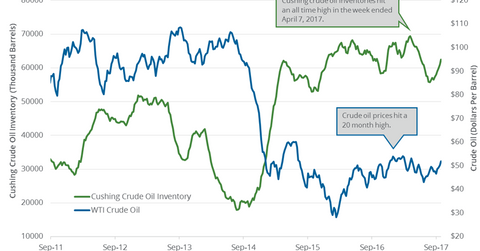

Cushing Inventories Are above Their 5-Year Average

Cushing crude oil inventories rose for the sixth consecutive week. Any rise in Cushing inventories is bearish for crude oil (USO) (USL) (SCO) prices.

Oct. 10 2017, Published 12:14 p.m. ET

Cushing inventories

A market survey estimates that the crude oil inventories at Cushing rose on September 29–October 6, 2017. Cushing crude oil inventories rose for the sixth consecutive week. Any rise in Cushing inventories is bearish for crude oil (USO) (USL) (SCO) prices.

Moves in crude oil prices impact oil and gas exploration and production companies’ (XLE) (XOP) (OIH) profitability like Continental Resources (CLR), Carrizo Oil & Gas (CRZO), and PDC Energy (PDCE).

EIA’s Cushing inventories

The EIA (U.S. Energy Information Administration) estimates that Cushing inventories rose by 1,525,000 barrels to 62.5 MMbbls (million barrels) on September 22–29, 2017. It’s the largest weekly gain since March 10, 2017. Cushing inventories rose 2.5% week-over-week. However, the inventories have fallen by 190,000 barrels or 0.3% YoY (year-over-year).

EIA’s US crude oil inventories

Nationwide crude oil inventories fell by 6 MMbbls to 464.9 MMbbls on September 22–29, 2017. Inventories fell 1.3% week-over-week and by 4.1 MMbbls or 0.8% YoY. For the week ending September 29, 2017, US crude oil inventories were 23% above the five-year average.

Impact

Cushing inventories are at the highest level since June 2, 2017. They’re also above the five-year average by 16.5 MMbbls or 36% YoY. They have risen by 6.6 MMbbls or 12% in the last ten weeks.

High US and Cushing crude oil inventories could weigh on crude oil (SCO) (DBO) prices. Lower crude oil prices have a bearish impact on oil and gas producers (RYE) (VDE) (XES) like Carrizo Oil & Gas and PDC Energy.

In the next part, we’ll analyze how the US crude oil rig count impacts crude oil prices.