Energy Select Sector SPDR® ETF

Latest Energy Select Sector SPDR® ETF News and Updates

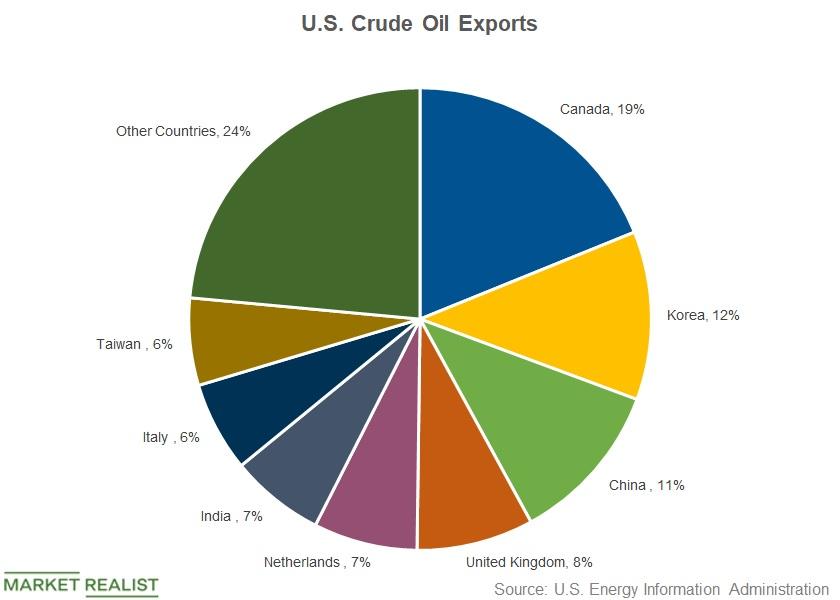

Where Does the United States Export Oil?

In this part, we’ll take a look at the top countries where the US exports its crude oil.

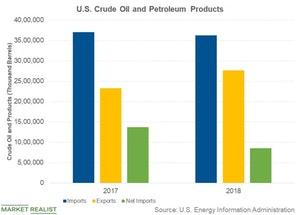

Why the United States Imports Oil

Several factors contributed to the rising crude oil exports in 2018.

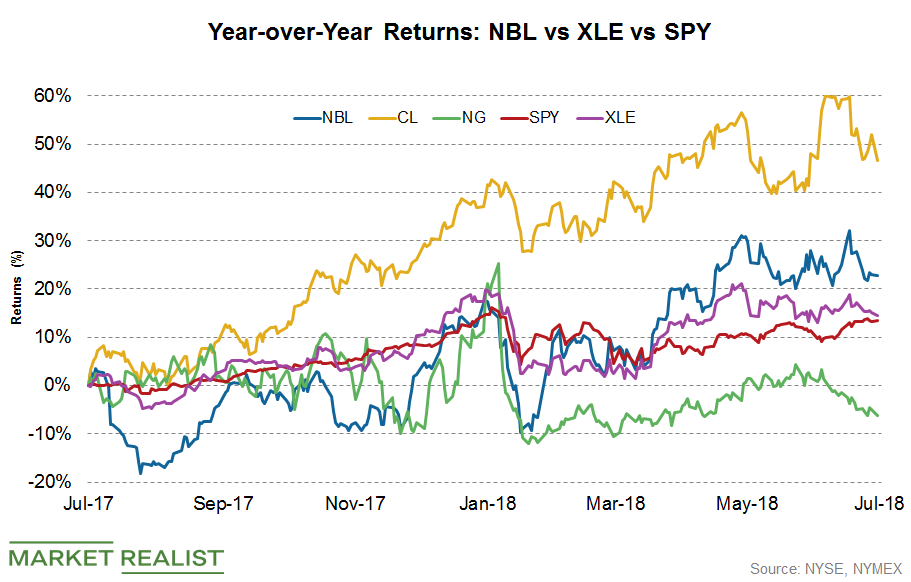

How Has Noble Energy Stock Been Performing Recently?

Year-over-year, NBL stock has risen ~22.7%, while crude oil prices have surged 46.5% in the same period.

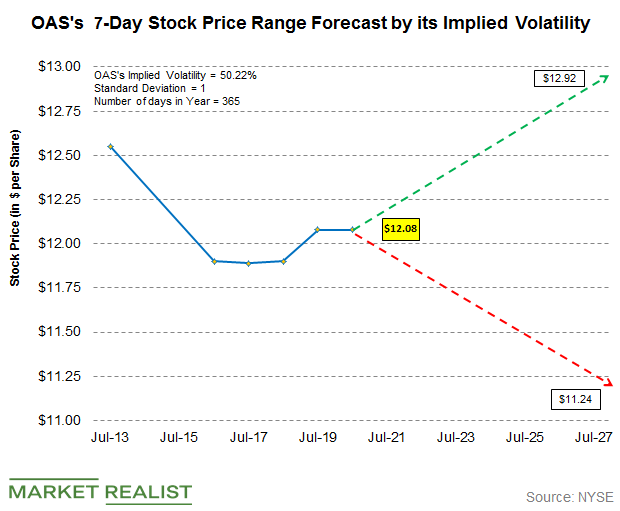

Using Implied Volatility to Forecast Oasis’s Stock Price Range

Oasis Petroleum (OAS) stock’s current implied volatility is ~ 50.22%, which is ~2.08% higher than its 15-day average of 49.19%.

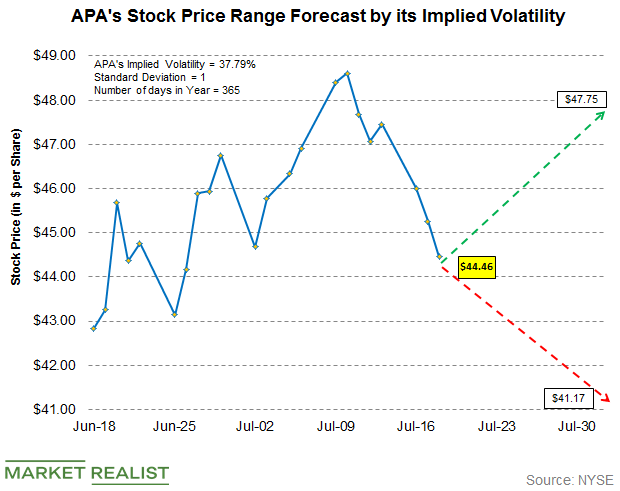

Forecasting Apache’s Stock Price Range

The current implied volatility in Apache’s stock (APA) is ~37.79%. In comparison, the Energy Select Sector SPDR ETF (XLE) has an implied volatility of 17.8%.

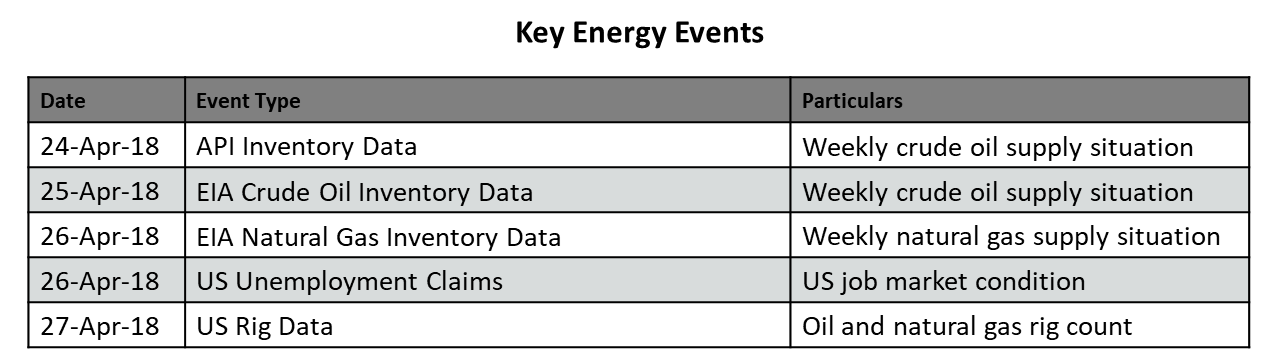

Key Energy Events This Week

The EIA’s crude oil and natural gas inventory data are scheduled to be released on April 25 and April 26, 2018, respectively.

USAC, CCLP: Will the Outperformance Continue?

USA Compression Partners, CSI Compressco, and Archrock Partners are up 11%, 32%, and 4%.

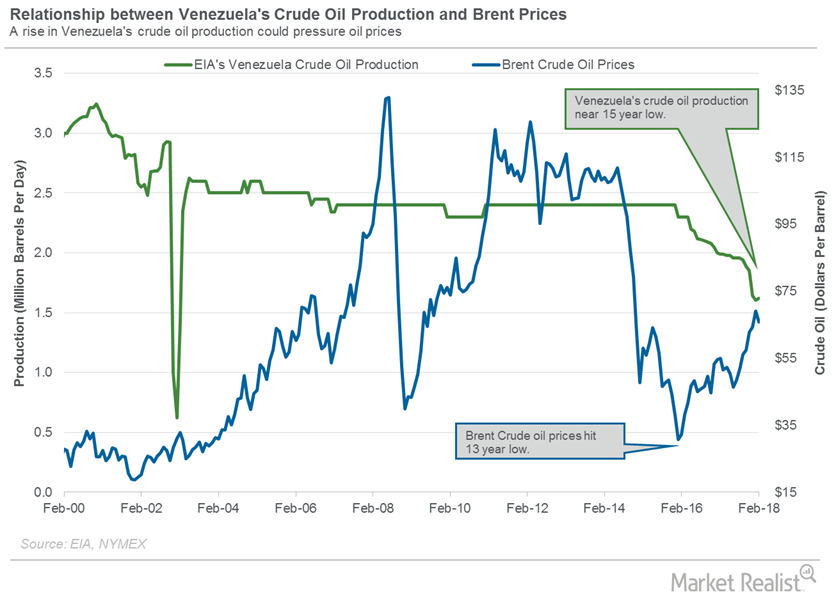

Crude Oil Traders Track Venezuela’s Oil Production

The EIA estimates that Venezuela’s crude oil production increased by 15,000 bpd to 1,620,000 bpd in February 2018—compared to January 2018.

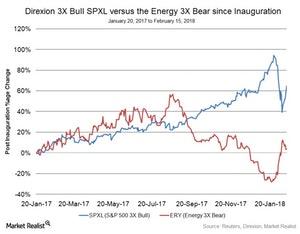

Could Energy Continue Its Wild Ride in 2018?

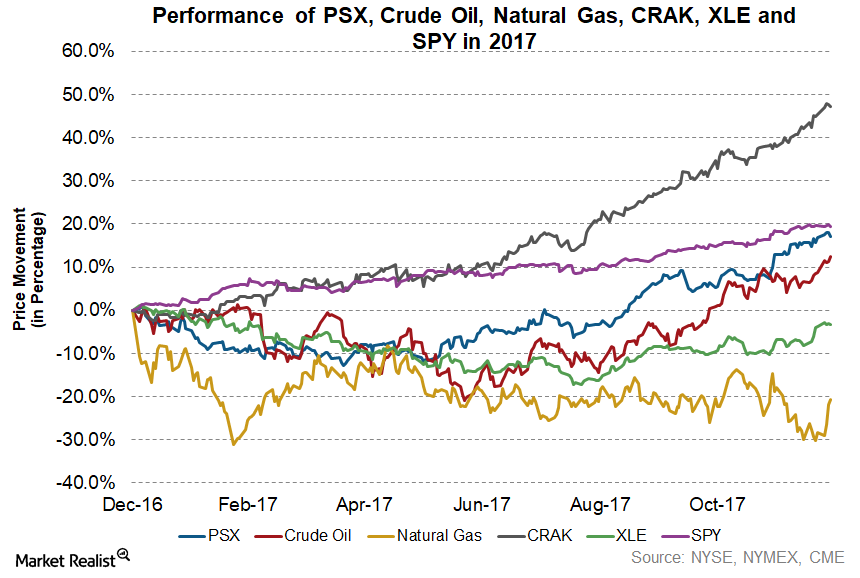

From the presidential election in November 2016 through August 2017, the energy sector saw its worst time.

Phillips 66’s Strong Performance in 2017

In 2017, Phillips 66 (PSX) was the fifth-best-performing energy stock of the Energy Select Sector SPDR ETF (XLE).

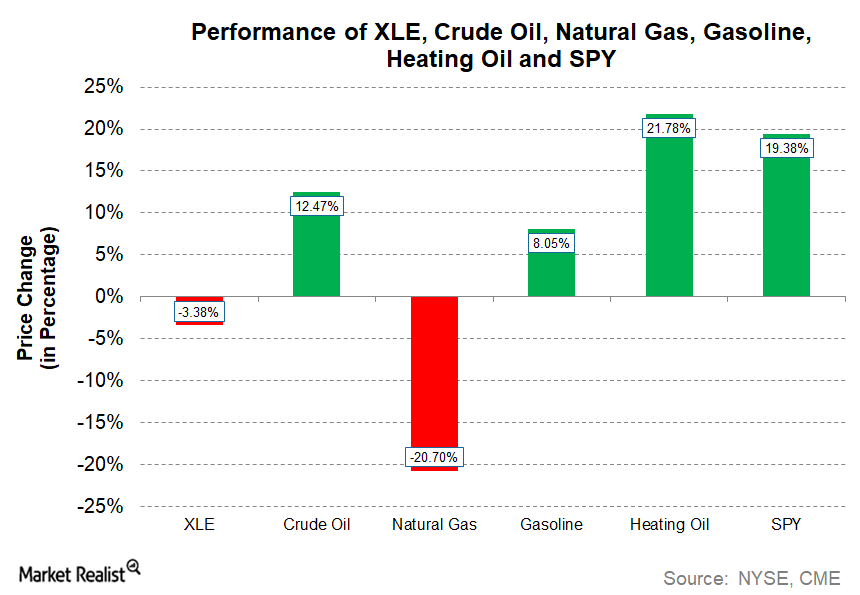

How the Energy Sector Performed in 2017

In this series, we’ll look at the best-performing and worst-performing stocks of the Energy Select Sector SPDR ETF (XLE) and analyze the earnings and developments behind the movements.

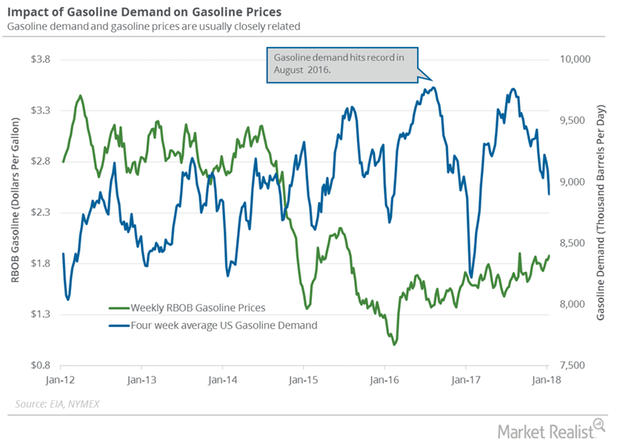

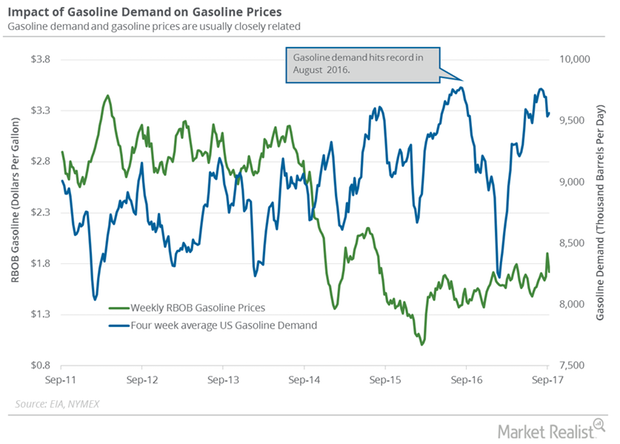

US Gasoline Demand Could Extend the Crude Oil Price Rally

The EIA estimated that four-week average US gasoline demand decreased by 190,000 bpd (barrels per day) to 8,904,000 bpd on January 5–12, 2018.

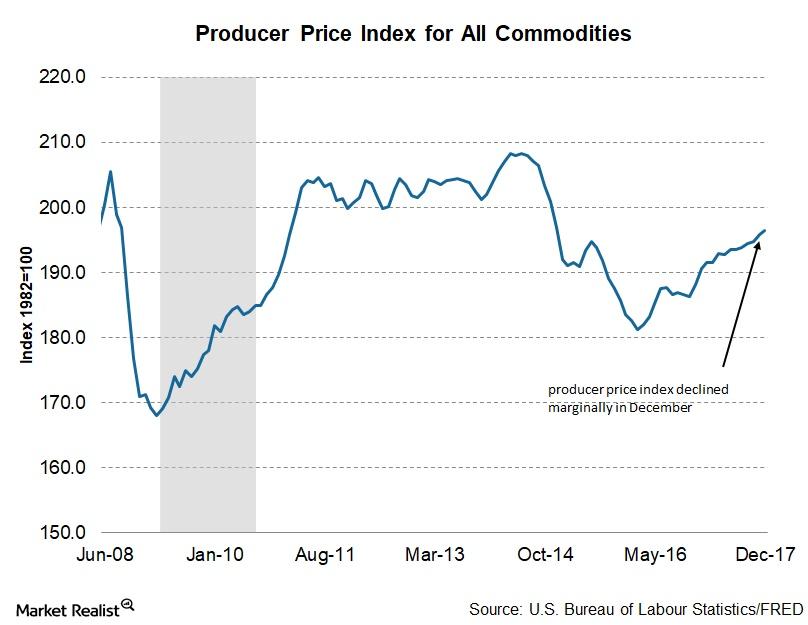

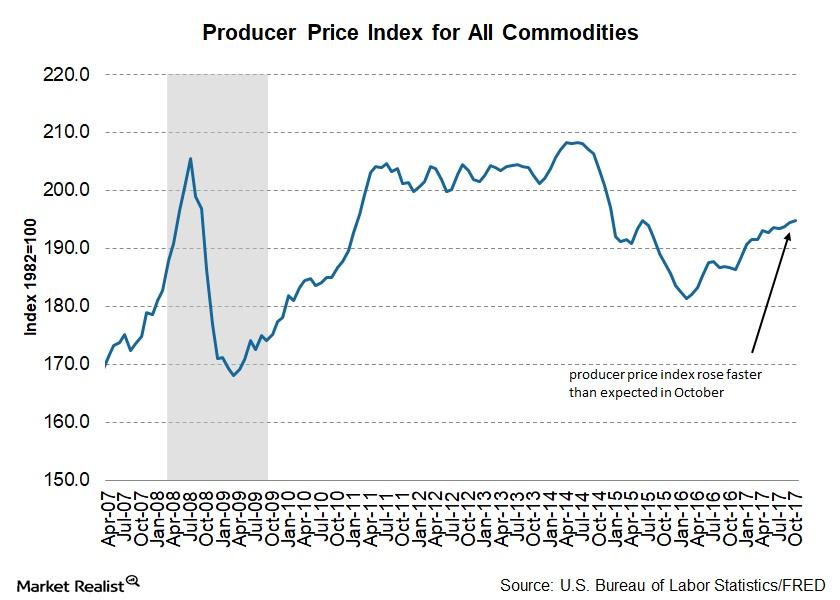

Analyzing the Producer Price Index in December

The December PPI fell 0.1% month-over-month—compared to a 0.4% increase in November and October. The final demand index rose 2.6% in 2017.

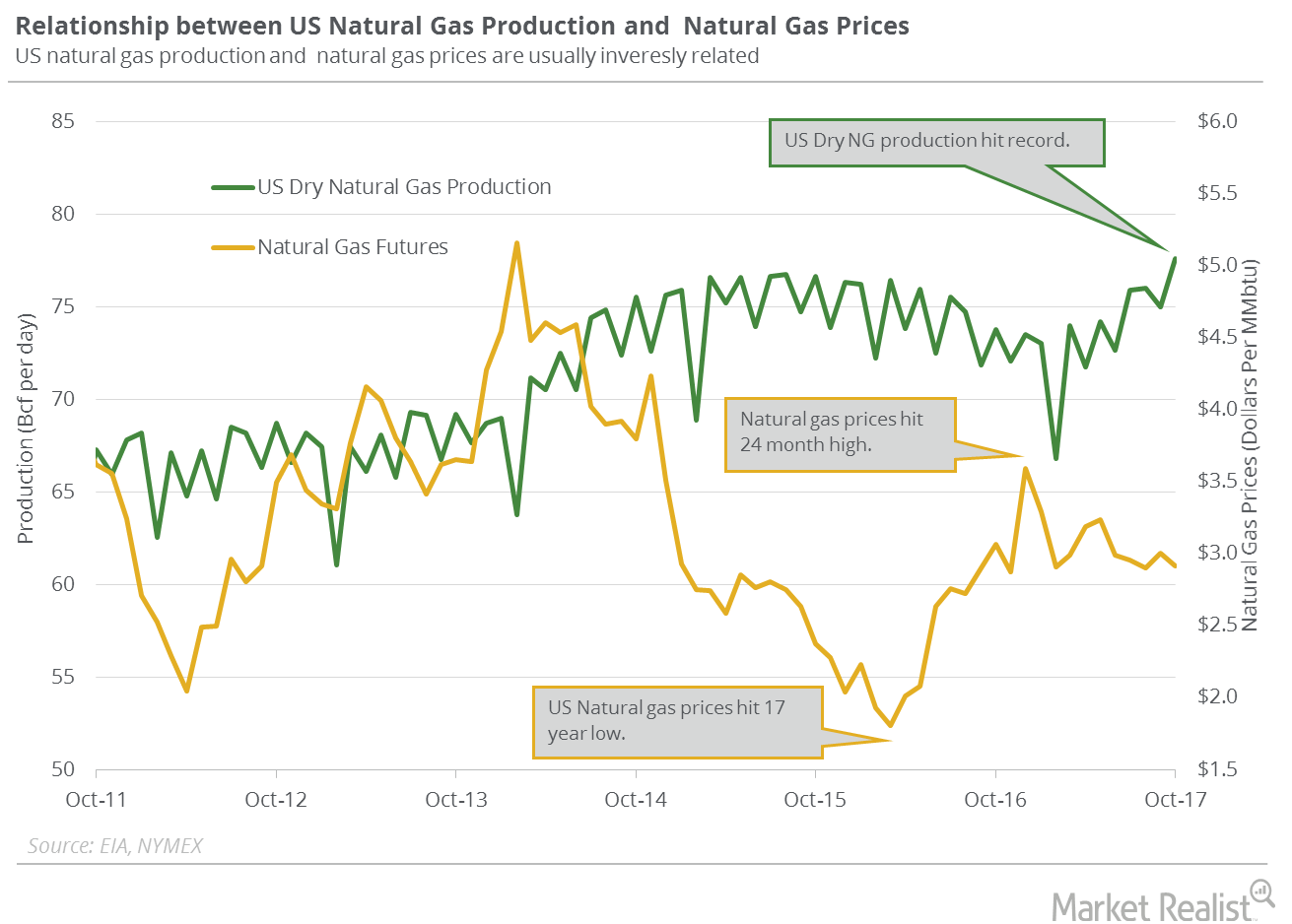

Will US Natural Gas Production Hit a Record in 2018 and 2019?

US dry natural gas production rose by 1.2 Bcf (billion cubic feet) per day or 1.6% to 74 Bcf per day on January 4–10, 2018, according to PointLogic.

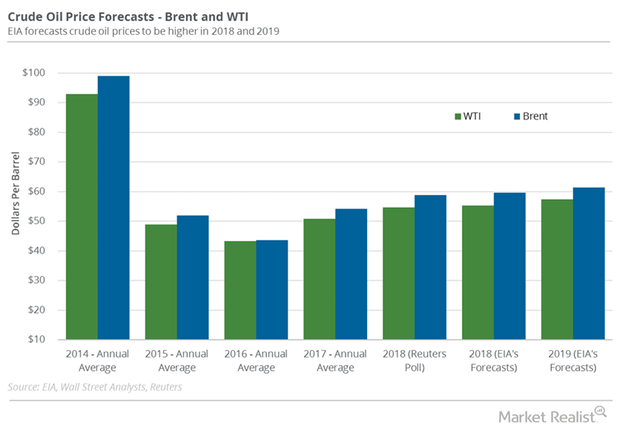

EIA Upgraded Crude Oil Price Forecasts for 2018

The EIA forecast that Brent (BNO) crude oil would average $59.74 per barrel in 2018—4.3% higher than the previous estimates in December 2017.

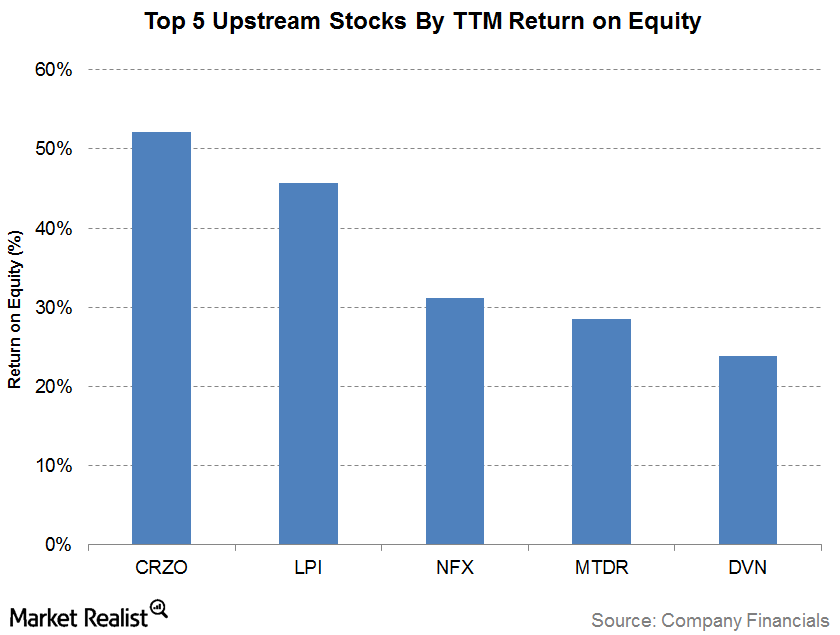

The Top 5 Upstream Companies Based on Return on Equity

The company with the highest trailing 12-month ROE (return on equity) as of 3Q17 is Carrizo Oil & Gas (CRZO) with an ROE of 52.1%.

Crude Oil Inventories Fell, Refinery Utilization Hit 12-Year High

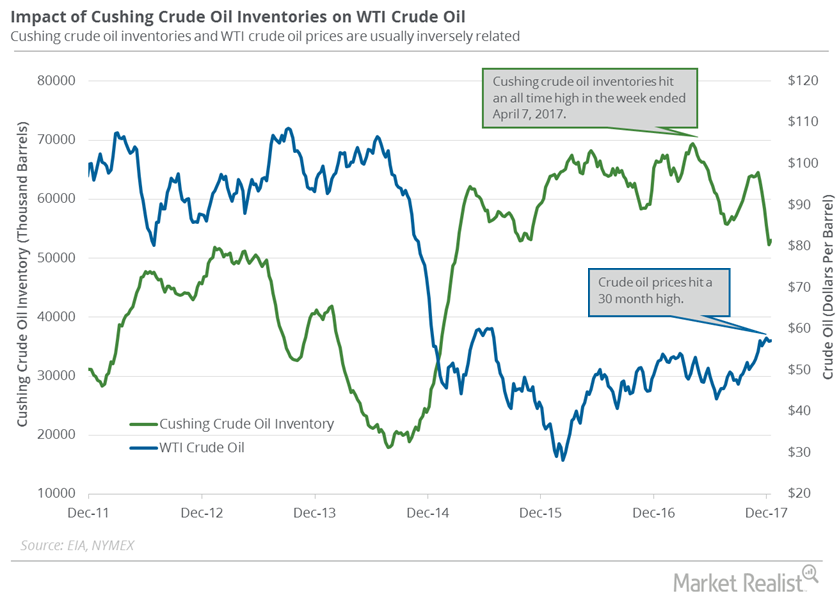

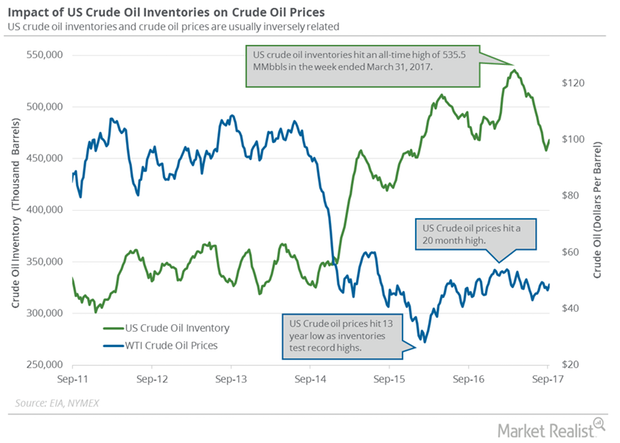

US crude oil futures contracts for February delivery fell 0.1% to $61.95 per barrel at 1:05 AM EST on January 5, 2018—the highest level since December 2014.

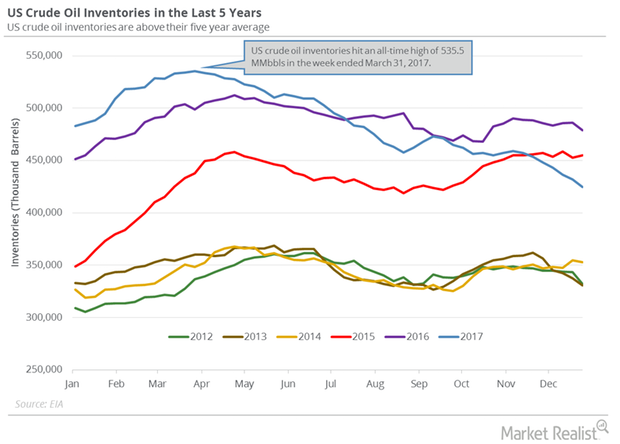

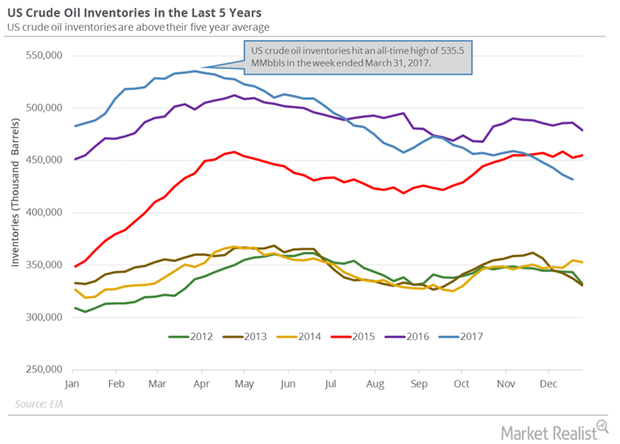

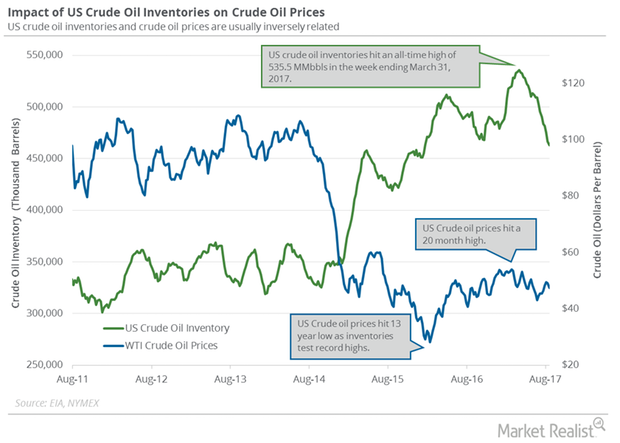

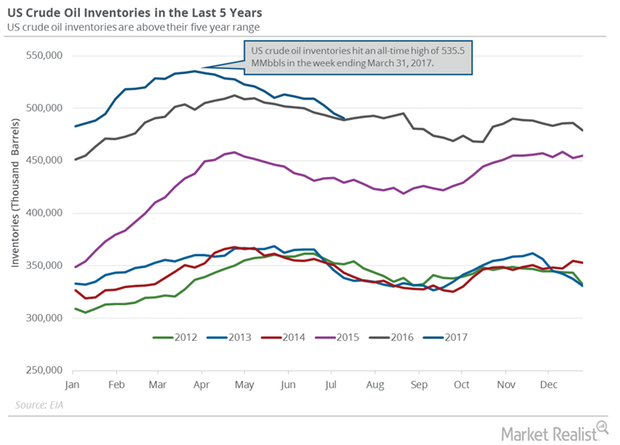

US Crude Oil Inventories Have Fallen ~10.6% in 2017

February WTI crude oil futures (DWT)(SCO) contracts rose 0.8% to $60.3 per barrel at 12:45 AM EST on December 29, 2017—the highest level since June 2015.

Cushing Inventories Rose for the First Time in Nearly 2 Months

Cushing inventories rose by 754,000 barrels or 1.4% to 52.9 MMbbls (million barrels) on December 8–15, 2017, according to the EIA.

Understanding KBR’s Business Segments

Business segments KBR’s (KBR) business is classified into three core segments (government services, technology and consulting, and engineering and construction) and two non-core segments (non-strategic business and other business). Government services The government service segment’s primary focus is providing support solutions to US, UK, and Australian government agencies. According to KBR’s Form 10-K, the segment offers “full […]

A Look at KBR’s Subsidiaries

Primary subsidiaries Previously, we discussed various acquisitions completed by KBR (KBR). Let’s now take a look at some of KBR’s subsidiaries and how they fit into the big picture for the company. Energy and construction Granherne, a KBR technology and engineering subsidiary, operates in the oil and gas industry. Granherne provides front-end engineering and design services […]

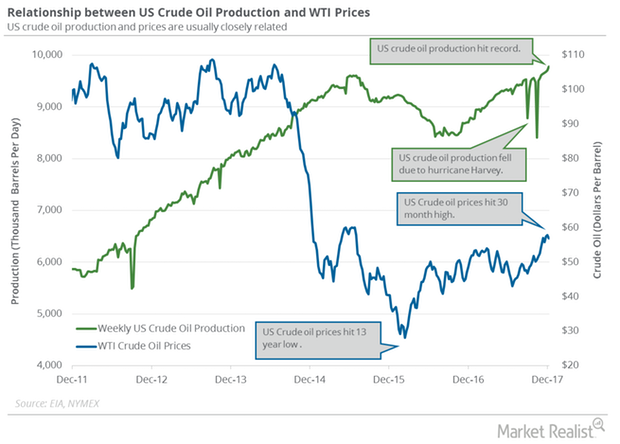

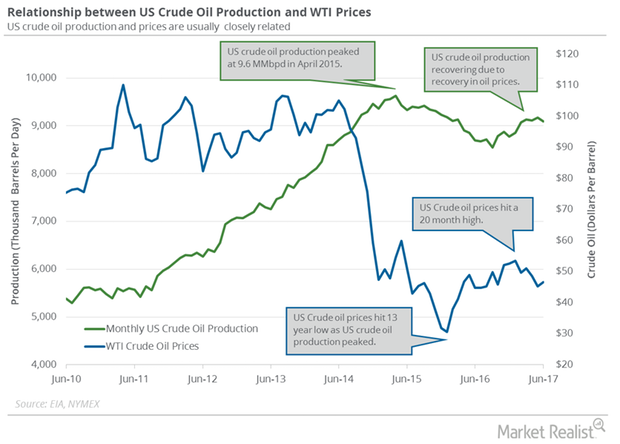

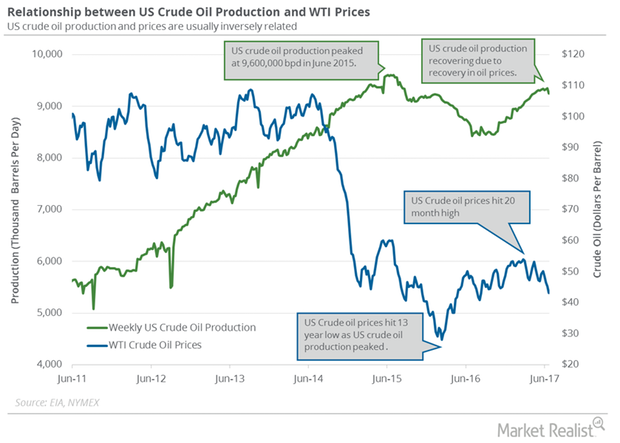

US Crude Oil Production Has Risen 16% since July 2016

US crude oil production rose by 73,000 bpd (barrels per day) to 9,780,000 bpd on December 1–8, 2017, according to the EIA.

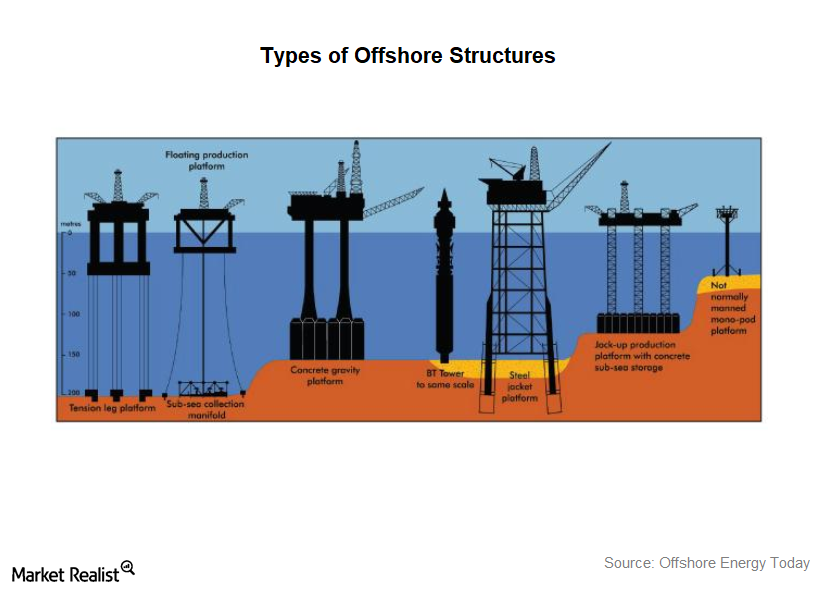

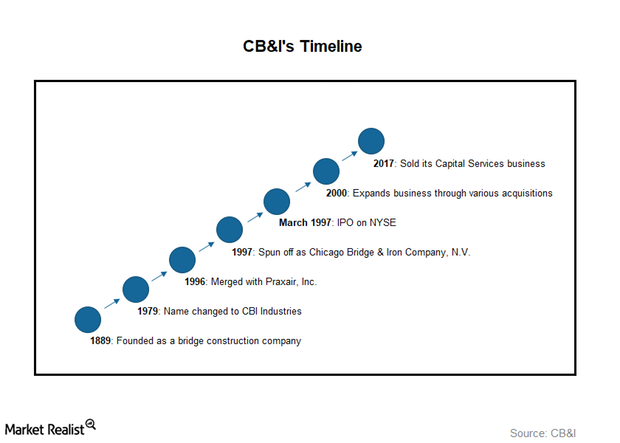

Chicago Bridge & Iron Company: An Introduction

In this series, we’ll analyze Chicago Bridge & Iron’s (CBI) business model. We’ll explore how it has expanded its business and evaluate its key operational metrics and financial position.

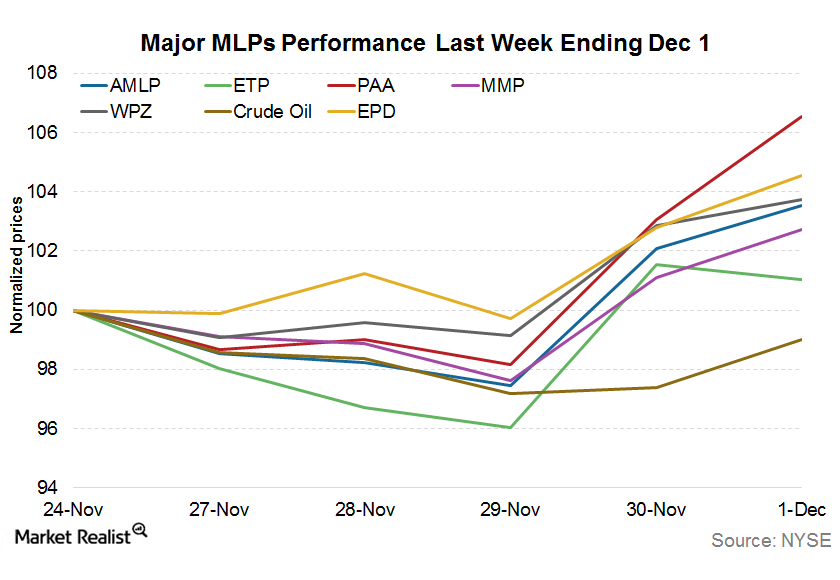

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

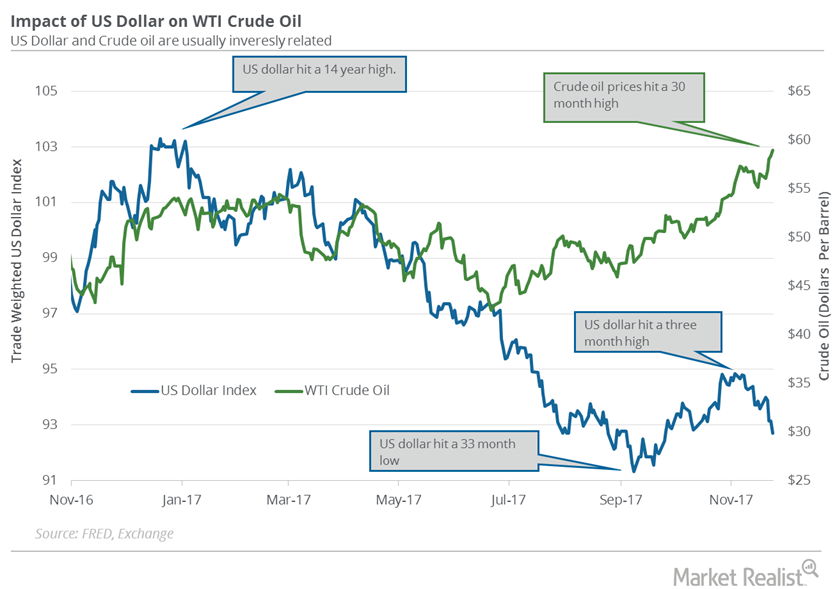

US Dollar Is near a 2-Month Low

The US Dollar Index fell 0.5% to 92.7 on November 24, 2017—the lowest level in almost two months. The US dollar (UUP) fell 1.27% last week.

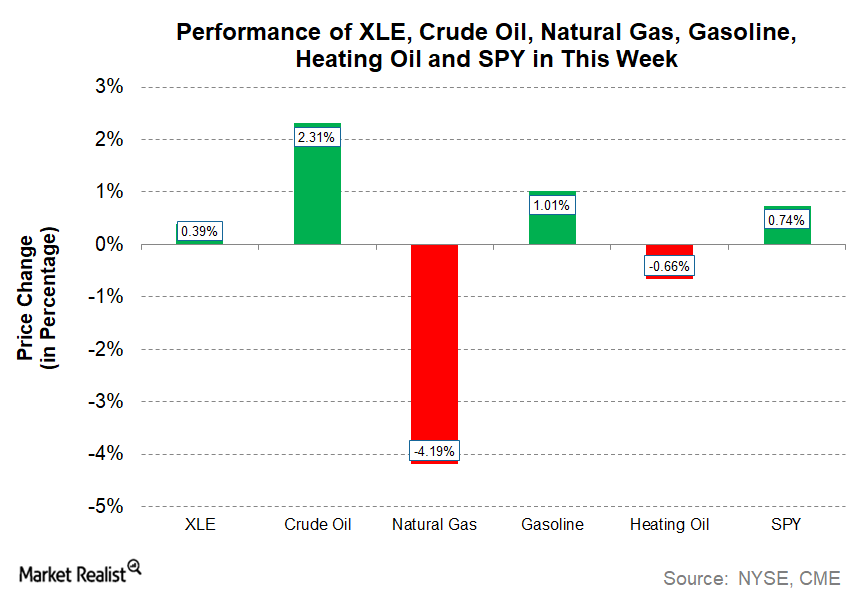

Energy Sector Saw a Mixed Performance This Week

With the mixed performance from natural gas and crude oil, the energy sector is showing a modest increase this week.

How an Increase in the Producer Price Index Affects the Economy

The October Producer Price Index rose 0.4% month-over-month, and it was unchanged compared to the September reading. On a year-over-year basis, the index has risen 2.8%.

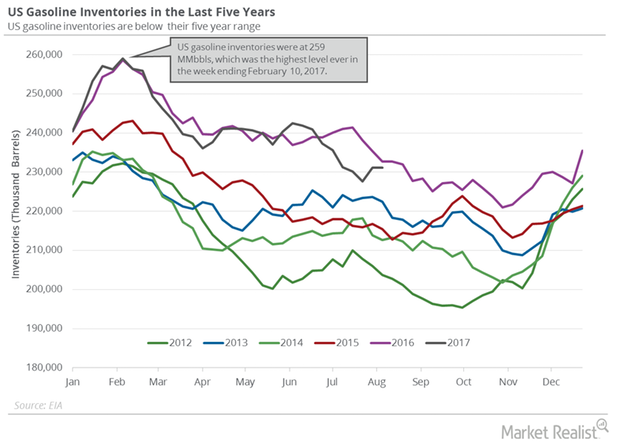

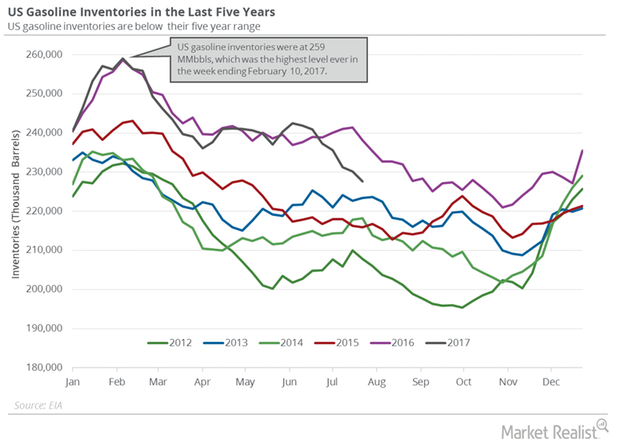

US Gasoline Demand: Are the Crude Oil Bears Taking Control?

Weekly US gasoline demand rose by 81,000 bpd to 9.5 MMbpd on September 15–22, 2017. Gasoline demand rose by 642,000 bpd or 7.2% YoY.

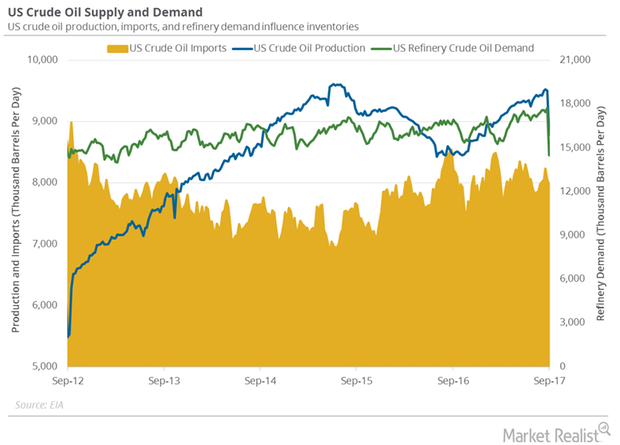

Are US Crude Oil Supply and Demand Tightening?

WTI (West Texas Intermediate) crude oil (XLE)(XOP)(USO) futures contracts for October delivery rose 2.2% to $49.3 per barrel on September 13.

US Crude Oil Production Hit a 5-Month Low

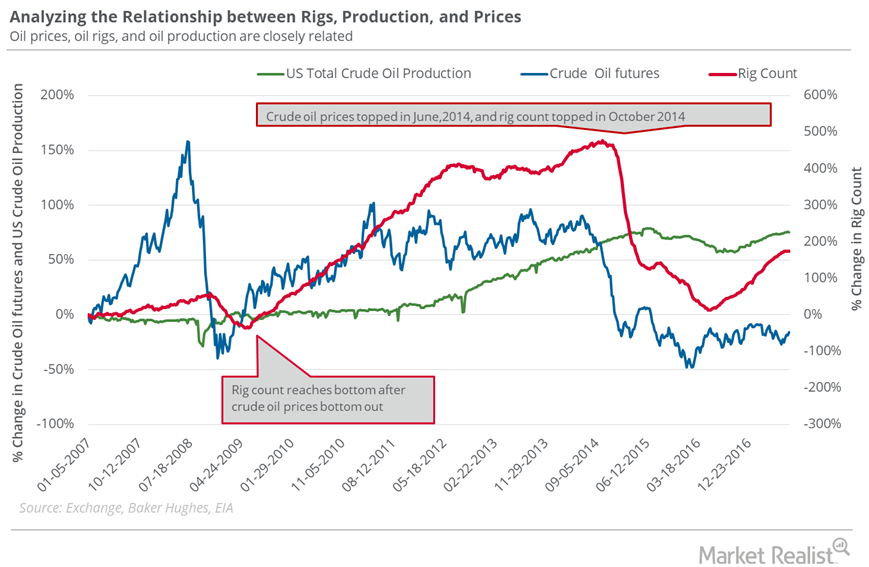

US crude oil production hit a five-month low due to slowing crude oil rigs and lower crude oil (XLE) (USO) (UCO) prices in the past few months.

Hurricanes Could Impact Global and US Crude Oil Demand

West Texas Intermediate crude oil (DBO) (DIG) (XLE) futures contracts for October delivery rose 1.2% to $48.07 per barrel on September 11, 2017.

Harvey and API Crude Oil Inventories: The Impact on Crude Futures

US crude oil futures contracts for October delivery fell 0.3% to $46.44 per barrel on August 29, 2017.

US Gasoline Inventories Pressured Gasoline and Crude Oil Futures

The EIA reported that US gasoline inventories rose by 22,000 barrels or 0.1% to 231.1 MMbbls (million barrels) on August 4–11, 2017.

Could the Oil Rig Count Threaten Bullish Bets on Oil Prices?

The US oil rig count rose by three to 768 for the week ended August 11, 2017.

Analyzing US Crude Oil and Gasoline Inventories

The API estimates that US gasoline inventories rose by 1.5 MMbbls (million barrels) on July 28–August 4, 2017.

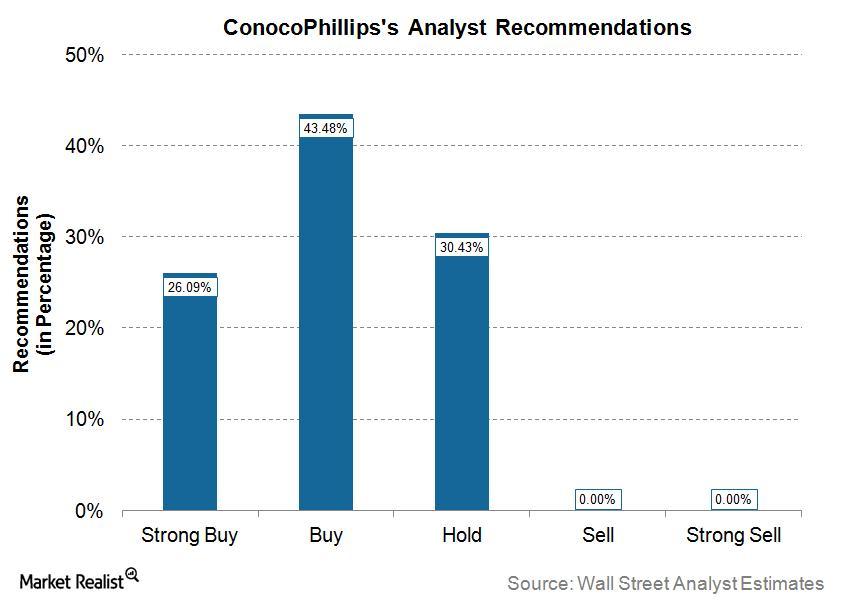

What Wall Street Analysts Are Saying about ConocoPhillips

As of July 28, 2017, 43.48% of the total Wall Street analysts covering ConocoPhillips (COP) have a “hold” recommendation on ConocoPhillips.

US Crude Oil Inventories Could Fall below the 5-Year Average

The EIA estimates that US crude oil inventories fell by 4.7 MMbbls (million barrels) to 490.6 MMbbls on July 7–14, 2017.

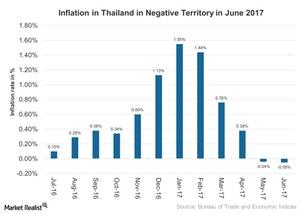

Is Negative Inflation Suggesting Contraction in Thailand in 2017?

Thailand’s (EEM) inflation in June 2017 exceeded the market estimate of a 0.1% drop.

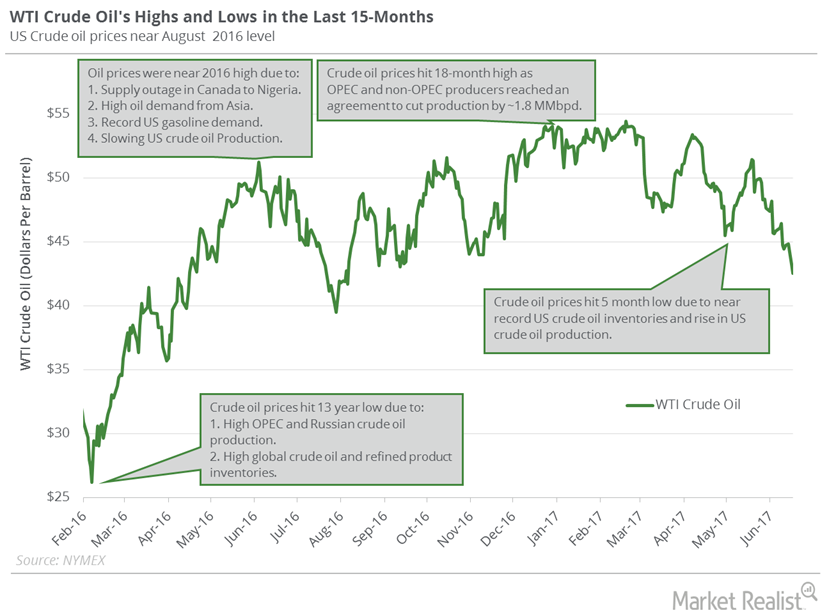

Will Libya and Iran Swing Crude Oil Prices?

Market surveys project that Libya’s crude oil production is near 1 MMbpd—the highest level in three years. High production could pressure crude oil prices.

US Crude Oil Prices Could Be Range Bound Next Week

August WTI (West Texas Intermediate) crude oil (XOP) (VDE) (RYE) futures contracts rose 0.5% and closed at $42.74 per barrel on June 22, 2017.

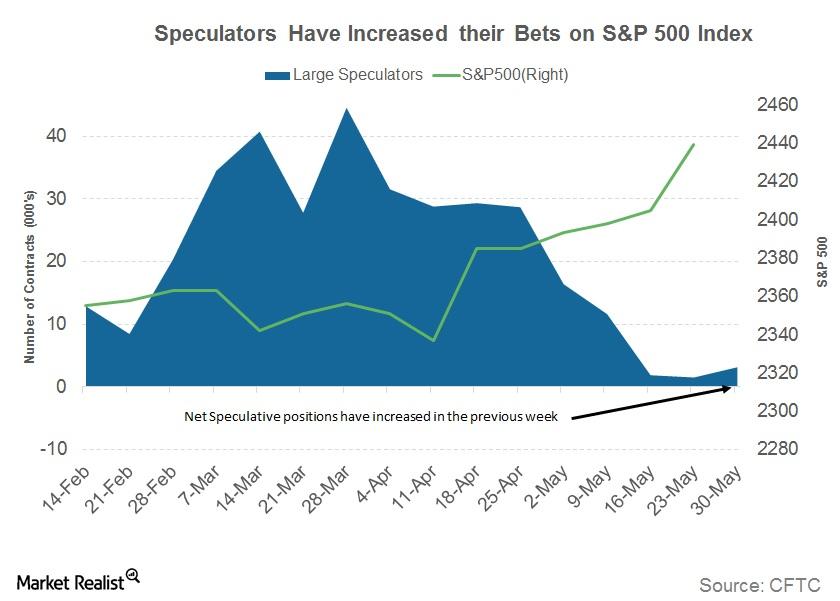

Can the S&P 500 Index Keep Rallying amid Slow Job Growth?

SPY recorded yet another lifetime high of 2,440.04 on Friday, June 2, gaining 0.96% for the week and continuing its 1.43% gain from the previous week.

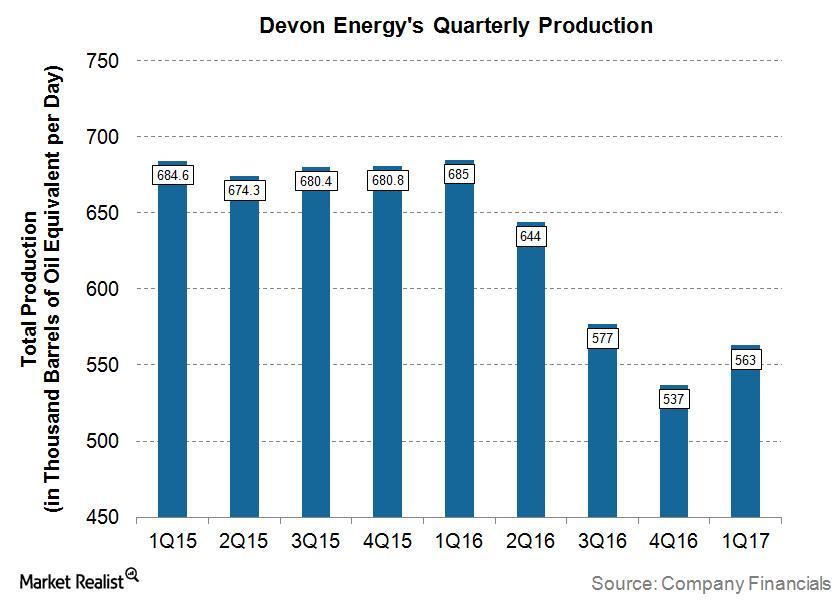

Understanding Devon Energy’s Production Volumes

For 1Q17, Devon Energy (DVN) reported total production of 563 MBoepd, which is ~18% lower when compared with 1Q16.

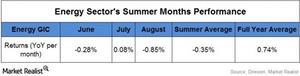

Will the Energy Sector Lag in Summer Months?

2016 proved fruitful for the energy sector (XLE) with an improvement in oil prices (USO) (USL).

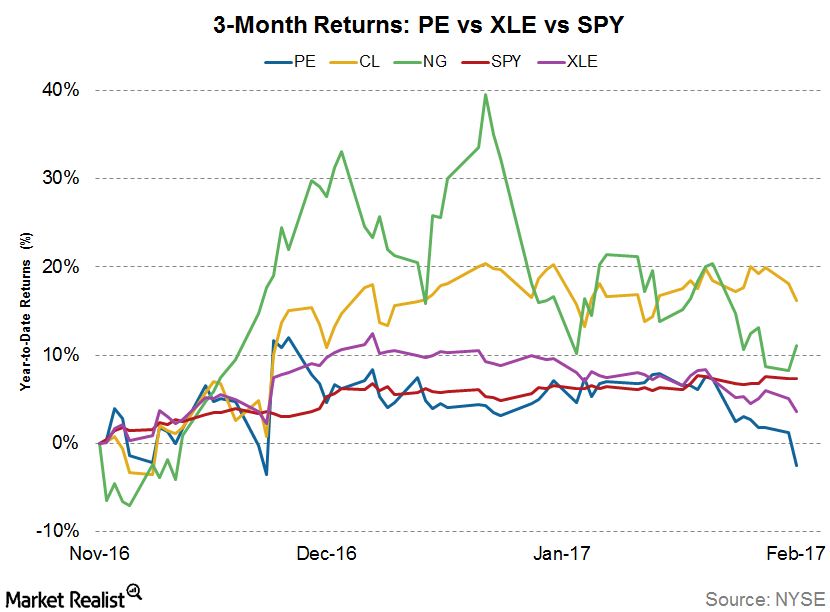

How Did Parsley Energy’s Stock React to Acquisition News?

Parsley Energy’s (PE) latest acquisition news came after markets closed on February 7, 2017.

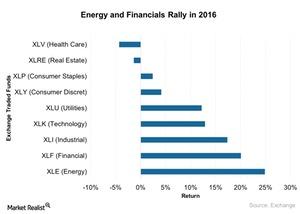

2016 US Sector Performance: Top Performers in Energy and Financials

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure.

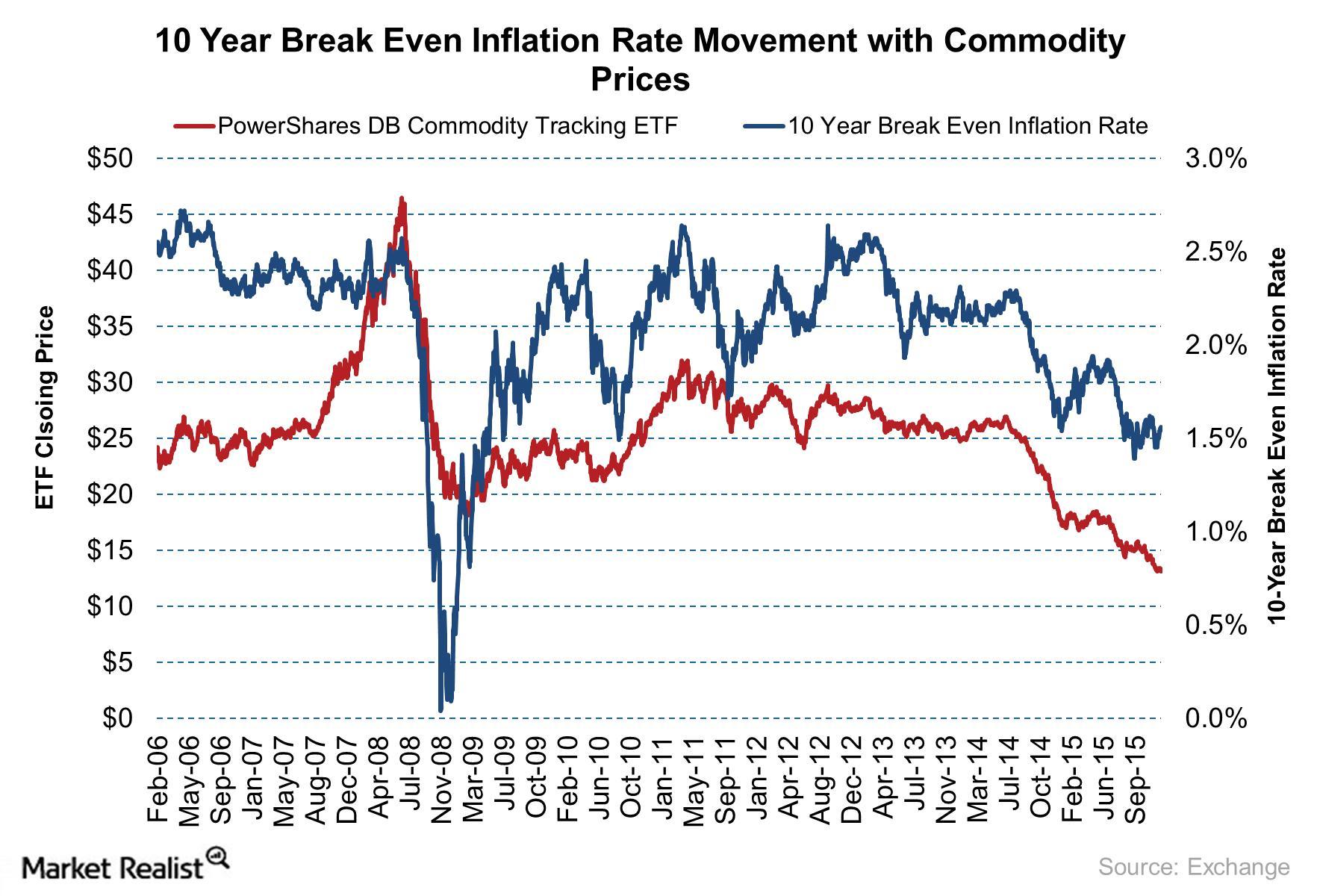

Goldman Sachs Is Long on the 10-Year US Breakeven Inflation Rate

After the announcement of the US election results, the 10-Year US Breakeven Inflation Rate showed an uptick. Goldman Sachs has advised investors to go long on the rate.

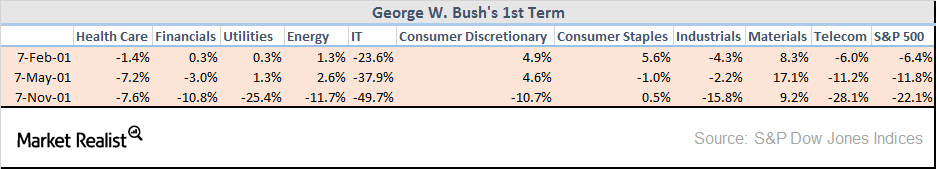

Which Sectors to Invest in If Donald Trump Wins

When Republican George H.W. Bush was elected president, the S&P 500 rose 8.5% three months after the election. It had a return of 11.2% six months after the election.

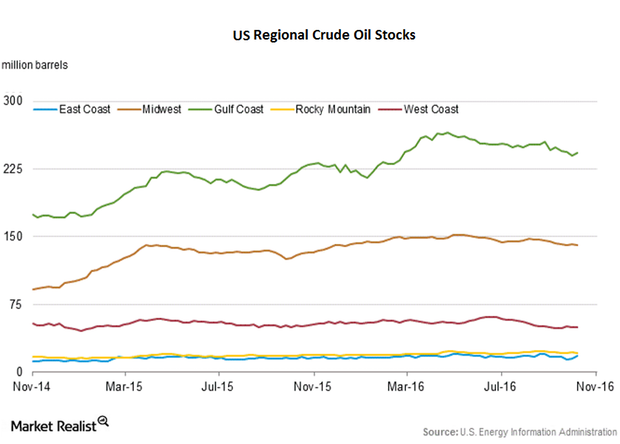

Analyzing US Crude Oil Inventories by Region: The Latest

The EIA divides the United States into five storage regions. Let’s assess the changes in crude oil inventories for these regions between September 30 and October 7.

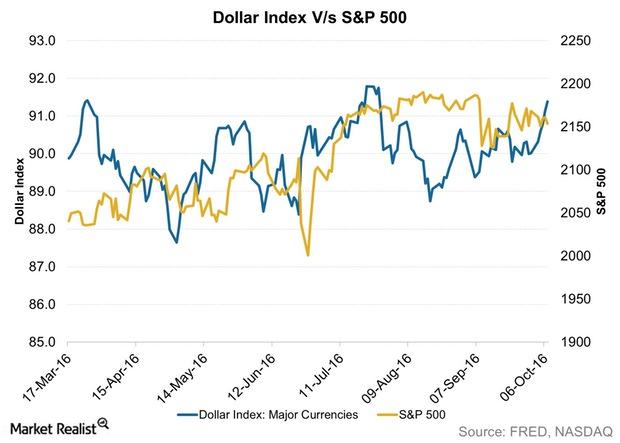

How Does a Strong Dollar Affect Stocks?

The relationship between the US dollar and US stock indexes can be best said to be complex. It’s mostly a change in the greenback that impacts stocks.

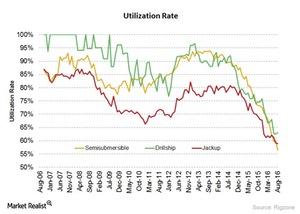

How Are Offshore Drilling Rig Utilization Rates Trending?

The rig utilization rate has drastically fallen compared to its historical rates. The utilization rate is an important indicator to gauge demand and activity in the offshore drilling industry.