Bonanza Creek Energy Inc

Latest Bonanza Creek Energy Inc News and Updates

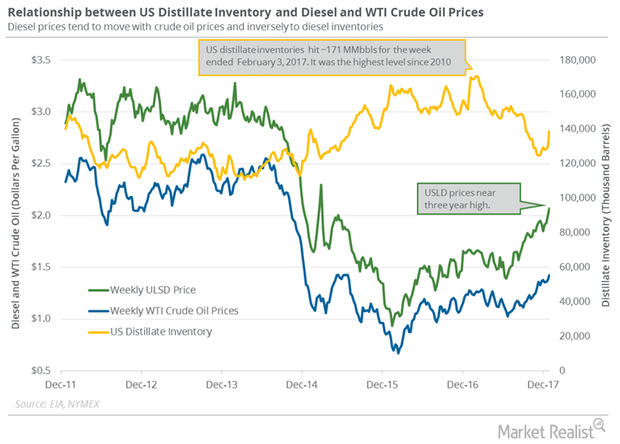

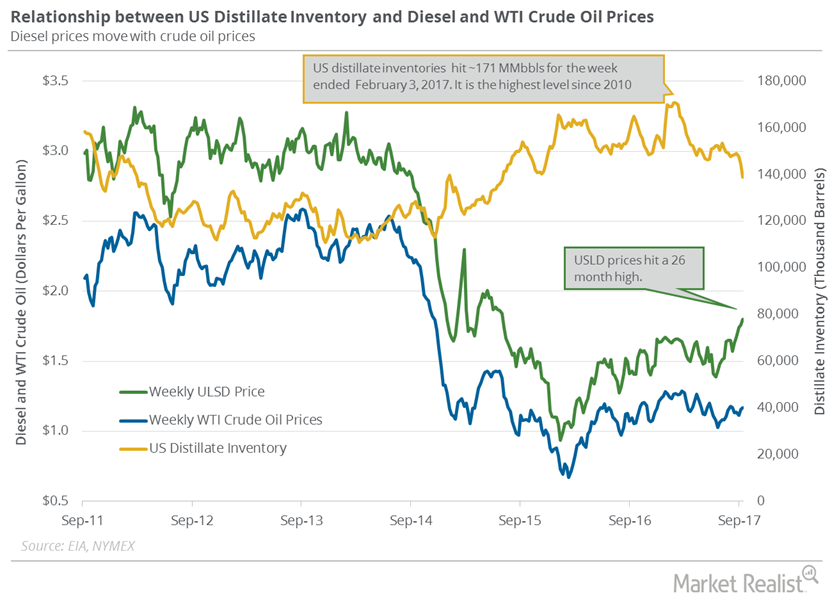

US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

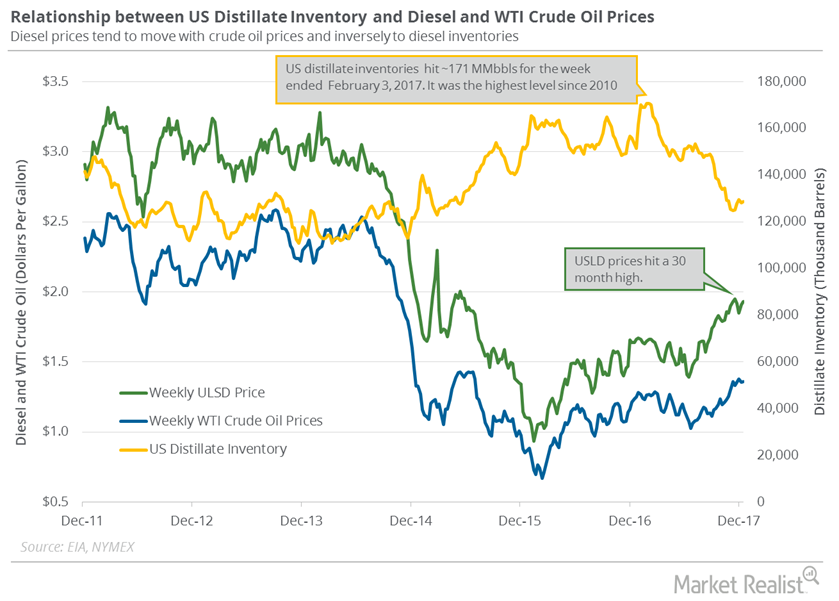

US Distillate Inventories Rose for the Fourth Time in 5 Weeks

US distillate inventories rose for the fourth time in the last five weeks. They rose ~3% in the last five weeks, which is bearish for diesel and oil prices.

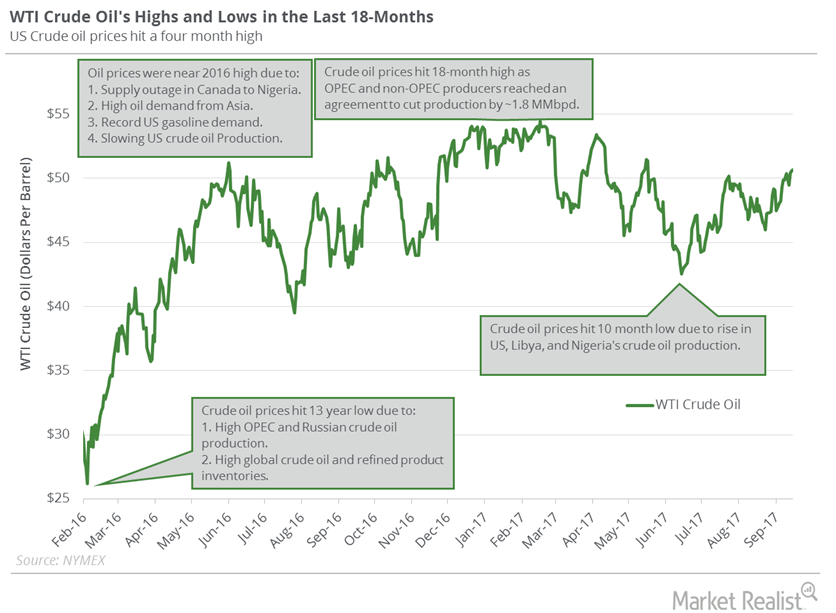

Will US Crude Oil Futures Fall from 4-Month Highs?

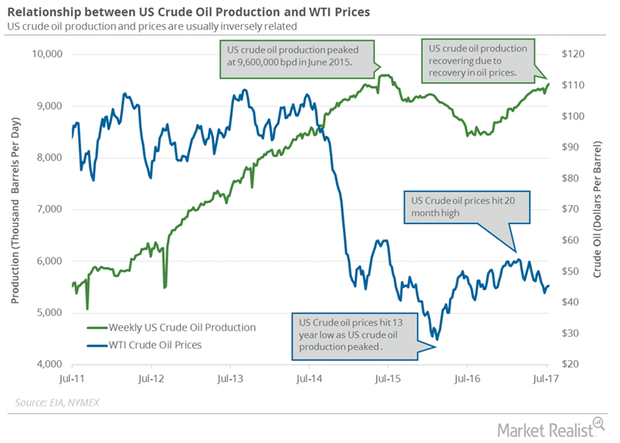

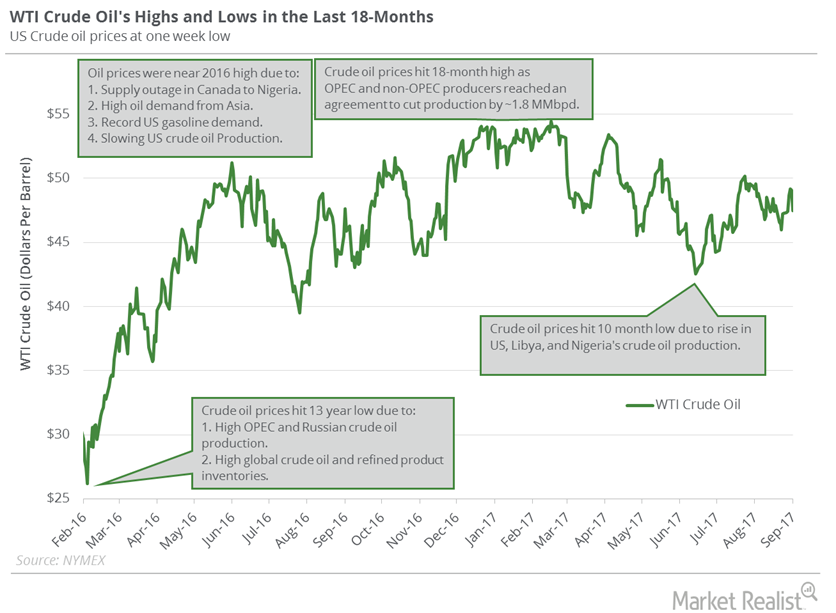

WTI (West Texas Intermediate) crude oil (RYE) (VDE) futures hit $26.21 per barrel on February 11, 2016—the lowest level in more than a decade.

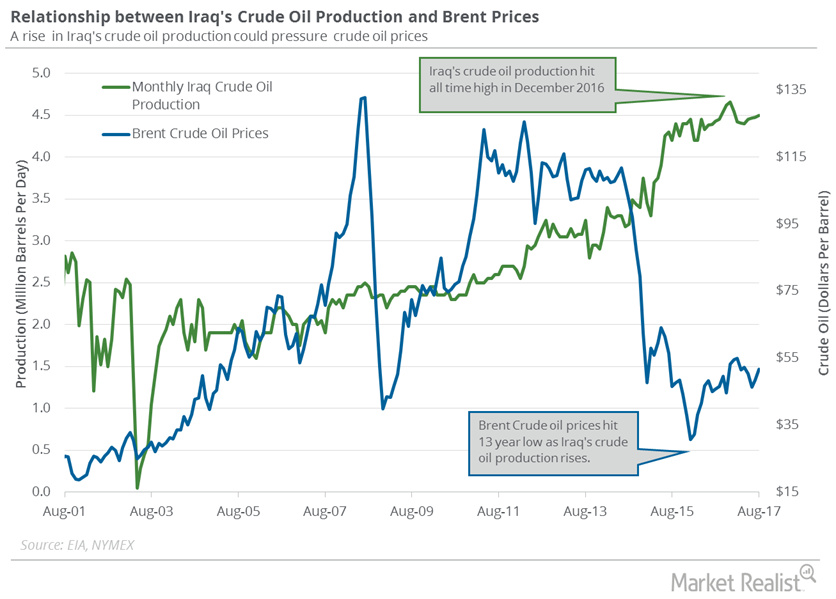

Geopolitical Tensions Impact Crude Oil Prices

On October 3, 2017, Iraq banned selling dollars to Kurdistan’s banks due to the vote in the referendum. Geopolitical tensions could impact crude oil prices.

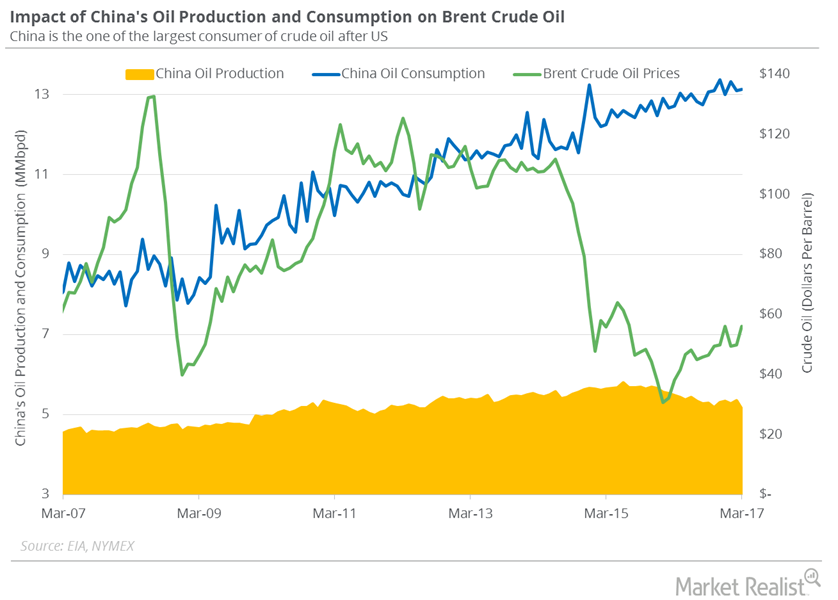

China’s Crude Oil Imports Hit a New Record

China’s General Administration of Customs reported that China’s crude oil imports rose to 9.21 MMbpd (million barrels per day) in March 2017.

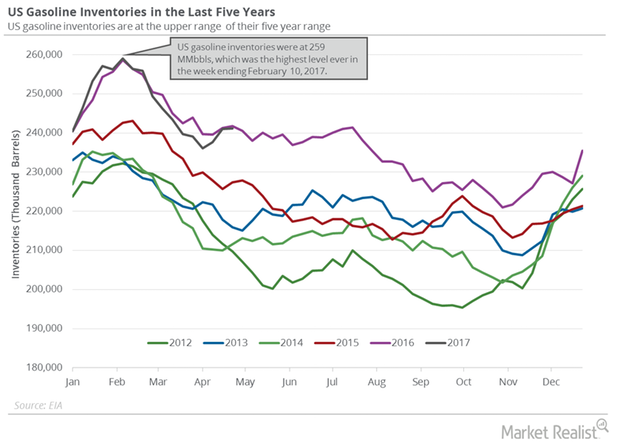

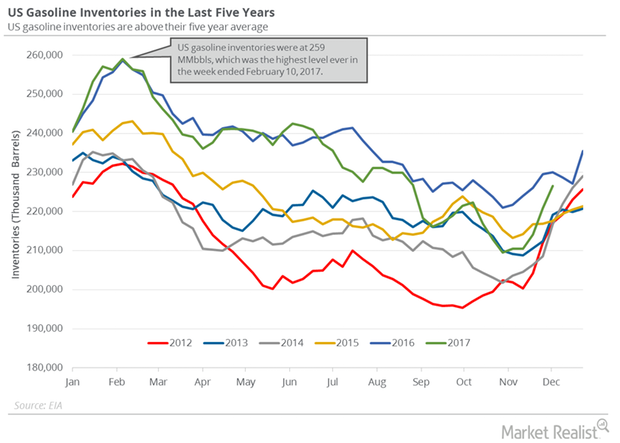

Why US Gasoline Inventories Rose for the Third Straight Week

A less-than-expected rise in gasoline inventories supported gasoline prices on May 3, 2017. Gasoline and crude oil (DIG) (SCO) (VDE) prices rose on May 3.

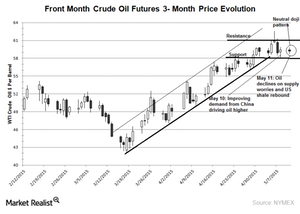

Uncertain Times for the Crude Oil Market: Neutral Doji Pattern

June WTI crude oil futures showed the neutral doji pattern on May 9. Oil prices are swinging due to the frequent change in supply and demand dynamics.

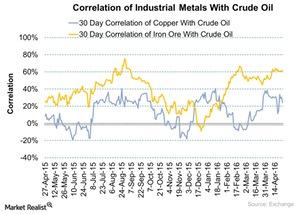

Analyzing the Correlation of Crude Oil and Industrial Metals

In the past year, US crude oil was more correlated with iron ore than copper. In August 2015, the correlation between crude oil and iron ore touched 75.5%.

Geopolitical Tension Could Drive Brent and US Crude Oil Futures

Brent crude oil futures fell 0.7% to $49.61 per barrel on July 4, 2017. August WTI crude oil (XLE) (XOP) (PXI) futures contracts rose in electronic trading.

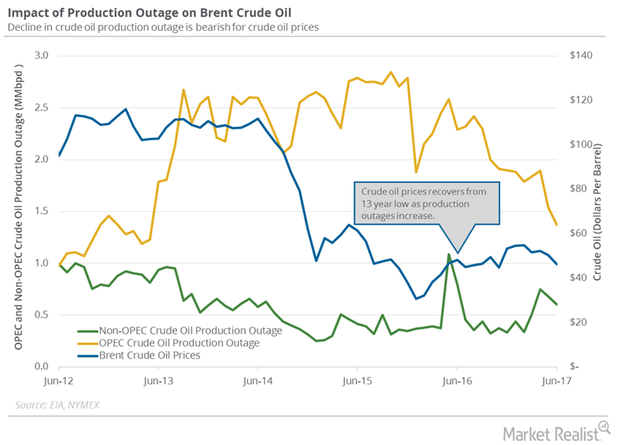

Global Crude Oil Supply Outages Near 5-Year Low

The US Energy Information Administration estimates that global crude oil supply outages fell by 247,000 bpd (barrels per day) to 2.0 MMbpd (million barrels per day) in June 2017.

US Crude Oil Production Could Hit a Record

The EIA reported that US crude oil production rose by 32,000 bpd (barrels per day) to 9,429,000 bpd on July 7–14, 2017. Production is at a two-year high.

Distillate Inventories: More Bullish News for Oil

The US Energy Information Administration (or EIA) released its weekly crude oil and gasoline inventory report on September 20, 2017.

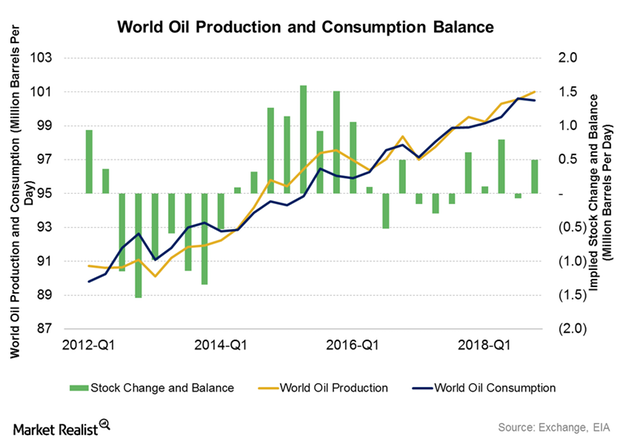

Inside the Global Crude Oil Supply-Demand Gap

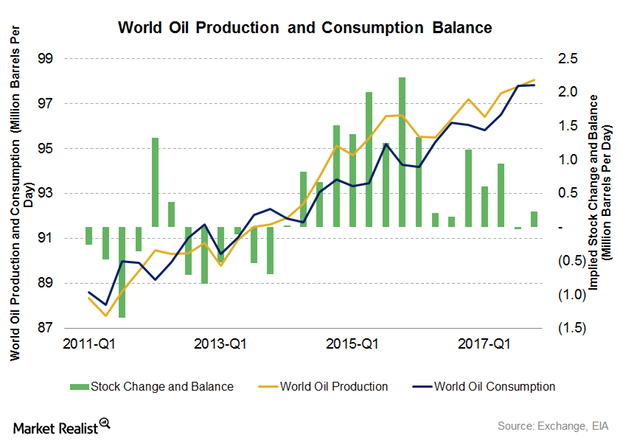

The EIA estimated that the global crude oil supply-demand gap averaged 0.58 MMbpd (million barrels per day) in 1H16.

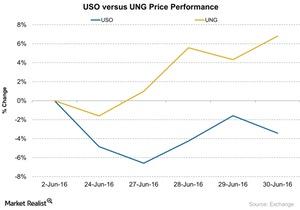

Why Did UNG Outperform USO?

From June 23—30, the United States Natural Gas ETF (UNG) outperformed the United States Oil ETF (USO). UNG rose ~6.8%, while USO fell ~3.4%.

US Gasoline Inventories: Turning Point for Crude Oil Futures?

US gasoline inventories rose by 5.6 MMbbls (million barrels) or 2.6% to 226.5 MMbbls on December 1–8, 2017.

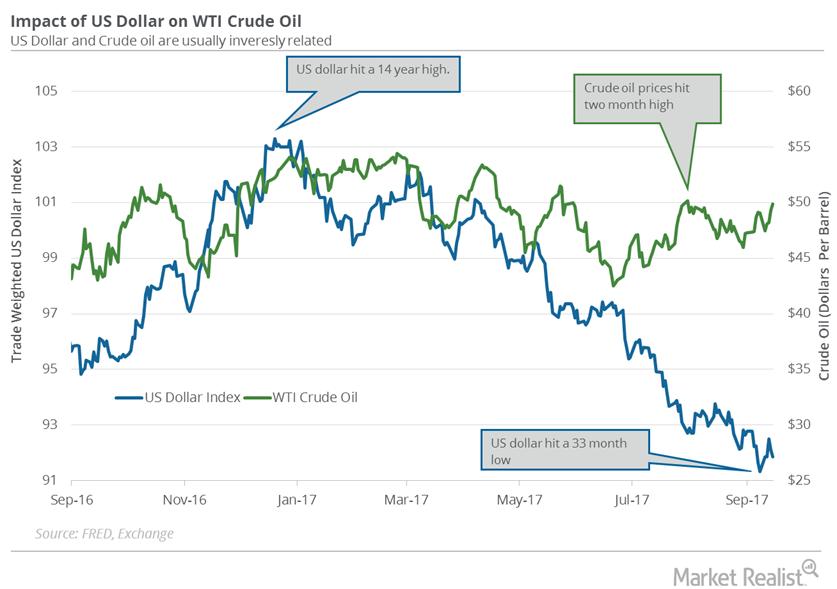

Will the FOMC Meeting Drive the US Dollar and Crude Oil Futures?

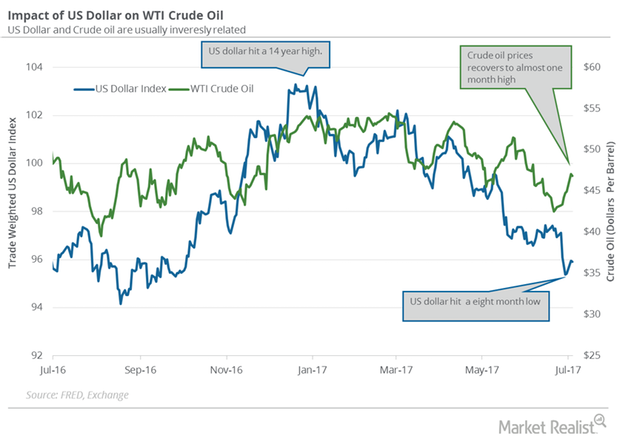

The US Dollar Index fell 0.27% to 91.86 on September 15. It’s near a 33-month low. Prices fell due to the surprise decline in US retail sales in August.

What to Watch: This Week’s Key Crude Oil Price Drivers

Let’s track some important events for crude oil and natural gas traders from September 11 to 15, 2017.

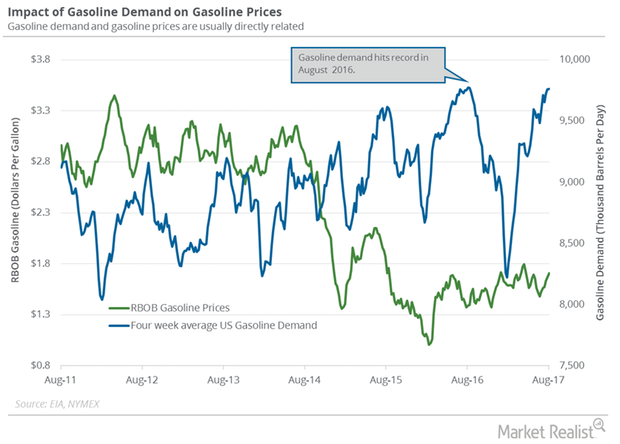

What to Expect from US Gasoline Demand

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand fell by 45,000 bpd (barrels per day), or 0.45%, to 9,797,000 bpd between July 28 and August 4, 2017.

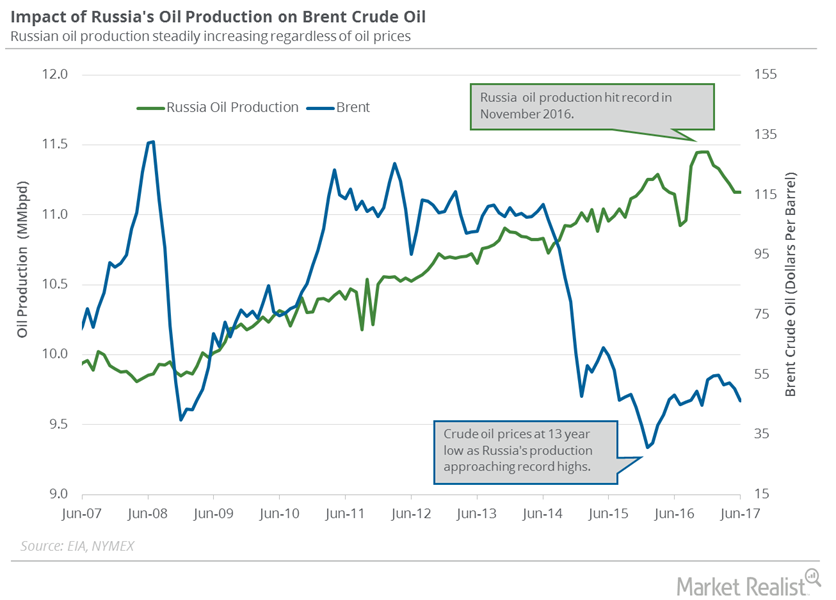

Russia’s Crude Oil Production Was Flat Again

The Russian Energy Ministry estimates that Russia’s crude oil production was flat at 10.95 MMbpd in July 2017—compared to the previous month.

Will the US Dollar Continue Its Bearish Momentum This Week?

August 2017 West Texas Intermediate crude oil futures contracts fell 0.5% and were trading at $46.83 per barrel in electronic trade at 1:45 AM EST on July 4, 2017.

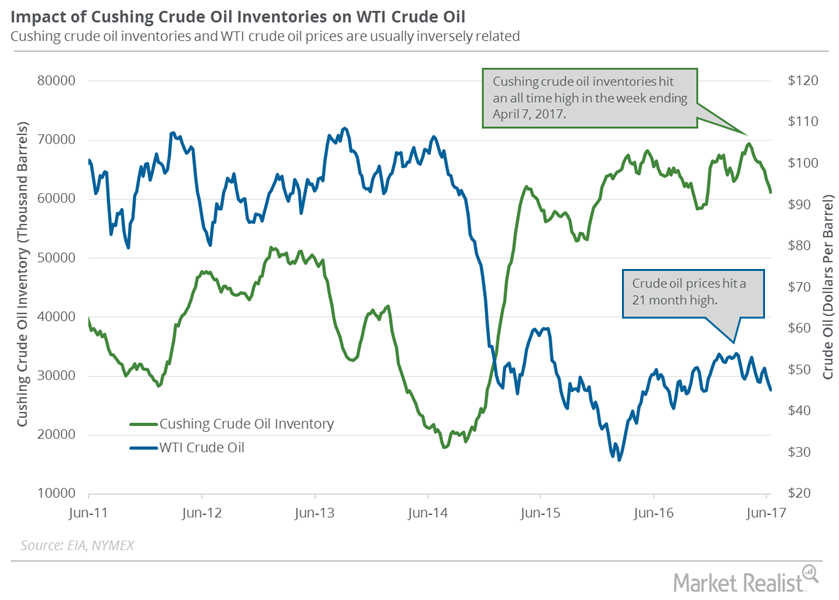

Cushing Inventories Fell for the Ninth Time in 10 Weeks

The EIA (U.S. Energy Information Administration) will release weekly data on crude oil and gasoline inventories on June 28, 2017.

Decoding the World Oil Supply and Demand Gap in 2017

The EIA estimates that the world oil supply and demand gap averaged 780,000 bpd (barrels per day) in 1H16. It’s expected to average 650,000 bpd in 2H16.