Carrizo Oil & Gas Inc

Latest Carrizo Oil & Gas Inc News and Updates

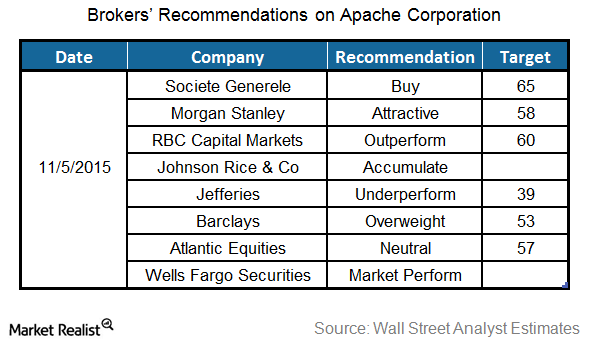

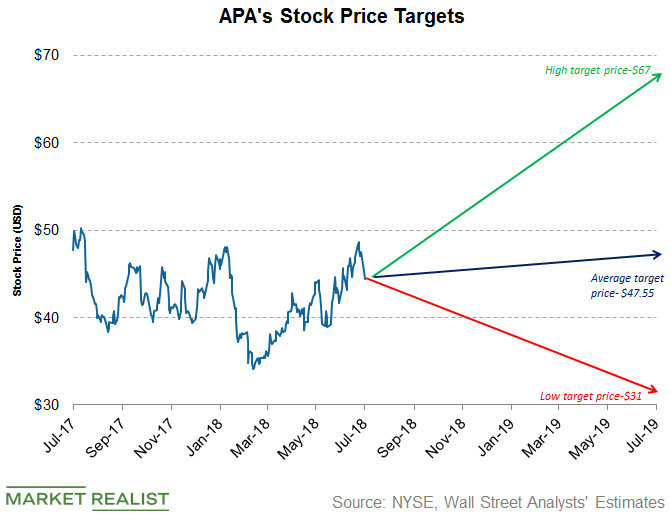

What Are Analyst Recommendations for Apache?

Wall Street analysts gave mixed recommendations after Apache’s quarterly results. Apache shares fell 5% on November 6, 2015, after the earnings release.

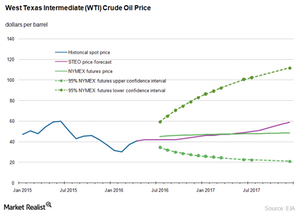

Why Goldman Sachs Revised Its Crude Oil Price Forecast

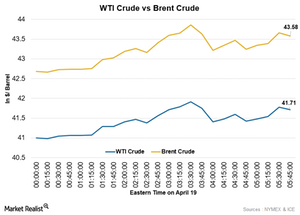

Goldman Sachs (GS) forecast that Brent crude oil prices could test $50 per barrel in 2H16 due to recent supply outages.

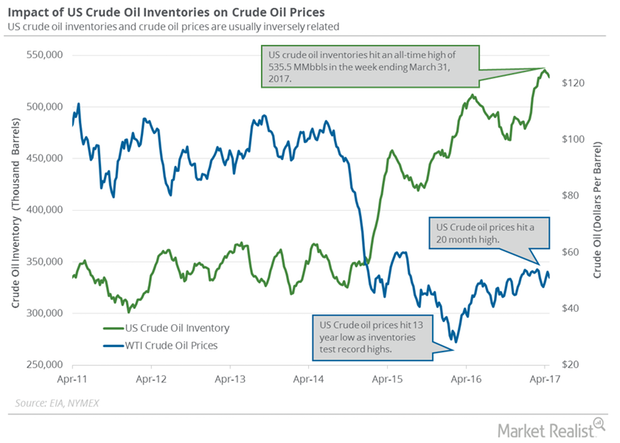

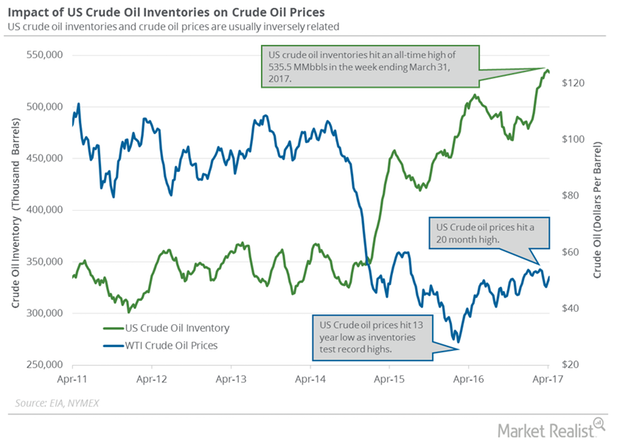

US Crude Oil Inventory Report Might Disappoint Traders

An unexpected increase in US oil inventories pressured WTI oil (USO) (UCO) prices in post-settlement trade on November 28, 2017.

Will US Crude Oil Prices Outperform in 2H17?

WTI crude oil (BNO) (PXI) (UCO) (XOP) prices have fallen 18% year-to-date. They have fallen 7% in the past year due to bearish drivers.

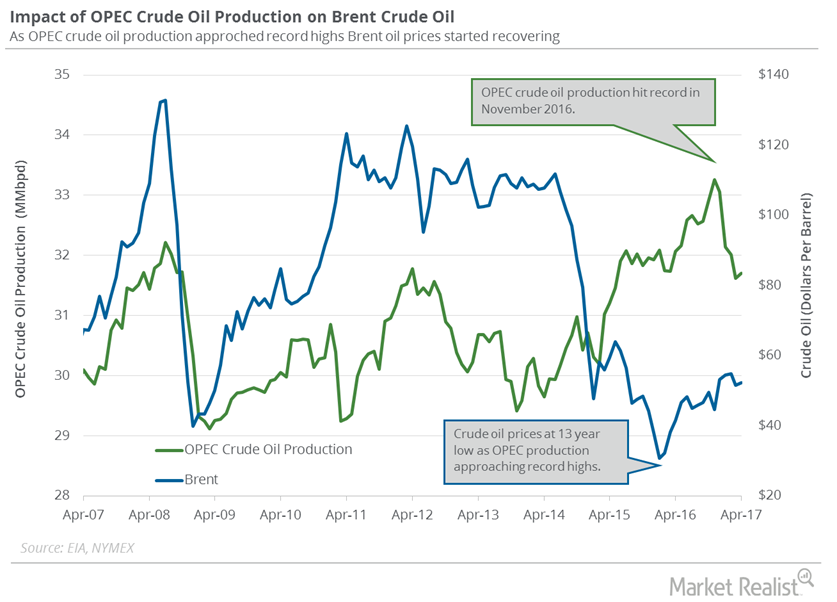

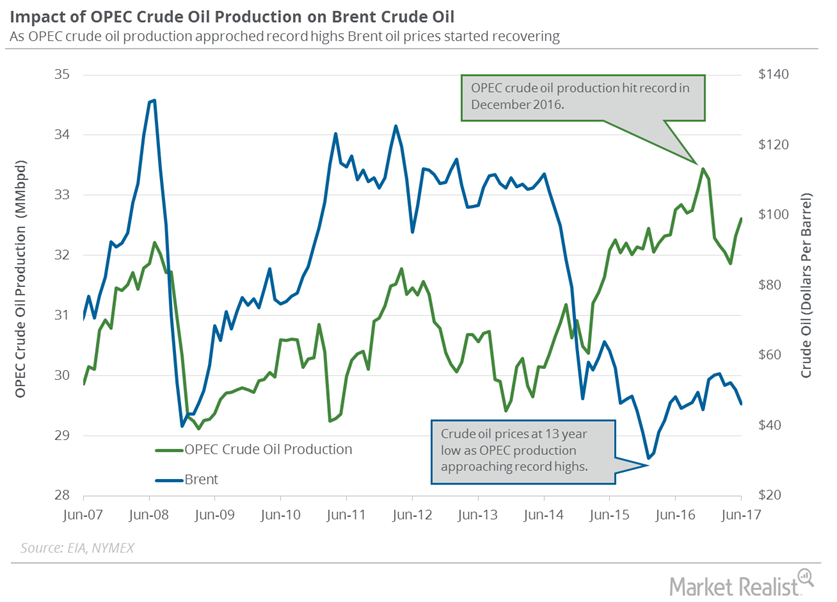

OPEC’s Crude Oil Production: Key for Crude Oil Traders?

A Bloomberg survey estimates that OPEC’s crude oil production rose by 315,000 bpd to 32.21 MMbpd in May 2017—compared to the previous month.

How OPEC and Non-OPEC Producers Affect Crude Oil Prices

Crude oil (BNO) (PXI) (USL) (USO) (UCO) prices were up ~4% between December 7, 2016, and December 19, 2016.

Near-Record US Crude Oil Inventory: Will Oil Blood Bath Continue?

June WTI crude oil futures contracts fell 0.40% and were trading at $48.68 per barrel in electronic trade at 2:35 AM EST on May 2, 2017.

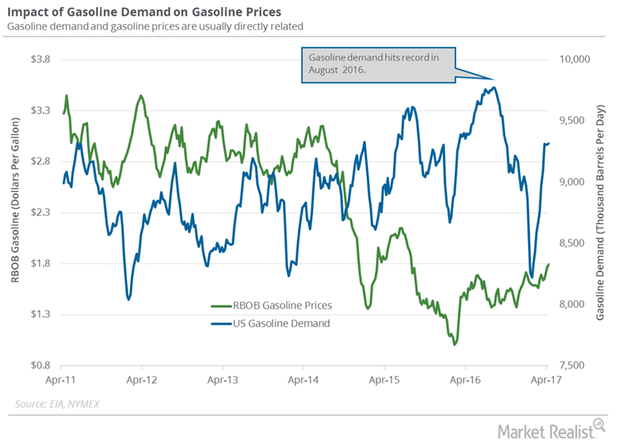

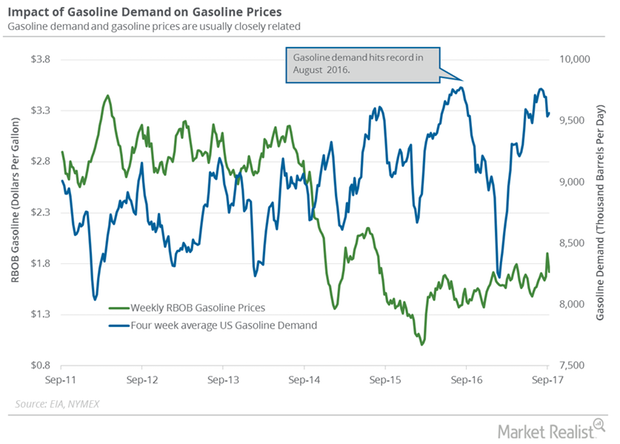

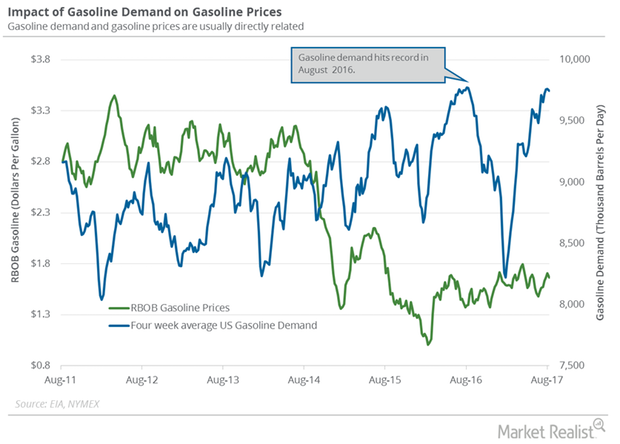

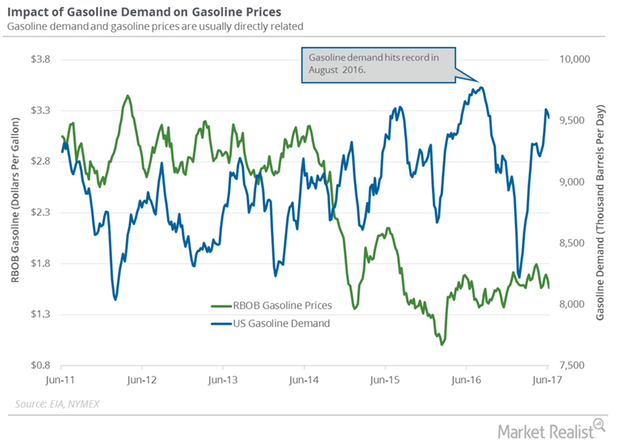

US Gasoline Demand: Bullish or Bearish for Oil Prices?

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand rose by 6,000 bpd to 9,317,000 bpd on April 7–14.

Will the EIA’s Crude Oil Inventories Support Crude Oil Bulls?

On April 18, 2017, the API released its weekly crude oil inventory report. It reported that US crude oil inventories fell by 0.84 MMbbls from April 7–14.

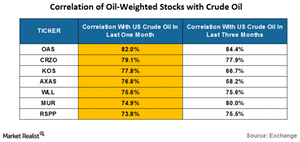

Crude Oil’s Comeback: Analyzing Oil-Weighted Stocks

On August 15, 2016, US crude oil (USO) (OIIL) (USL) (SCO) contracts for September delivery closed at $45.74 per barrel—2.8% above its previous closing price.

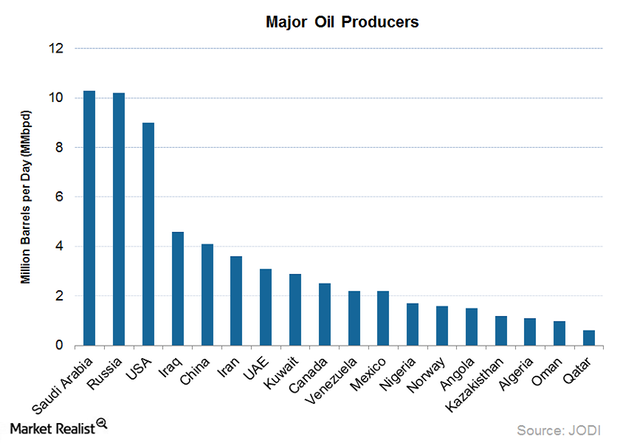

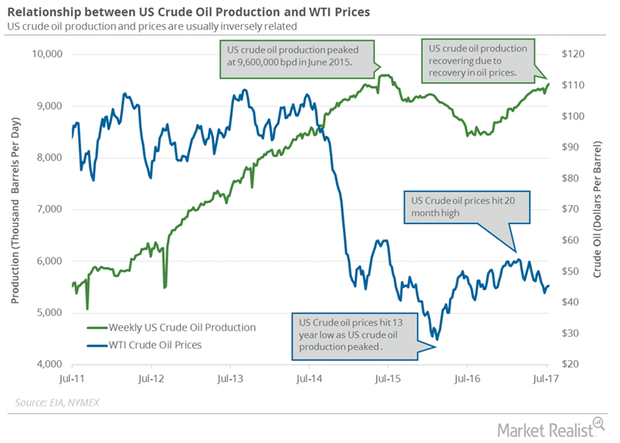

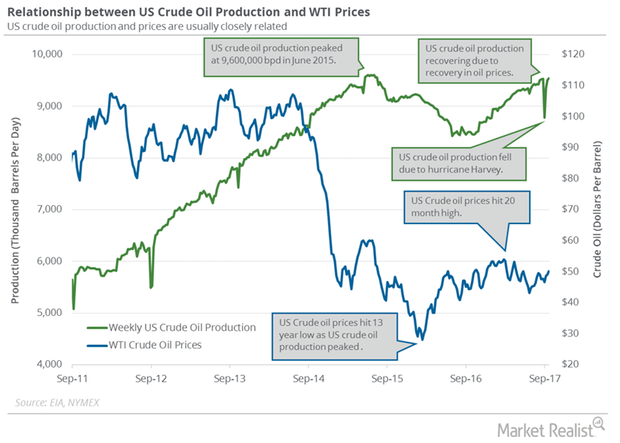

US Crude Oil Production Could Hit a Record

The EIA reported that US crude oil production rose by 32,000 bpd (barrels per day) to 9,429,000 bpd on July 7–14, 2017. Production is at a two-year high.

Apache Stock: What Are Analysts’ Recommendations?

On June 11, Argus upgraded Apache stock from “hold” to “buy.” On March 7, UBS initiated coverage on Apache stock with a “sell” rating.

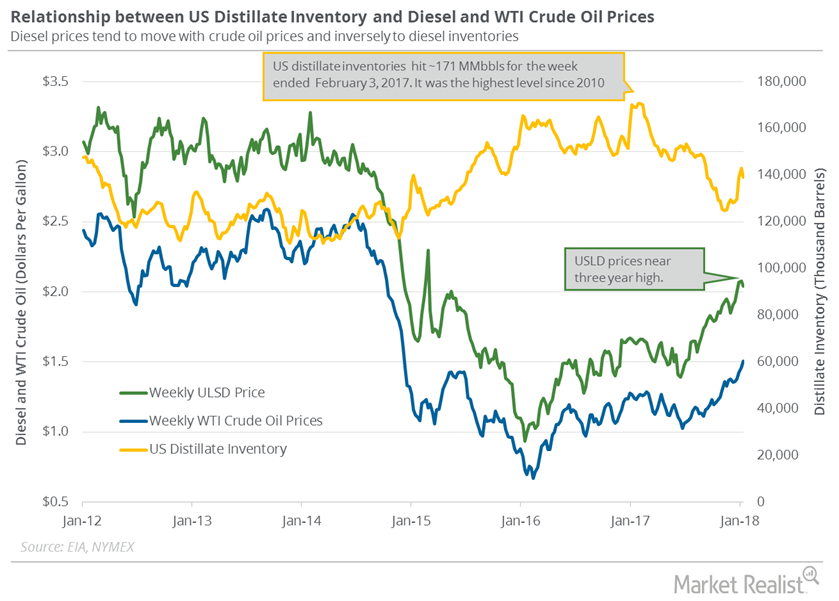

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

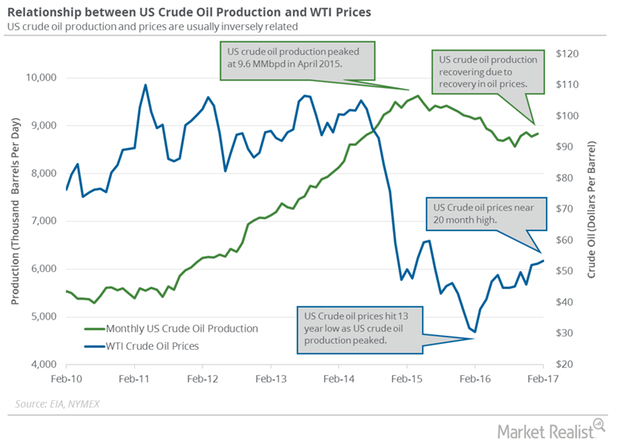

Monthly US Crude Oil Production Hit May 2016 High

The EIA reported that monthly US crude oil production rose by 60,000 bpd (barrels per day) to 8.8 MMbpd in January 2017—compared to the previous month.

What US Crude Oil Production’s 26-Month High Could Mean

On September 27, 2017, the EIA estimated that US crude oil production rose 37,000 bpd (barrels per day) to ~9.5 MMbpd from September 15–22, 2017.

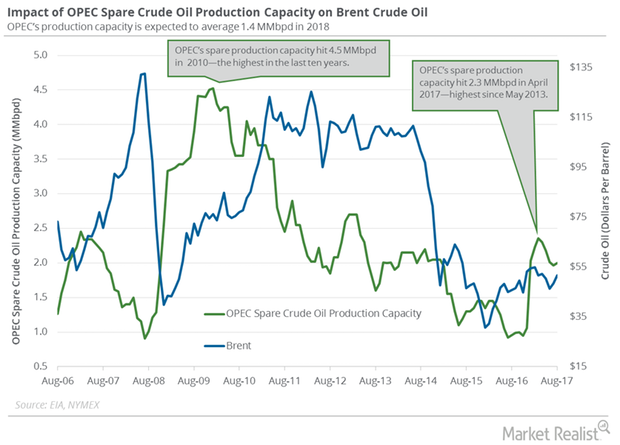

How OPEC’s Spare Crude Oil Production Capacity Is Recovering

The EIA estimates that OPEC’s spare crude oil production capacity rose 35,000 bpd (barrels per day) to 2 MMbpd (million barrels per day) in August 2017.

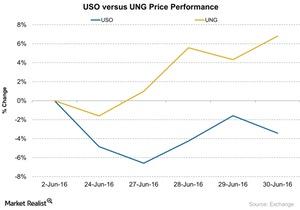

Why Did UNG Outperform USO?

From June 23—30, the United States Natural Gas ETF (UNG) outperformed the United States Oil ETF (USO). UNG rose ~6.8%, while USO fell ~3.4%.

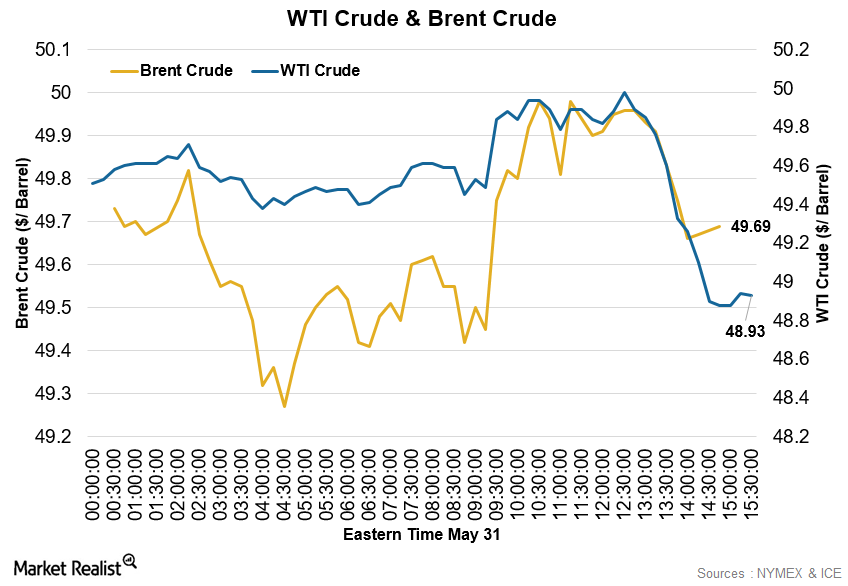

How Did Crude Oil Perform on Tuesday, May 31?

Crude oil had a volatile trading day on Tuesday, May 31, 2016. At 1:40 PM EDT, WTI crude for July delivery traded at $49.67 per barrel, a gain of 0.67%.

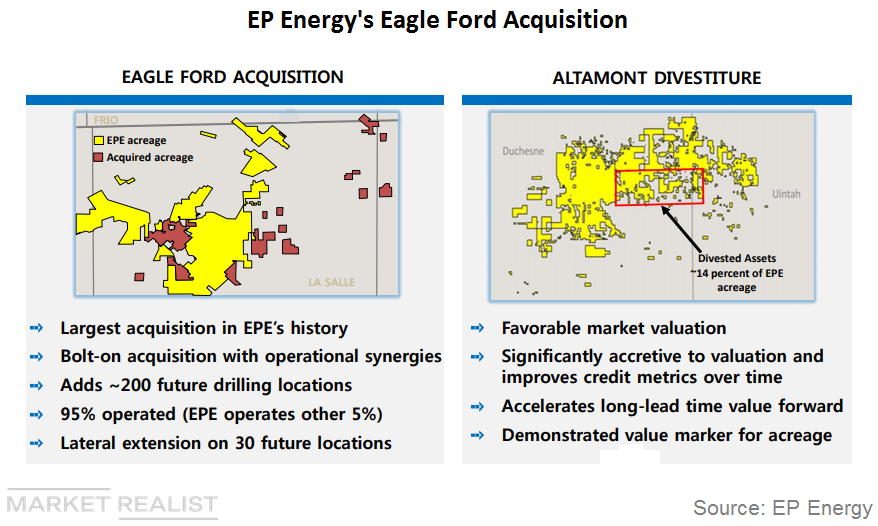

Is EP Energy Increasing Its Focus on Eagle Ford?

In February, EP Energy (EPE) announced that it had closed the acquisition of Carrizo Oil & Gas’s (CRZO) Eagle Ford assets.

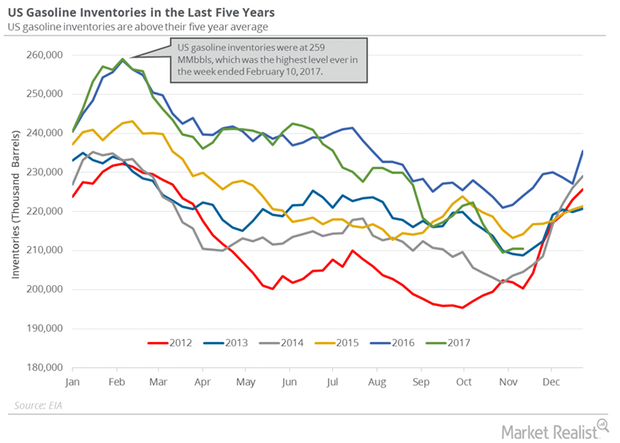

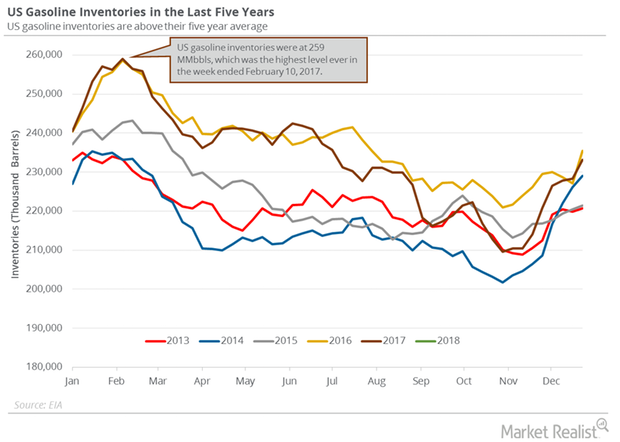

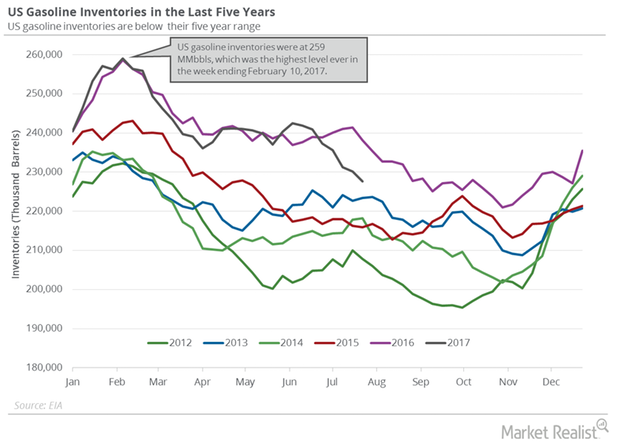

US Gasoline Inventories: More Concerns for Oil in 2018?

US gasoline inventories rose by 4.1 MMbbls (million barrels) to 237.3 MMbbls between December 29, 2017, and January 5, 2018.

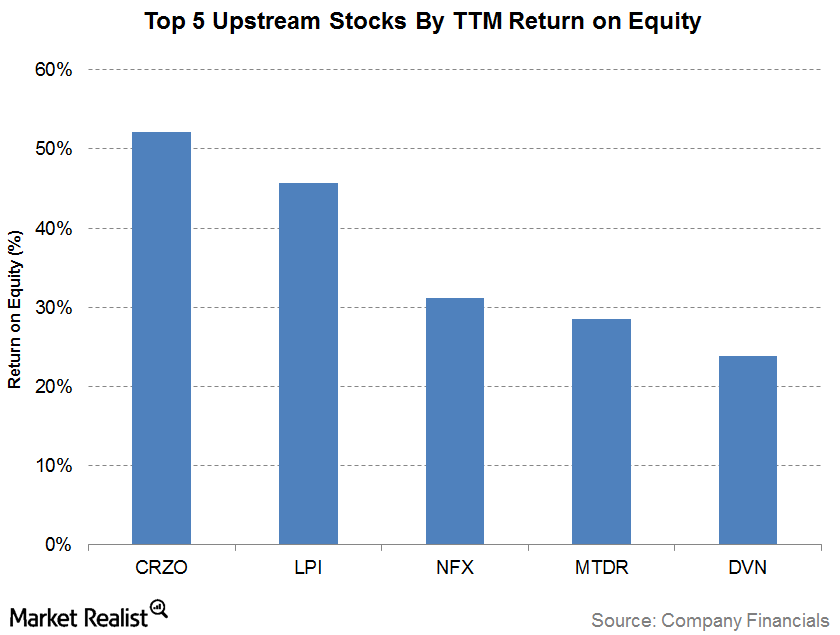

The Top 5 Upstream Companies Based on Return on Equity

The company with the highest trailing 12-month ROE (return on equity) as of 3Q17 is Carrizo Oil & Gas (CRZO) with an ROE of 52.1%.

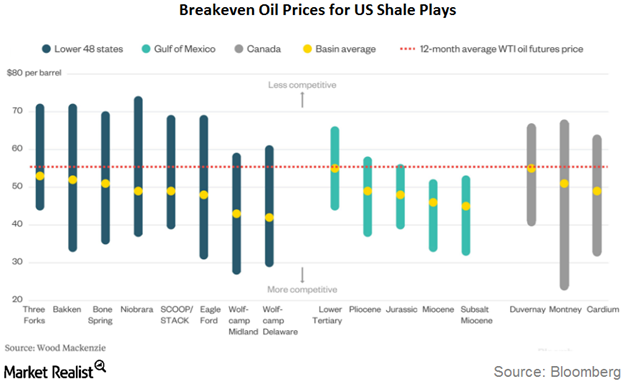

A Look at Breakeven Prices and Trends i n Eagle Ford Well

According to IHS, the top quintile wells are dominated by EOG Resources (EOG), Marathon Oil (MRO), and ConocoPhillips (COP).

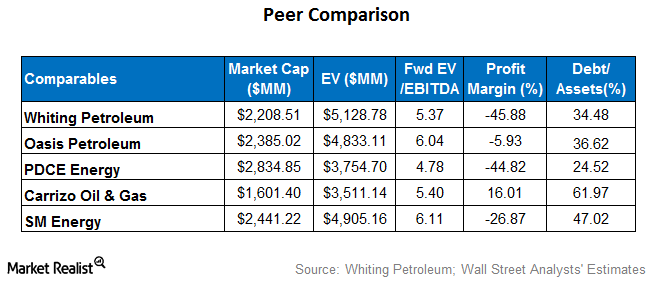

Where Whiting Petroleum Stands Next to Peers

Whiting Petroleum’s (WLL) forward EV-to-EBITDA multiple of ~5.4x is mostly in line with the peer average of 5.5x.

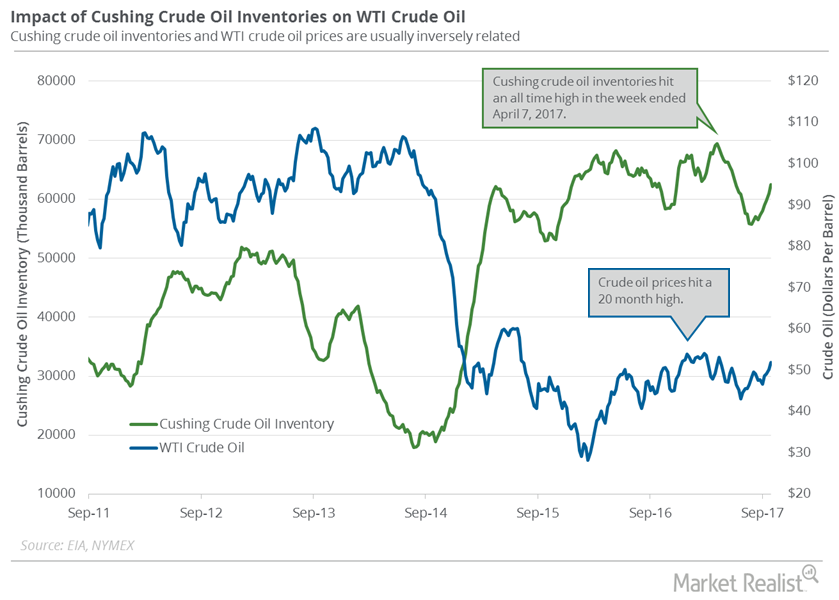

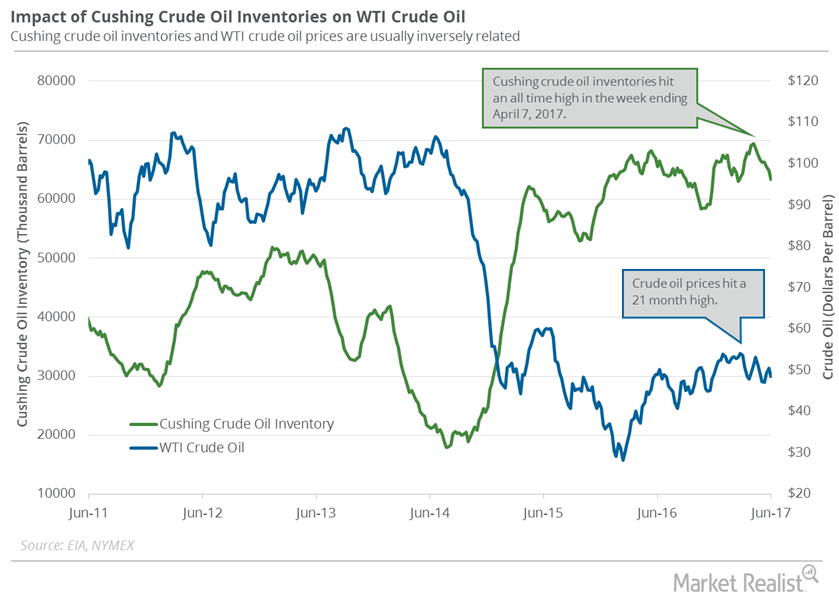

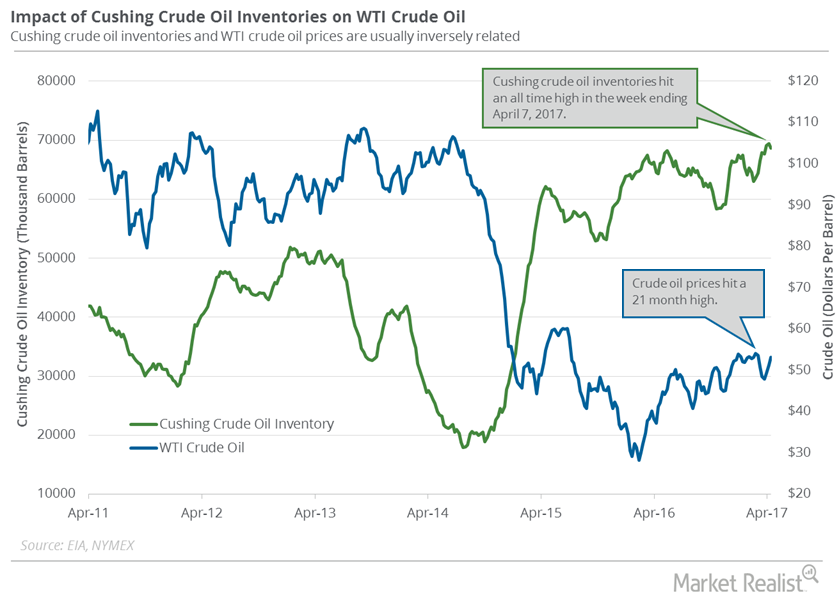

Cushing Inventories Are above Their 5-Year Average

Cushing crude oil inventories rose for the sixth consecutive week. Any rise in Cushing inventories is bearish for crude oil (USO) (USL) (SCO) prices.

US Gasoline Demand: Are the Crude Oil Bears Taking Control?

Weekly US gasoline demand rose by 81,000 bpd to 9.5 MMbpd on September 15–22, 2017. Gasoline demand rose by 642,000 bpd or 7.2% YoY.

Will US Gasoline Demand Impact Gasoline and Crude Oil Futures?

The EIA estimates that weekly US gasoline demand rose 107,000 bpd (barrels per day), or 1.1%, to 9.6 MMbpd between August 11 and August 18.

US Gasoline Inventories Limit the Upside for Crude Oil Futures

US gasoline inventories rose by 3.4 MMbbls to 231.1 MMbbls on July 28–August 4, 2017. Inventories rose for the third time in the last ten weeks.

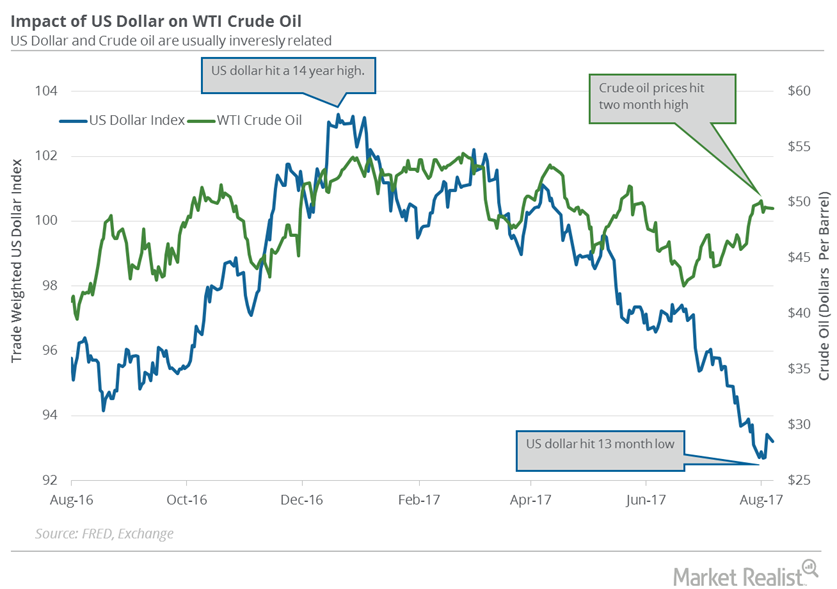

US Dollar Recovers from a 13-Month Low

The US Dollar Index rose 0.77% to 93.7 on August 4, 2017. The US dollar rose due to the better-than-expected rise in US unemployment data.

Problems for Crude Oil Bulls as OPEC Production Hits 2017 High

September US crude oil futures contracts rose 0.20% and were trading at $50.29 per barrel in electronic trading at 1:35 AM EST on August 1, 2017.

US Gasoline Demand: Positive or Negative for Crude Oil?

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand rose by 547,000 bpd or 6% to 9,816,000 bpd on June 9–16, 2017.

Cushing Crude Oil Inventories Fell Again

A recent survey estimated that inventories at Cushing could have fallen on June 2–9, 2017. Inventories at Cushing fell for the seventh time in ten weeks.

Cushing Crude Oil Inventories Fell for 3rd Consecutive Week

Market surveys estimate that Cushing crude oil inventories rose between April 28 and May 5, 2017.

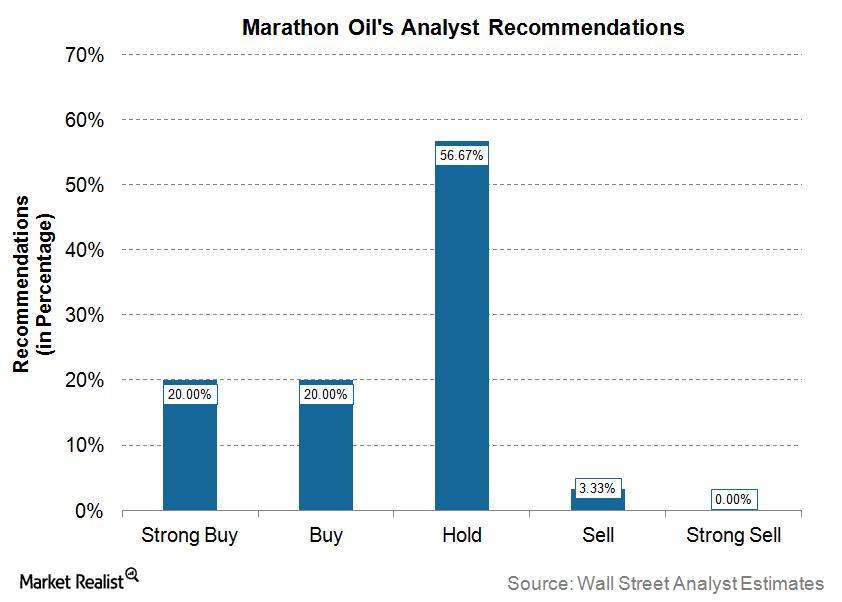

What Are Analysts Saying about Marathon Oil?

Recommendations Currently, 30 analysts cover Marathon Oil (MRO). They’ve given six “strong buy,” six “buy,” 17 “hold,” and one “sell” recommendation on the stock. There were no “strong sell” recommendations. Target price Analysts’ median target price for MRO is $20, which is ~25% higher than the closing price of $16.05 on February 9, 2017. The mean […]

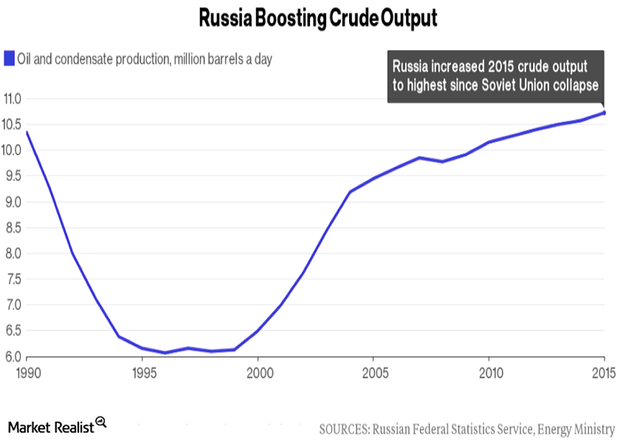

Russia’s Crude Oil Production Will Pressure the Crude Oil Market

Russia’s crude oil production rose to 10.84 MMbpd in June 2016—compared to the previous month—according to sources from the Russian Energy Ministry.

Why Did Oil Prices Rise This Morning?

Oil prices rose early today because of the oil workers’ strike in Kuwait. Here’s what you need to know.