Energy Select Sector SPDR® ETF

Latest Energy Select Sector SPDR® ETF News and Updates

Permian Basin: Is It a Sweet Spot for Apache and US Producers?

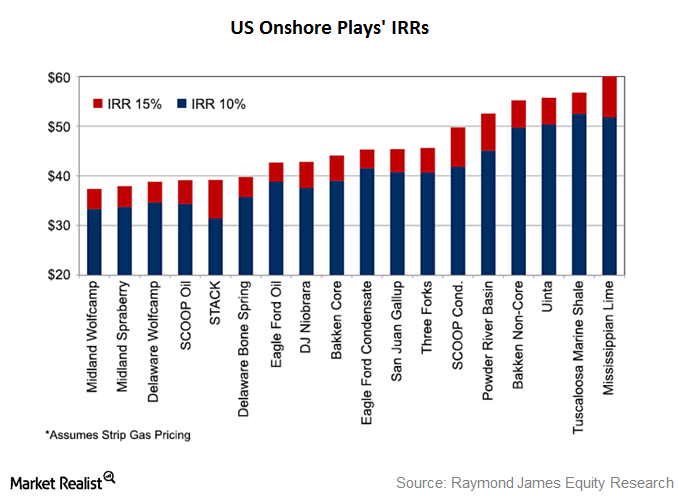

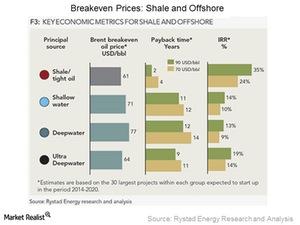

The Midland and Delaware basins, which are sub-basins of the Permian, had IRRs of 15% even at sub-$40 oil prices. Apache (APA) has significant operations in both of these basins.

Phillips 66 Segments: A Fully Integrated Downstream Model

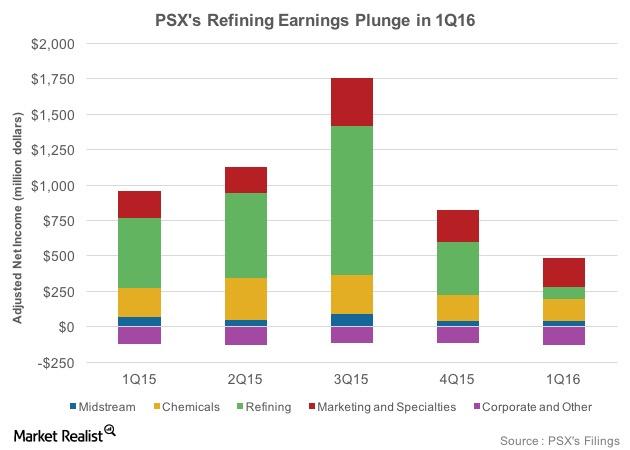

Phillips 66 (PSX) has segments in refining, midstream, chemicals, and marketing. In 1Q16, the refining segment contributed $86 million, or 24%, to its adjusted net income.

Rationale for the Memorial Resource-Range Resources Transaction

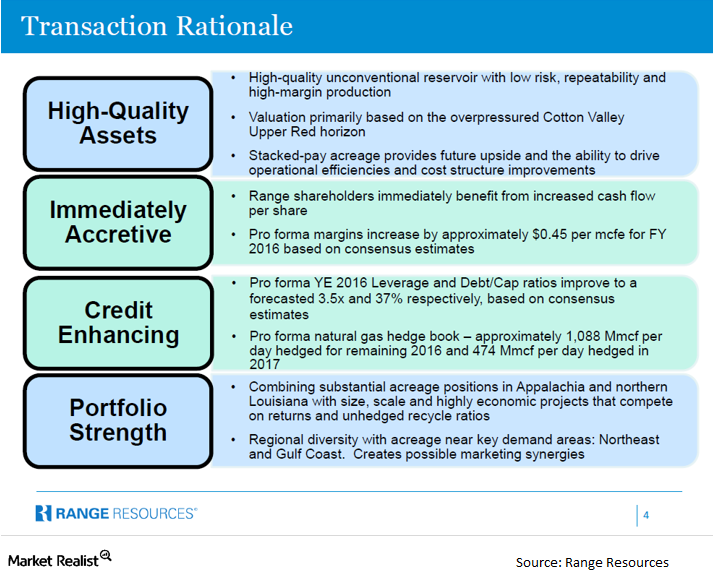

Range Resources is growing its portfolio in the Southeast US. Natural gas exports seem to be a promising growth area. The deal will enhance its credit profile.

ETF Exposure in the Offshore Drilling Space

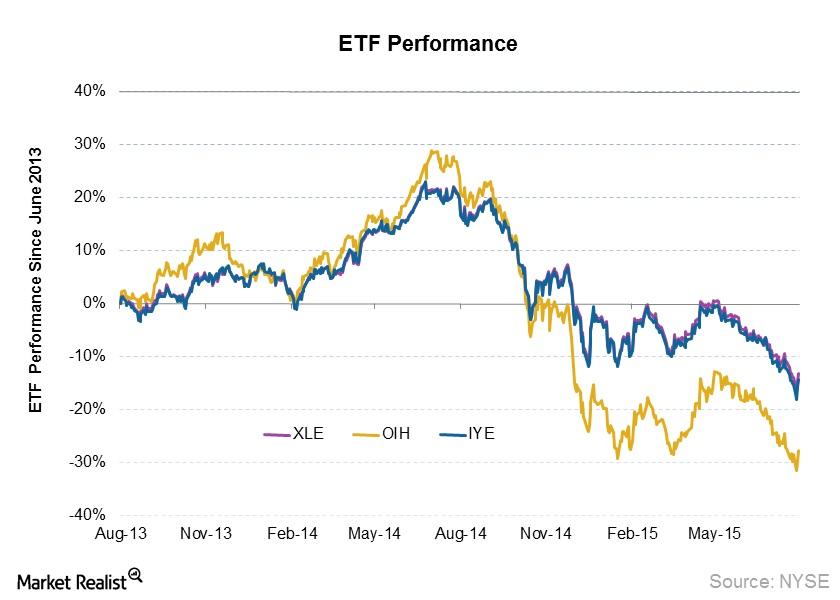

Among the biggest ETFs in the offshore drilling space, investors can choose between ETFs like OIH, XLE, and IYE for exposure to offshore drilling.

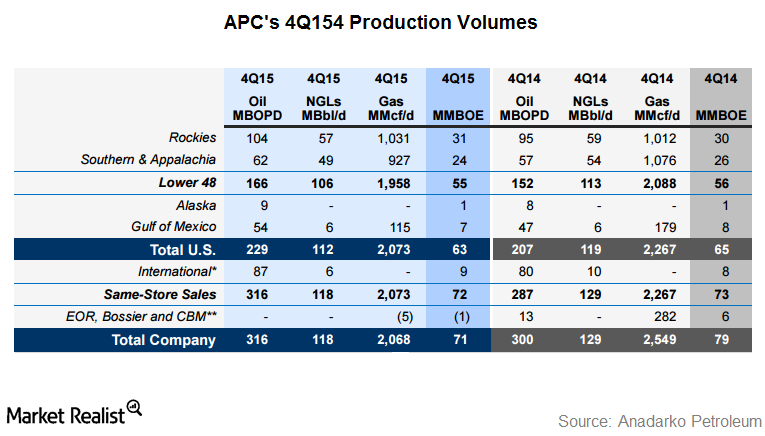

Anadarko Petroleum Slashes Its 2016 Capital Expenditure Budget

Anadarko Petroleum’s preliminary capex (capital expenditure) budget for 2016 is $2.8 billion—nearly 50% less than 2015 levels.

How Offshore and Onshore Drilling Perform when Oil Prices Tumble

Unconventional sources of onshore drilling have started gaining popularity in recent years, but the crude from these sources are costly to produce.

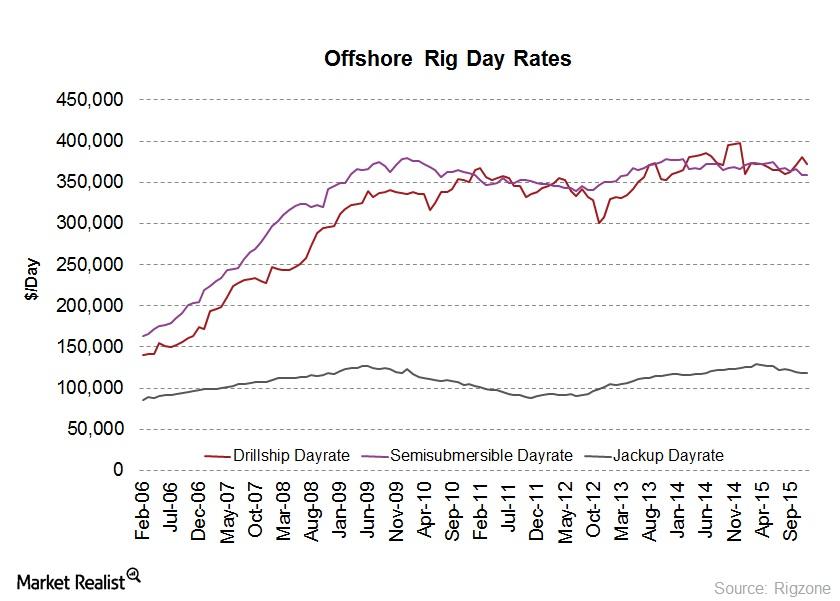

Day Rates and Lifelines of Offshore Drilling Companies

Even in the same category of rigs, different water depth capabilities cause offshore drilling day rates differ. Day rates are also impacted by region.

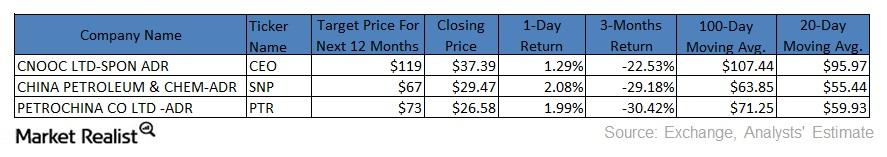

Moving Average Analysis of Chinese Energy Companies

Chinese energy companies CNOOC, China Petroleum & Chemical, and PetroChina Company have fallen below their 100-day and 20-day moving averages.

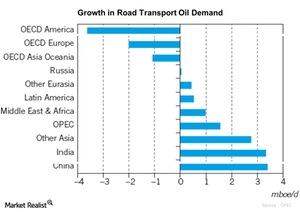

Crude Oil Demand Expected to Grow from Road Transportation

OPEC has estimated that the road transportation sector will account for one-third of the global crude oil demand growth between 2014 and 2040.

ONEOK: Trading 57% below Its 50-Day Moving Average

ONEOK (OKE) is currently trading 57% below its 50-day moving average. It’s generally been trading below its 50-day moving average since mid-2014 when energy prices began falling.

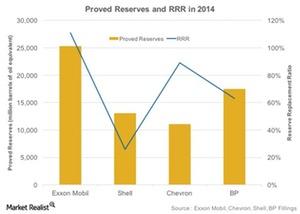

Why Is Reserve Replacement Ratio Important to the Upstream Sector?

RRR reflects how many barrels of oil equivalent the company adds to its reserves in replacement of ones that are produced.

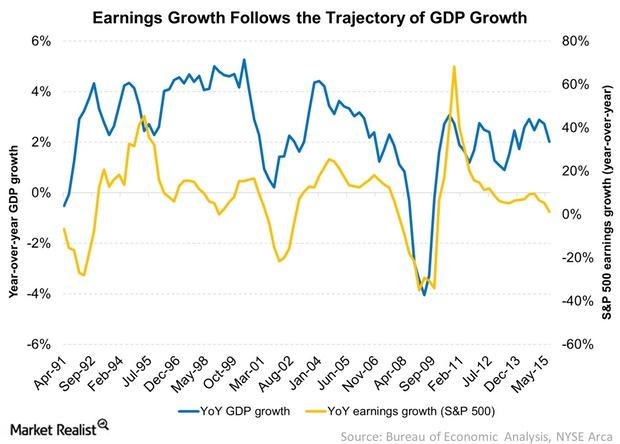

What’s the Biggest Driver of Earnings Growth?

Economic growth is the biggest driver of earnings growth. Earnings growth seems to follow the same trajectory of GDP growth.

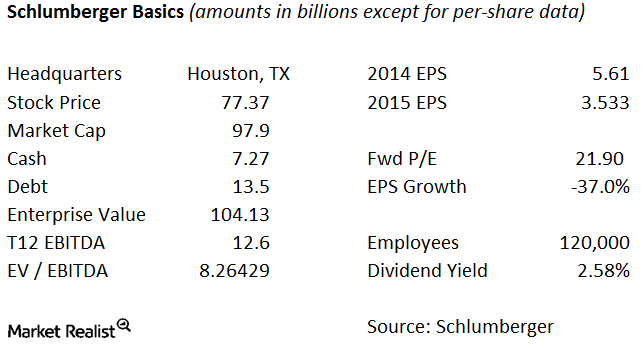

Basics of Schlumberger

Schlumberger (SLB) provides technology, project management, and information technology services to the oil and natural gas exploration and production industry.

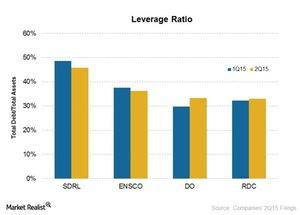

Which Offshore Driller Is the Most Leveraged?

As the above chart shows, Seadrill (SDRL) has the highest leverage, with a debt-to-asset ratio of 46%. Ensco (ESV) has the second highest ratio at 36%.

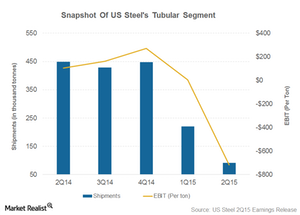

Losses Widen in U.S. Steel’s Tubular Segment as Fixed Costs Rise

Demand for OCTG products is expected to be subdued in the coming months. This would continue to put pressure on U.S. Steel’s Tubular segment.

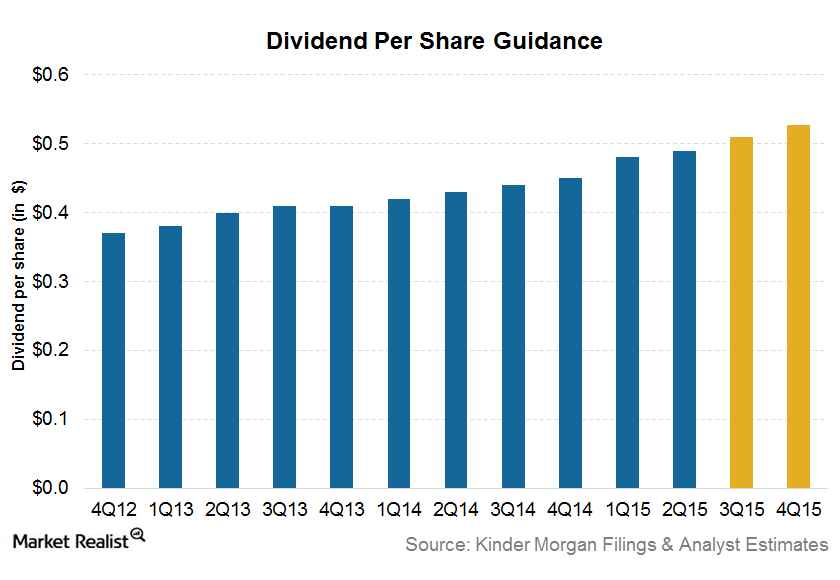

Kinder Morgan’s Outlook for the Rest of 2015

According to Wall Street analysts’ consensus outlook, Kinder Morgan’s (KMI) dividend is expected to grow by ~15.3% year-over-year by the end of 2015.

US Crude Production Dropped in Week Ended July 24, but Why?

According to data from the U.S. Energy Information Administration, US crude production dropped to 9.4 million barrels per day in the week ended July 24.

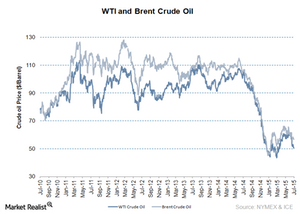

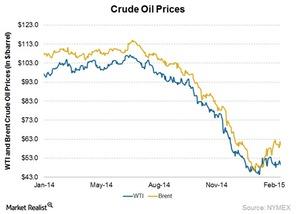

Brent and WTI Crude Oil Prices Widen in the Depressed Oil Market

August WTI crude oil futures contracts fell by $0.74 and closed at $50.15 per barrel on July 20. Brent fell by $0.45 and settled at $56.65 at the close of trade.

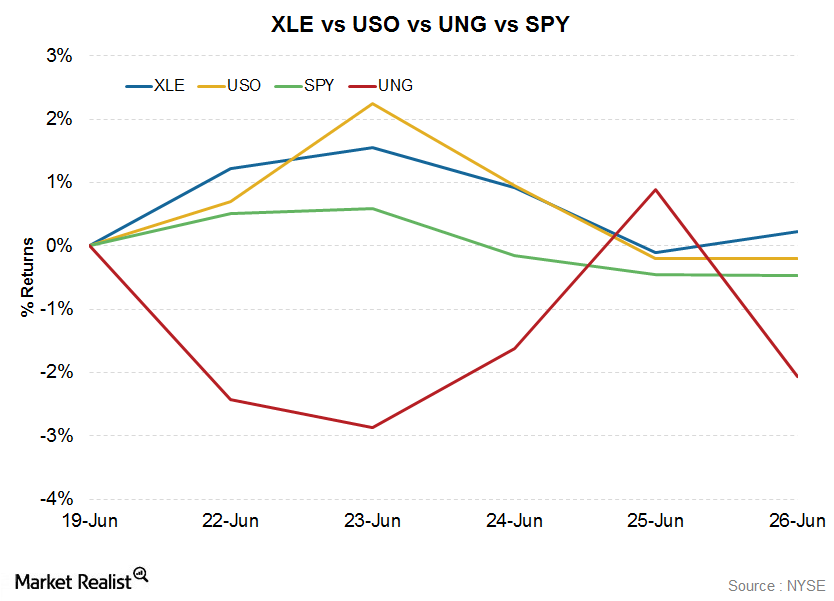

XLE Is Up Even as Commodity ETFs Track Energy Prices Lower

The Energy Select Sector SPDR ETF (XLE) rose 0.22% in the week to June 26. The ETF tracks a diverse group of ~45 of the largest US energy stocks.

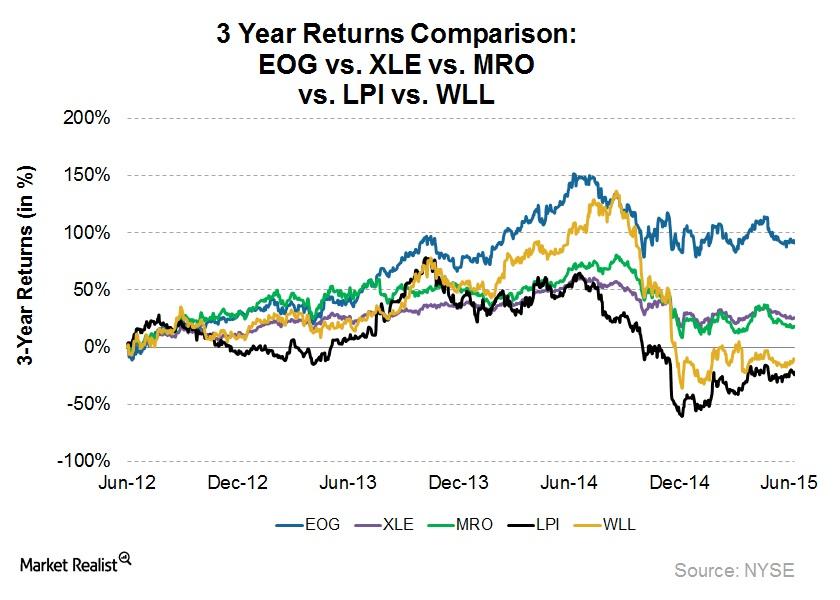

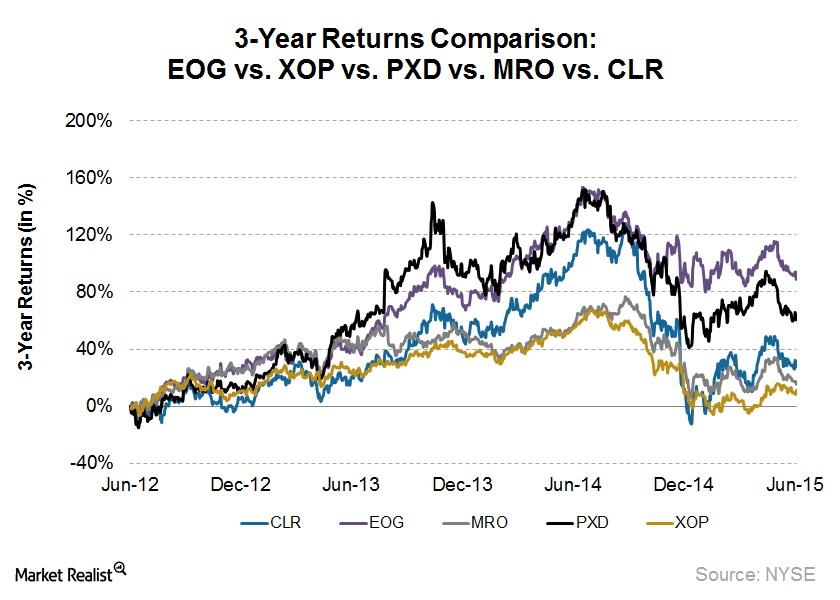

Why EOG Resources Is among the Best Upstream Stocks

EOG Resources (EOG) has generated above-par returns over a three-year period. EOG returned 91.8% in the last three years, mainly due to its strong performance.

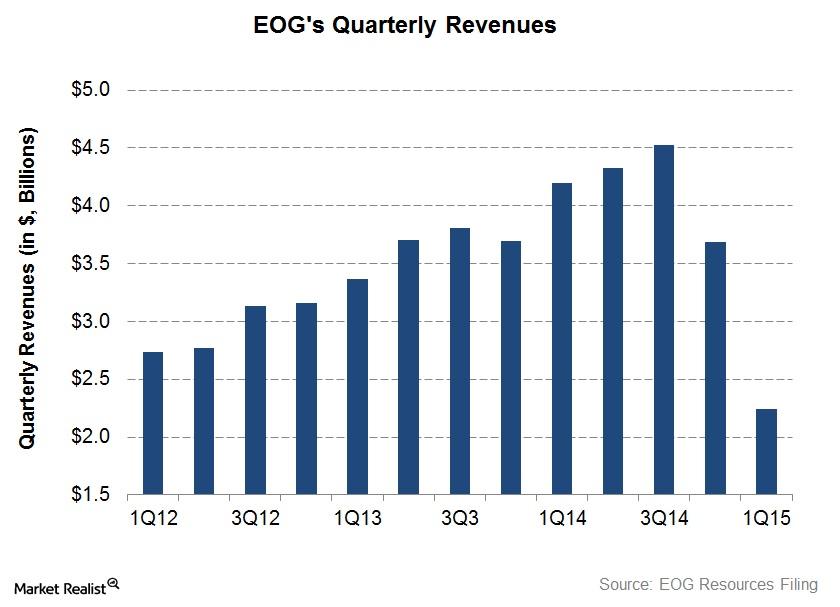

EOG Resources: Growing Revenue Is Battered by the Crude Oil Slump

EOG Resources’ 1Q15 adjusted revenue fell 39% quarter-over-quarter. This was mainly a result of the fall in crude oil and natural gas prices starting in 2H14.

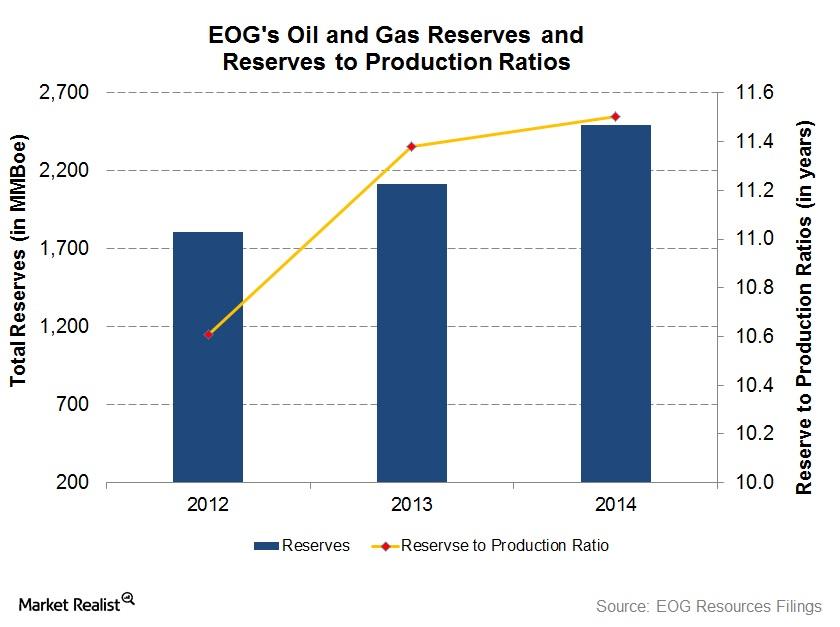

Growth in EOG Reserves Outpaces Production

EOG’s reserves-to-production ratio, or reserve life, increased from 10.6x in 2012 to 11.5x in 2014. It would take EOG 11.5 years to deplete its proved reserves at its 2014 production rate.

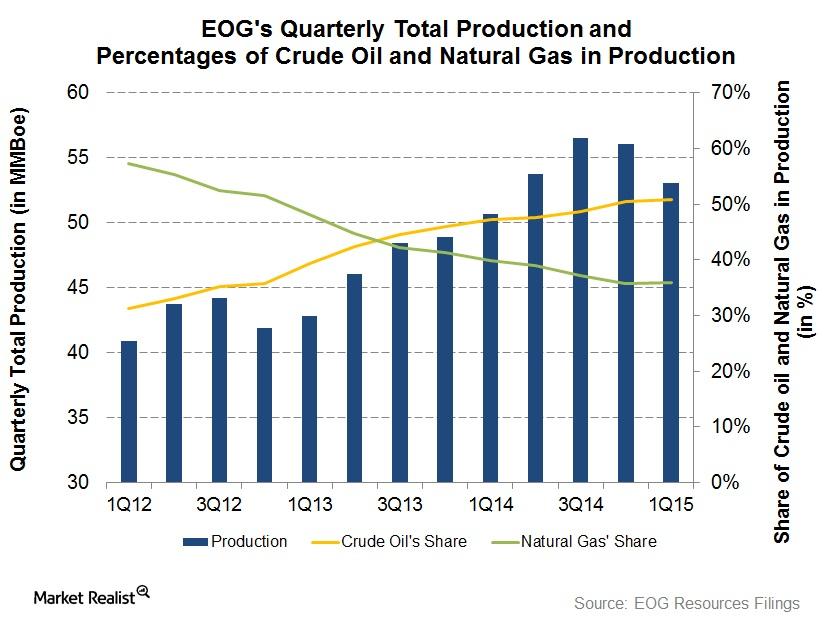

EOG Production Adjusts to Weak Energy Prices

On the heels of weak energy prices, EOG Resources wants to maintain steady production. This may result in flat production growth in 2015.

EOG and Pioneer: The Best Upstream Stocks in the Past 3 Years

Of the top American upstream stocks, EOG Resources has been the outperformer since June 2012, returning 93%. During the same period, Pioneer Natural Resources (PXD) returned 61%.

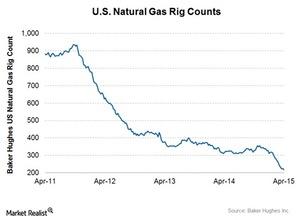

Natural Gas Rig Count Back to Downtrend in Week Ended April 17

There were 217 natural gas rigs operating in the week ended April 17, a loss of eight from the previous week. Natural gas rig count increased by three the previous week.

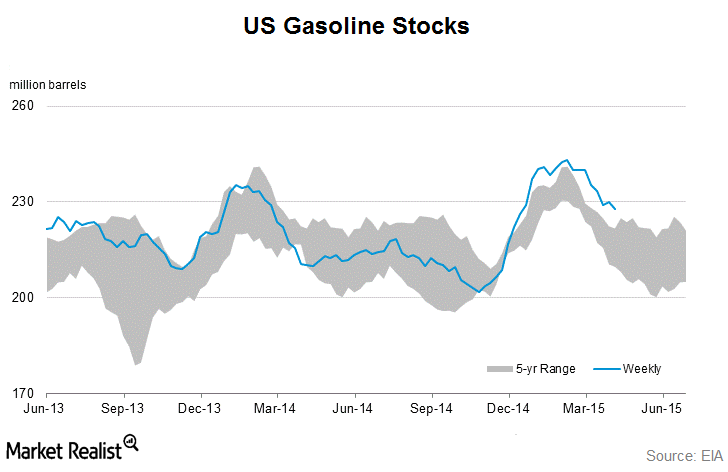

Gasoline Inventories Returned to Downtrend Last Week

Gasoline demand increased from ~8.61 MMbpd to ~8.91 MMbpd last week. Gasoline inventories remain outside the five-year range despite the draw in inventories reported on Wednesday.

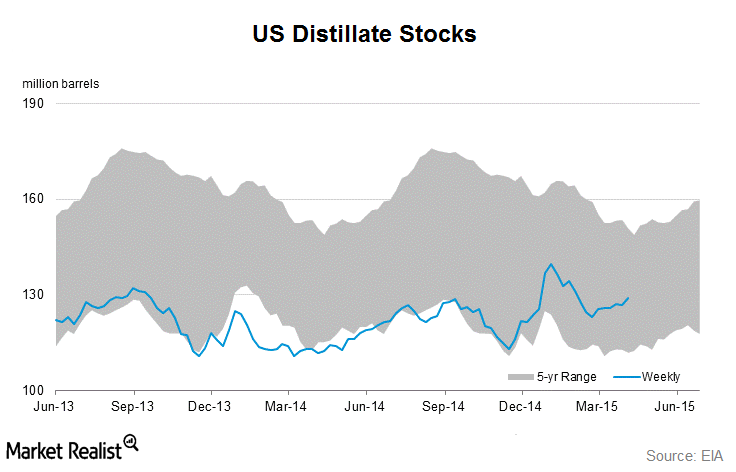

Distillate Inventories Increased Last Week

Distillate demand drives crude demand and crude prices. So, energy investors watch distillate inventories closely.

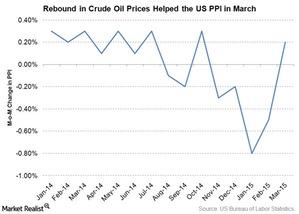

A Rebound in Crude Oil Prices Helped the PPI in March

On Tuesday, April 14, the U.S. Bureau of Labor Statistics released its PPI (Producer Price Index) figures for February. The PPI gained 0.2% in March.

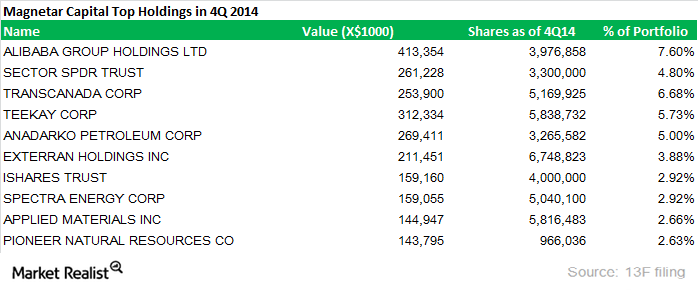

Magnetar Capital Initiated New Positions in 4Q14

Magnetar Capital was established in 2005 by Alec Litowitz and Ross Laser. Currently, the hedge fund manages assets in excess of $12 billion.

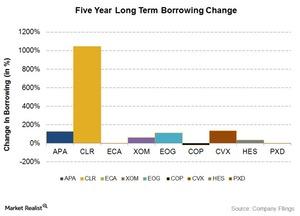

Why are some energy companies more leveraged than others?

In the past five years, many of the upstream and integrated energy companies have increased their debt. Some are more leveraged than others.

Why have energy companies increased their debt?

In 2010, US upstream energy companies aggregated $128 billion of total debt. As of 4Q14, this increased to $199 billion of combined debt, a jump of 55%.

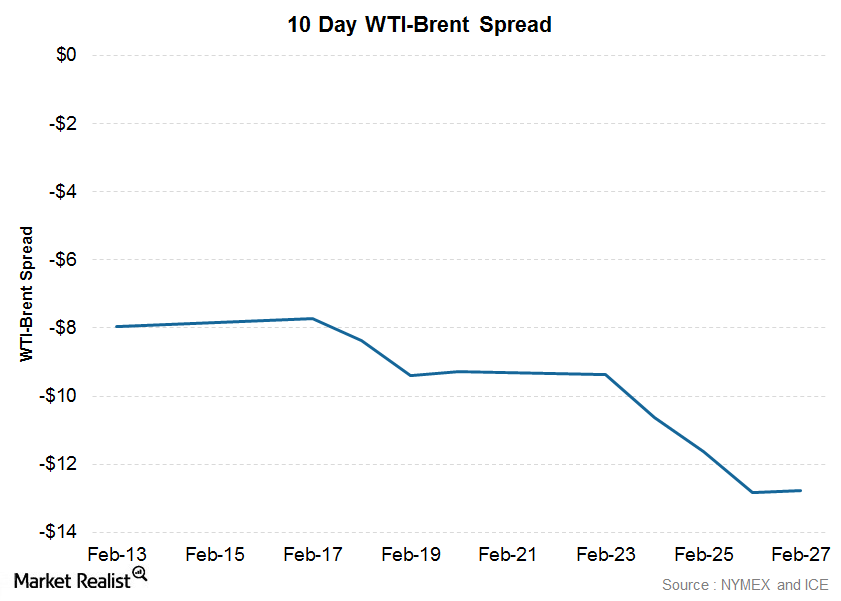

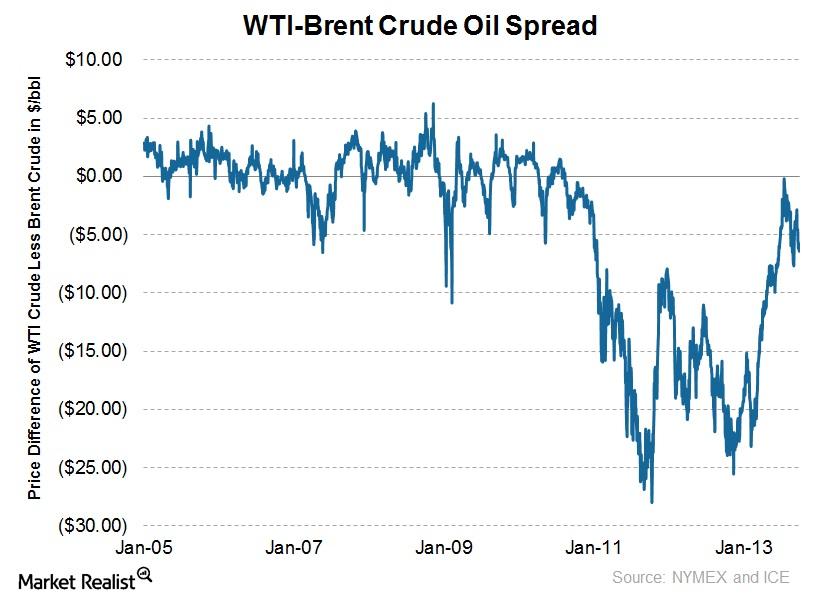

What caused the WTI-Brent spread to widen?

Capping the month with a gain of 3.1% since January 30, WTI’s (West Texas Intermediate) increase has been small compared to Brent’s 18% increase.

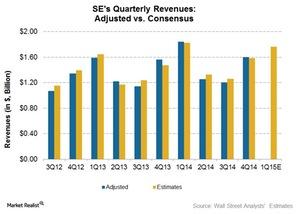

Spectra Energy 4Q14 earnings beat estimates

Spectra Energy 4Q14 adjusted earnings beat estimates by 46%. On average, adjusted EPS has exceeded consensus EPS by ~9% in the past ten quarters.

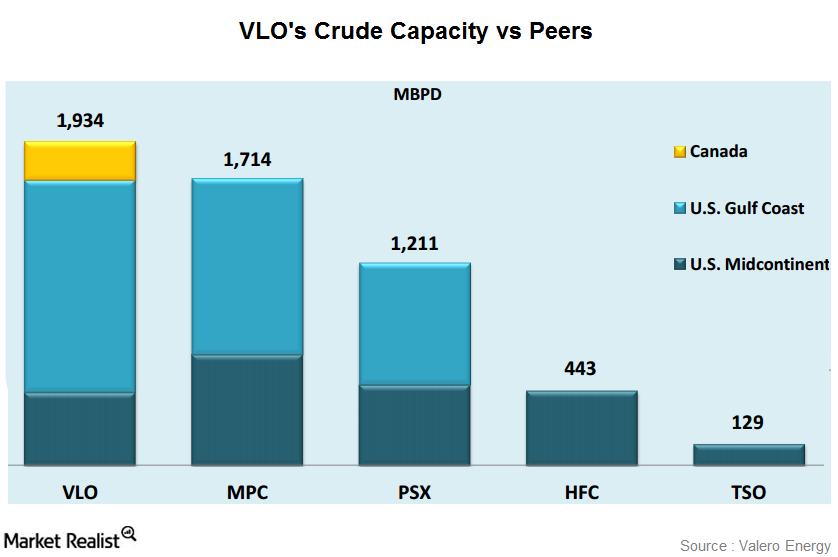

Why Valero Energy benefits from export opportunities

Location-advantaged refiners like Valero Energy (VLO), Phillips 66 (PSX), and Marathon Petroleum (MPC), with refineries along the Gulf Coast, can export refined products.

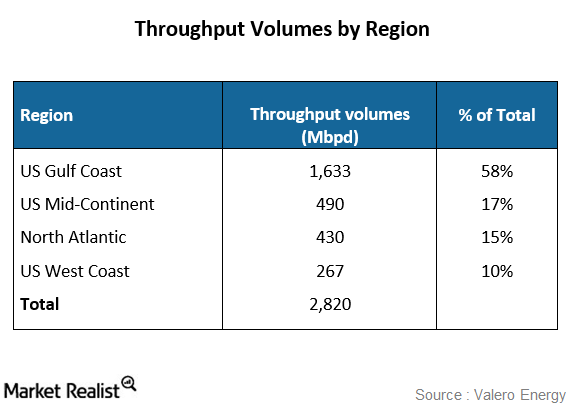

Analyzing Valero Energy’s operational performance in 4Q 2014

Valero Energy’s (VLO) refining segment’s throughput volumes increased by 41,000 barrels a day compared to the previous year’s fourth quarter.

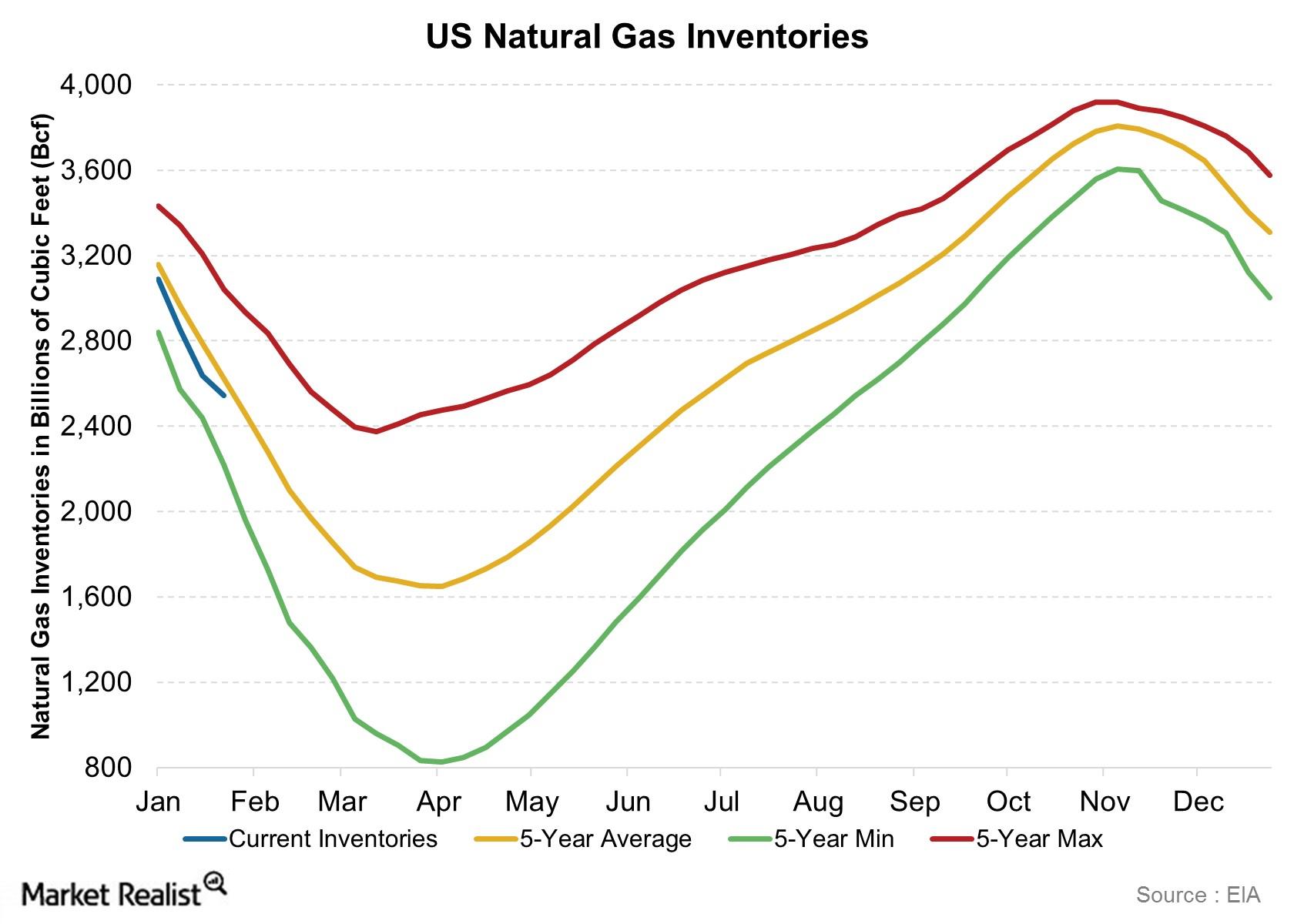

The EIA natural gas inventory report: Why should I care?

Natural gas inventory levels have a direct bearing on natural gas prices, which in turn affect the profitability of natural gas producers.

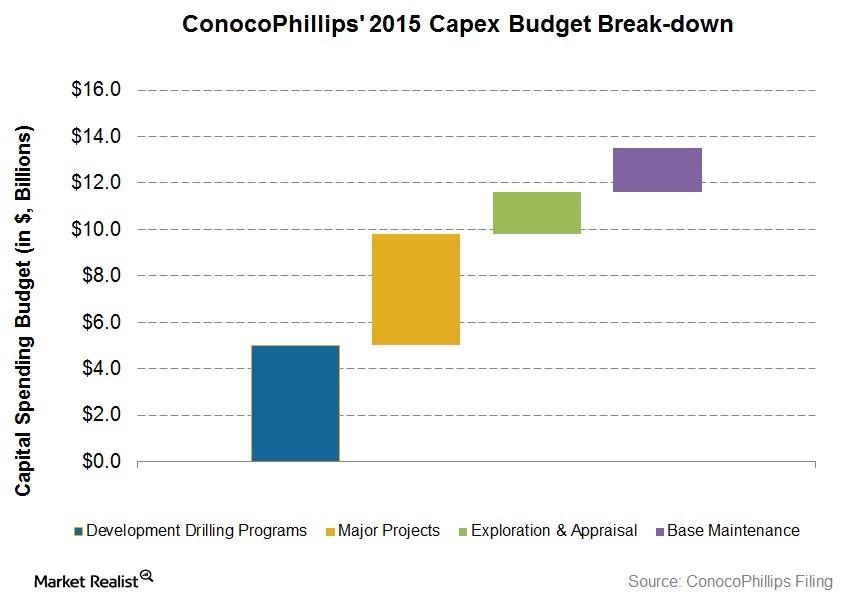

A key analysis of ConocoPhillips’ capex breakdown for 2015

ConocoPhillips’ capex breakdown for 2015 includes major projects, development drilling, exploration and appraisal, and base maintenance.

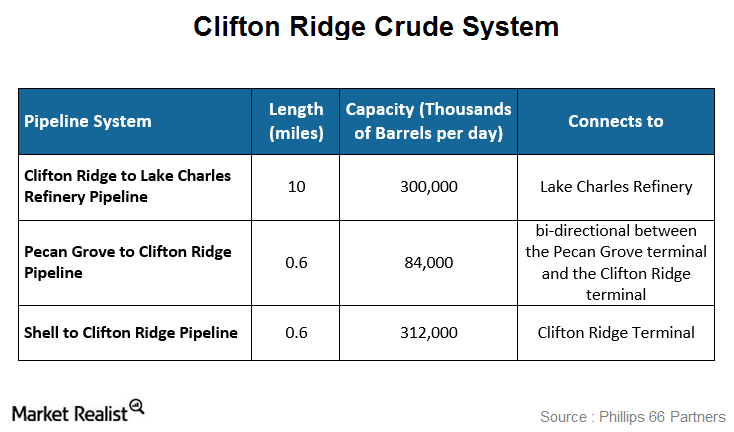

Phillips 66 Partners: The Clifton Ridge crude system

The Clifton Ridge crude system is made up of three pipelines and two terminals. It supports the Lake Charles refinery in Westlake, Louisiana.

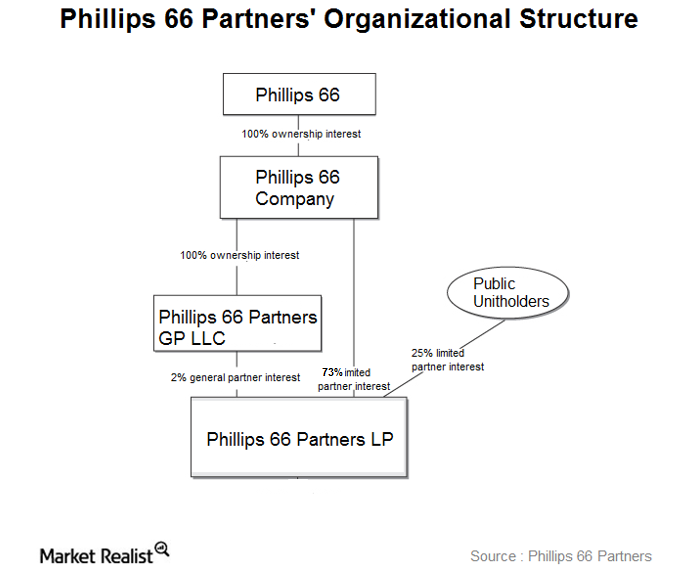

Business overview: Phillips 66 Partners

Phillips 66 Partners (PSXP) is a master limited partnership formed by Phillips 66 (PSX). PSXP operations are integral to PSX refineries.

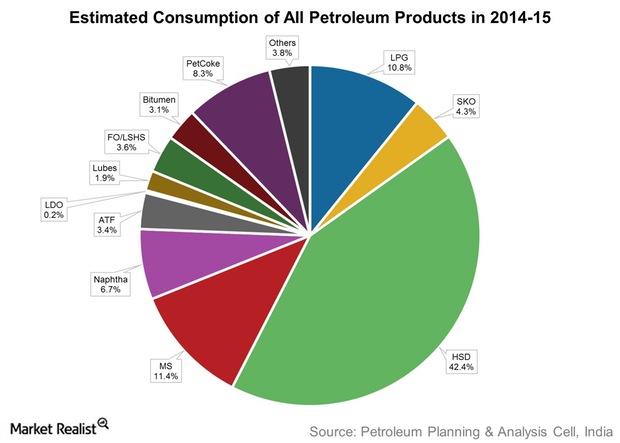

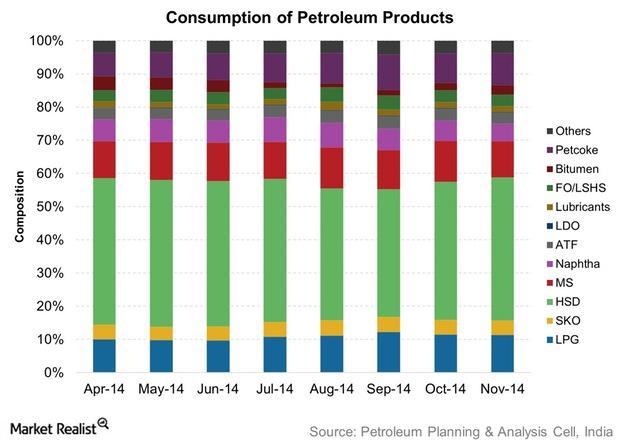

Analyzing India’s oil consumption

In India, the consumption of oil products saw steady growth over the years. The CAGR (compound annual growth rate) for the ten years ending in March 2014 is above 3.5%.

What products does India produce and consume?

Before moving on to India’s petroleum consumption, production, and refining, it would be beneficial to take a look at the various products that India produces and consumes.

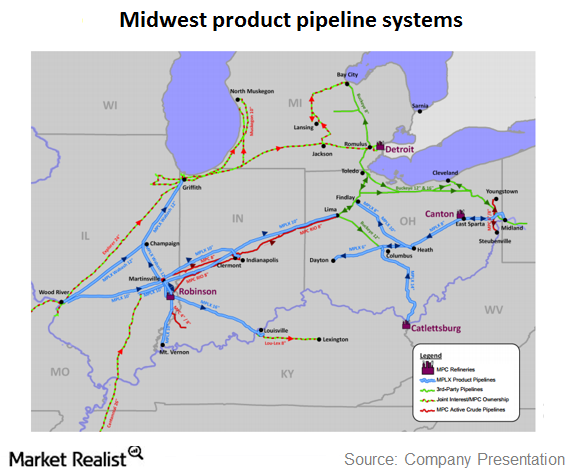

The MPLX Midwest product pipeline systems

Canton to East Sparta consists of two parallel pipelines that connect MPC’s Canton refinery with the MPLX East Sparta, Ohio, breakout tankage and station.

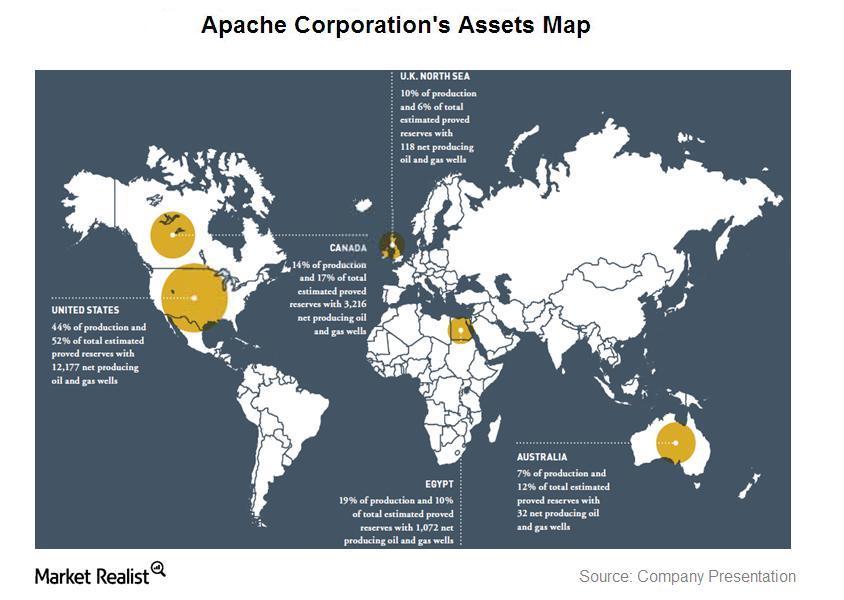

An overview of Apache Corporation’s oil and gas asset sales

Apache Corporation is planning asset sales of certain of its oil and gas operations. The company is focused on building onshore acreage instead.

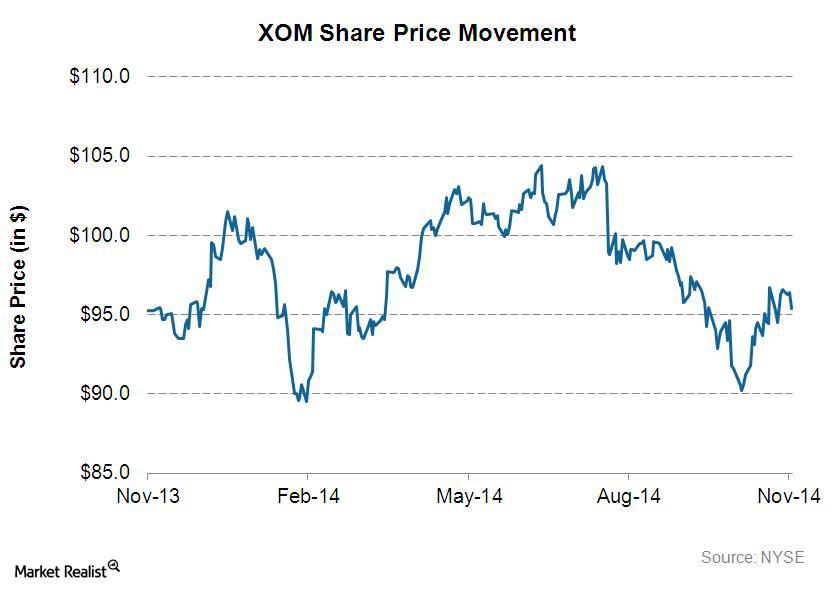

An overview of ExxonMobil

Exxon Mobil’s (XOM) stock price went up 2.4%, to $96.71, on October 31, 2014. Starting in November 2013, Exxon Mobil’s share price went up by 1.5%.

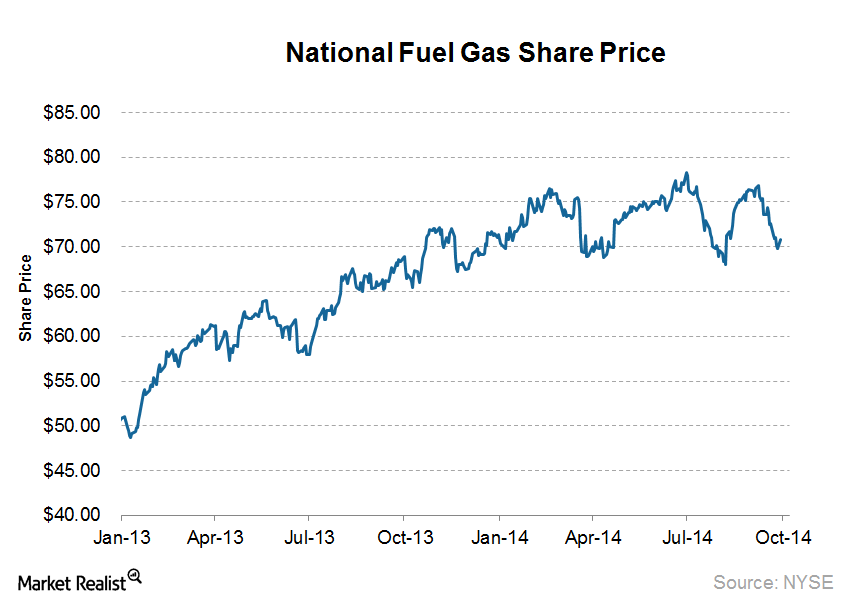

Mario Gabelli’s GAMCO Investors goes activist on National Fuel Gas

Activist investor Mario Gabelli’s GAMCO Investors, which owns a 9.1% in National Fuel Gas (NFG), is pressuring the company to spin off its gas utility segment from its natural gas exploration and midstream assets.

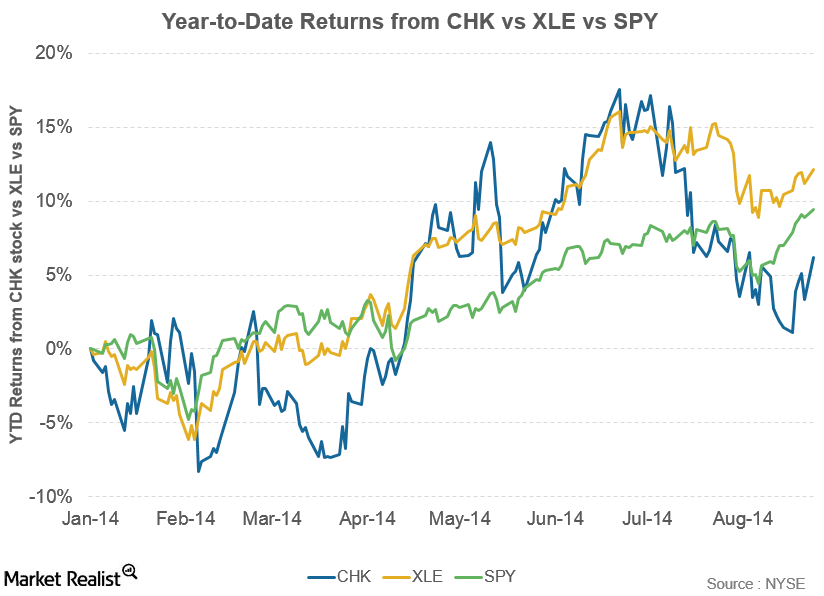

An investor’s must-read introduction to Chesapeake Energy

Chesapeake Energy (CHK) is an eminent energy exploration and production company in the U.S. Its operations span across the Marcellus, Utica, Niobrara, Mississippian Lime, Eagle Ford, Barnett, and Haynesville shales.

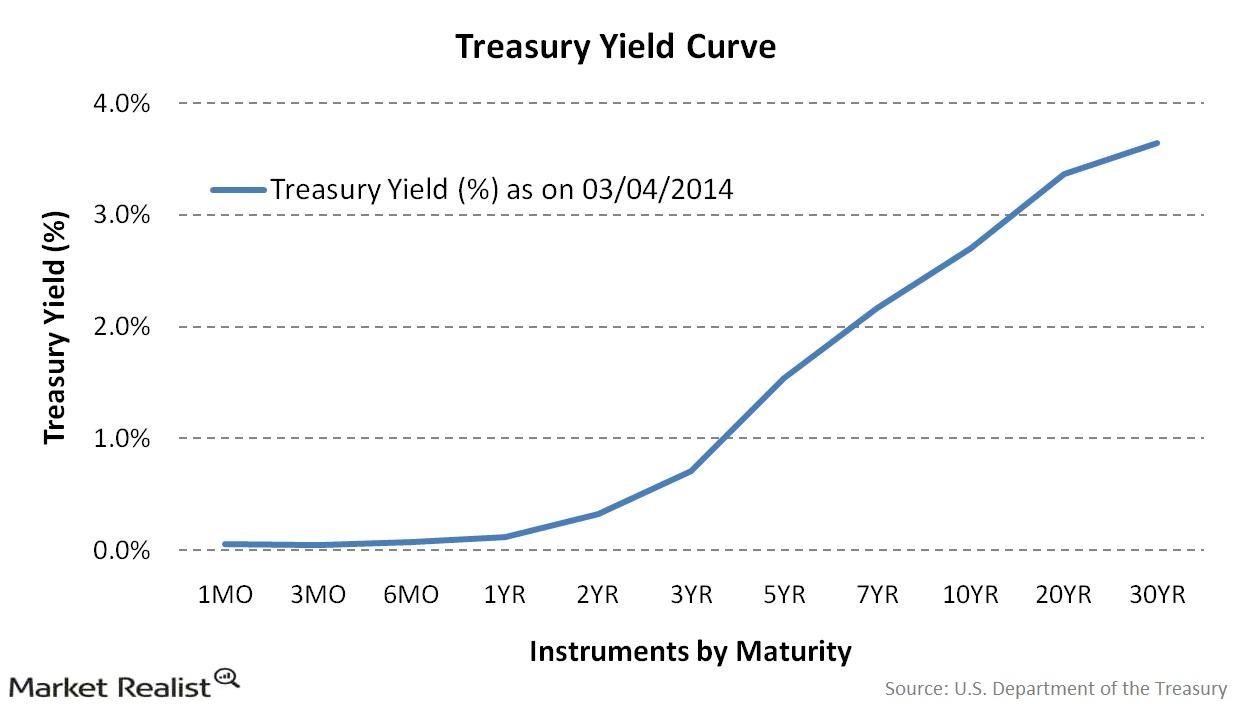

The yield curve: An indicator of the monetary policy implications

Intelligent investors have an opportunity to earn profits and avoid losses, if they understand how the yield curve may move when the Fed acts.

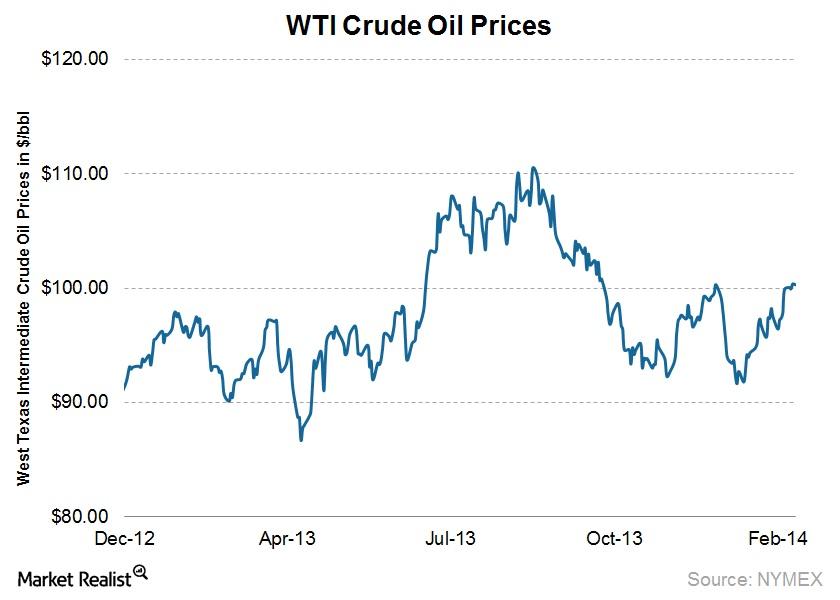

WTI crude prices break $100 per barrel for the 1st time in 2014

WTI traded flat last week, but firstly traded up $100 per barrel since December 27. This past week’s upward movement in prices was a short-term positive for the sector.

Why the spread between WTI and Brent oil drifted wider

The spread between WTI and Brent closed through most of 2013, but it has experienced some volatility in recent months, given events in Libya and Syria.