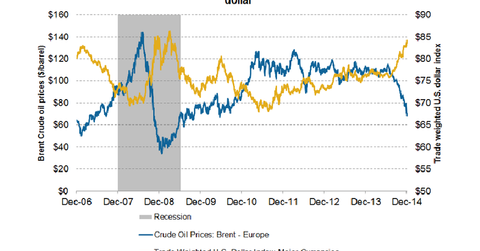

How the strengthening US dollar is impacting crude oil prices

The US dollar plays a major role in the price movements of commodities such as gold and crude oil. A strengthening US dollar is often seen as negative.

Nov. 20 2019, Updated 3:50 p.m. ET

Significance of the US dollar

The US dollar plays a major role in the price movements of commodities such as gold and crude oil. As commodities trade globally, often using the US dollar as a medium, price movements in the US dollar have important consequences. A weaker US dollar is often positive for crude oil producers. An appreciating or strengthening US dollar is often viewed as negative.

You can see the relationship between the US dollar and crude oil in the above chart. Crude oil declines as the dollar rises. This decline in the price of oil impacts the profitability of oil companies such as Chevron Corporation (CVX), Exxon Mobil (XOM), BP (BP), and PetroChina (PTR). The United States Oil ETF (USO) is down by ~20% from November highs.

US economy and the dollar

Economic activity in the United States in 2014 reflects a faster recovery and shows improvement in employment, the housing market, and financial conditions. This has led to a strengthening of the US dollar. Since crude oil is US-dollar denominated, the rising dollar indicates a fall in the value of oil relative to the US dollar.

The US dollar is expected to strengthen further in 2015 due to growing economic conditions in the United States. The Federal Reserve is likely to increase interest rates in 2015. Central banks in Japan, Europe, and China will probably reduce interest rates in 2015. Pumping liquidity into the economy is likely to widen interest-rate differentials. So the United States will be an attractive investment opportunity. This will lead to further strengthening of the US dollar.

An appreciating US dollar will continue to put downward pressure on crude oil prices, causing trouble for the energy sector (XLE). Lower oil prices will also impact shale oil producers such as Laredo Petroleum (LPI), Whiting Petroleum (WLL), and Marathon Oil Corporation (MRO).

What’s next? Let’s look at the geopolitical tensions.