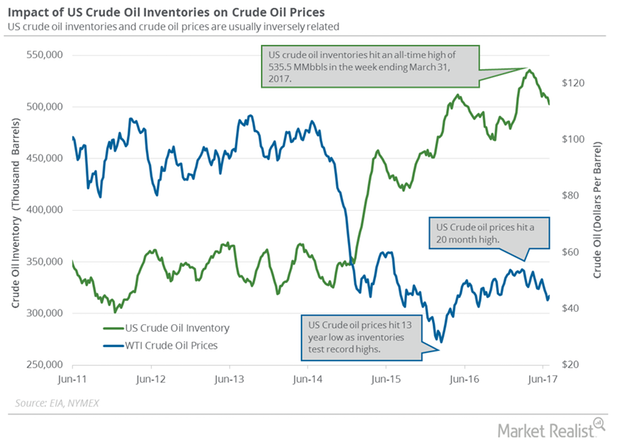

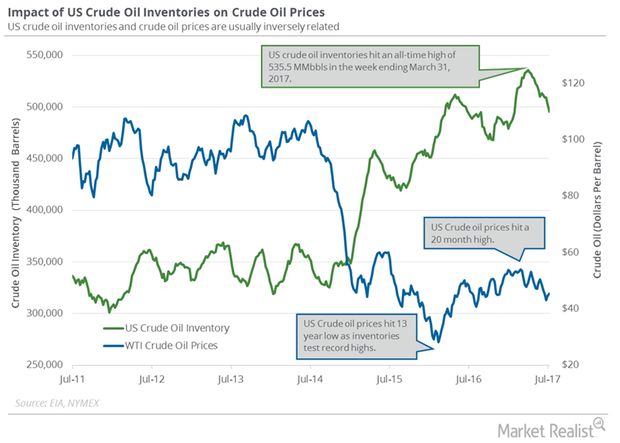

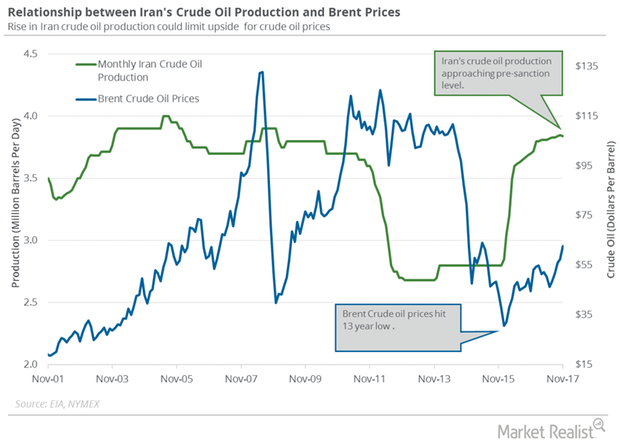

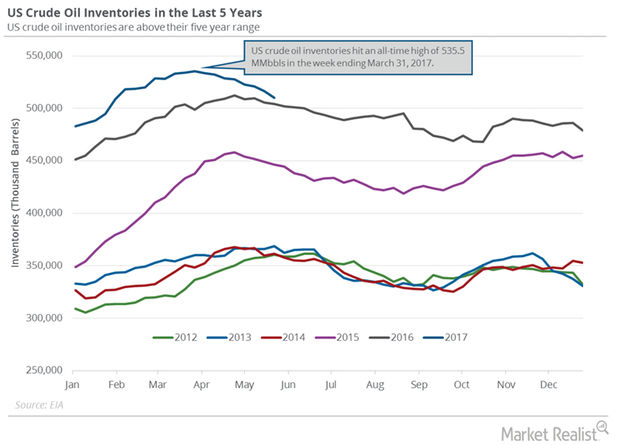

Why investors should track crude oil inventory levels

The difference between actual and expected changes in US crude oil inventory levels affects crude prices and thus revenues and earnings of major companies.

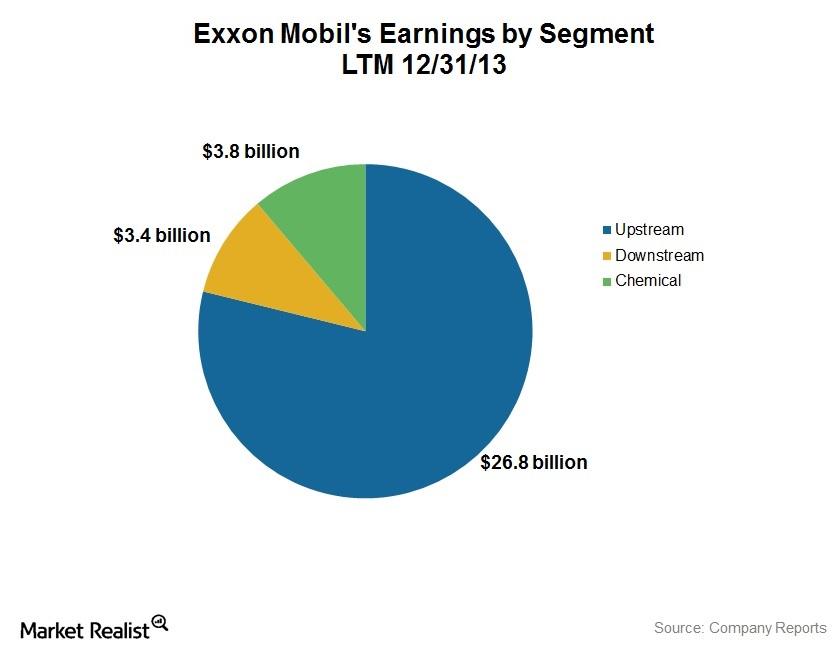

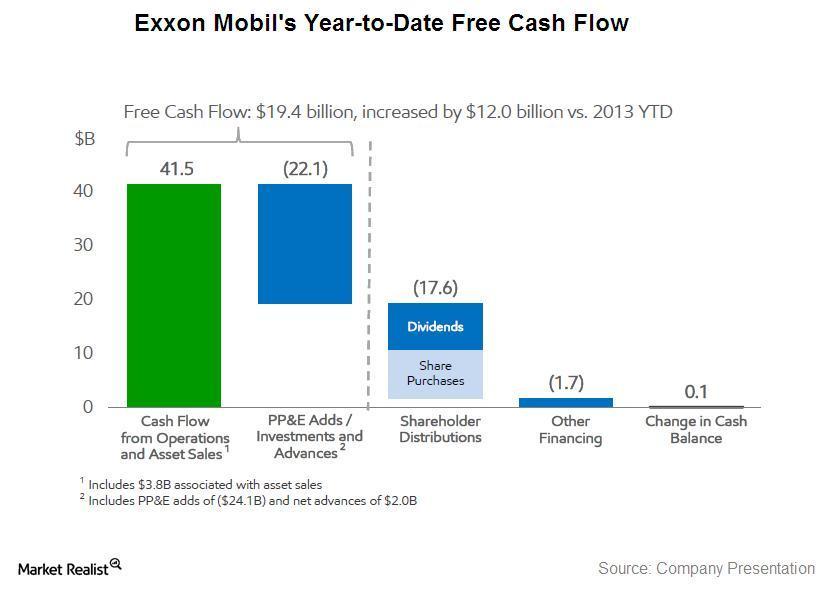

An essential guide to Exxon Mobil: XOM’s major areas of operation

Exxon Mobil has three major business segments: Upstream, Downstream, and Chemical. Upstream contributes the most to XOM’s earnings.

China’s Economic Data Might Drag Oil Prices

On December 14, China reported the November industrial output growth at 5.4% on a year-over-year basis—the lowest growth since early 2016.

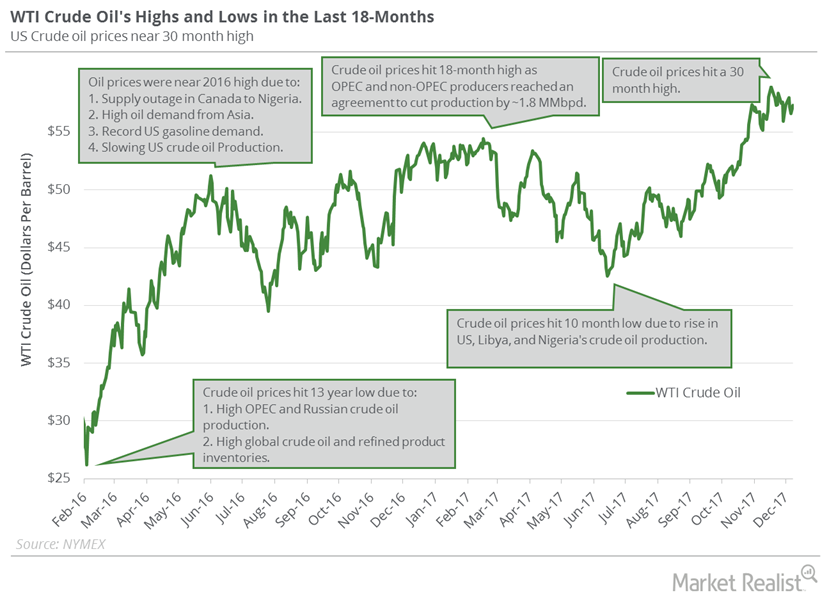

Will US Crude Oil Futures Be Range Bound This Week?

WTI crude oil (USO) futures hit $58.95 per barrel on November 24, 2017—the highest level in nearly three years.

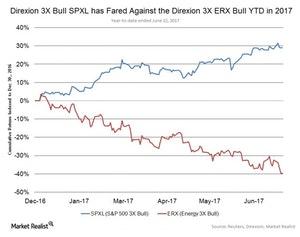

Is this Summer a Good Time to Invest in Energy?

So far this year, the S&P 500 energy sector has struggled mightily, down 12% versus an almost 9.5% gain in the S&P500 this year.

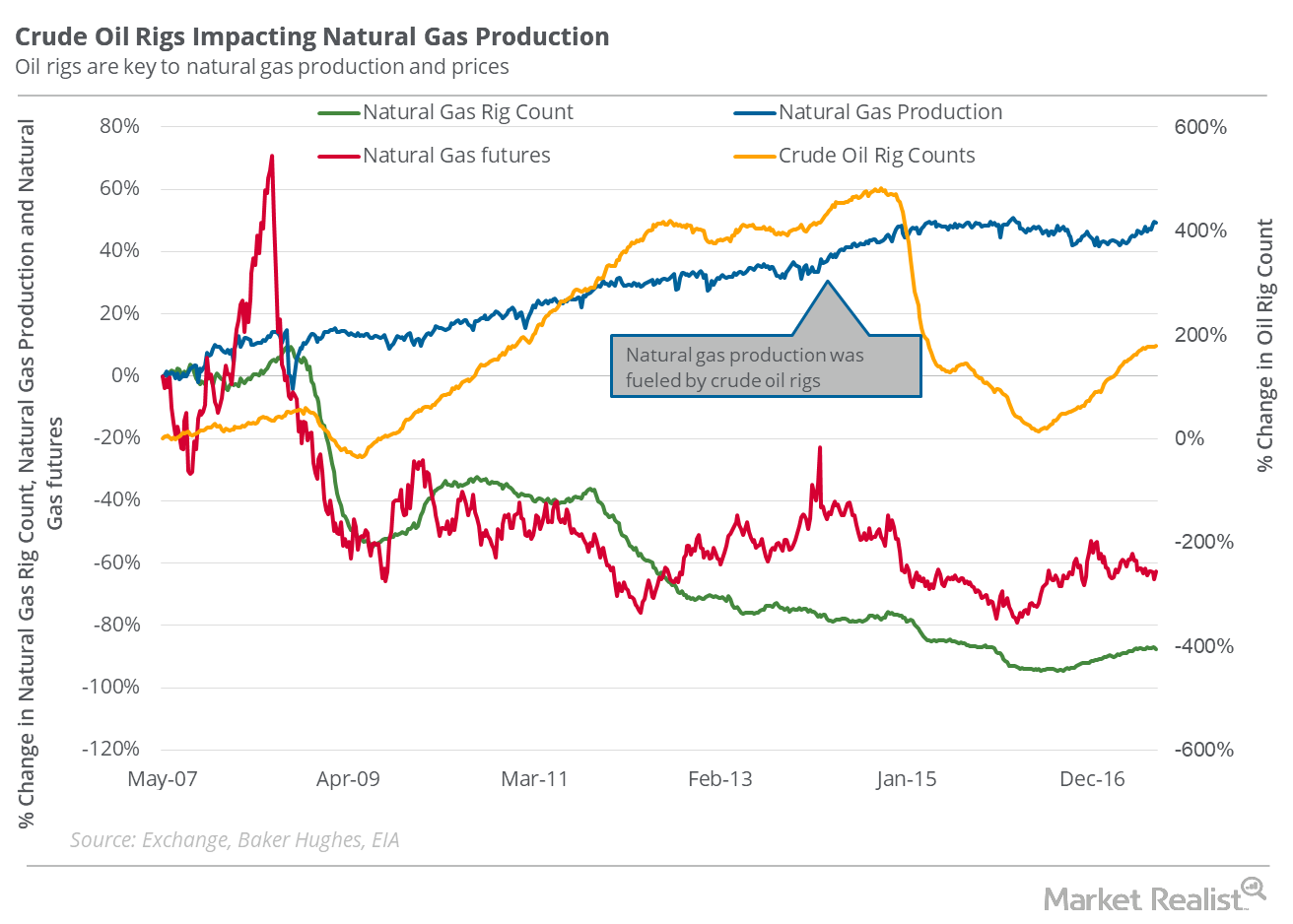

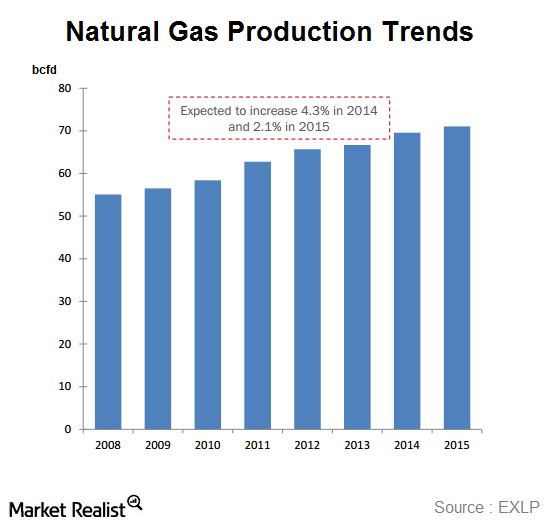

Behind the Natural Gas Rig Count: Will Production Rise?

The natural gas rig count rose by four to 187 in the week ended September 8, 2017. On a YoY basis, the natural gas rig count more than doubled that week.

US Crude Oil Inventory Report Might Disappoint Traders

An unexpected increase in US oil inventories pressured WTI oil (USO) (UCO) prices in post-settlement trade on November 28, 2017.

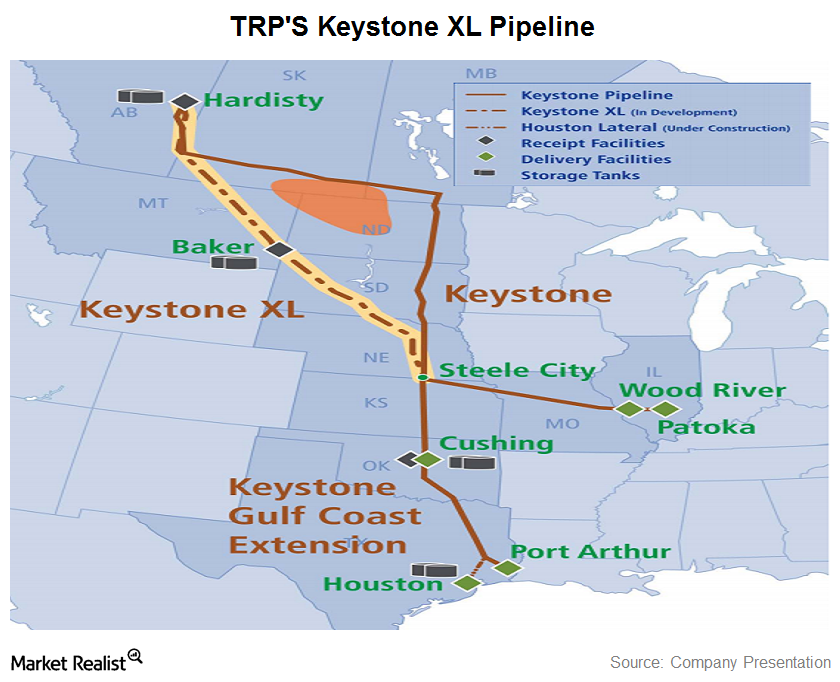

TransCanada’s controversial Keystone XL Pipeline project

The Keystone XL Pipeline project is a proposed 1,179-mile pipeline. It begins in Alberta, Canada and extends south to join the existing Keystone Pipeline in Steele City, Nebraska.

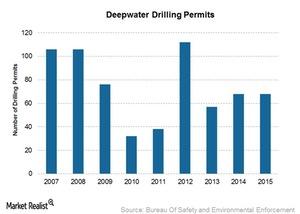

The 2010 Gulf Oil Spill Tragedy and Its Aftermath across the Industry

The marine oil spill in April 2010 was the worst environmental disaster in US history, causing millions of barrels of oil gushed into the Gulf.

An overview of the natural gas compression industry

Natural gas compression is essential for transporting natural gas. Compression is used several times during the natural gas production and transportation cycle.

Oil Majors Keep New Projects Worth $200 billion on Ice

Wood Mackenzie research shows that the oil majors have deferred more than 45 significant oil and gas projects since the beginning of the crude oil price collapse last year.

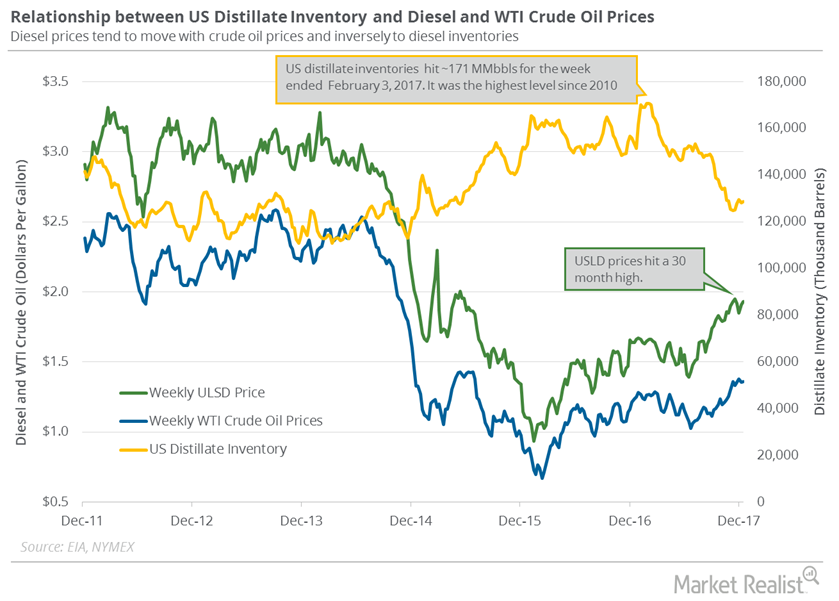

US Distillate Inventories Rose for the Fourth Time in 5 Weeks

US distillate inventories rose for the fourth time in the last five weeks. They rose ~3% in the last five weeks, which is bearish for diesel and oil prices.

Dimensional Fund Advisors’ Major Holdings in Q3

Dimensional Fund Advisors’ top buys are Apple (AAPL), AT&T (T), Microsoft (MSFT), L3Harris Technologies (LHX), and Verizon Communications (VZ).

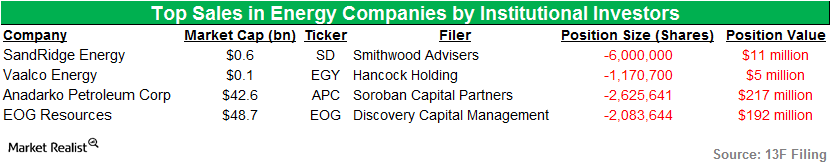

Smithwood Advisers and Hancock Sell Stakes in Energy in 1Q15

Smithwood Advisers was among the hedge funds that sold their stakes in SandRidge Energy in 1Q15. Hancock Holding was one of the firms that sold stakes in Vaalco Energy.

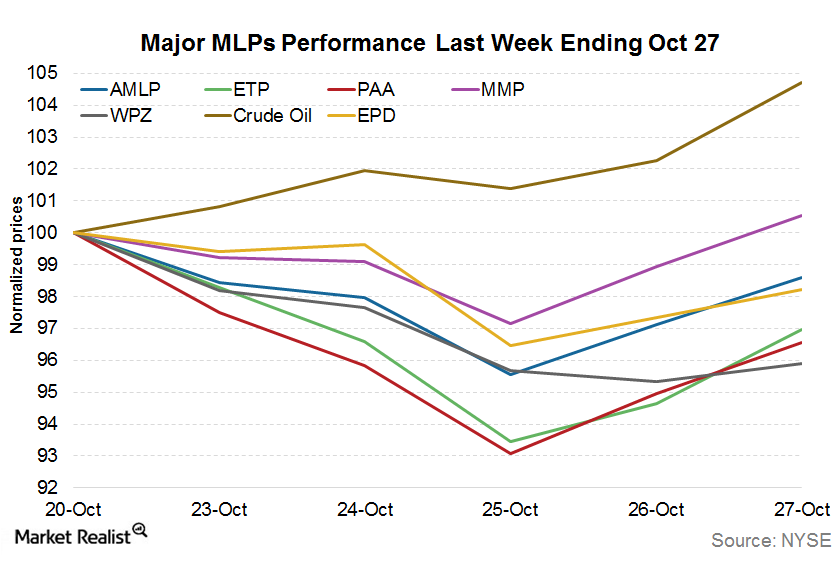

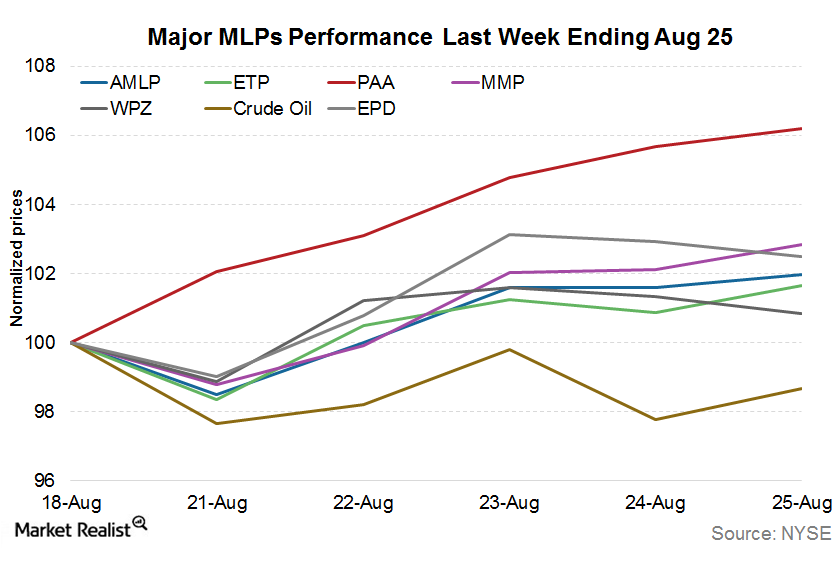

Why MLPs’ Sluggishness Continued Last Week

MLPs’ sluggishness continued last week despite strong crude oil. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, fell 1.2% last week.

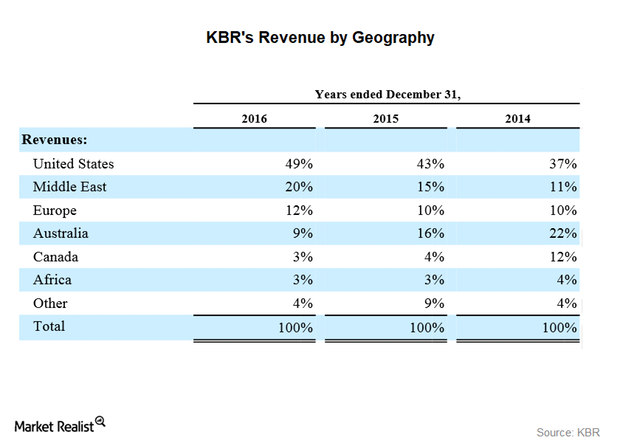

More about KBR’s Major Clients

Clients and their sectors KBR (KBR) has a diverse customer base. According to KBR, its customers are “domestic and foreign governments, international and national oil and gas companies, independent refiners, petrochemical producers, fertilizer producers and manufacturers.” Revenue from overseas operations represented 63%, 57%, and 51% of KBR’s total revenue in 2014, 2015, and 2016, respectively. In this part, we’ll look at […]

Schlumberger and Halliburton Compared to the Industry

By market capitalization, Schlumberger is the largest OFS company. Schlumberger’s stock price has declined 4% since May 3, 2017.

Crude Oil Prices Rise: Is It Time for a Collapse?

WTI crude oil prices have risen 9.4% since June 21, 2017. Brent and US crude oil prices are near a three-week high.

Positive and negative effects on ExxonMobil’s returns

Currently, the biggest concern affecting Exxon Mobil (XOM) and other energy companies is the falling crude price and falling oil and gas production.

MPLX LP: The infrastructure link in Marathon Petroleum’s chain

Marathon Petroleum Corporation, or MPC, owns 100% of the MPLX general partnership, or GP, interests, as well as the incentive distribution rights.

Supply, Demand: Will Crude Oil Futures Rally Be Short-Lived?

August WTI (West Texas Intermediate) crude oil futures contracts rose 1.0% and closed at $45.49 per barrel on Wednesday, July 12, 2017.

MLPs Recovered Slightly in the Week Ending August 25

MLPs recovered slightly in the week ending August 25—possibly due to an overcorrection in the first three weeks of the month.

Bullish Oil Traders Must Count the Oil Rigs

On November 24, 2017, US crude oil settled at the highest closing price in 2017. The oil rig count could be at a three-year high by May 2018.

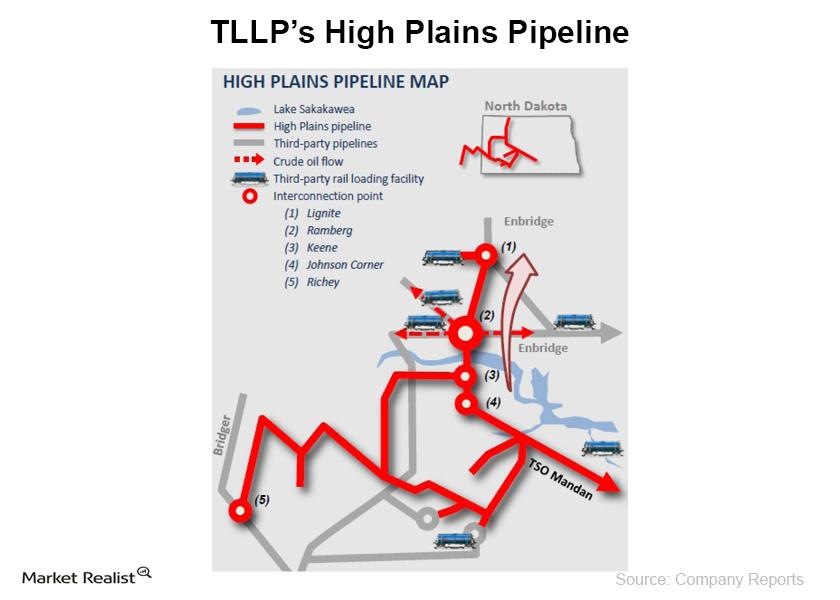

Why Tesoro’s crude oil gathering and pipeline segment is positive

Tesoro Logistics’ (TLLP) operations are organized into the Crude Oil Gathering segment and the Terminalling and Transportation segment.

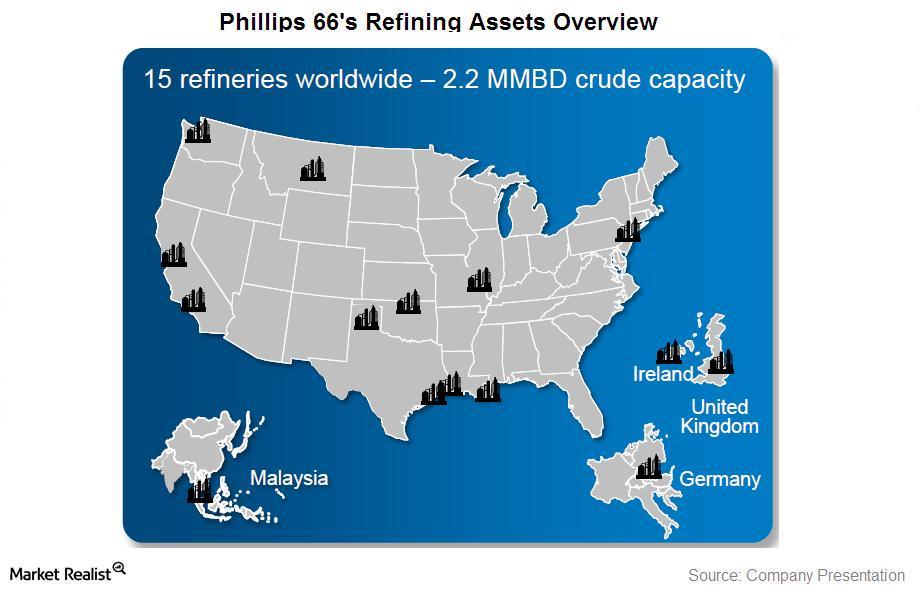

Phillips 66: An overview

In 2013, Phillips 66 generated 67%, 13%, and 6% of its revenues from the United States, the United Kingdom, and Germany, respectively. The company’s other foreign operations contributed ~16%.

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

US Crude Oil Inventories: Lower than the Market’s Expectation

The EIA reported that US crude oil inventories fell by 6.4 MMbbls (million barrels) to 509.9 MMbbls on May 19–26, 2017.