Swift Energy Co

Latest Swift Energy Co News and Updates

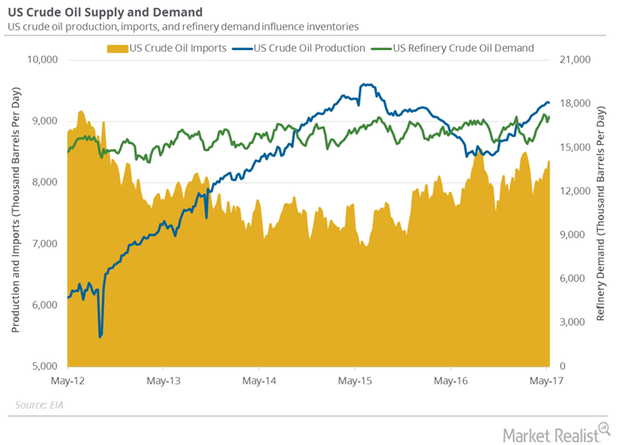

US Refinery Demand Impacts Crude Oil Inventories

US refineries operated at 93.4% of their operable capacity in the week ending May 5, 2017. The rise in refinery demand is bullish for crude oil prices.

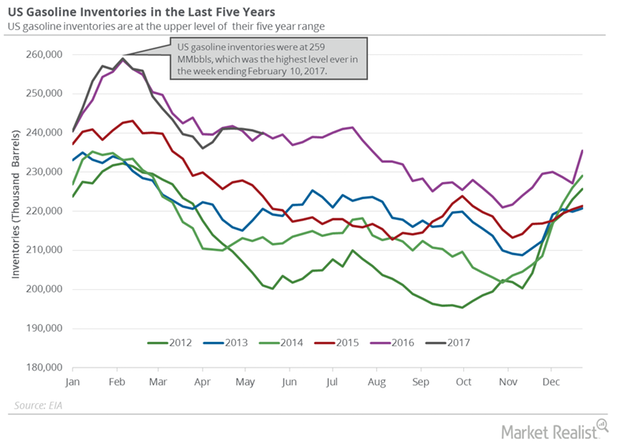

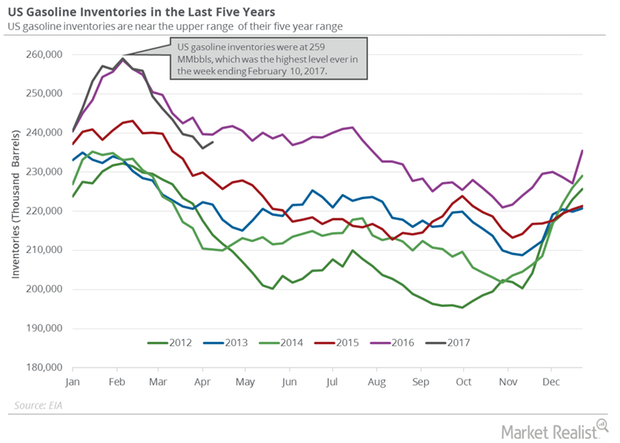

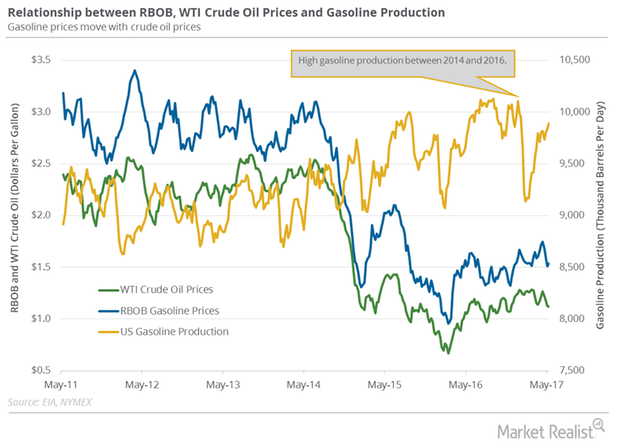

US Gasoline Inventories Fell Less, Pressured Gasoline Prices

The EIA released its weekly crude oil report on May 24, 2017. US gasoline inventories fell by 0.8 MMbbls to 239.9 MMbbls on May 12–19, 2017.

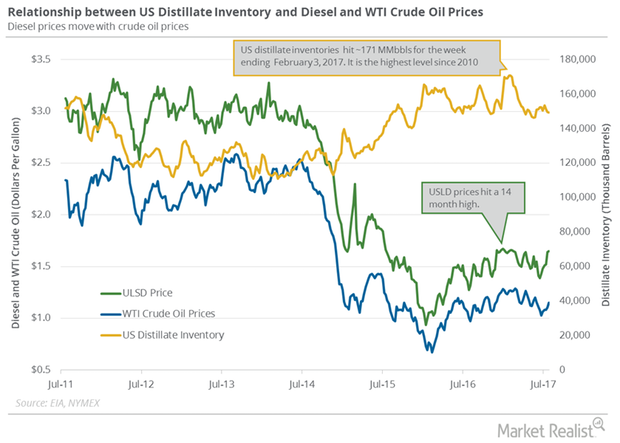

US Distillate Inventories Fell for the Tenth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2 MMbbls to 148.3 MMbbls on April 7–14, 2017.

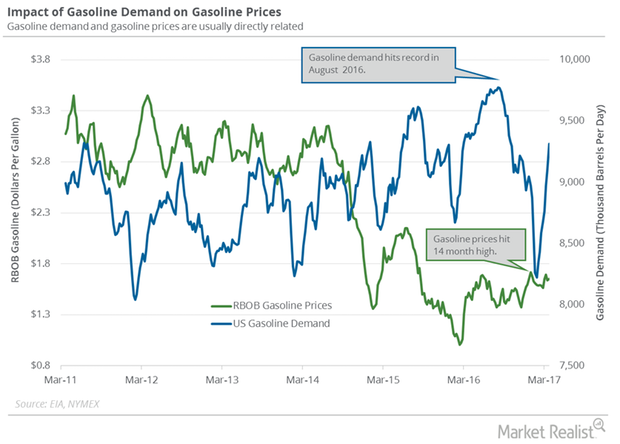

US Gasoline Demand: Key Crude Oil Driver in 2017

The EIA estimated that four-week average US gasoline demand rose by 210,000 bpd (barrels per day) to 9,312,000 bpd from March 17–24, 2017.

US Distillate Inventories Fell for the Fourth Straight Week

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 1.72 MMbbls to 147.7 MMbbls on July 28–August 4, 2017.

Analyzing Hedge Funds’ Net Long Position on US Crude Oil

Hedge funds increased their net long positions in US crude oil futures and options by 16,345 contracts to 149,951 contracts on June 27–July 4, 2017.

WTI Crude Oil and Gasoline Futures Diverge

US gasoline futures contracts for June delivery fell 0.1% to $1.60 per gallon on May 17, 2017. Prices fell due to a lower fall in US gasoline inventories.

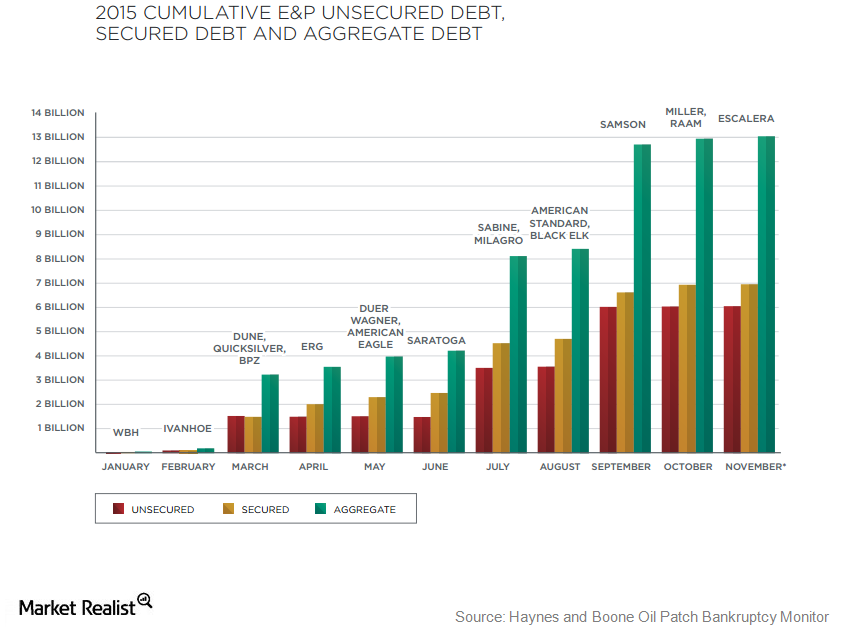

US Oil and Gas Companies’ Debt Exceeds $200 Billion

US oil and gas exploration and production companies are under severe pressure.