US Gasoline Demand: Key Crude Oil Driver in 2017

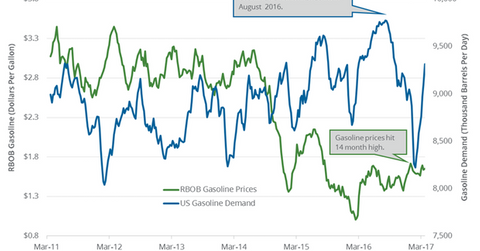

The EIA estimated that four-week average US gasoline demand rose by 210,000 bpd (barrels per day) to 9,312,000 bpd from March 17–24, 2017.

Nov. 20 2020, Updated 12:02 p.m. ET

US gasoline demand

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand rose by 210,000 bpd (barrels per day) to 9,312,000 bpd from March 17–24, 2017. US gasoline demand rose 2.3% week-over-week, but fell 0.9% year-over-year. US gasoline demand rose for the eighth time in the last nine weeks. The rise in gasoline demand is bullish for gasoline and crude oil (SCO) (RYE (IEZ) (DIG) prices. For more on crude oil prices, read Part 1 and Part 2 of this series.

Higher gasoline and crude oil (FXN) (IXC) (IYE) prices have a positive impact on refiners and oil producers’ earnings like Valero (VLO), Tesoro (TSO), Marathon Petroleum (MPC), Bonanza Creek Energy (BCEI), Whiting Petroleum (WLL), and Swift Energy (SFY).

Gasoline prices

US gasoline prices hit $1.14 per gallon on March 15, 2016—the lowest price in 12 years. As of April 4, 2017, prices have risen 51% from their lows in February 2016 due to the increase in gasoline demand. Rising gasoline demand partially supported crude oil prices as well. US crude oil prices rose ~93.1% during the same period. Changes in gasoline demand drive gasoline inventories. For updates on gasoline inventories, read the previous part of the series.

US gasoline consumption estimates for 2017

The EIA estimates that US gasoline consumption will average 9,290,000 bpd and 9,390,000 bpd in 2017 and 2018, respectively. US gasoline consumption figures for 2018 will be the highest ever.

US gasoline consumption averaged 9,330,000 bpd and 9,180,000 bpd in 2016 and 2015, respectively. US gasoline consumption hit a record in 2016. High gasoline consumption over the long term should have a positive impact on gasoline and crude oil prices.

In the last part of this series, we’ll take a look at some crude oil price forecasts.