Matador Resources Co

Latest Matador Resources Co News and Updates

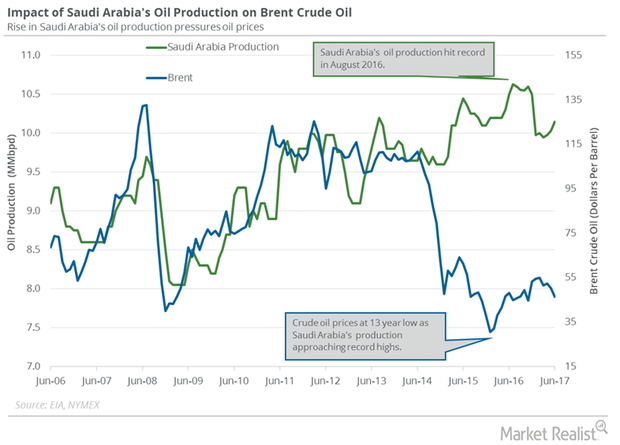

Will Saudi Arabia’s Crude Oil Export Plans Rescue Oil Prices?

Saudi Arabia is the largest crude oil producer and exporter among the OPEC (Organization of the Petroleum Exporting Countries) member countries.

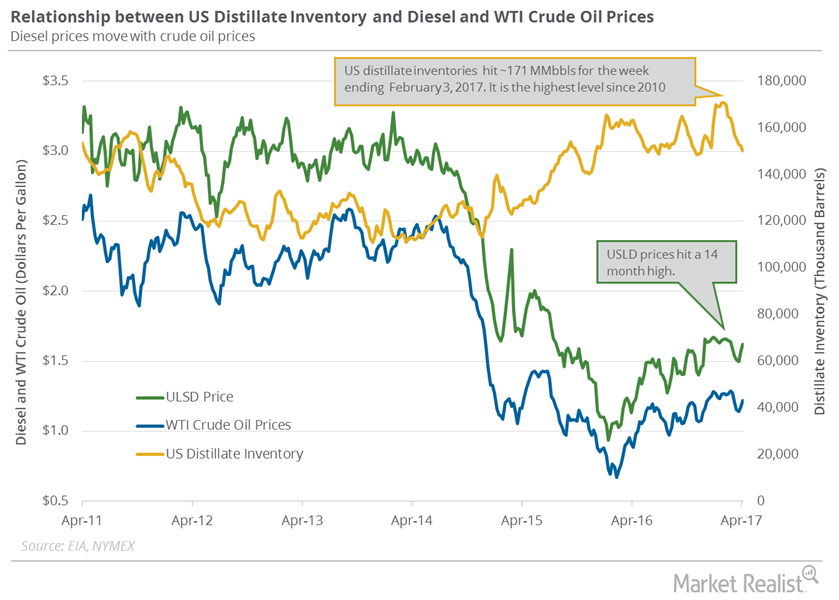

How US Distillate Inventories Affect Diesel and Oil Prices

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2.2 MMbbls (million barrels) to 150.2 MMbbls between March 31 and April 7, 2017.

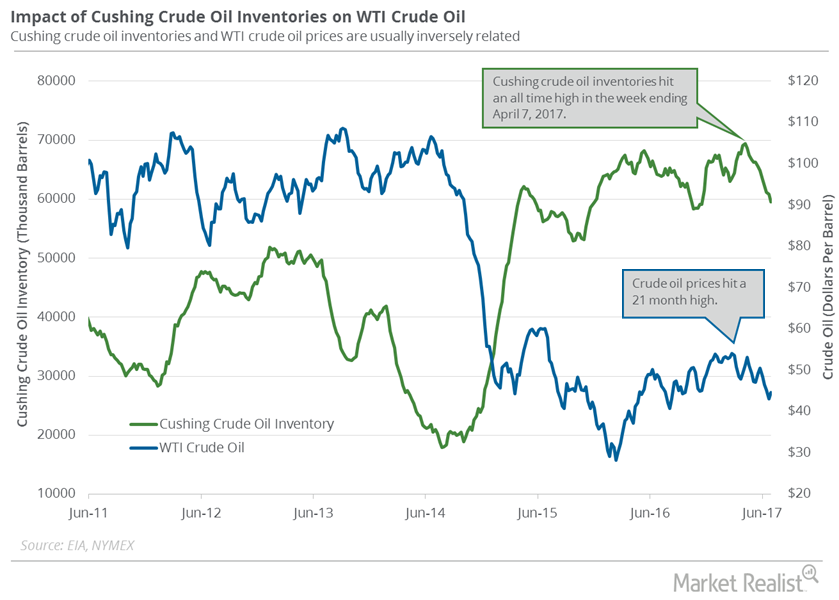

Cushing Inventories: Lowest Level since November 2016

Cushing inventories could have fallen on June 30–July 7, 2017. Crude oil inventories at Cushing have fallen for the seventh straight week.

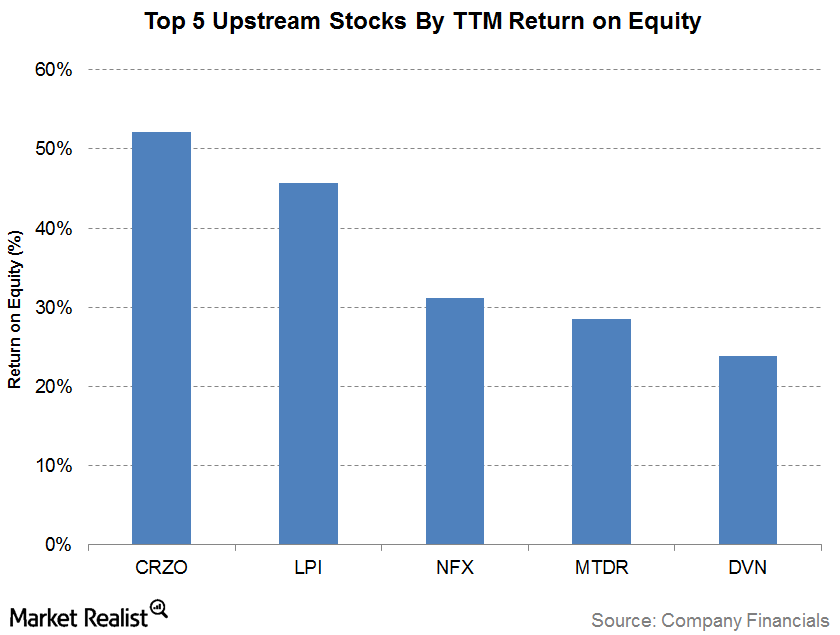

The Top 5 Upstream Companies Based on Return on Equity

The company with the highest trailing 12-month ROE (return on equity) as of 3Q17 is Carrizo Oil & Gas (CRZO) with an ROE of 52.1%.

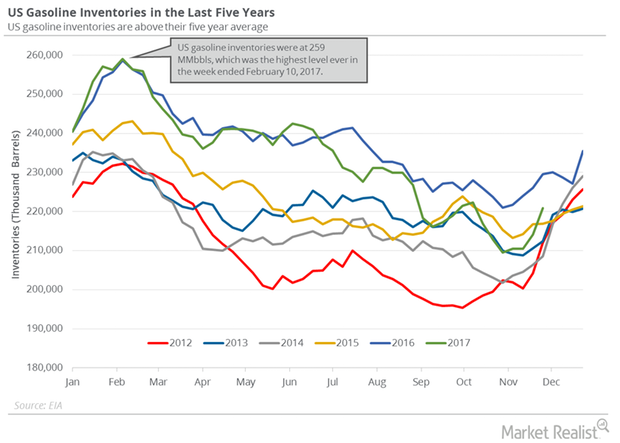

US Gasoline Inventories Add More Pain to Crude Oil Futures

According to the EIA, US gasoline inventories rose by 6,780,000 barrels to 220.8 MMbbls (million barrels) on November 24–December 1, 2017.

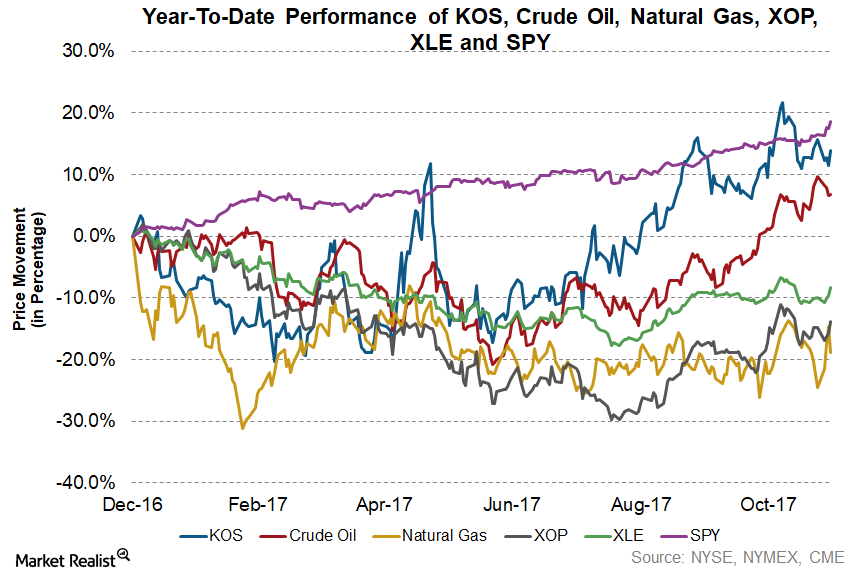

The Fourth-Best-Performing Upstream Stock Year-to-Date

In 9M17, KOS’s production increased ~107.0% to ~7.8 million barrels when compared with 9M16.

US Gasoline Inventories Fell for 4th Time in 5 Weeks

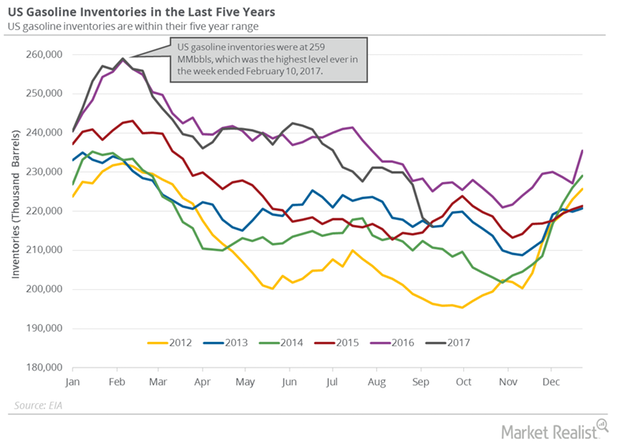

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories fell 2.1 MMbbls (million barrels), or 1%, to 216.1 MMbbls between September 8, 2017, and September 15, 2017.

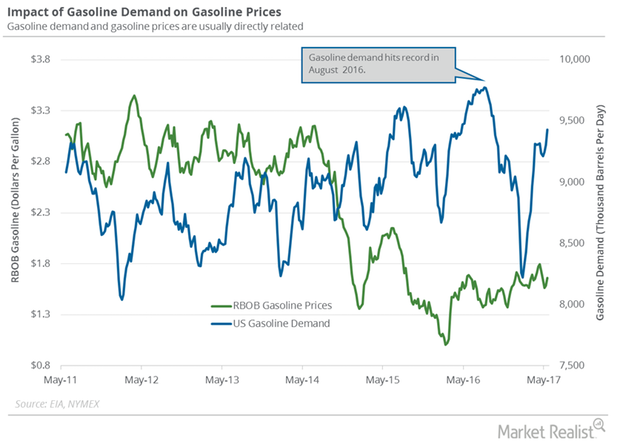

US Gasoline Consumption Rose in May

The EIA estimates that US gasoline consumption averaged 9,600,000 bpd (barrels per day) in May 2017—0.16 MMbpd higher than the same period in 2016.

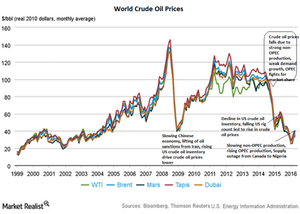

Why Did Crude Oil Prices Diverge before OPEC’s Meeting?

July WTI (West Texas Intermediate) crude oil futures contracts trading in NYMEX fell by 0.47% and settled at $49.1 per barrel on Tuesday, May 31, 2016.