SPDR® MSCI World Quality Mix ETF

Latest SPDR® MSCI World Quality Mix ETF News and Updates

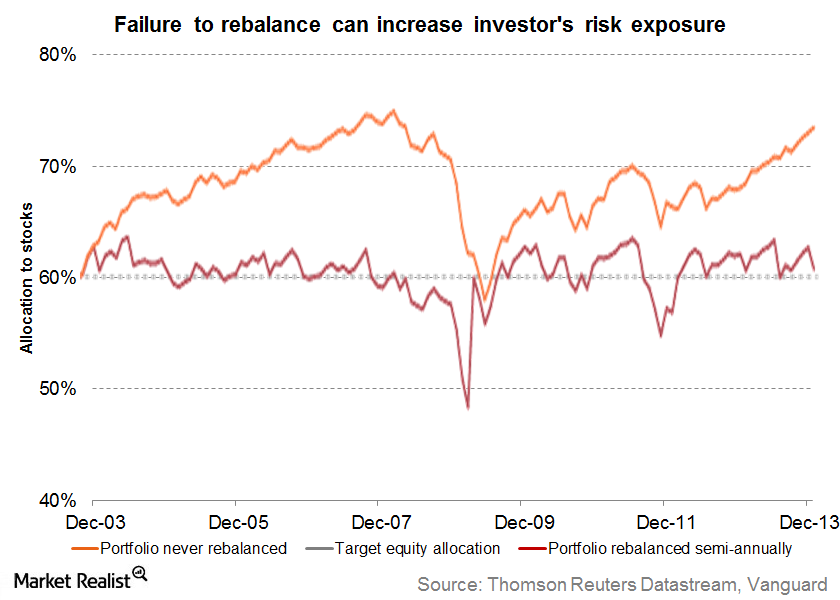

The Importance of Rebalancing Your Portfolio

Rebalancing your portfolio means bringing the portfolio back to the asset allocation levels specified in the financial plan. Not rebalancing can expose you to higher risk.

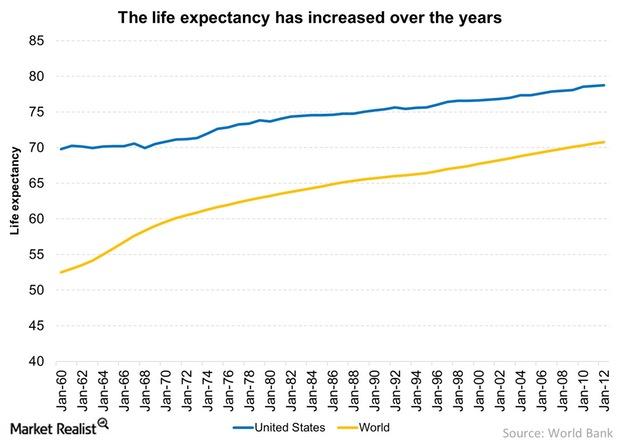

Increased Life Expectancy Means A Longer Investment Horizon

Increased life expectancy means a longer investment horizon. With life expectancy increasing, young investors should invest in equities aggressively.

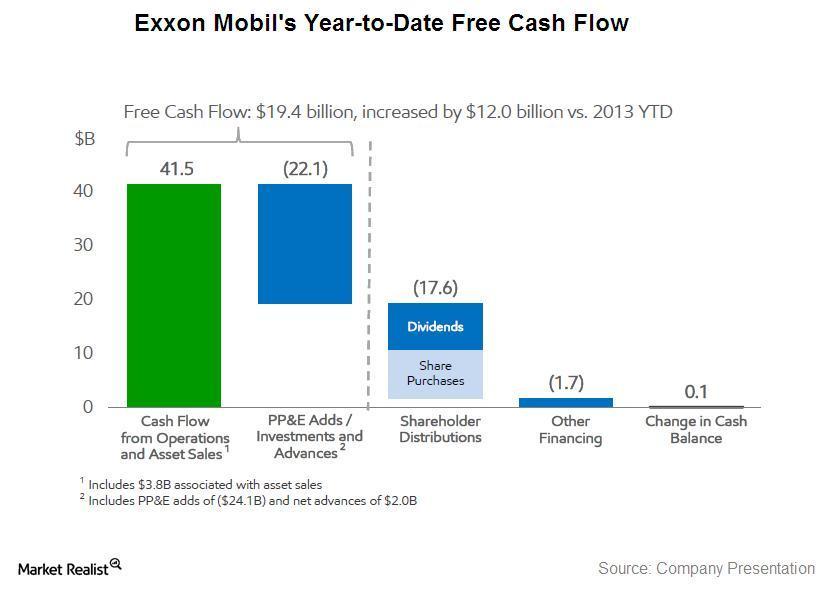

Positive and negative effects on ExxonMobil’s returns

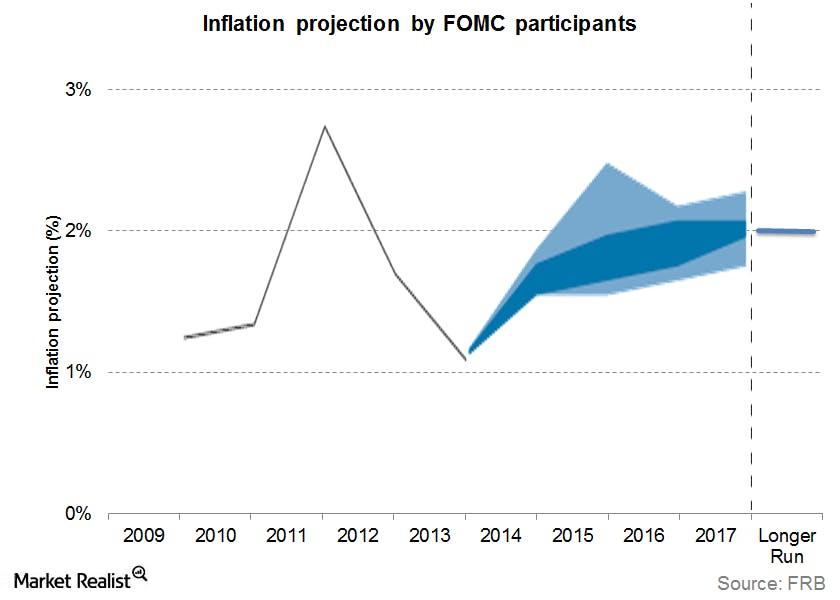

Currently, the biggest concern affecting Exxon Mobil (XOM) and other energy companies is the falling crude price and falling oil and gas production.Why US inflation data is important and how we measure it

U.S. inflation is not just a measure of growth and price pressure in the U.S. economy. It has more far-reaching consequences.

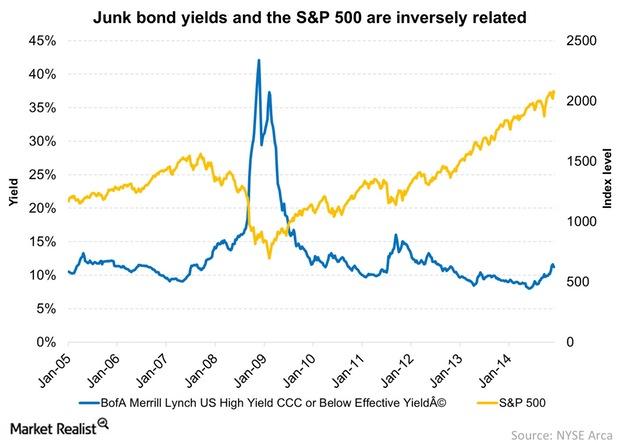

Connection Between Equities And High Yield Bonds

Equities and high yield bonds perform well when the economy is improving, and both underperform when the economy is slumping.

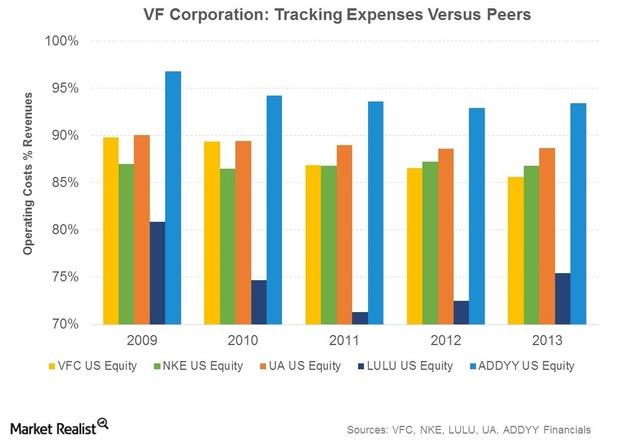

VF Corp.’s Location, Manufacturing, And Supply Chain Advantages

VFC manufactures ~27% of its products in facilities operated by the company. The company owns 28 manufacturing facilities.

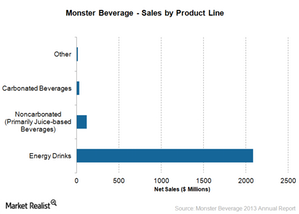

Monster Beverage’s extensive line of energy drinks

Monster Beverage Corporation (MNST) emerged as a leader in energy drinks. It has a 14% market share in the world’s energy drink market.

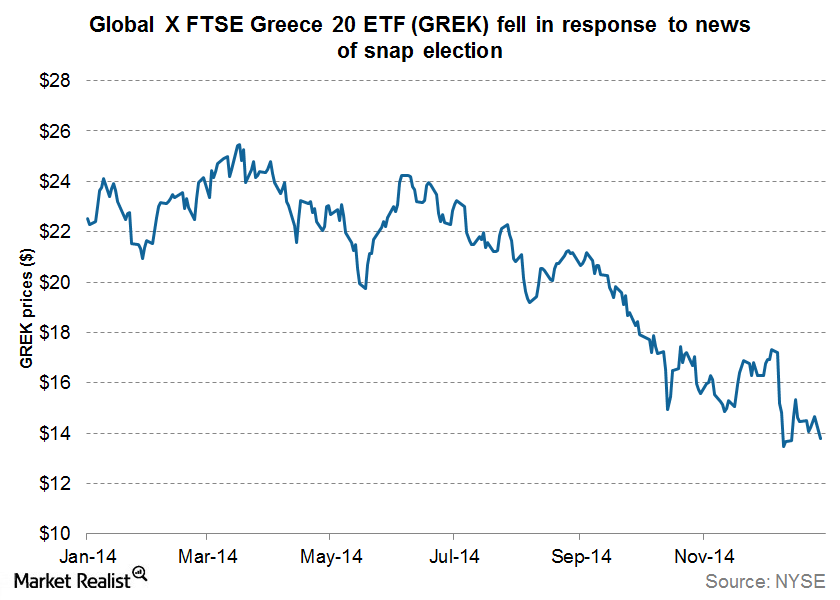

Is Greek Political Instability A Tragedy In The Making?

It’s indeed déjà vu as a fresh round of worry over Greek political instability engulfs the Eurozone (EZU).

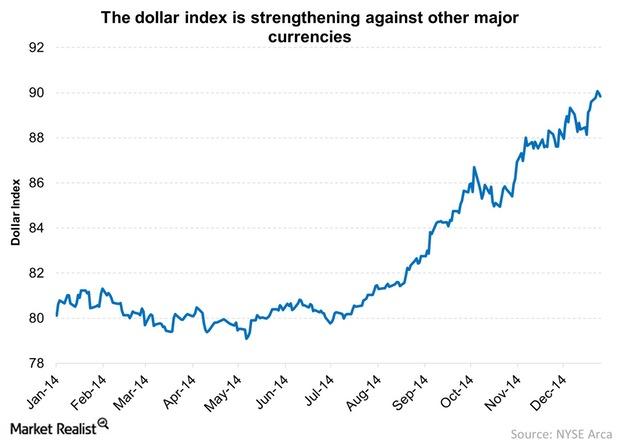

Key Catalysts Behind The US Dollar Rally In 2014

Can the US dollar rally continue? What does this mean for commodities? Russ answers these queries in his latest Ask Russ installment.

Headwinds And Tailwinds For Lululemon Revenues This Year

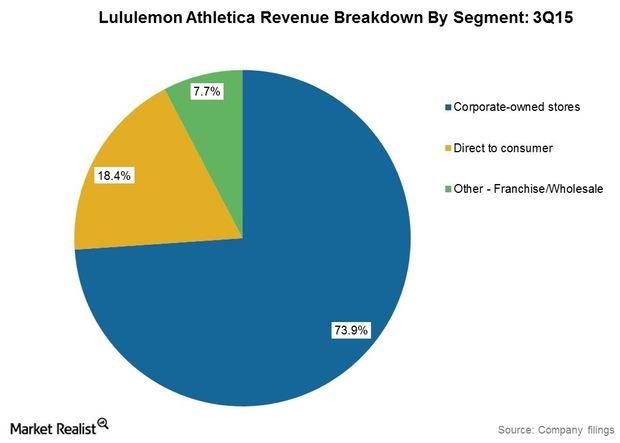

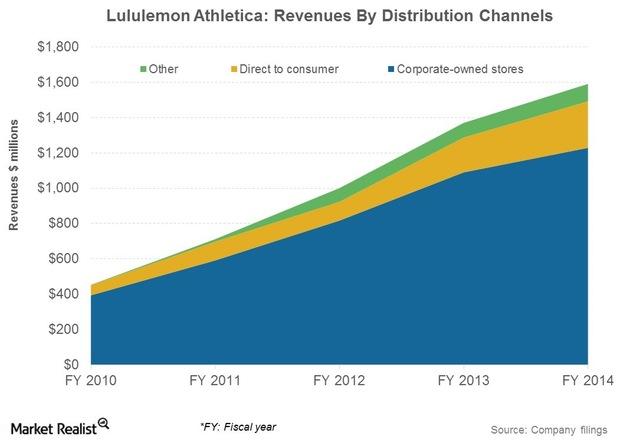

Lululemon Athletica announced an increase of 10.4% in its revenues to $419.4 million in the third quarter of fiscal 2015 compared to $379.9 million in 3Q14.

Why Lululemon’s Distribution Channels Are A Competitive Advantage

LULU’s sale through wholesale channels is much lower than its competitors VF Corporation, NIKE, and Under Armour. This is why LULU’s margins are higher.

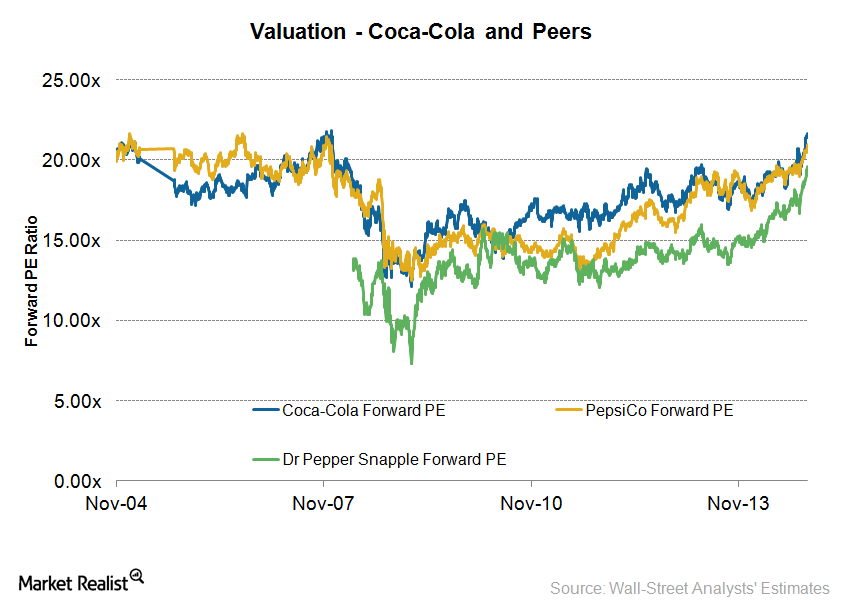

The Coca-Cola Company versus PepsiCo: A battle of giants

The Coca-Cola Company (KO) and Pepsico, Inc. (PEP), are dominant players in the soft drinks market. Both companies own a strong portfolio of liquid refreshments and several brands.

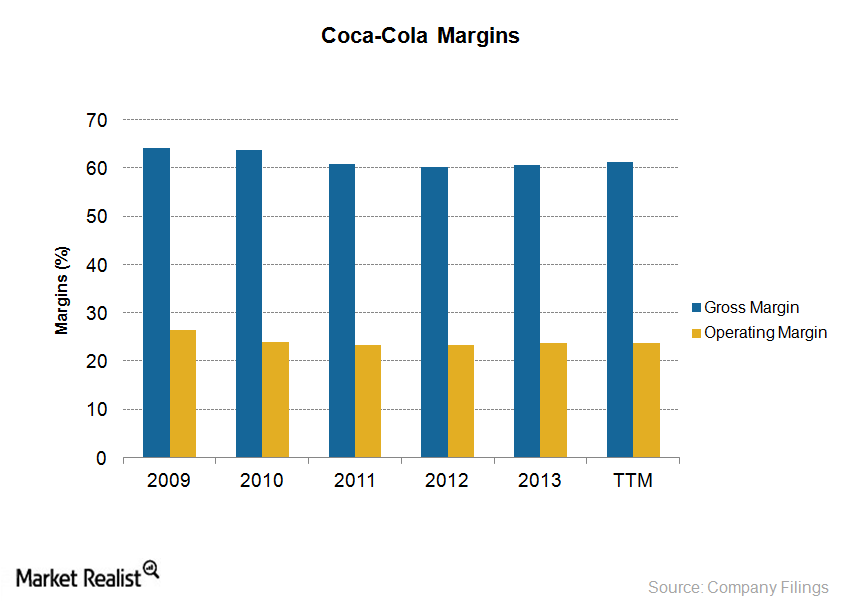

Coca-Cola fights declining margins with productivity measures

The Coca-Cola Company (KO) has been implementing several efficiency initiatives to offset the impact of adverse market conditions and declining demand for carbonated soft drinks.