Continental Resources Inc (OKLA)

Latest Continental Resources Inc (OKLA) News and Updates

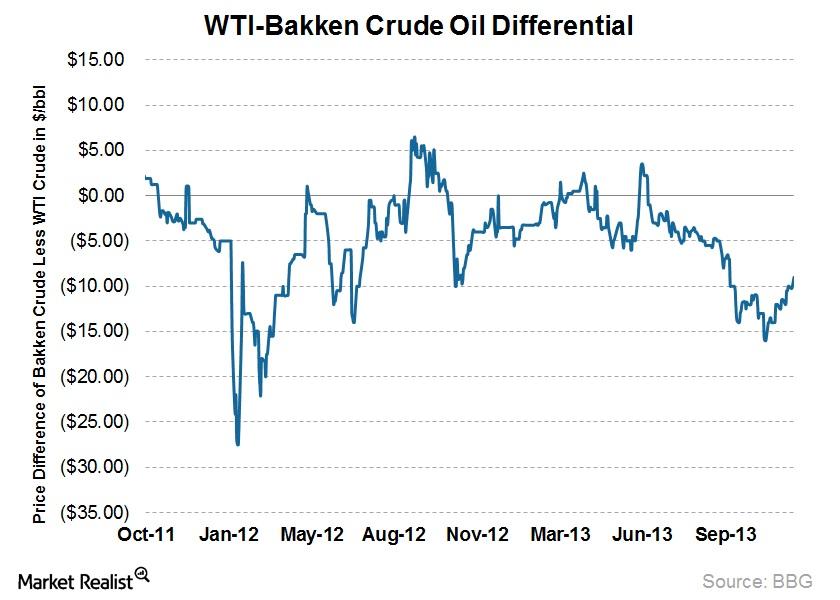

Why oil takeaway capacity in the Bakken can affect earnings

The availability of takeaway capacity from the Bakken can affect producers’ earnings.

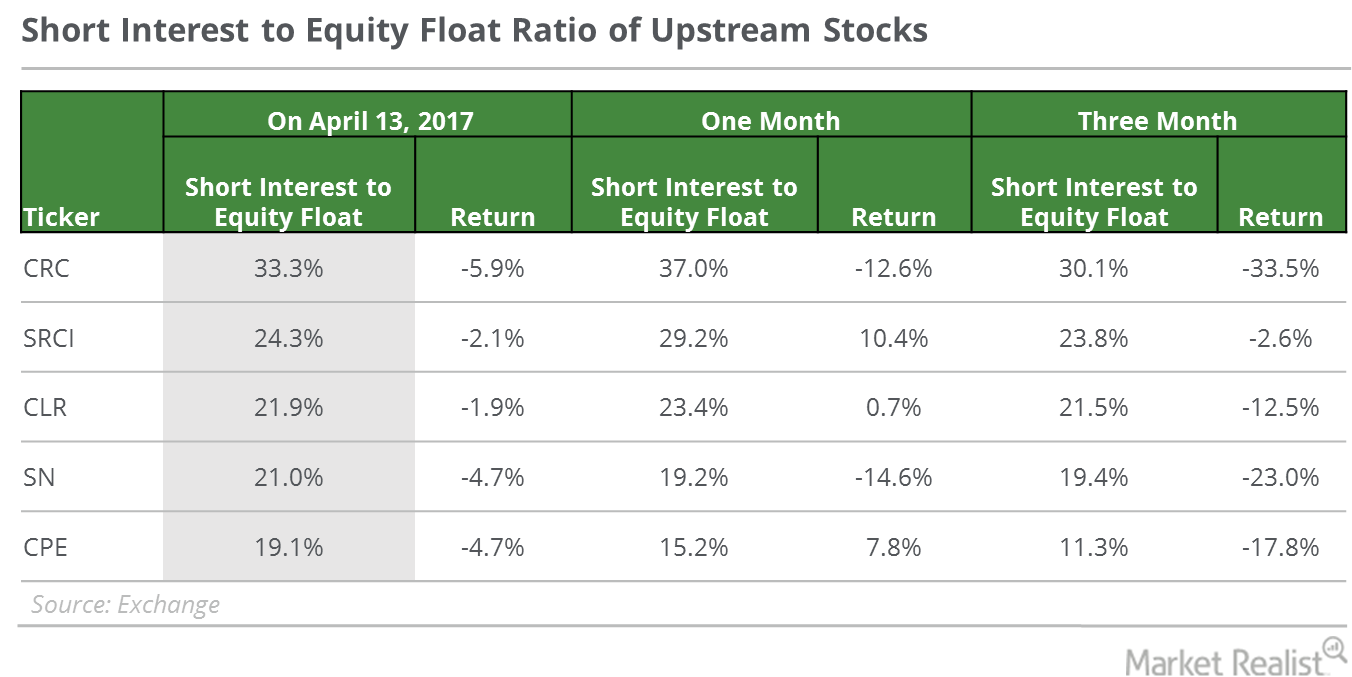

Why the Numbers Look Bearish for These Upstream Stocks

All these upstream companies have seen the short interest in their stocks rise—an potential indication of market skepticism in these companies’ abilities to profit from oil’s recent gains.

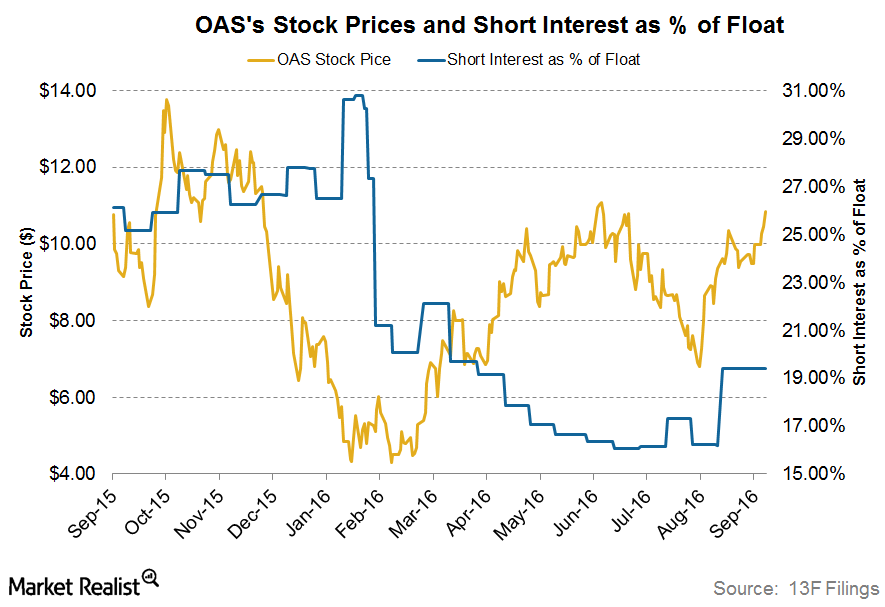

Analyzing Short Interest Trends in Oasis Petroleum

Oasis Petroleum’s short interest ratio on September 13, 2016, was ~19.4%. Its short interest ratio on June 30, 2016, was 16.1%.

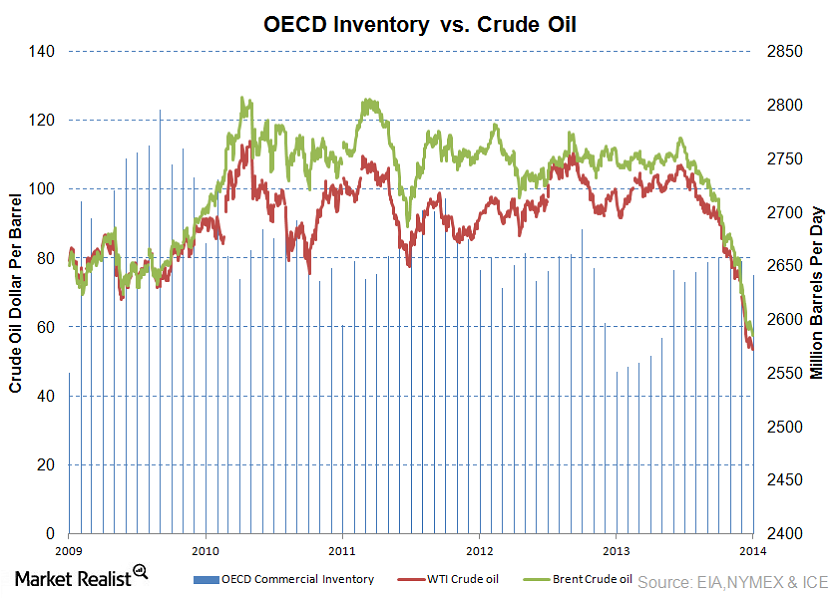

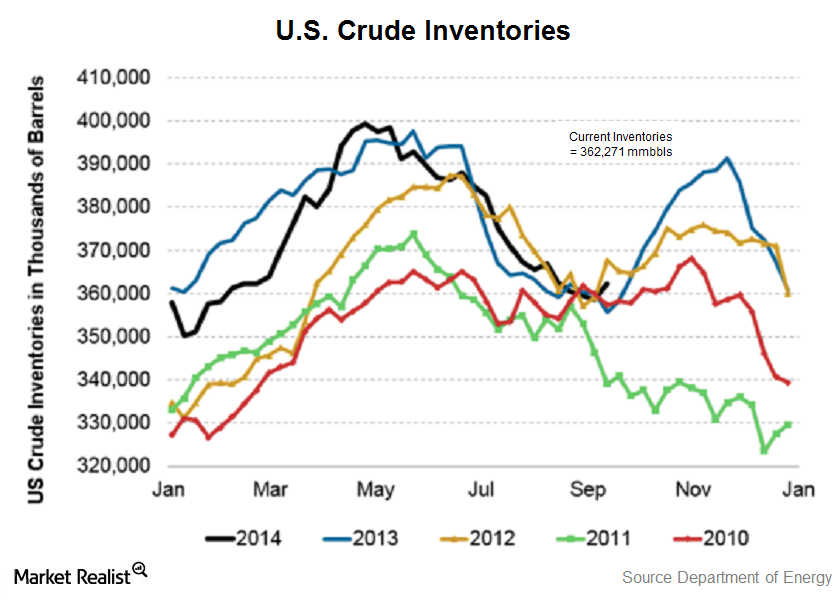

Why investors should track crude oil inventory levels

The difference between actual and expected changes in US crude oil inventory levels affects crude prices and thus revenues and earnings of major companies.

Must-know: Why energy investors monitor crude oil inventories

Analysts had expected a drop of 1.5 million barrels (mmbbls) in crude inventories last week. The following parts will cover actual changes in inventories.

Should Energy Investors Be Cautious with Oil-Weighted Stocks?

On March 7, US crude oil April futures fell 2.3% and closed at $61.15 per barrel. Here’s what you need to know.Financials Why the inverted head and shoulder pattern is formed

The inverted head and shoulder pattern is the reverse of the head and shoulder pattern. It’s formed at the bottom of the downtrend.

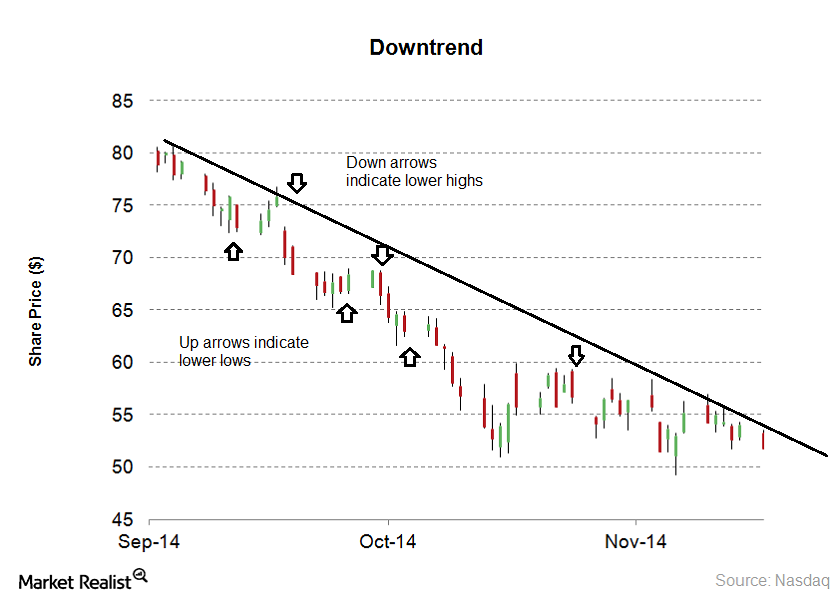

Why downtrends and sideways trends impact investors

It’s advisable to sell stocks on bounces when the stock is in a downtrend. In a sideways trend, it’s advisable to buy stock at support levels and sell at resistance levels.

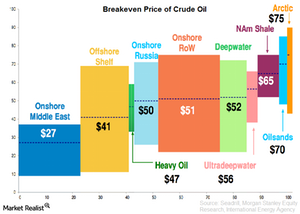

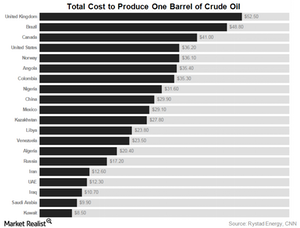

Why is the breakeven price of crude oil so important?

Knowing the breakeven price of crude oil is important when trying to figure out what OPEC needs in order to regain market share.

Why it’s important to know the crude oil extraction process

Before learning the costs components of crude oil extraction, let’s take a look at how producers extract crude oil from the ground.

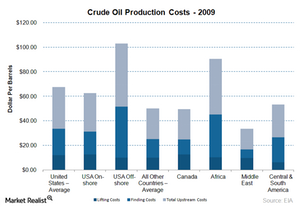

How does the production cost of crude oil affect oil prices?

Recent consensus says the production cost of crude oil could range from $20 to $25 per barrel.

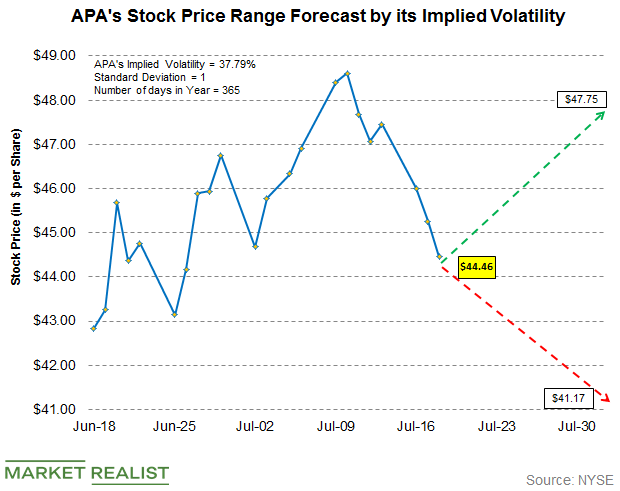

Forecasting Apache’s Stock Price Range

The current implied volatility in Apache’s stock (APA) is ~37.79%. In comparison, the Energy Select Sector SPDR ETF (XLE) has an implied volatility of 17.8%.

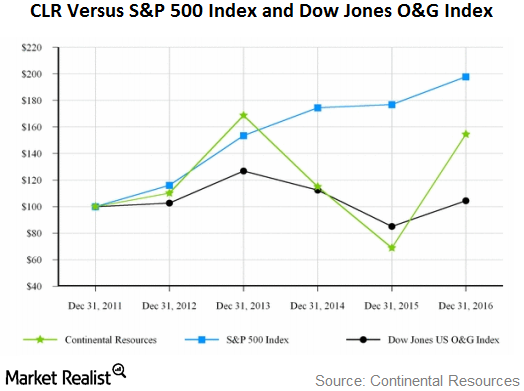

How Has CLR Performed Compared to S&P 500 and Dow Jones?

Let’s take a look at Continental Resources’ (CLR) stock performance in comparison to the performances of the S&P 500 Index and the Dow Jones Oil & Gas Index since 2011.

What Do Analysts Recommend for Whiting Petroleum?

Approximately 38.5% of the analysts rated Whiting Petroleum (WLL) as a “buy,” while ~56.4% rated it as a “hold.” The average broker target price is $14.28.

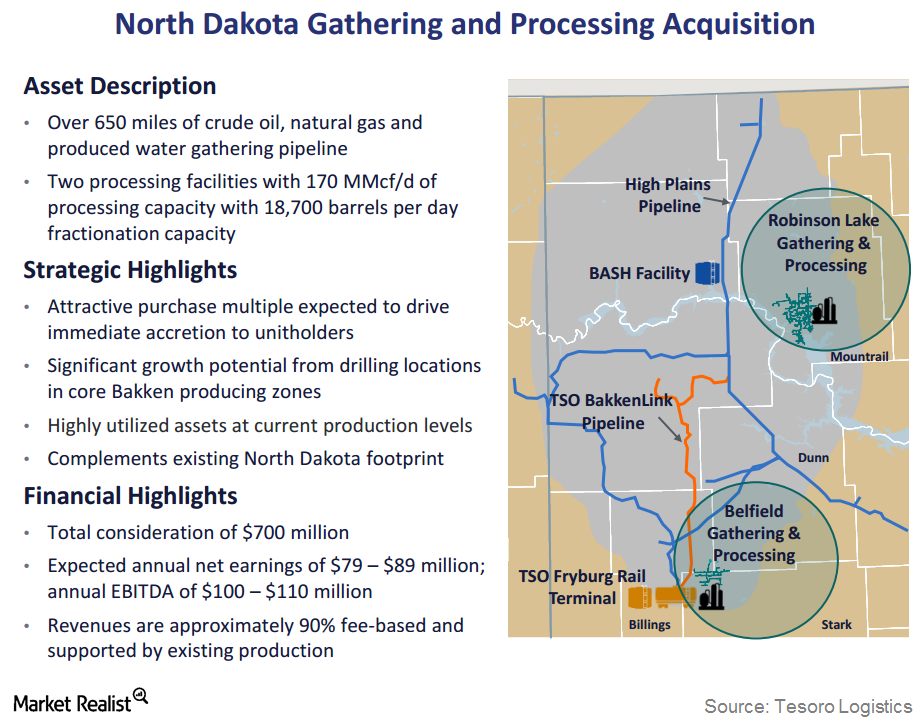

Whiting Petroleum Announces Bakken Midstream Divestiture

On November 21, 2016, Whiting Petroleum announced its intention to sell its Bakken midstream assets to an affiliate of Tesoro Logistics Rockies for $375 million.

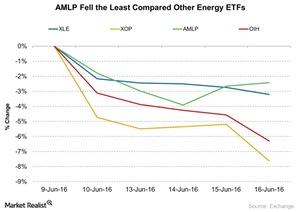

AMLP Fell: Did It Outperform Other Energy ETFs?

The Alerian MLP ETF (AMLP) outperformed other energy ETFs from June 9–16, 2016. Falling crude oil has less of an impact on midstream companies.

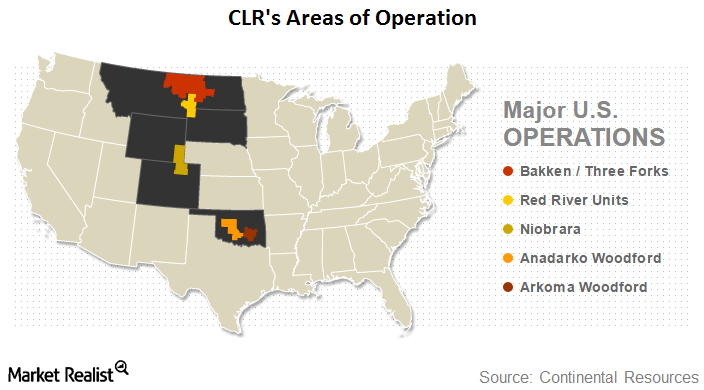

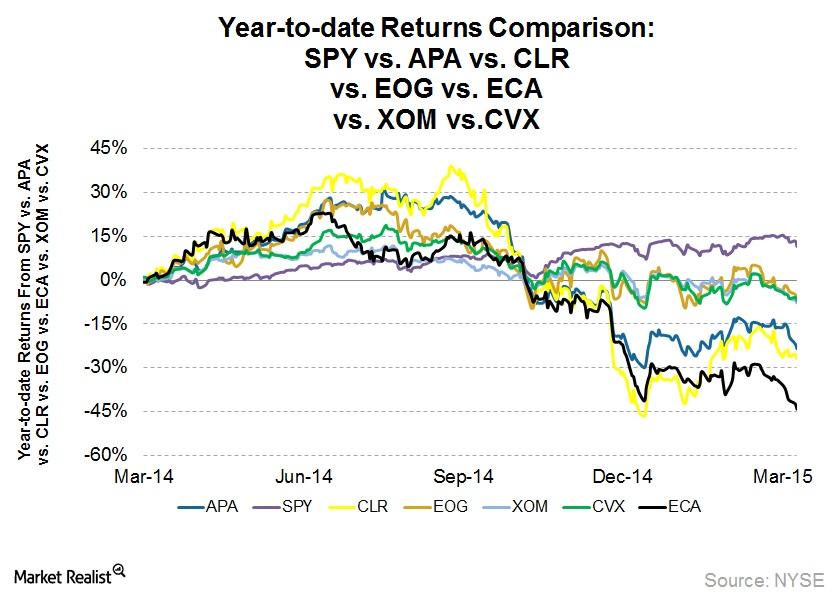

Continental Resources: An Introduction

In this series, we will analyze how badly Continental Resources (CLR) was hit by weak oil prices, and what measures it has taken to counter this situation. In 2015, crude oil accounted for 66% of CLR’s total production and 85% of its revenues.

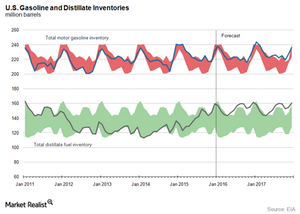

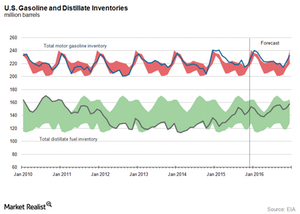

Gasoline and Distillate Inventories Overshadow Crude Oil Market

The EIA (U.S. Energy Information Administration) reported that the US gasoline inventory rose by 8.4 MMbbls to 240.4 MMbbls for the week ending January 8, 2016.

Crude Oil’s Total Cost of Production Impacts Major Oil Producers

OPEC members Nigeria, Libya, and Venezuela have the highest total cost of producing crude oil at $31.6 per barrel, $23.80 per barrel, and $23.50 per barrel.

Will the Gasoline and Distillate Inventory Pressure Crude Oil Prices?

The API (American Petroleum Institute) published its weekly crude oil, gasoline, and distillate inventory report on January 12, 2016.

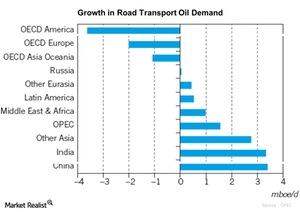

Crude Oil Demand Expected to Grow from Road Transportation

OPEC has estimated that the road transportation sector will account for one-third of the global crude oil demand growth between 2014 and 2040.

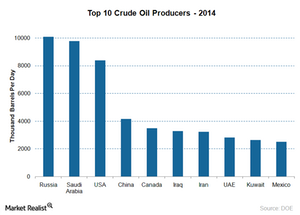

How Top Crude Oil Producers Impact the Crude Oil Market

The world’s largest producer of crude oil is Russia. It is also among the largest crude oil exporters.

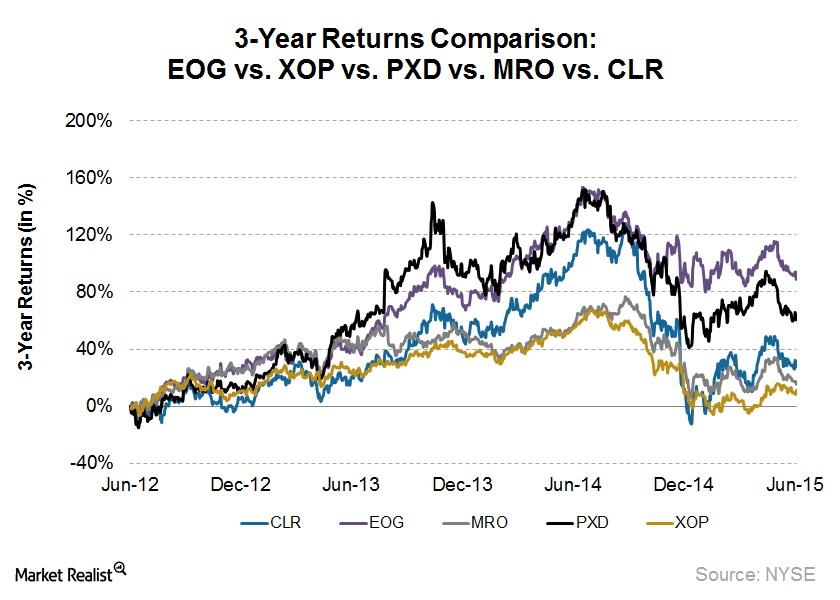

EOG and Pioneer: The Best Upstream Stocks in the Past 3 Years

Of the top American upstream stocks, EOG Resources has been the outperformer since June 2012, returning 93%. During the same period, Pioneer Natural Resources (PXD) returned 61%.

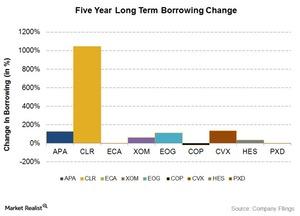

Why are some energy companies more leveraged than others?

In the past five years, many of the upstream and integrated energy companies have increased their debt. Some are more leveraged than others.

Falling oil prices affect energy upstream and integrated companies

Falling oil prices have started to affect energy upstream companies’ revenues. These companies have resorted to cutting costs and focusing on cash flow.

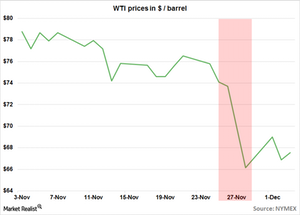

Why the bottom fell out of crude oil

Oil markets had been watching what OPEC would do in its November 27 meeting. Crude oil fell ~30% since June. It decided to stay production levels. Crude oil dropped ~10% after the news.