Positive and negative effects on ExxonMobil’s returns

Currently, the biggest concern affecting Exxon Mobil (XOM) and other energy companies is the falling crude price and falling oil and gas production.

Nov. 20 2020, Updated 2:17 p.m. ET

Factors affecting ExxonMobil’s returns

The factors that are positively affecting ExxonMobil’s (XOM) performance include the following:

- Earnings increasing consistently. ExxonMobil has consistently increased its earnings per share (or EPS) over the past year. From 9M13 to 9M14, EPS increased 10.6% to $6.04, from $5.46. Higher natural gas price realization, improved downstream and chemicals segment performance in 3Q14, and steady upstream earnings contributed to ExxonMobil’s healthy performance. Lower crude prices keep downstream input costs down.

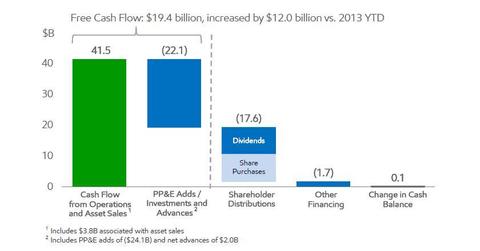

- Strong free cash flows. ExxonMobil recorded a total of $41.5 billion from aggregate cash flow from operations and asset sales. This covers the $28.07 billion capital and exploration expenditure and the $17.6 billion dividend distribution. Year to date 2014, ExxonMobil recorded $19.4 billion free cash flows, $12.0 billion higher than year to date 2013. This year-to-date free cash flow growth reflects ExxonMobil’s operational performance and a prudent capital allocation approach.

ExxonMobil’s concerns

Currently, the biggest concern affecting ExxonMobil (XOM) and other energy companies is the falling crude price and falling oil and gas production.

From 3Q13 to 3Q14, ExxonMobil’s total production of natural gas and liquids decreased 4.7% on an oil-equivalent basis. The company’s average U.S. and non-U.S. crude oil selling price in 3Q14 decreased 11.9% and 9.3%, respectively, in 3Q14 compared to 3Q13. ExxonMobil’s upstream earnings are negatively affected by falling crude price. For more on ExxonMobil’s risks, read Market Realist’s article Must-know: What investors should watch for at ExxonMobil.

ExxonMobil’s (XOM) long-term borrowing is $11.59 billion. In comparison, its industry peer Chevron Corporation’s (CVX) long-term borrowing is $20.04 billion, while BP Plc’s (BP) long-term borrowing currently stands at $47.15 billion. ExxonMobil is also a component of the Energy Select Sector of Standard and Poors depositary receipt (or SPDR) exchange-traded fund (or ETF) (XLE) and SPDR MSCI World Quality Mix ETF (QWLD).