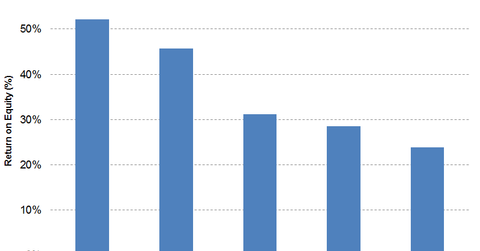

The Top 5 Upstream Companies Based on Return on Equity

The company with the highest trailing 12-month ROE (return on equity) as of 3Q17 is Carrizo Oil & Gas (CRZO) with an ROE of 52.1%.

Jan. 10 2018, Published 8:06 a.m. ET

Why return on equity is important

Equity and debt financing are the two major sources of financing in the capital-intensive upstream or oil and gas exploration and production industry.

Therefore, in order to measure management’s effectiveness in investing shareholder equity, an important metric to consider is ROE (return on equity). A company’s ROE is a profitability measure that indicates how much profit it has generated with the money invested by its shareholders.

In this series, we’ll look at the top five upstream companies based on their TTM (trailing 12-month) ROE.

The data we’ll use will be based on upstream companies included in these three key energy sector ETFs:

CRZO and LPI come in at the top

The company with the highest TTM ROE as of 3Q17 is Carrizo Oil & Gas (CRZO) with an ROE of 52.1%.

Laredo Petroleum (LPI) reported the second-highest operating TTM ROE of 45.7% in 3Q17.

NFX, MTDR, and DVN

Newfield Exploration (NFX), Matador Resources (MTDR), and Devon Energy (DVN) all made the top five upstream companies by TTM ROE. NFX’s ROE in 3Q17 was 31.1%, while MTDR’s TTM ROE came in at 28.5%. DVN’s TTM ROE was 23.8%.

In the rest of this series, we’ll look at the individual ROE trends for these companies.