PDC Energy Inc

Latest PDC Energy Inc News and Updates

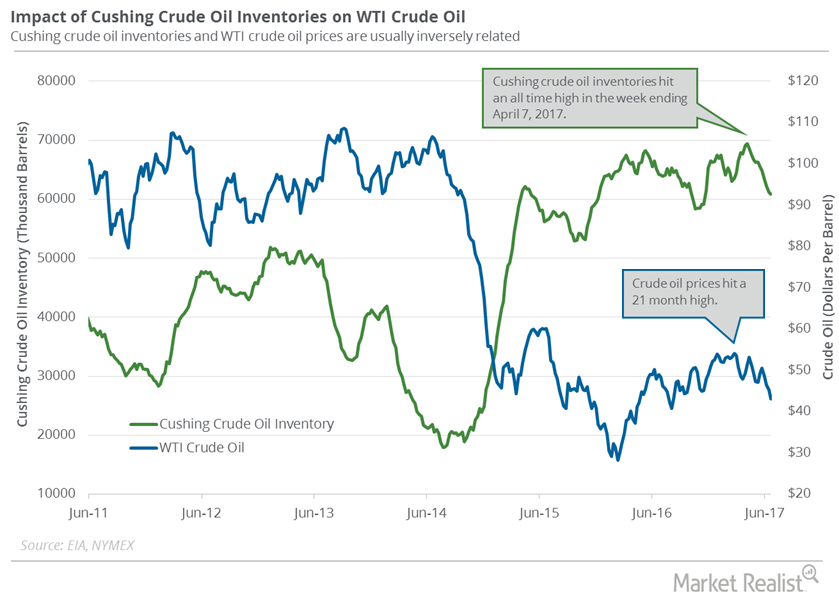

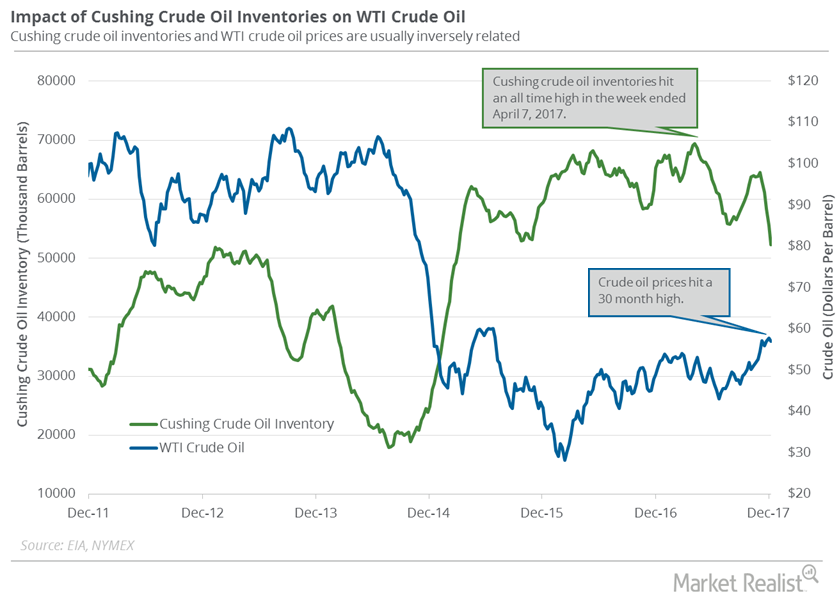

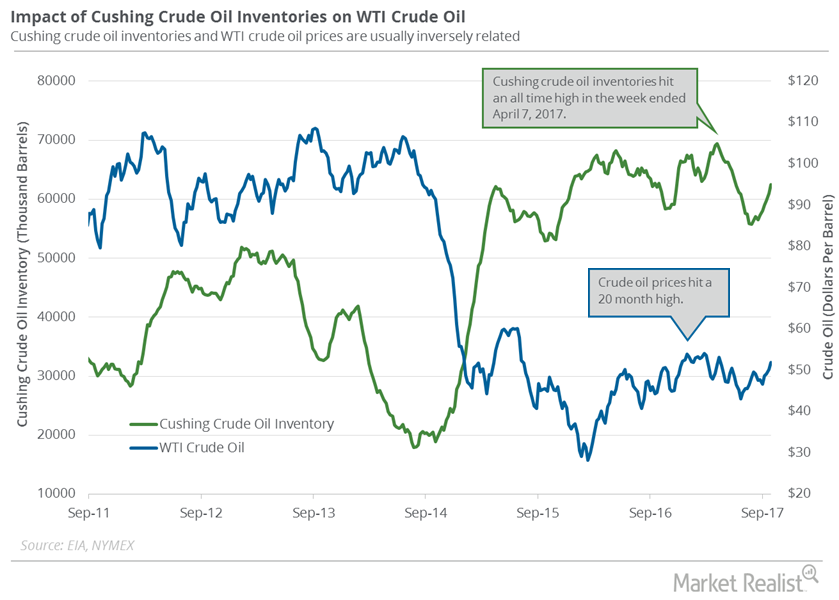

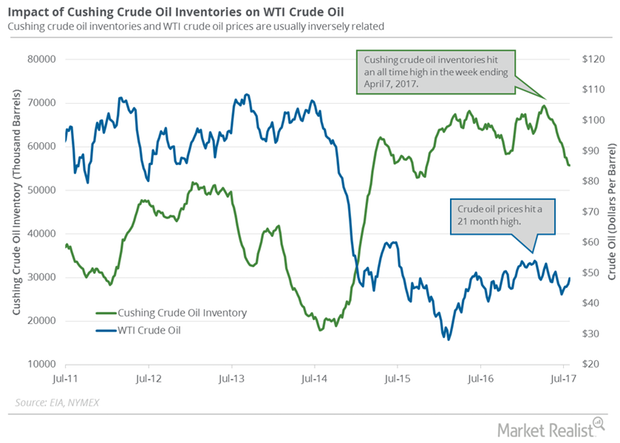

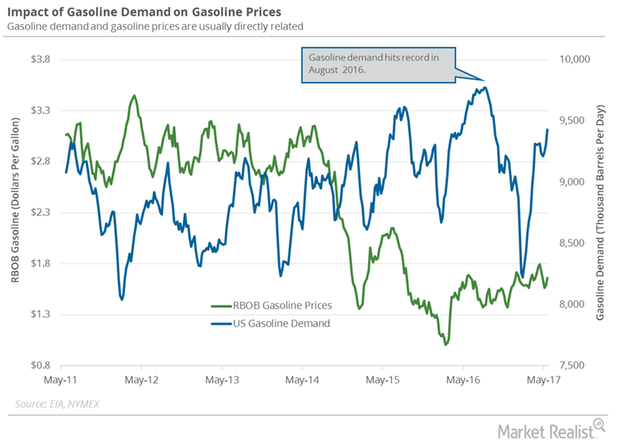

Cushing Inventories Have Fallen 10% in the Last 10 Weeks

Cushing crude oil inventories have fallen 10% in the last ten weeks. A better-than-expected fall in Cushing inventories could support US crude oil prices.

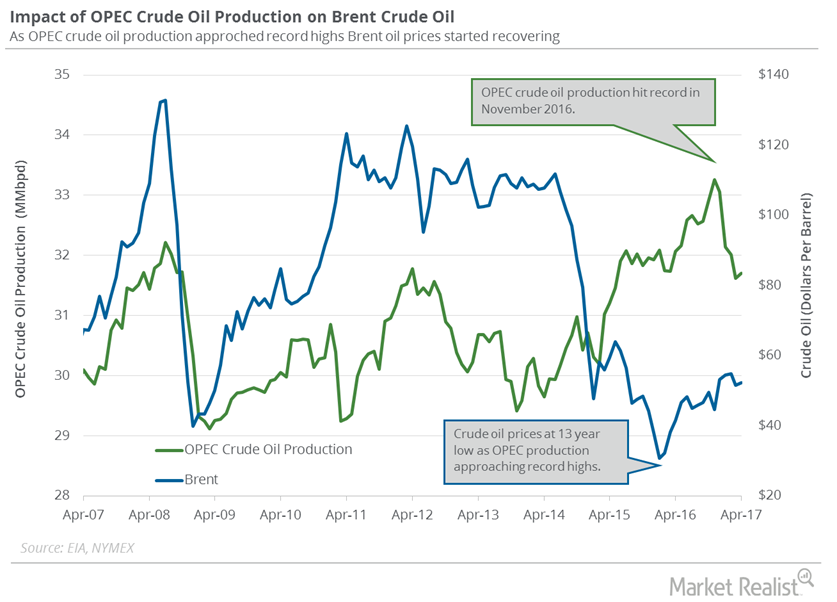

OPEC’s Crude Oil Production: Key for Crude Oil Traders?

A Bloomberg survey estimates that OPEC’s crude oil production rose by 315,000 bpd to 32.21 MMbpd in May 2017—compared to the previous month.

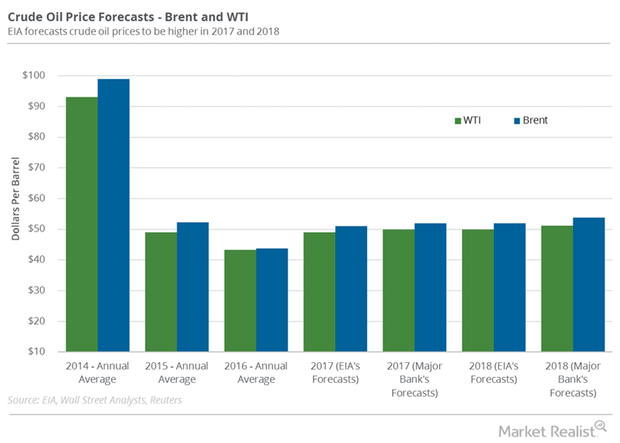

Crude Oil: Price Forecasts and Hedge Funds’ Position

Hedge funds increased their net long positions in US crude oil futures and options by 43,861 contracts or 18.4% to 282,362 contracts on July 25–August 1.

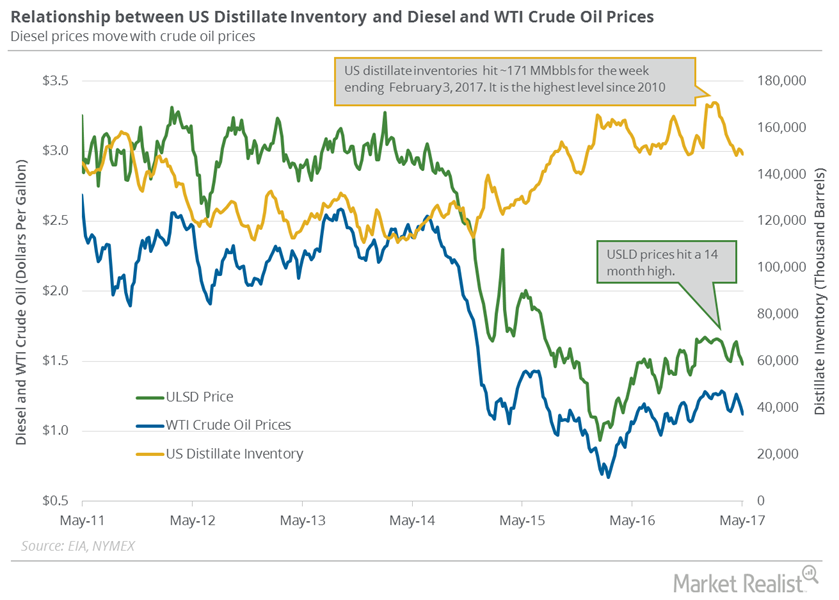

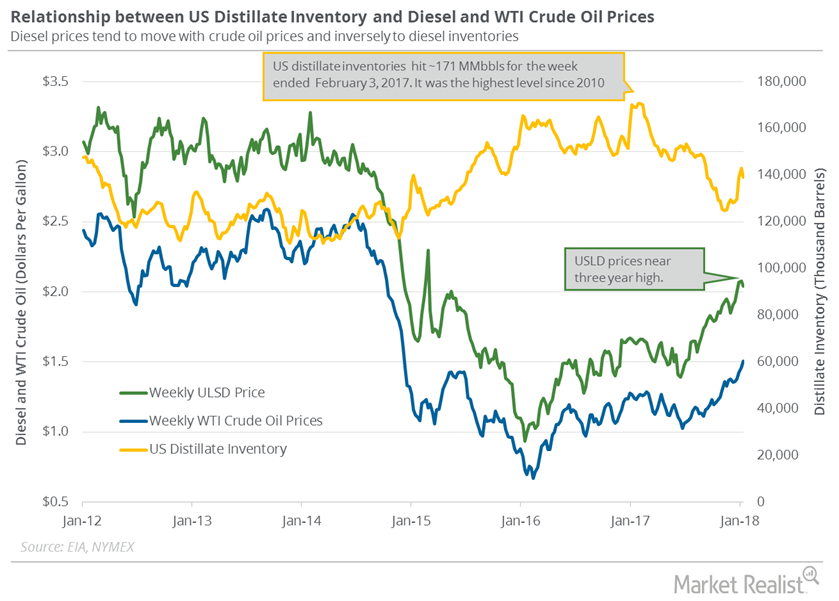

Why Did US Distillate Inventories Fall Again?

June diesel futures contracts rose 2.1% to $1.47 per gallon on May 10, 2017. Prices rose due to the larger-than-expected fall in distillate inventories.

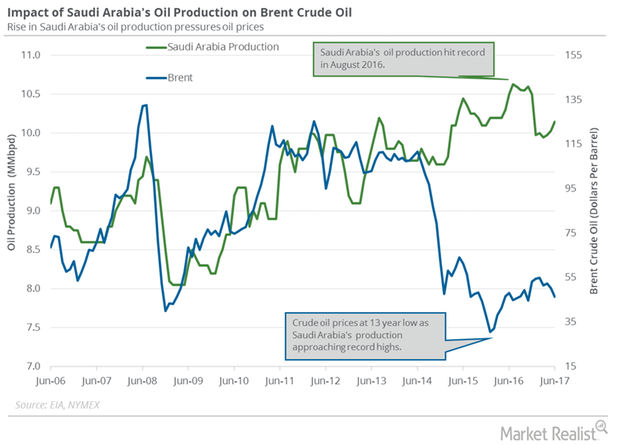

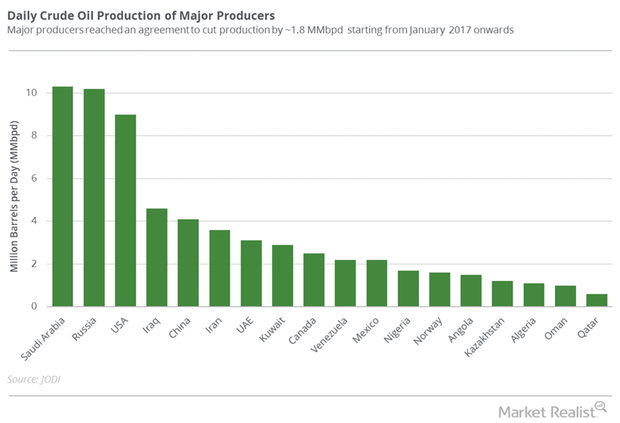

Will Saudi Arabia Remove Excess Oil from the Market?

Saudi Arabia is expected to cut exports 10% to North Asian refiners in September 2017 due to OPEC’s production cut deal.

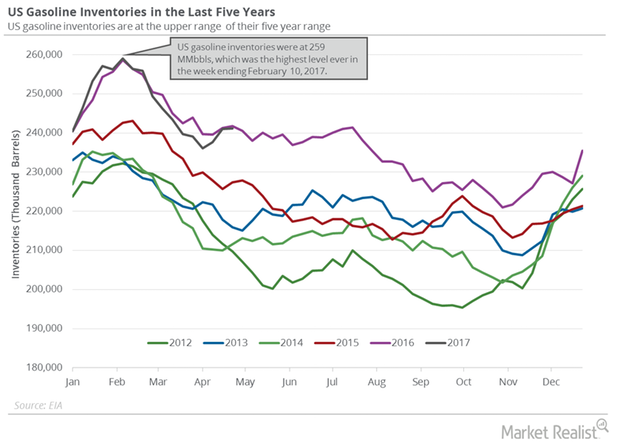

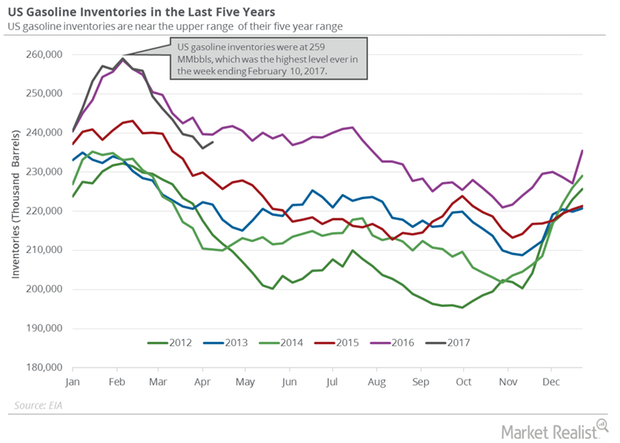

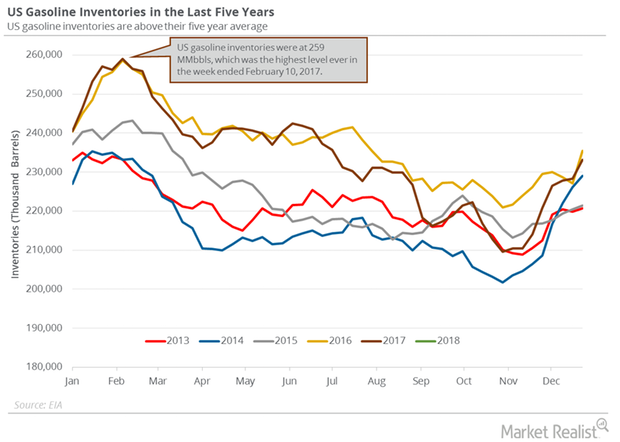

Why US Gasoline Inventories Rose for the Third Straight Week

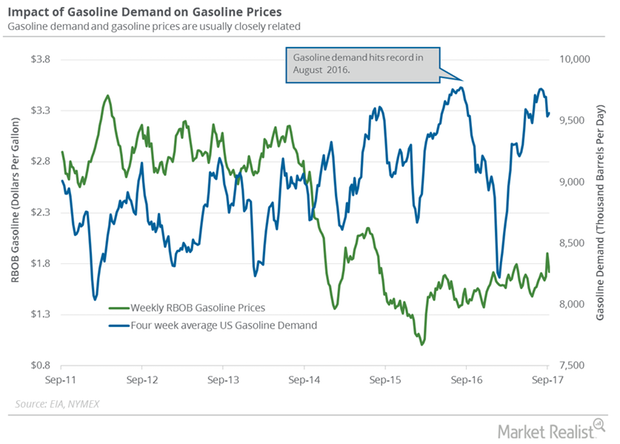

A less-than-expected rise in gasoline inventories supported gasoline prices on May 3, 2017. Gasoline and crude oil (DIG) (SCO) (VDE) prices rose on May 3.

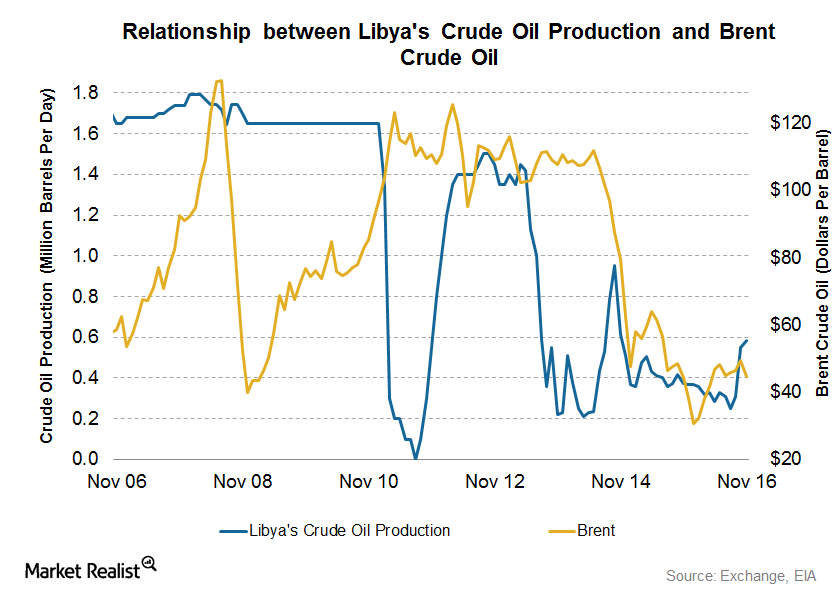

Libya, Iran, and Nigeria Could Impact Crude Oil Prices in 2017

Libya’s crude oil production On December 20, 2016, Libya’s National Oil Corporation reported that pipelines leading from the Sharara and El Feel fields were reopened. The pipelines were closed for two years due to militant attacks. The pipelines are expected to add 270,000 bpd (barrels per day) of crude oil supply over the next three months. The […]

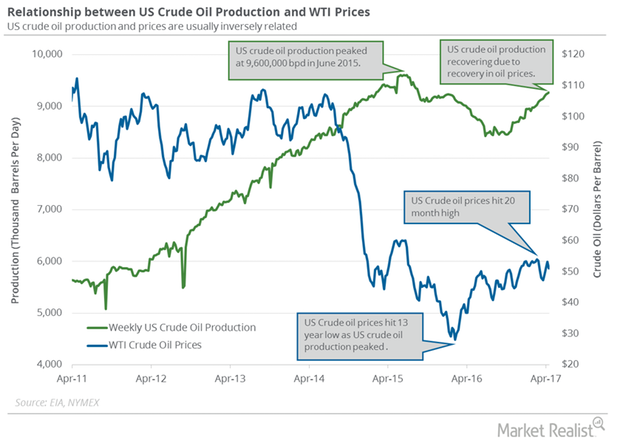

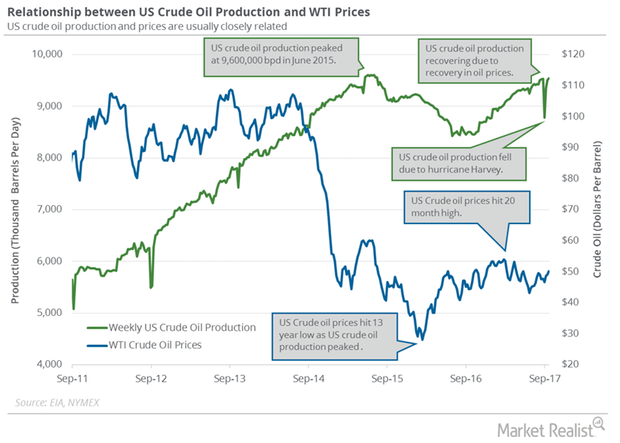

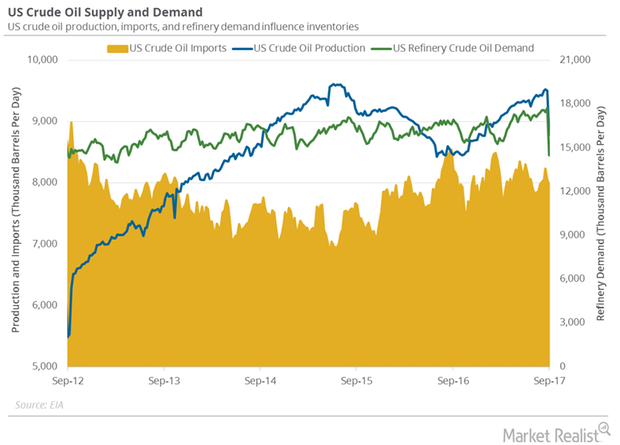

US Crude Oil Production Is near August 2015 High

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 13,000 bpd (barrels per day) to 9,265,000 bpd on April 14–21.

US Distillate Inventories Fell for the Tenth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2 MMbbls to 148.3 MMbbls on April 7–14, 2017.

US Distillate Inventories Fell for the Third Time in 10 Weeks

US distillate inventories fell by 3.8 MMbbls or 2.7% to 139.2 MMbbls on January 5–12, 2018. The inventories fell by 29.9 MMbbls or 18% from a year ago.

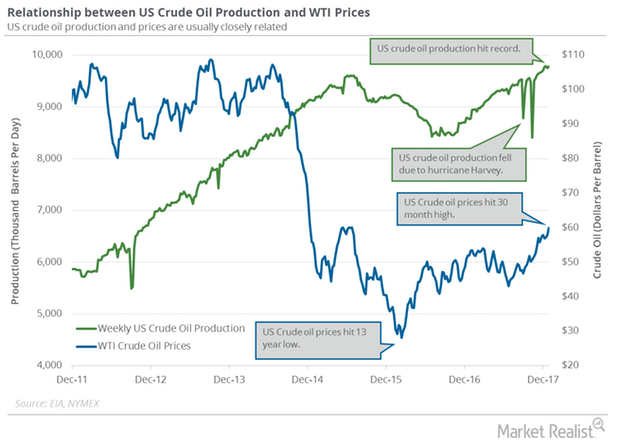

What US Crude Oil Production’s 26-Month High Could Mean

On September 27, 2017, the EIA estimated that US crude oil production rose 37,000 bpd (barrels per day) to ~9.5 MMbpd from September 15–22, 2017.

Will US Crude Oil Production Undermine Crude Oil Futures?

According to the EIA, US crude oil production increased by 28,000 bpd (barrels per day) to 9,782,000 bpd on December 22–29, 2017.

US Gasoline Inventories: More Concerns for Oil in 2018?

US gasoline inventories rose by 4.1 MMbbls (million barrels) to 237.3 MMbbls between December 29, 2017, and January 5, 2018.

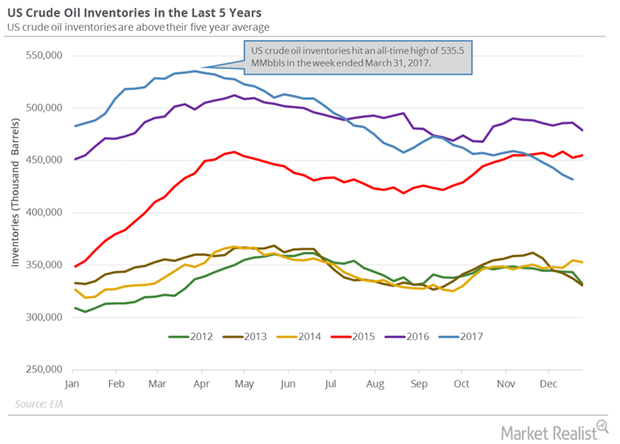

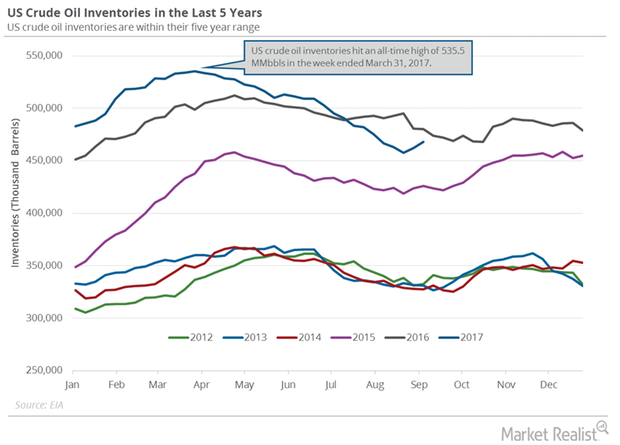

US Crude Oil Inventories Have Fallen ~10.6% in 2017

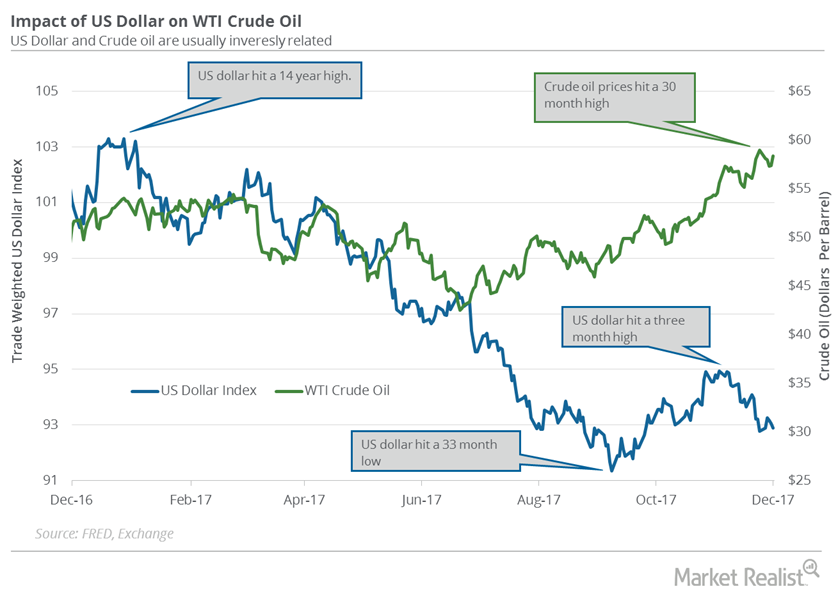

February WTI crude oil futures (DWT)(SCO) contracts rose 0.8% to $60.3 per barrel at 12:45 AM EST on December 29, 2017—the highest level since June 2015.

Cushing Inventories: Largest Weekly Fall since 2009

Cushing inventories fell by 3,317,000 barrels to 52.2 MMbbls (million barrels) on December 1–8, 2017, according to the EIA.

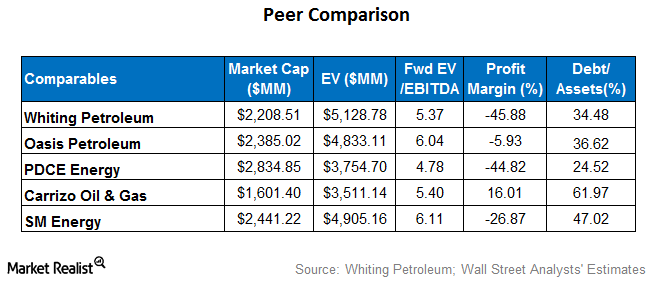

Where Whiting Petroleum Stands Next to Peers

Whiting Petroleum’s (WLL) forward EV-to-EBITDA multiple of ~5.4x is mostly in line with the peer average of 5.5x.

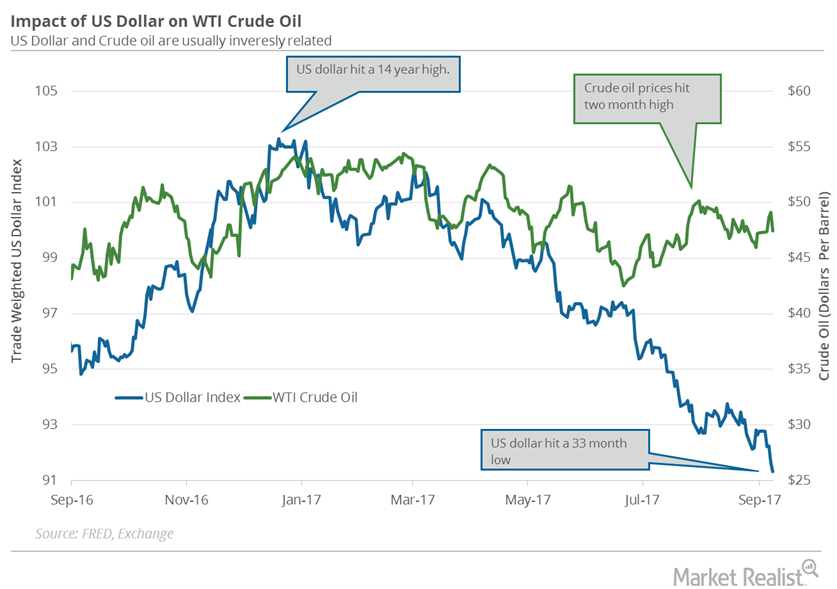

How Could US Tax Bill Affect Dollar and Crude Oil Prices?

The US Dollar Index advanced 0.1% to 92.8 last week. Consequently, it pressured oil prices during the week.

Cushing Inventories Are above Their 5-Year Average

Cushing crude oil inventories rose for the sixth consecutive week. Any rise in Cushing inventories is bearish for crude oil (USO) (USL) (SCO) prices.

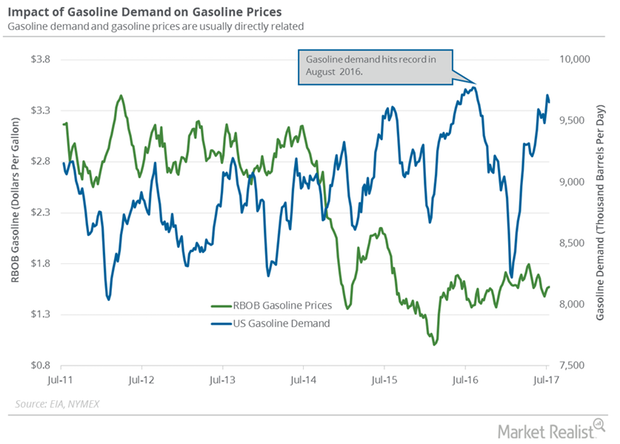

US Gasoline Demand: Are the Crude Oil Bears Taking Control?

Weekly US gasoline demand rose by 81,000 bpd to 9.5 MMbpd on September 15–22, 2017. Gasoline demand rose by 642,000 bpd or 7.2% YoY.

Will Major Oil Producers Extend the Output Cut Deal past March?

October WTI (West Texas Intermediate) crude oil (USO)(UCO)(DIG) futures contracts rose 0.16% and were trading at $49.98 per barrel in electronic trading at 2:10 AM EST on September 18.

Why US Crude Oil Inventories Rose Again

On September 13, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report.

Hurricanes Could Impact Global and US Crude Oil Demand

West Texas Intermediate crude oil (DBO) (DIG) (XLE) futures contracts for October delivery rose 1.2% to $48.07 per barrel on September 11, 2017.

Why the US Dollar Hit a 33-Month Low

The US Dollar Index fell 0.34% to 91.33 on September 8—the lowest level in the last 33 months. Prices fell due to the following factors.…

Cushing Inventories Fell 20% from the Peak

A preliminary market survey estimates that Cushing inventories fell on July 28–August 4, 2017. Inventories fell for the 11th consecutive week.

Why US Gasoline Demand Rose for 2nd Consecutive Month

The EIA (US Energy Information Administration) estimates that US gasoline demand rose 1.5% to 9.6 MMbpd (million barrels per day) in May 2017 compared to May 2016.

US Gasoline Demand Could Hit a Peak This Summer

The EIA estimated that four-week average US gasoline demand rose by 124,000 bpd (barrels per day) to 9,430,000 bpd on May 12–19, 2017.

Cushing Crude Oil Inventories Fell for 3rd Consecutive Week

Market surveys estimate that Cushing crude oil inventories rose between April 28 and May 5, 2017.

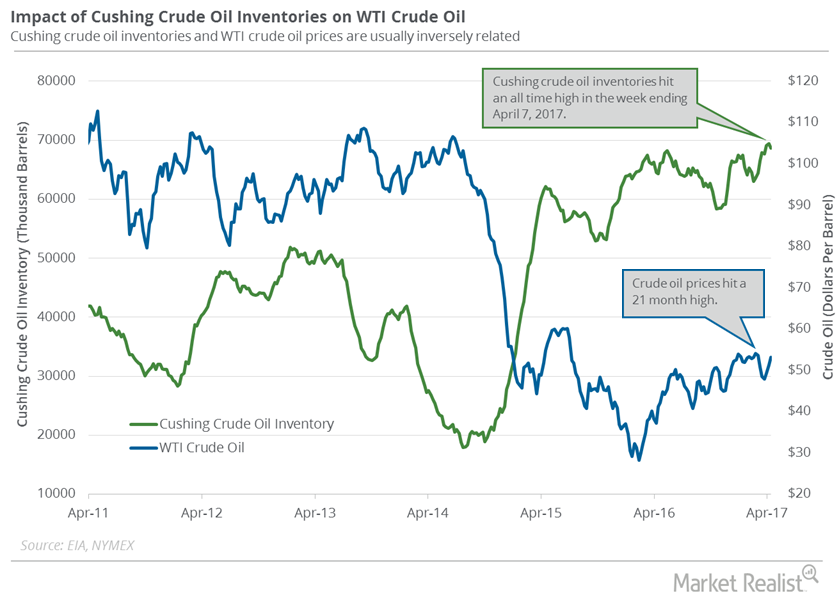

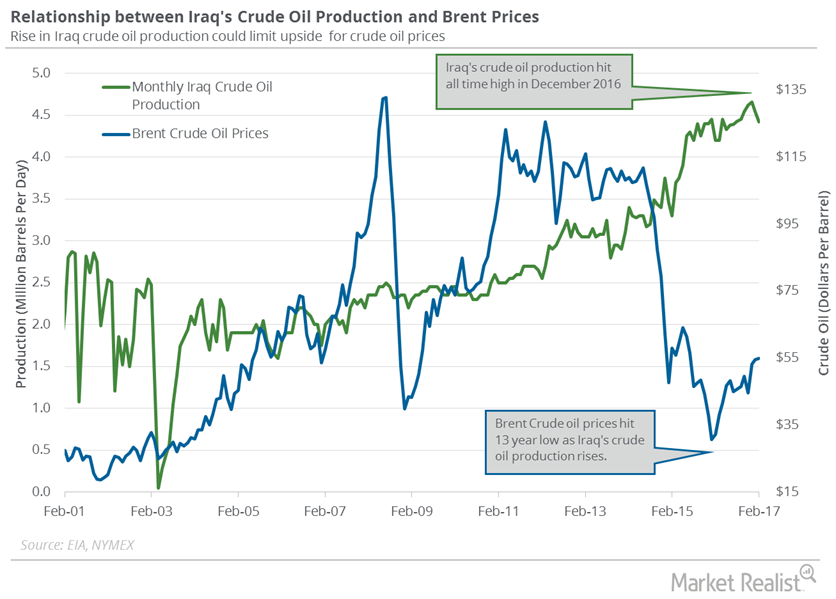

Iraq’s Crude Oil Production: More Pain for Crude Oil Bears

The EIA estimates that Iraq’s crude oil production fell by 115,000 bpd (barrels per day) to 4.42 MMbpd in February 2017—compared to the previous month.

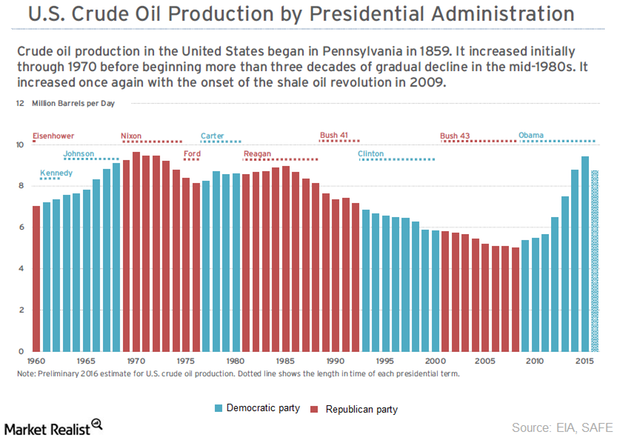

How Political Parties Impact US Crude Oil Production

Under President Obama’s tenure, US crude oil production rose 92% and peaked at 9.6 MMbpd (million barrels per day) in June 2015.

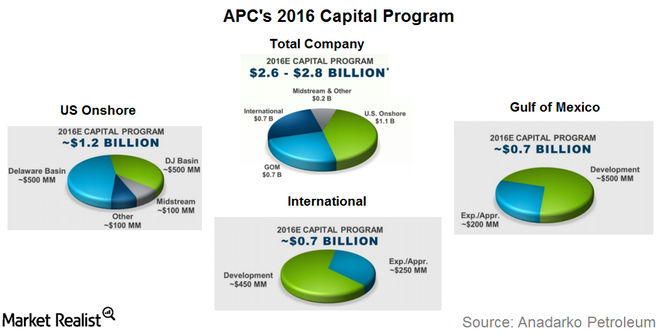

What Are Anadarko’s Capex Plans in 2016?

Anadarko Petroleum’s (APC) 2016 capex (capital expenditures) budget is $2.6 billion–$2.8 billion, a 50% reduction from $5.4 billion in 2015.

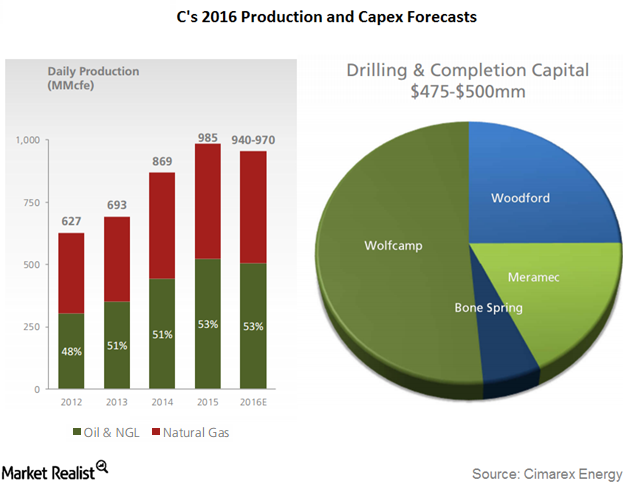

What Happened to Cimarex’s 1Q16 Production Volumes and Realized Prices?

Cimarex Energy’s (XEC) total production volume in 1Q16 was 973 MMcfe (millions of cubic feet equivalent). This represents a rise of ~3% YoY

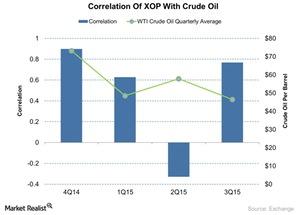

An Analysis of the Correlation between XOP and Crude Oil

Here we’ll present the results of a quarterly correlation analysis between crude oil and the SPDR S&P Oil & Gas Exploration & Production ETF (XOP).