EOG Production Adjusts to Weak Energy Prices

On the heels of weak energy prices, EOG Resources wants to maintain steady production. This may result in flat production growth in 2015.

June 19 2015, Published 2:19 p.m. ET

EOG Resources

In the first part of this series, we saw that EOG Resources (EOG) produced the highest returns in our select group of companies over the past three years. Now let’s take a close look at EOG’s production pattern.

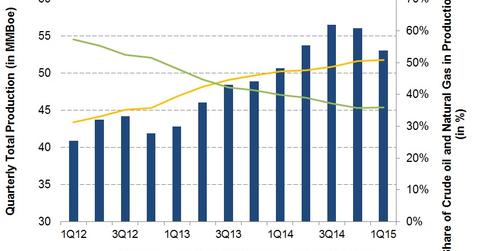

In 1Q15, EOG Resources’ total production decreased 5% from 4Q14 to ~53 million barrels of oil equivalent (or MMBoe). In comparison, Suncor Energy (SU), a Canadian integrated energy company, saw a 5.7% decrease in 1Q15 production over 4Q14. Concho Resources (CXO), a much smaller energy upstream company than EOG Resources, saw 1Q15 production decrease 3.6% from the previous quarter.

EOG Resources is one of the largest independent energy companies in the United States. It makes up 3.9% of the Energy Select Sector SPDR ETF (XLE) and 3% of the iShares U.S. Energy ETF (IYE).

Production may remain flat in 2015

EOG Resources’ crude oil and natural gas production has increased over the past 13 quarters. From 1Q12 to 1Q15, total production increased 30%, from 40.2 MMBoe to 53 MMBoe. Despite the quarter-over-quarter fall, its 1Q15 production was still 5% higher than the year-ago period.

However, on the heels of weak energy prices, EOG Resources wants to maintain steady production. This may result in flat production growth in 2015.

Crude oil growing, natural gas slowing down

As you can see in the above graph, the share of crude oil in EOG Resources’ (EOG) total production increased over the past 13 quarters. It went from 31% in 1Q12 to 51% in 1Q15. At the same time, the share of natural gas in EOG’s production fell from 57% to 36%. The rest of EOG Resources’ production consists of natural gas liquids (or NGLs).

Crude oil prices have been trading at more profitable levels on a cost equivalent basis since the shale boom pressured natural gas prices over the last few years. That’s why many American energy companies switched their focus to crude oil.

In 2014, EOG Resources primarily increased production in the unconventional resources shales of the Eagle Ford, the Rocky Mountain region, and the Permian Basin. All these shales are rich in crude oil.

In the next part of this series, we’ll look at EOG Resources’ (EOG) reserves.