Why is OPEC important to the price of crude oil?

High market share gives OPEC bargaining power to price oil above a competitive market. It can sway crude oil prices by increasing or decreasing production.

Nov. 20 2019, Updated 3:55 p.m. ET

Major crude oil producers

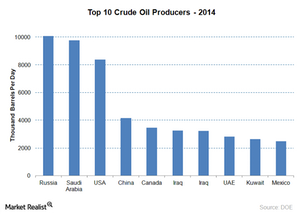

The first thing people need to know about crude is the producers. The major crude oil producers these days are Russia, Saudi Arabia, and the United States. The top ten oil-producing countries hold a market share of ~64% of crude oil production in the world.

The fall in crude oil prices impacts all the oil producers in these countries. Crude oil prices directly impact the revenue of US oil producers such as ConocoPhillips (COP), Anadarko Petroleum (APC), Apache Corporation (APA), and Pioneer Natural Resources (PXD). These companies are all part of energy ETFs such as the Energy Select Sector SPDR (XLE). Crude oil prices also affect the revenue of Saudi Aramco, Saudi Arabia’s largest oil company, Gazprom in Russia.

Organization of the Petroleum Exporting Countries (or OPEC)

Iran, Iraq, Syria, Kuwait, Saudi Arabia, Bahrain, Qatar, the United Arab Emirates (or UAE), Oman, and Yemen are members of the Organization of the Petroleum Exporting Countries (or OPEC). OPEC was formed in 1960. OPEC countries produce 40% of the world’s crude oil.

Seven sisters

Between 1940 and 1970, the following seven major oil companies dominated the oil market:

- Anglo-Persian Oil Company (now BP) (BP)

- Gulf Oil

- Standard Oil of California

- Texaco (now Chevron Corporation) (CVX)

- Royal Dutch Shell

- Standard Oil of New Jersey (also known as Esso)

- Standard Oil Company of New York (now Exxon Mobil) (XOM)

These companies are known as the seven sisters. They once controlled ~85% of the world’s petroleum reserves. This group tried to eliminate competitors so they could control the world crude oil market. So OPEC was formed to unify and coordinate members’ petroleum policies and ensure the stability of oil markets in order to secure an efficient, economic, and regular supply of petroleum to customers as well as a steady income to producers with a fair return.

Countries that were not part of OPEC were called non-OPEC countries. Declining petroleum reserves for non-OPEC countries and the growing influence of OPEC led to the decline of the seven sisters.

Significance of OPEC

OPEC has been gaining steady power and influencing the global oil market since the 1970s when OPEC had ~50% of market share in global crude oil production. High market share has also given OPEC the bargaining power to price oil above what prices would be in a more competitive market. This means OPEC has the ability to sway crude oil prices by increasing or decreasing production.

If OPEC has the power to sway prices by cutting production, why did OPEC decide not to cut production, which subsequently led to the recent collapse in the price of oil?