Energy Select Sector SPDR® ETF

Latest Energy Select Sector SPDR® ETF News and Updates

Financials Understanding the simple moving average in technical analysis

The simple moving average (or SMA) is an average of the closing price of a stock over a specified number of periods. The moving average smooths the short-term fluctuations in the stock prices.

Geopolitical Tension Could Drive Brent and US Crude Oil Futures

Brent crude oil futures fell 0.7% to $49.61 per barrel on July 4, 2017. August WTI crude oil (XLE) (XOP) (PXI) futures contracts rose in electronic trading.

Will the EIA’s Crude Oil Inventories Support Crude Oil Bulls?

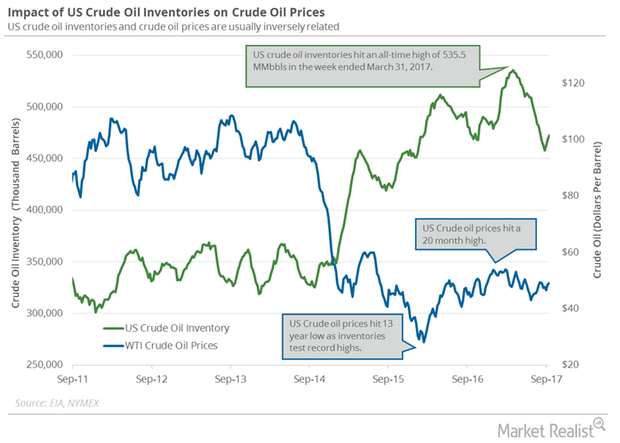

On April 18, 2017, the API released its weekly crude oil inventory report. It reported that US crude oil inventories fell by 0.84 MMbbls from April 7–14.

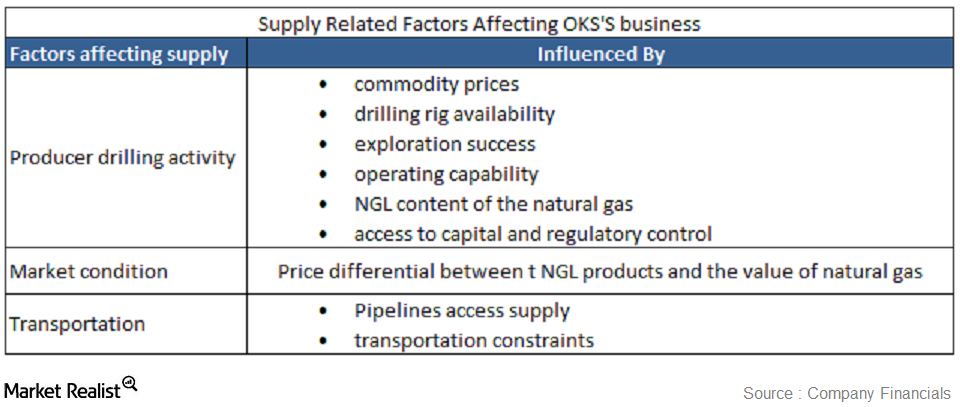

Must-know: Supply-related factors that affect ONEOK Partners

Natural gas, crude oil, and NGL (or natural gas liquid) supply is affected by several factors that could be supply related or demand related.

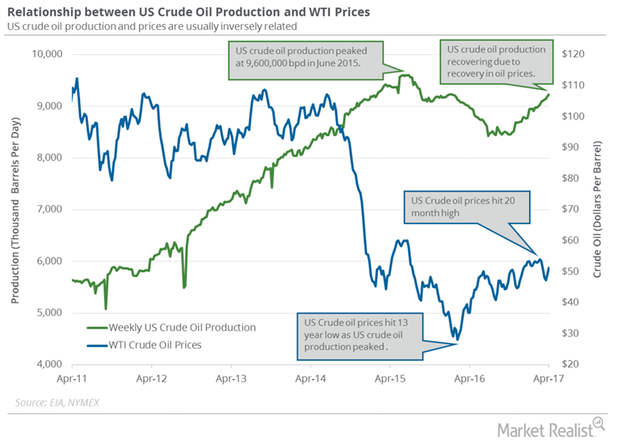

EIA Raises Estimates for US Crude Oil Production in 2018

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 36,000 bpd (barrels per day) to 9,235,000 bpd between March 31 and April 7, 2017.

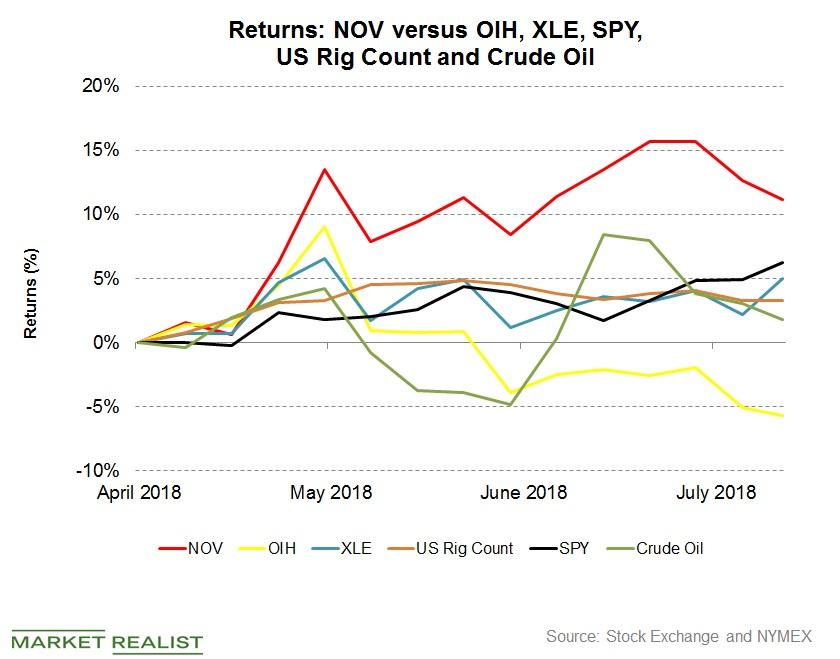

National Oilwell Varco’s Q2 2018 Earnings and the Market

Since April 26 when National Oilwell Varco released its Q1 2018 financial results, NOV stock has risen 10%.

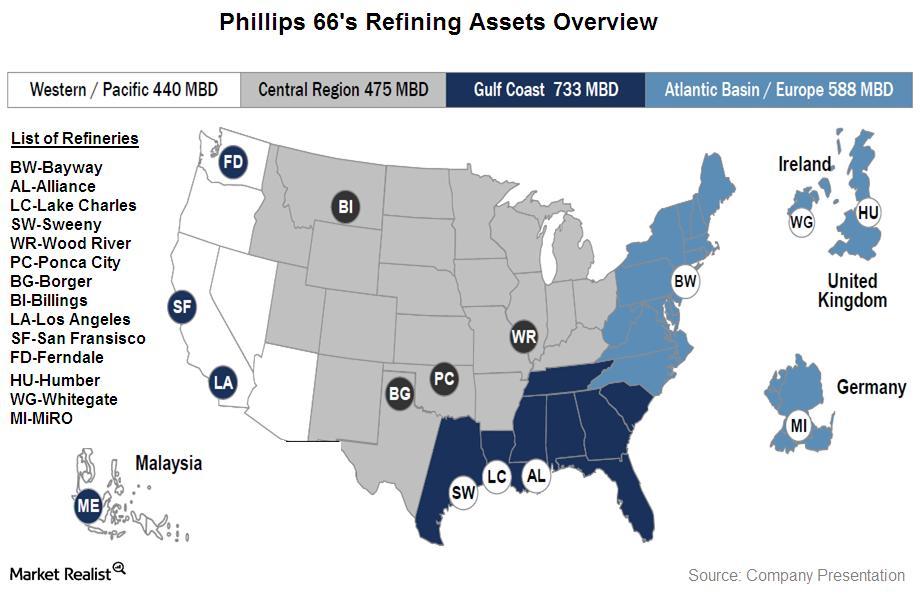

Must-know: An introduction to Phillips 66

Phillips 66 (PSX) is an energy company. It’s based in Texas. Phillips 66 started operating independently as a publicly-traded company on April 4, 2012, when it separated from ConocoPhillips (or COP).

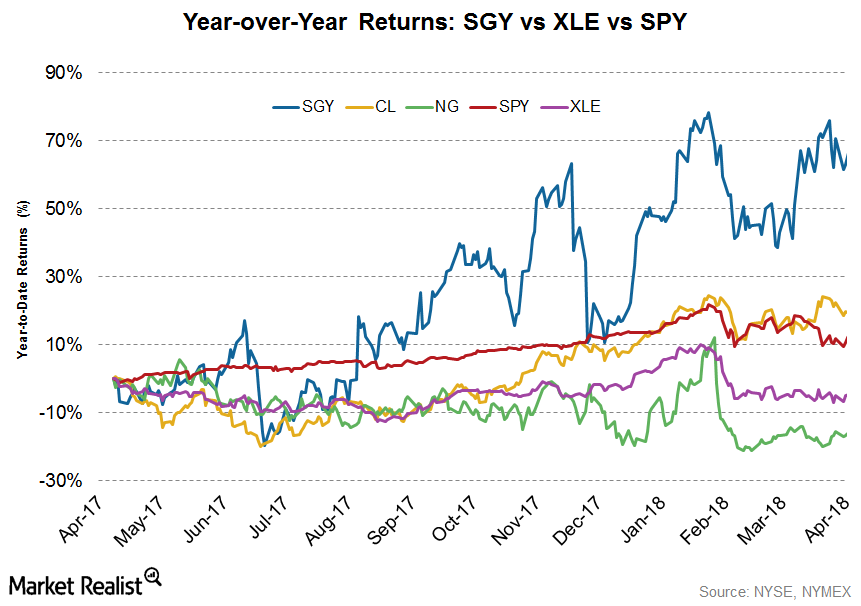

Stone Energy’s Stock Performance in 2018

Stone Energy stock has increased the most among our top five companies. Stone Energy stock has risen 60% YoY (year-over-year).

OPEC’s Monthly Report Could Pressure Oil Prices

OPEC will release its Monthly Oil Market Report on July 12, 2017. OPEC’s crude oil production rose in June 2017.

Energy Sector and Crude Oil Prices Helped the S&P 500

The S&P 500 rose ~0.7% to 2,733.01 on May 21 due to the rise in industrial stocks and crude oil prices—the highest level in more than two months.

Will Crude Oil Futures Rise or Fall This Week?

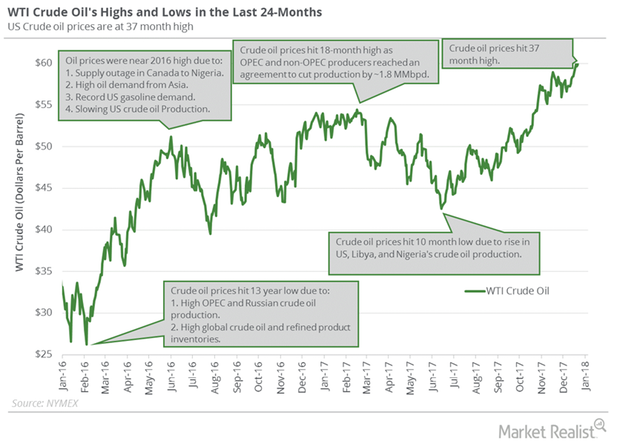

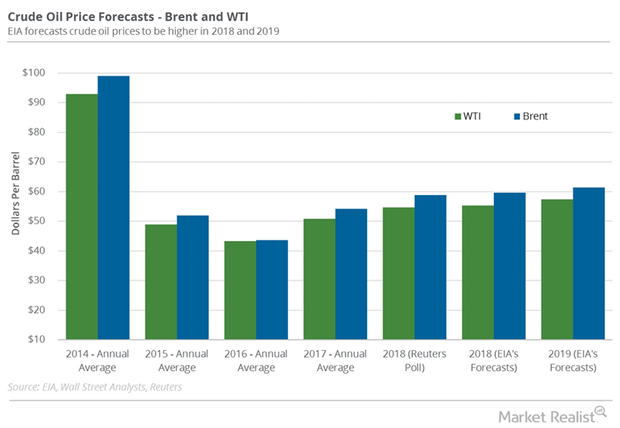

WTI crude oil (SCO) futures settled at $64.30 per barrel on January 12, 2018—the highest level since December 2014.Financials Key differences between PCE and CPI as inflation measures

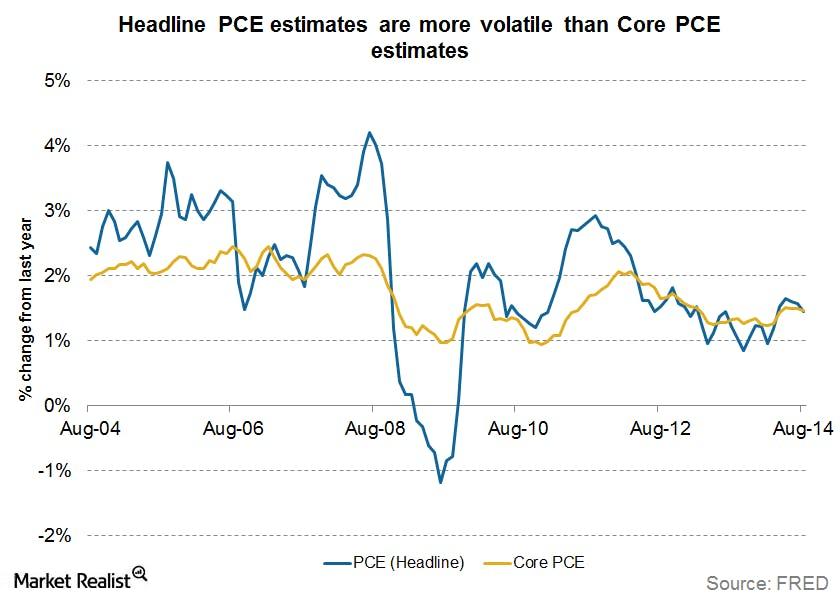

The CPI and PCE are both important indicators of U.S. inflation. CPI is more important from an individual perspective, while PCE is more important for monetary policy.

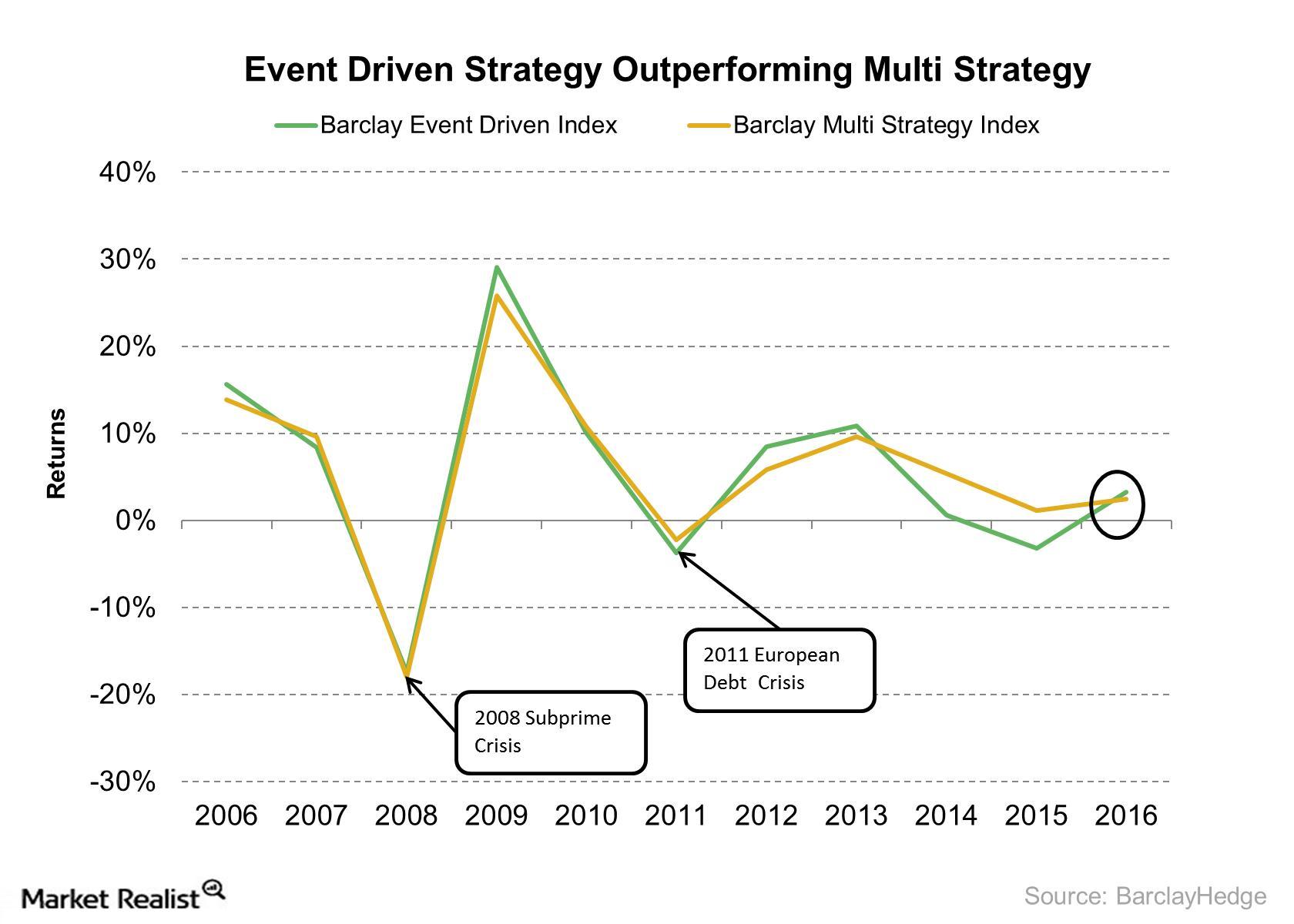

Event-Driven Strategy in a Volatile Market

Event-driven strategy is designed to make an investment in special situations, including mergers and acquisitions, restructuring, split-offs, bankruptcy, and other major events.

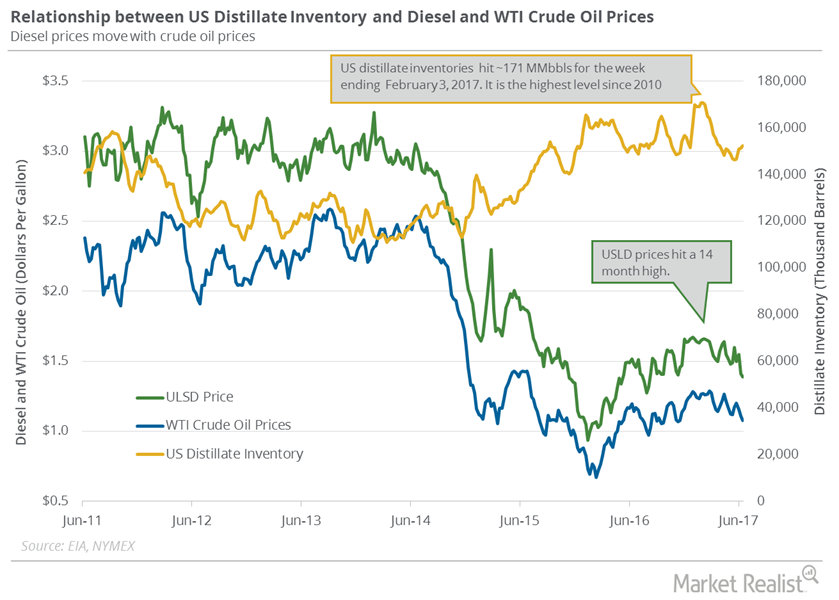

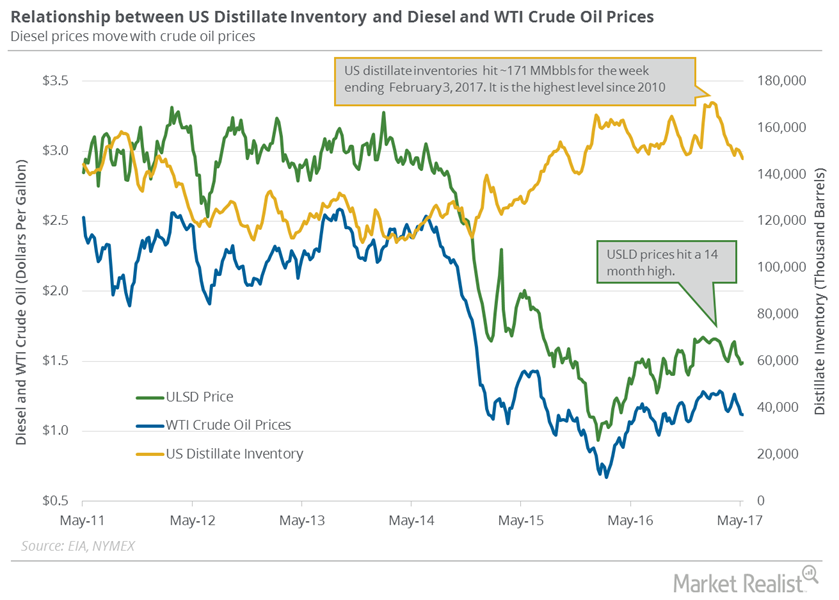

US Distillate Inventories Rose for the Fourth Straight Week

US distillate inventories rose by 1.1 MMbbls to 152.5 MMbbls on June 9–16, 2017. US distillate inventories rose for the fourth consecutive week.

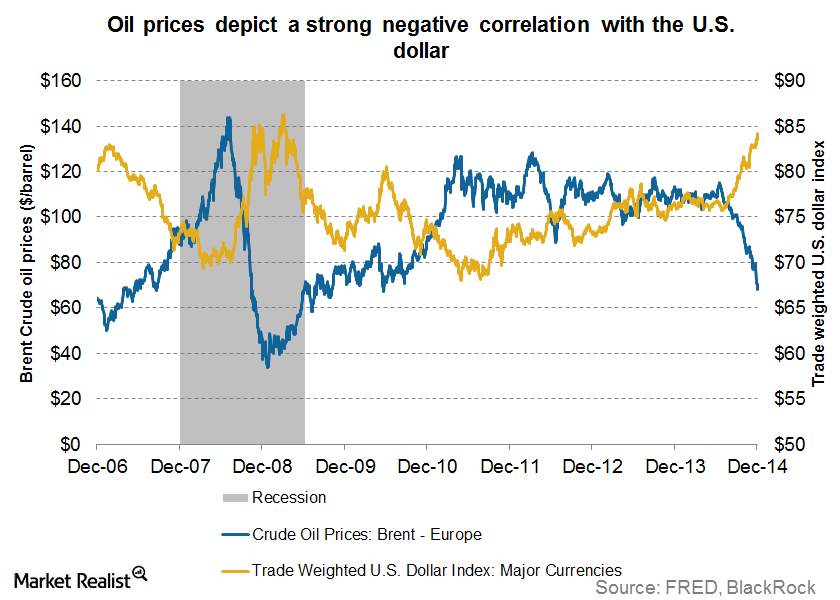

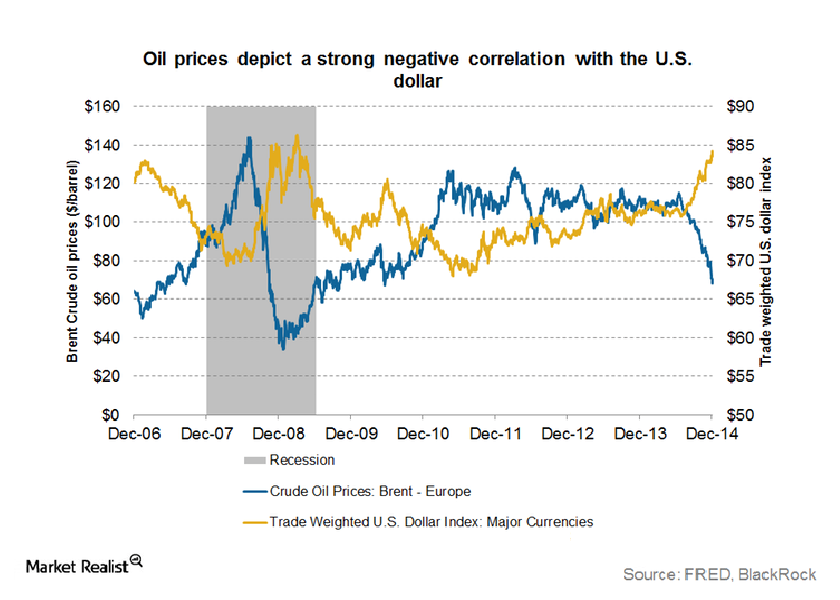

How The Rising Dollar Is Causing Oil Prices To Fall

A rising dollar has and will continue to put downward pressure on oil prices, causing trouble for the energy sector (XLE).

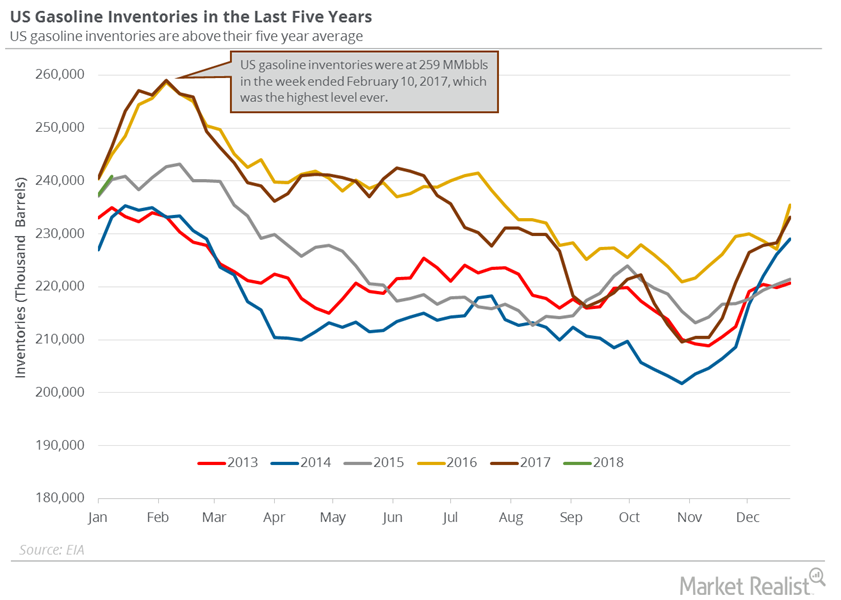

Gasoline Inventories Could Cap the Upside for Oil Prices

On January 23, 2018, the API released its crude oil inventory report. US gasoline inventories increased by 4.1 MMbbls on January 12–19, 2018.

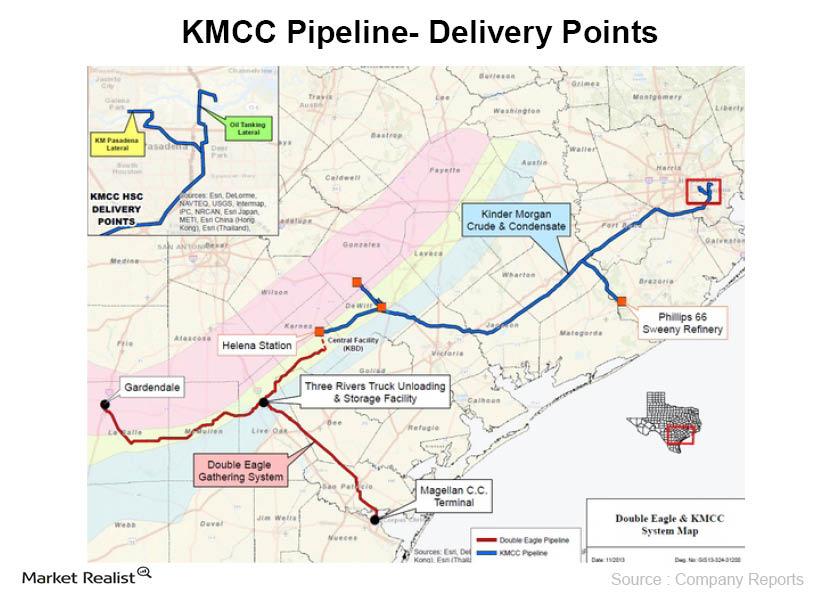

Must-know: Why the Kinder Morgan Eagle Ford expansion is positive

Kinder Morgan Energy Partners plans several major Eagle Ford joint ventures and projects that could reach almost $900 million in expenditures if company reports are to be believed.

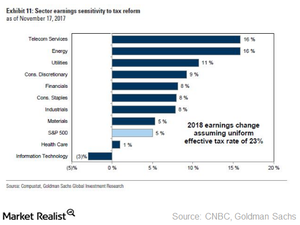

Will Tax Reform Hurt Health Care Sector?

The health care sector played an important role in the recent bull market (SPX-INDEX) rally.

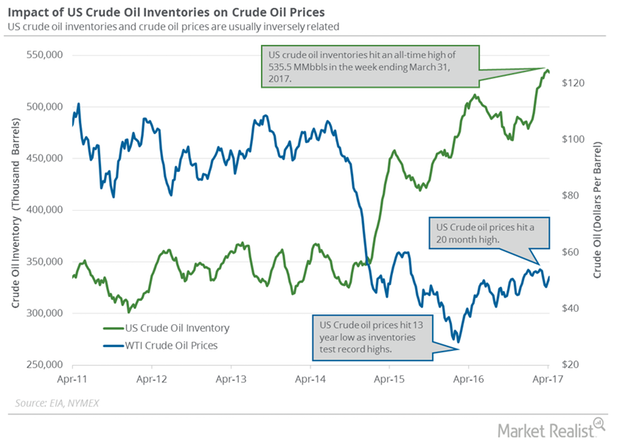

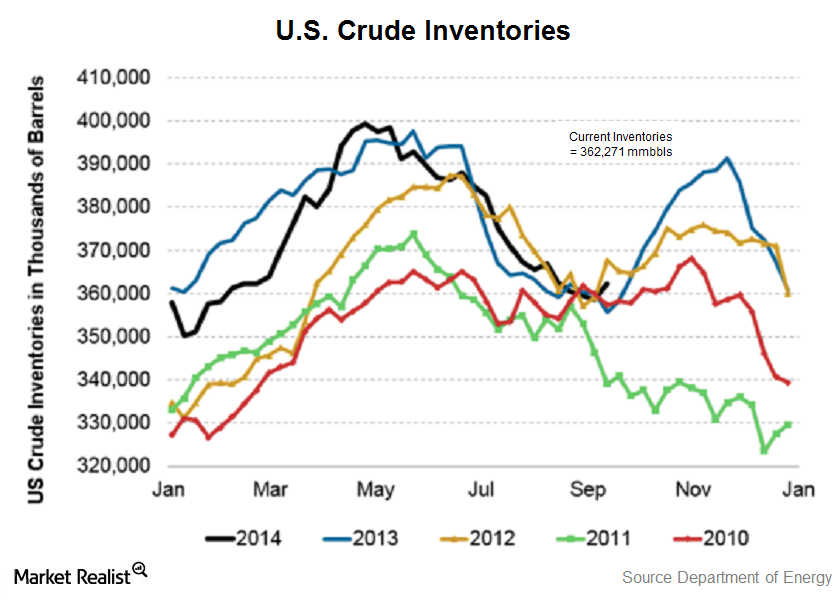

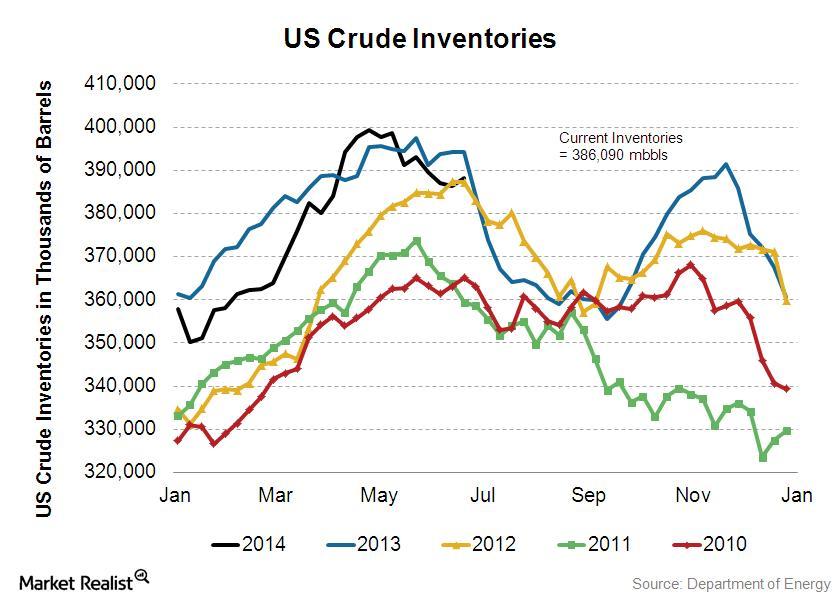

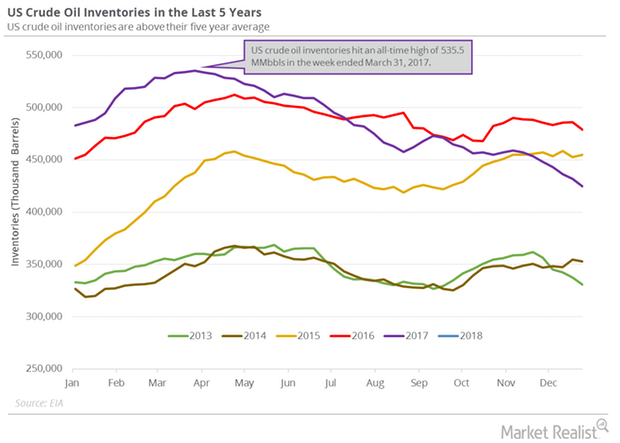

Must-know: Why energy investors monitor crude oil inventories

Analysts had expected a drop of 1.5 million barrels (mmbbls) in crude inventories last week. The following parts will cover actual changes in inventories.

Will OPEC Meeting in Vienna Affect Crude Oil Futures?

November US crude oil (UWT) (SCO) (DBO) futures contracts rose 1.6% and closed at $49.3 per barrel on September 20, 2017.Energy & Utilities Must-know: Is the utilities sector a bond market proxy?

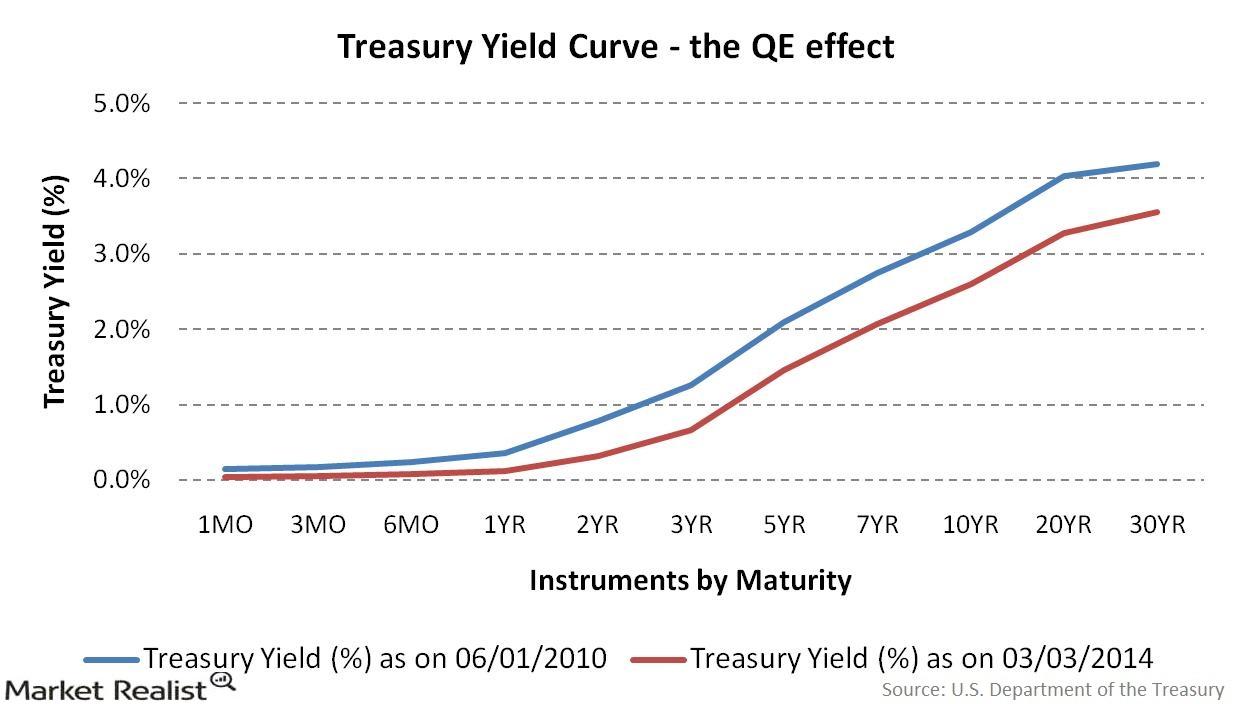

It’s important to note that higher real yields, not rising inflation, are driving today’s higher nominal yields as investors are demanding more compensation for holding bonds

US Distillate Inventories Fell for the Third Straight Week

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 146.8 MMbbls on May 5–12, 2017.

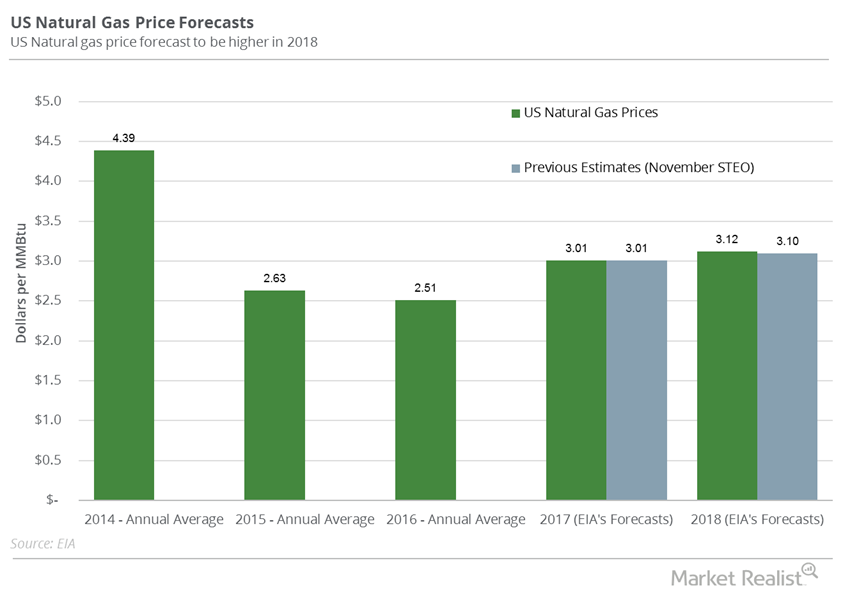

Will US Natural Gas Futures End 2017 on a Low Note?

January US natural gas (UGAZ) futures contracts were below their 100-day, 50-day, and 20-day moving averages on December 21, 2017.

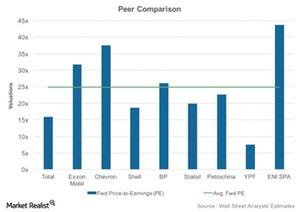

Total’s Forward Valuation: Peer Comparison

In the previous part of this series, we discussed Total’s historical valuation trends. Now we’ll compare its forward valuation with that of its peers.

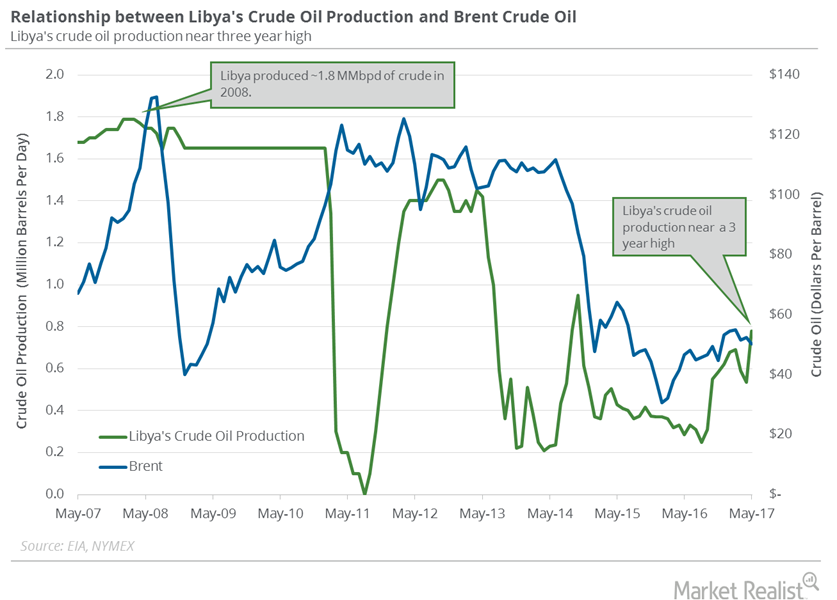

Libya’s Crude Oil Production Is at a 4-Year High

August West Texas Intermediate (or WTI) crude oil futures contracts rose $1.03 per barrel, or 2.2%, and settled at $47.07 per barrel on July 3, 2017.

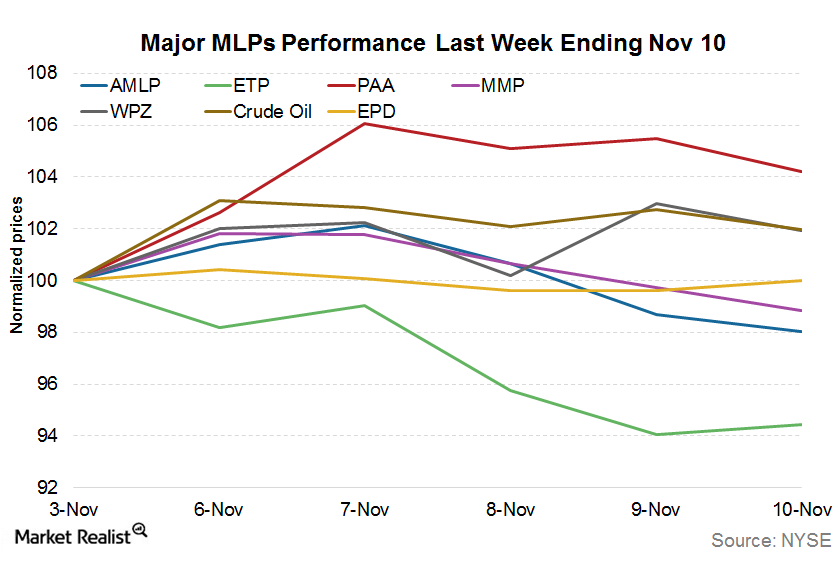

What’s behind MLP Performances for the Week Ended November 10?

Of the total 95 MLPs, 62 ended last week in the red, 30 ended in the green, and the remaining three ended flat. Energy Transfer Partners (ETP) fell 5.5%.

Why ONEOK Has Outperformed Its Peers in 2018

ONEOK (OKE) stock has risen ~21% so far in 2018, outperforming its peers in the midstream sector.

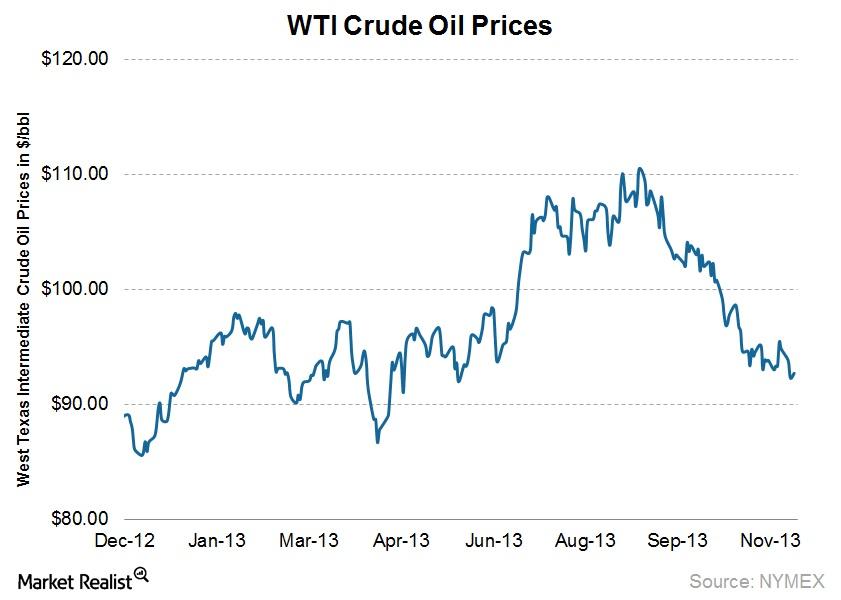

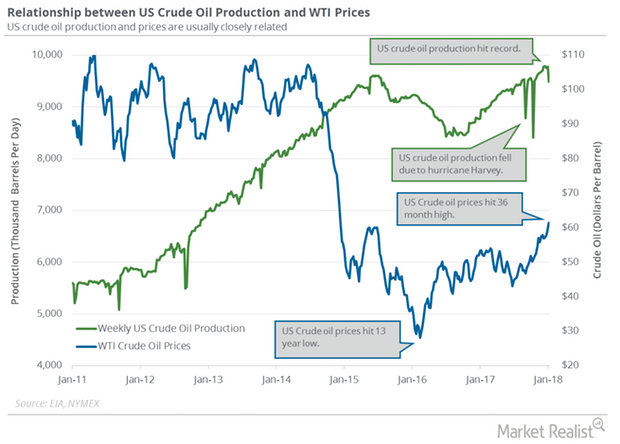

Why WTI crude oil prices are down over 15% in 3 months

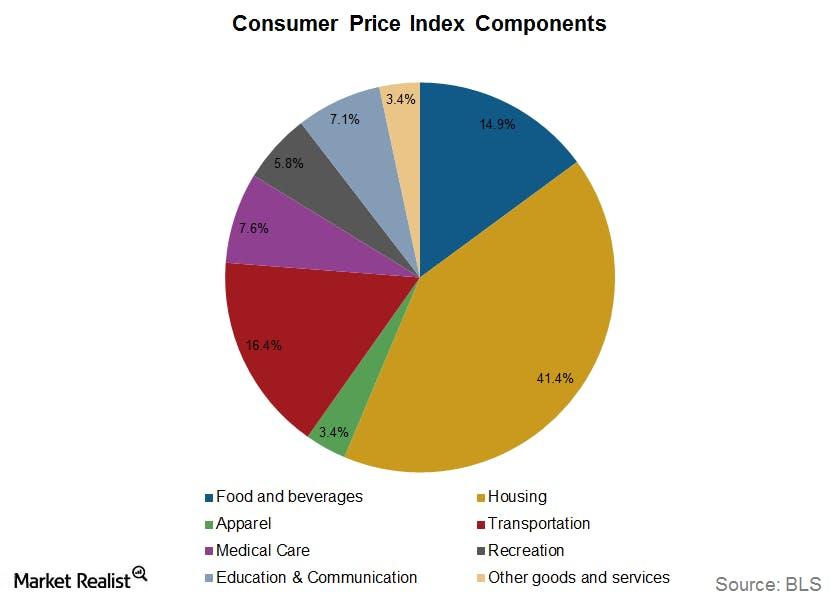

WTI crude oil prices continued to slide as U.S. crude inventories continued to grow, with domestic production surging.Must-know fundamentals about the US Consumer Price Index

The Bureau of Labor Statistics (or BLS) developed the U.S. CPI in 1913 to measure the change in prices.Why personal consumption expenditure is important to investors

The U.S. Bureau of Economic Analysis issues PCE data, and the price index is a measure of the average increase in prices for all domestic personal consumption.

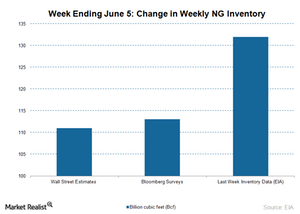

Natural Gas Prices Could Overshadow the Increasing Stockpile Data

The EIA will publish the weekly natural gas in storage report on June 11. US commercial natural gas inventories rose by 132 Bcf for the week ending May 29.

Why Elliott Management Might Be in Trouble

Last week, Elliott Management filed its 13F for the first quarter of 2020. In the last quarter, the hedge fund’s AUM was worth around $73.15 billion.

Bill Gross: Top Stock Picks with High Dividend Yields

On October 18, CNBC reported Bill Gross top picks. His top stock picks were Annaly Capital (NLY), Invesco (IVZ) and Allergan (AGN).Financials What’s the Dow Theory?

The Dow Theory was developed by Charles Dow. It identifies and signals the change in the stock market trends. It’s useful for trading and investing. The Dow Theory has six components.

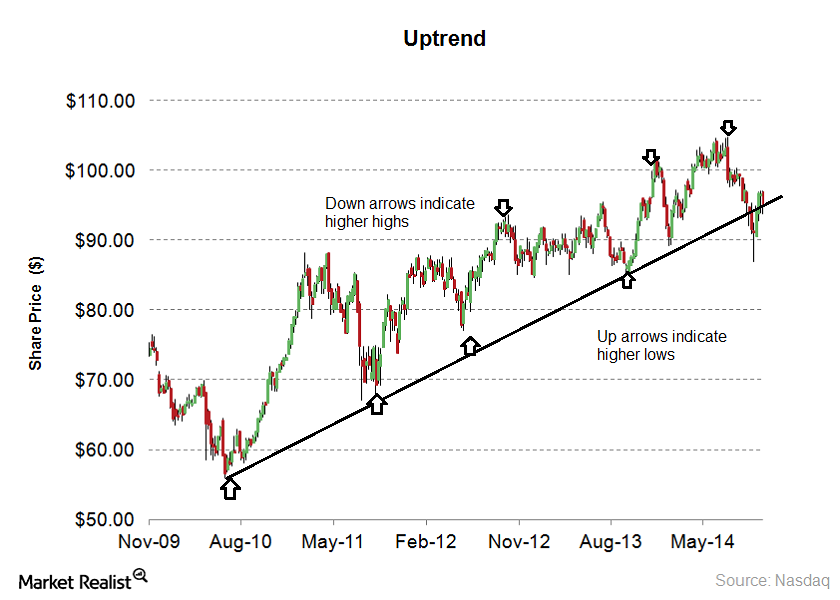

Why investors should buy stocks during an uptrend

Stocks are in an uptrend when they’re making higher highs and higher lows. An uptrend forms when psychological or fundamental factors are improving.

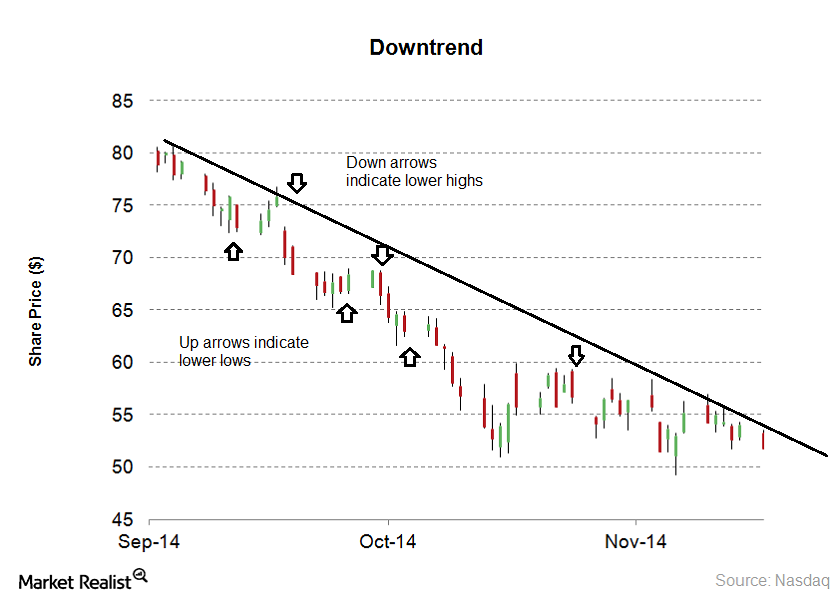

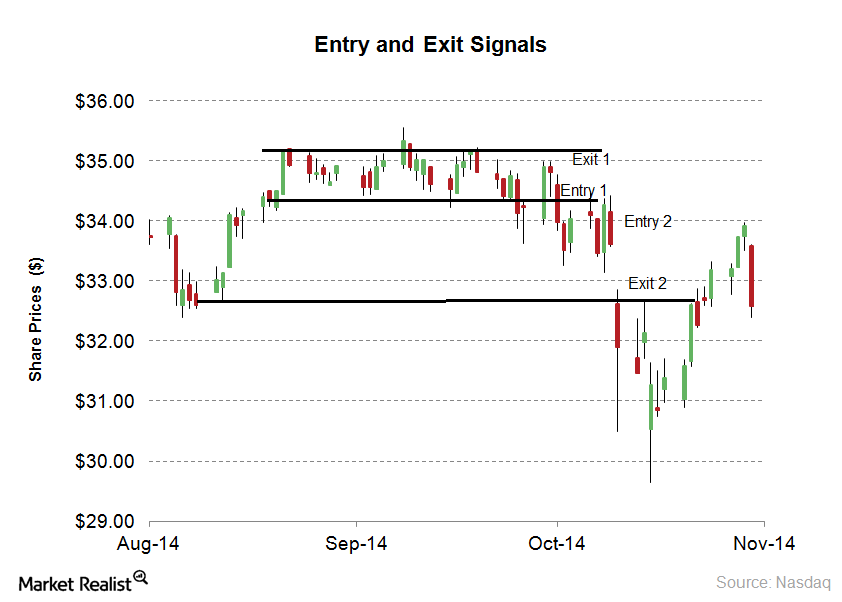

Why downtrends and sideways trends impact investors

It’s advisable to sell stocks on bounces when the stock is in a downtrend. In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.

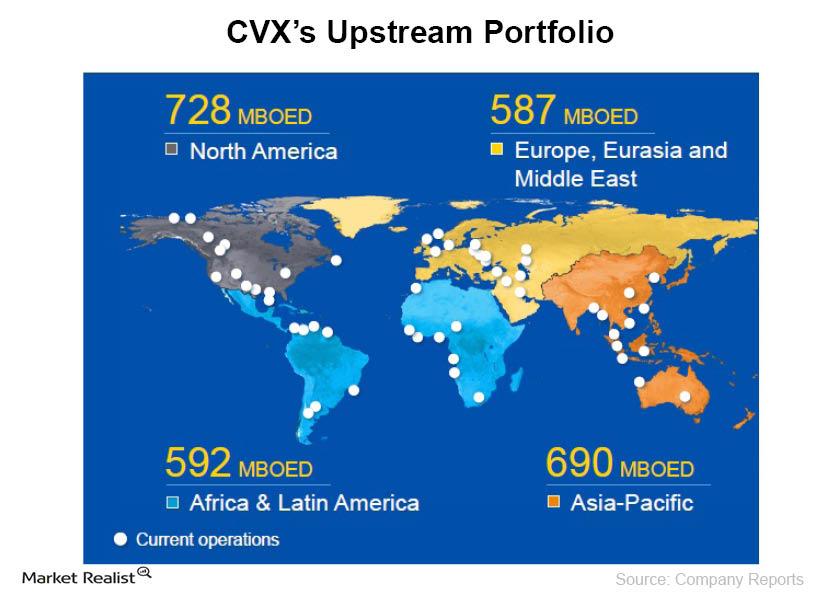

Must-know: An overview of Chevron Corporation

CVX is headquartered in San Ramon, California. It’s an energy company that engages in oil and gas exploration, production, refining, marketing, and transportation of oil and gas.

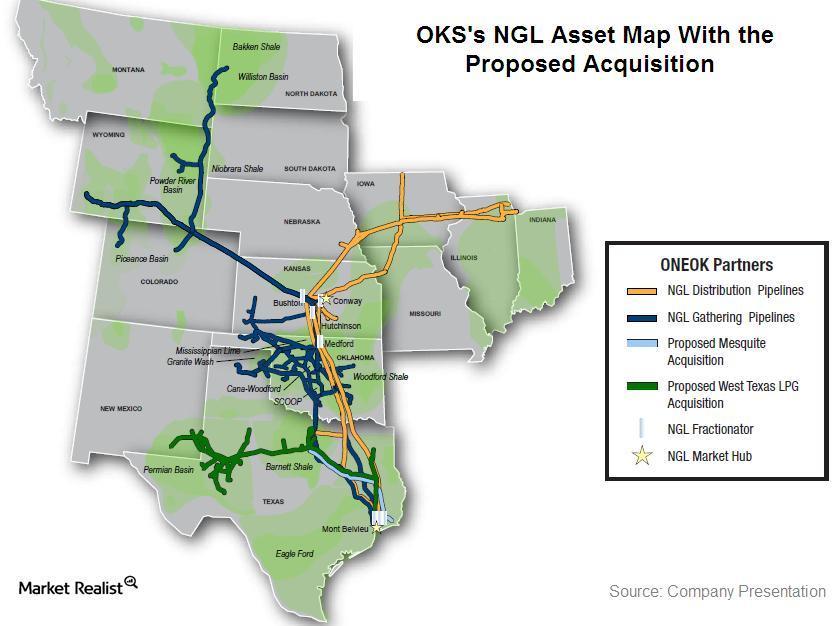

Why ONEOK Partners acquires Permian assets from Chevron

On October 27, ONEOK Partners (OKS) announced that it agreed to acquire Chevron Corporation’s (CVX) natural gas liquids (or NGLs) pipeline assets.

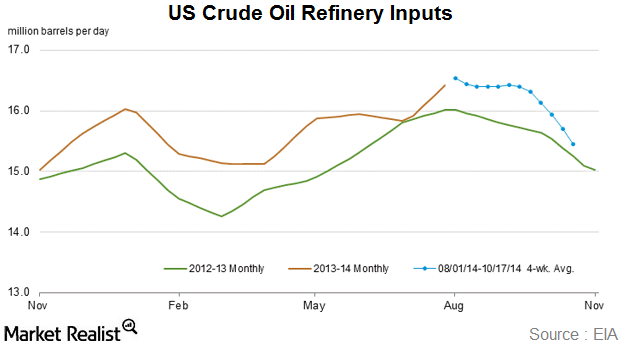

Why peak refinery maintenance season affects crude inventory

U.S. crude oil refinery inputs averaged 15.2 million barrels per day during the week ending October 17. Input levels were 113,000 bpd less than the previous week’s average.

Must-know: Why crude oil inventories can affect prices

Every week, the U.S. Energy Information Administration (or EIA) reports figures on crude inventories, or the amount of crude oil stored in facilities across the United States.Energy & Utilities What are the advantages of technical analysis?

Entry and exit strategy is recommended for short and long-term trading in technical analysis. Fundamental analysis is used for the long-term entry and exit point.

What are the disadvantages of technical analysis?

Technical analysis is used to forecast stocks. All of the technical indicators give possible entry and exit points. The forecasting accuracy isn’t 100%. This is one of disadvantages of technical analysis.

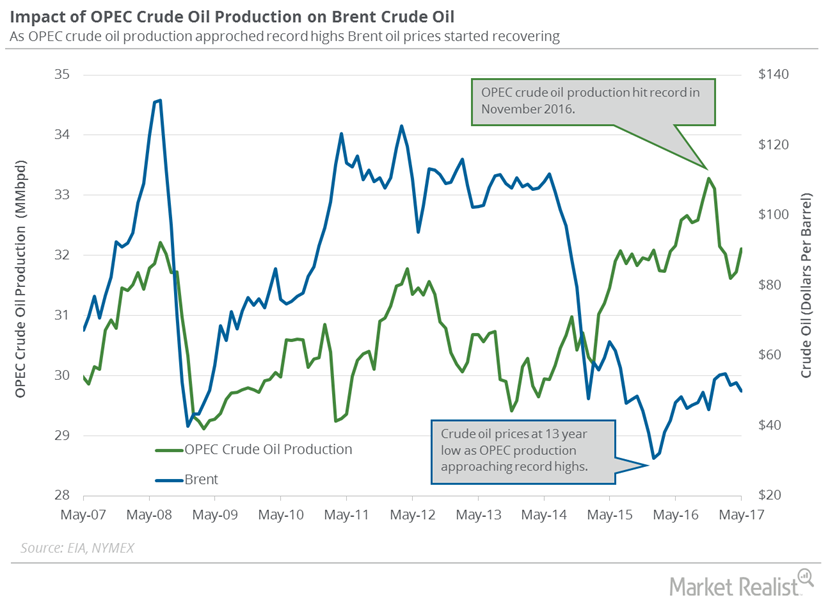

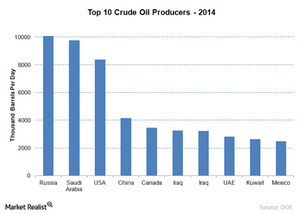

Why is OPEC important to the price of crude oil?

High market share gives OPEC bargaining power to price oil above a competitive market. It can sway crude oil prices by increasing or decreasing production.

How the strengthening US dollar is impacting crude oil prices

The US dollar plays a major role in the price movements of commodities such as gold and crude oil. A strengthening US dollar is often seen as negative.

The Fed taper: How quantitative easing affects the yield curve

QE is an unconventional form of monetary easing—the Fed’s way of putting in more money into circulation in the economy.

Will US Oil Production Pressure Crude Oil Futures?

February WTI crude oil futures contracts fell 0.9% to $63.73 per barrel on January 16. Brent oil futures fell 1.6% to $69.15 per barrel on the same day.

US Crude Oil Production Fell and Boosted Oil Futures

US crude oil production fell by 290,000 bpd (barrels per day) or 3% to 9,492,000 bpd between December 29, 2017, and January 5, 2018.

Traders Could Start Booking a Profit in Crude Oil Futures

On January 16, 2018, Goldman Sachs said that crude oil prices could exceed its forecast in the coming months.

Where Is US Crude Oil Headed? An Energy Update

On August 30, US crude oil October futures settled at $55.1 per barrel. On a week-over-week basis, US crude oil prices rose 1.7%.

Rise in Oil Pushed Energy ETFs Higher

US crude oil active futures have risen 8.6% in the trailing week, which might have boosted or limited the downside in OIH, XOP, XLE, and AMLP. They have returned 5.8%, 5%, 3.7%, and -0.7%, respectively.