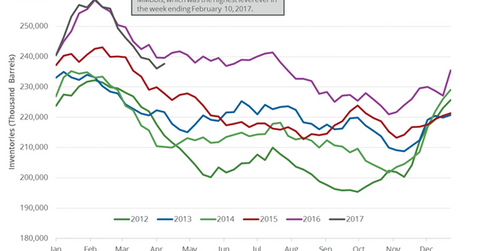

US Distillate Inventories Fell for the Tenth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2 MMbbls to 148.3 MMbbls on April 7–14, 2017.

Nov. 20 2020, Updated 12:13 p.m. ET

US distillate inventories

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2 MMbbls (million barrels) to 148.3 MMbbls on April 7–14, 2017. Surveys estimated that US distillate inventories would have fallen by 1 MMbbls on April 7–14, 2017.

US distillate inventories fell for the tenth consecutive week. Diesel futures contracts for May delivery fell 2.5% to $1.58 per gallon on April 19, 2017. Prices fell despite the fall in distillate inventories. Crude oil (DIG) (USO) (FXN) and diesel futures moved together on April 19, 2017.

Diesel prices usually move together with crude oil prices, as shown in the following chart. Moves in crude oil and diesel fuel prices impact US refiners and crude oil producers’ earnings like Western Refining (WNR), Valero (VLO), Swift Energy (SFY), and PDC Energy (PDCE). For more on crude oil prices, read Part 1 of this series.

Distillate production and demand

US distillate production rose by 90,000 bpd (barrels per day) to 5,150,000 bpd on April 7–14, 2017. US distillate imports rose by 49,000 bpd to 167,000 bpd for the same period. Weekly distillate demand fell by 458,000 bpd to 4,177,000 bpd during the same period.

Impact

US distillate inventories hit 170.7 MMbbls in the week ending February 3, 2017—the highest level since 2010. Since then, they have fallen ~15%. Falling distillate inventories are bullish for diesel prices. A rise in diesel prices is bullish for crude oil prices.

Read What Can Investors Expect in the Crude Oil Market in 2017 and EIA Downgraded Crude Oil Price Forecasts for 2017 and 2018 for more on crude oil prices.

Read Will Crude Oil Prices Test 3 Digits Again? for more on crude oil price forecasts.

For related analysis, visit Market Realist’s Energy and Power page.