Must-know: Why energy investors monitor crude oil inventories

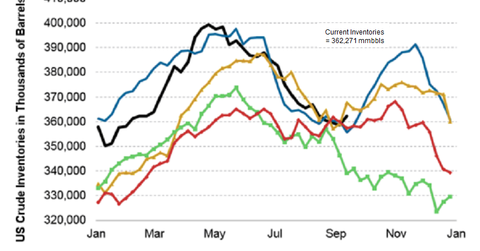

Analysts had expected a drop of 1.5 million barrels (mmbbls) in crude inventories last week. The following parts will cover actual changes in inventories.

Nov. 20 2020, Updated 11:29 a.m. ET

EIA inventory data

The U.S Energy Information Administration (or EIA) reports weekly figures for crude oil inventories every Wednesday. The report also provides data on inventories of distillates and gasoline, which are refined products of crude oil.

Crude oil inventory levels change based on demand and supply trends. Demand comes primarily from refineries that process this crude oil into refined products like gasoline and heating oil. Supplies come from sources like domestic production and imports from other countries.

Inventories increase when demand is lower than supplies for the week and decrease when demand is higher than supplies for the week. Every week, analysts anticipate an increase or decrease in crude oil inventories based on demand and supply for that week.

Analysts expected a drop of 1.5 million barrels (MMbbls) in crude oil inventories last week. The following parts of this series will cover actual changes in inventories.

Usually, if the actual decline is more than what analysts expected, it implies that demand was more than anticipated or that supplies were less than anticipated. But if the decline is less than what analysts expected, it implies that demand was less than anticipated or that supplies were more than anticipated.

The difference between actual and expected declines affects crude prices. We’ll cover crude price movements last week in a later part of this series.

Key stocks and ETFs

Crude oil prices directly affect earnings for major oil producers like ExxonMobil (XOM), ConocoPhillips (COP), Apache Corp. (APA), and Continental Resources (CLR)—all of which are major components of energy ETFs like the Energy Select Sector SPDR (XLE).

Cushing inventories

Another important figure that the EIA (Energy Information Administration) reports is the level of crude oil inventories at Cushing, Oklahoma. Cushing is a major inland oil hub in the U.S. It’s also the pricing point for the North American “benchmark,” WTI crude.

Inventory levels at Cushing reflect the pace at which increasing U.S. oil supply is moving from major inland production areas like the Bakken in North Dakota and the Permian in west Texas to end refining markets.

A buildup of inventories at Cushing may indicate that oil supply growth is outpacing takeaway infrastructure growth. So a buildup of inventories at Cushing can pressure WTI crude oil prices downwards and vice versa.

Changes in inventories and prices

The following parts of this series discuss changes in inventories and oil prices last week.