BTC iShares U.S. Oil Equipment & Services ETF

Latest BTC iShares U.S. Oil Equipment & Services ETF News and Updates

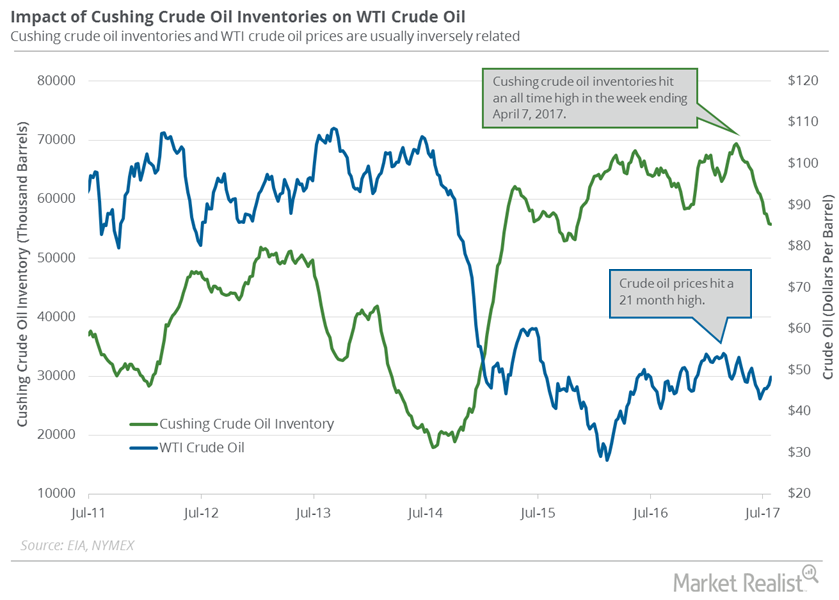

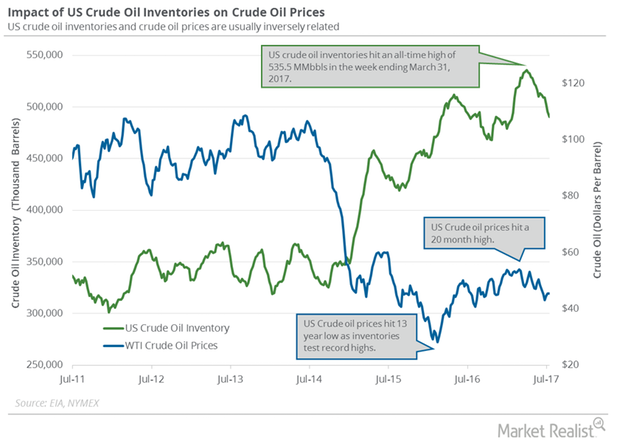

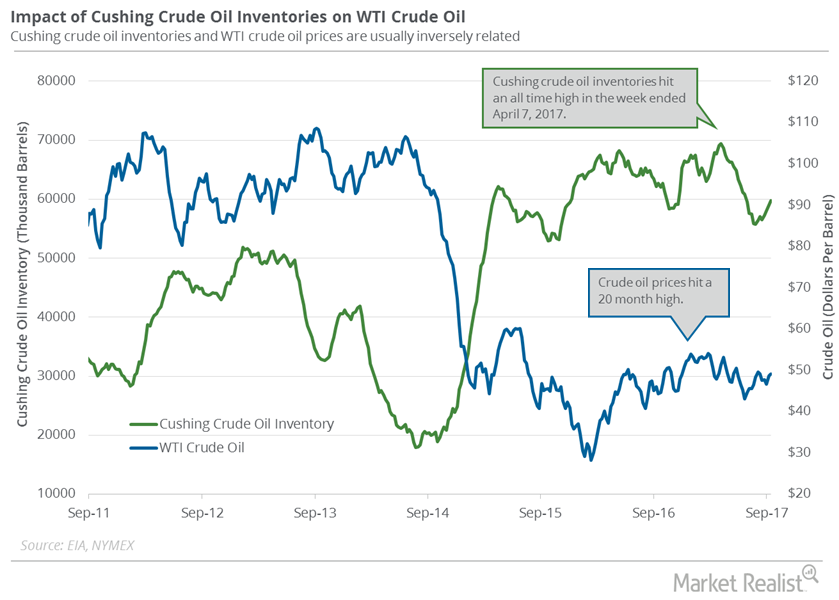

Cushing Inventories Rise for the First Time in 12 Weeks

Cushing is the largest crude oil storage hub in the United States. A market survey estimates that Cushing inventories fell from August 4 to August 11.

Crude Oil Prices Rally Due to Short Covering

WTI (West Texas Intermediate) crude oil futures contracts for January delivery rose slightly by 0.4% and closed at $43.04 per barrel on Wednesday.

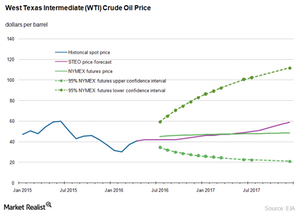

Why Goldman Sachs Revised Its Crude Oil Price Forecast

Goldman Sachs (GS) forecast that Brent crude oil prices could test $50 per barrel in 2H16 due to recent supply outages.

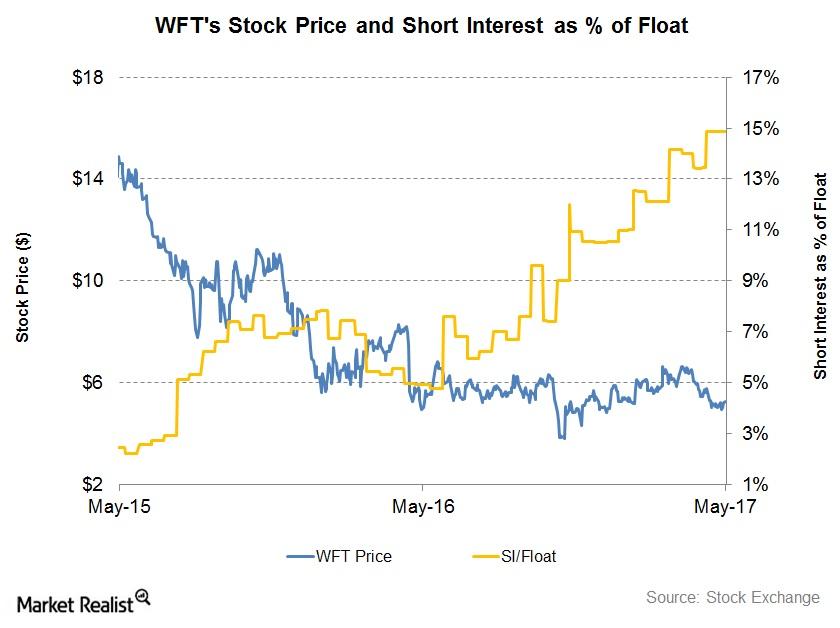

What Short Interest in Weatherford Indicates

Weatherford International’s (WFT) short interest as a percentage of its float was 14.9% as of May 22, 2017, compared to ~14% as of March 31, 2017.

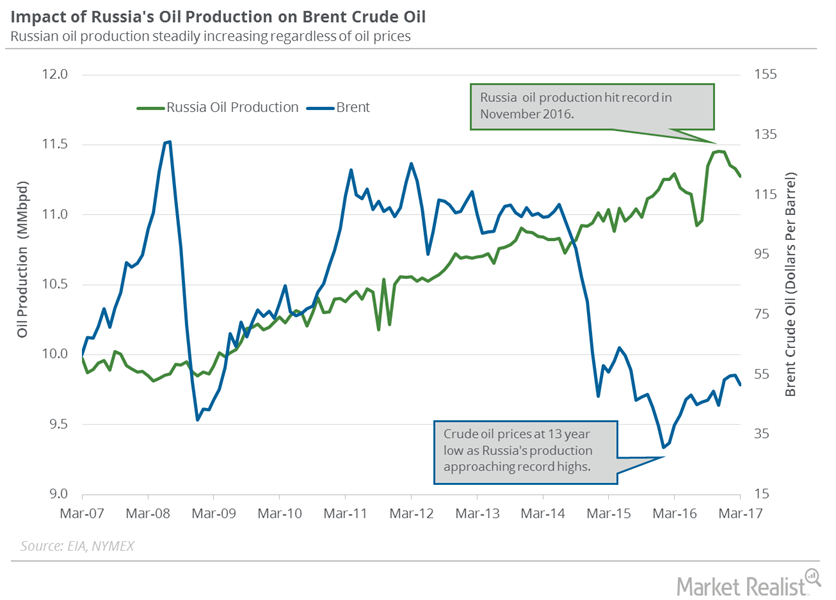

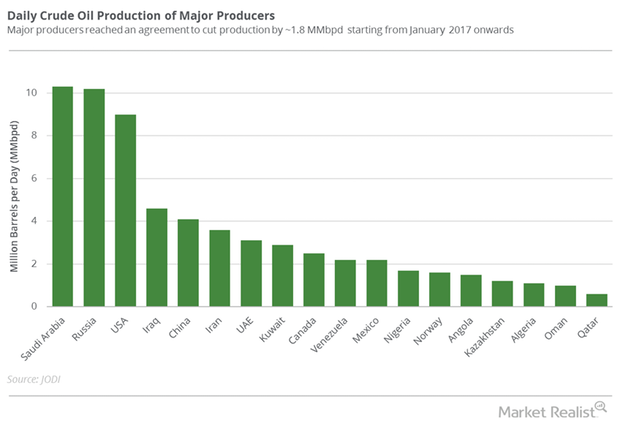

Will Russia’s Oil Production Fall in the Coming Months?

Russia’s Energy Ministry reported that its oil production fell in the first half of April 2017 due to major producers’ production cut deal.

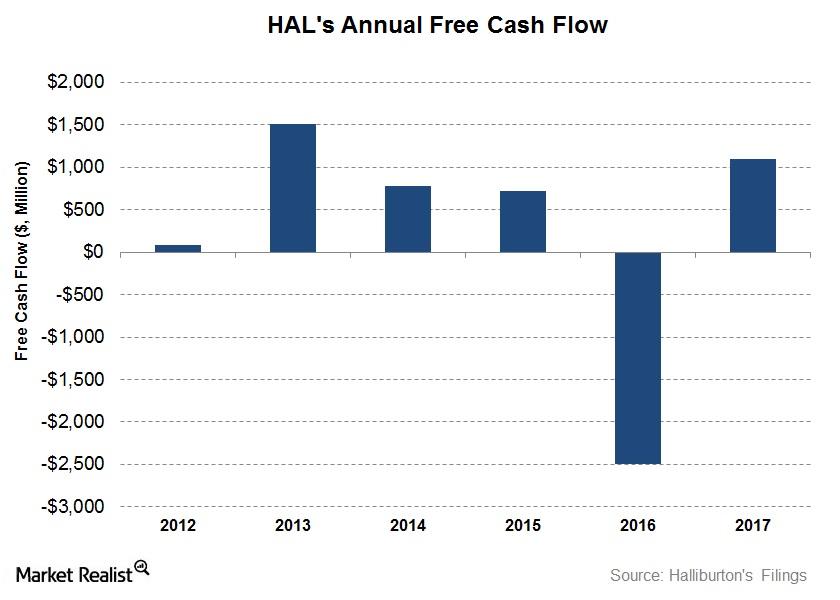

How Did Halliburton Turn Its Free Cash Flow Positive in 2017?

Halliburton’s (HAL) CFO (cash flow from operating activities) in 2017 was a significant improvement over 2016.

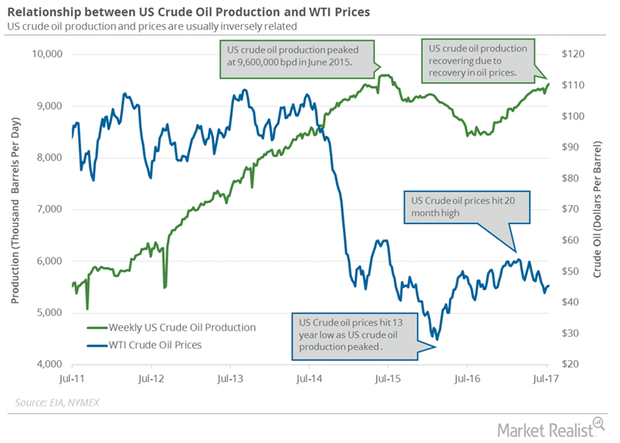

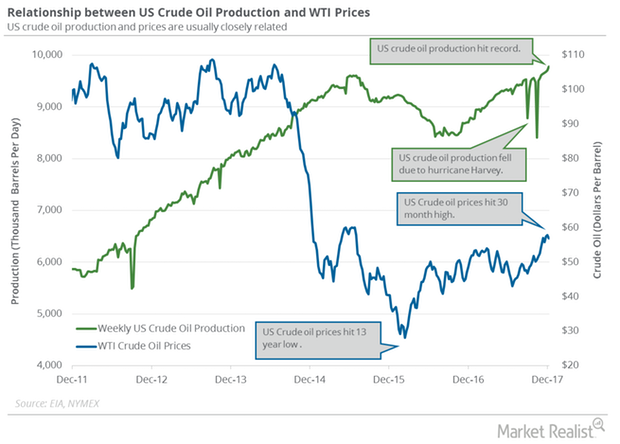

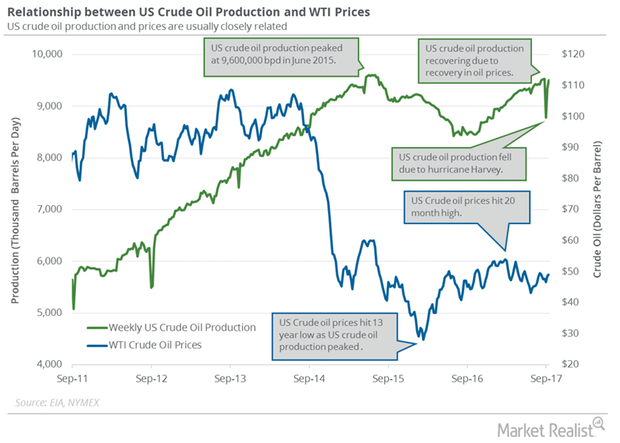

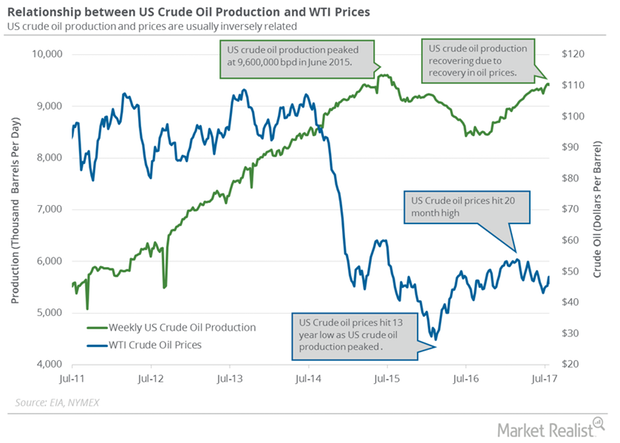

US Crude Oil Production Could Hit a Record

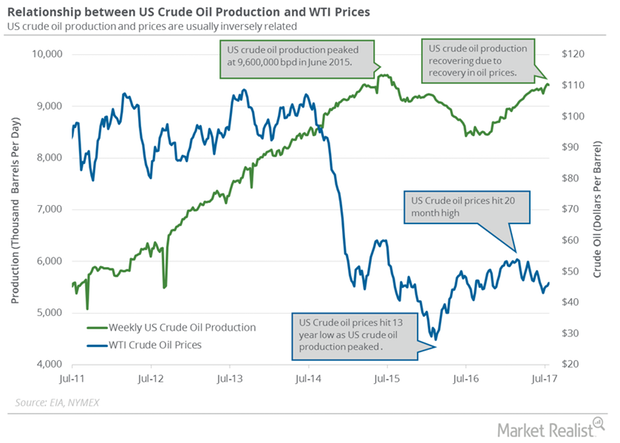

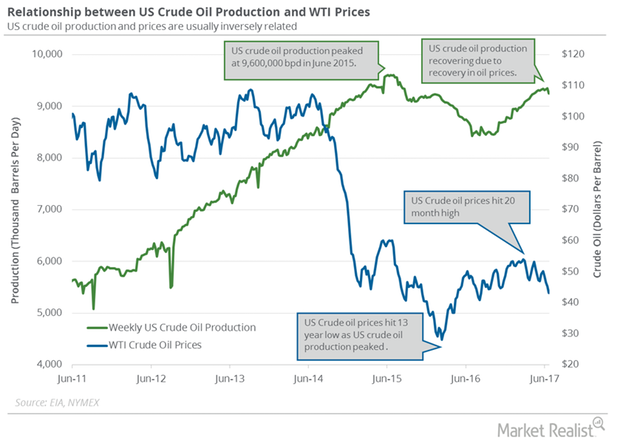

The EIA reported that US crude oil production rose by 32,000 bpd (barrels per day) to 9,429,000 bpd on July 7–14, 2017. Production is at a two-year high.

US Crude Oil Imports from Saudi Arabia Hit a 7-Year Low

US crude oil imports have fallen 4.5% YTD. US crude oil imports from Saudi Arabia are at a seven-year low at 524,000 bpd for the week ending July 14, 2017.

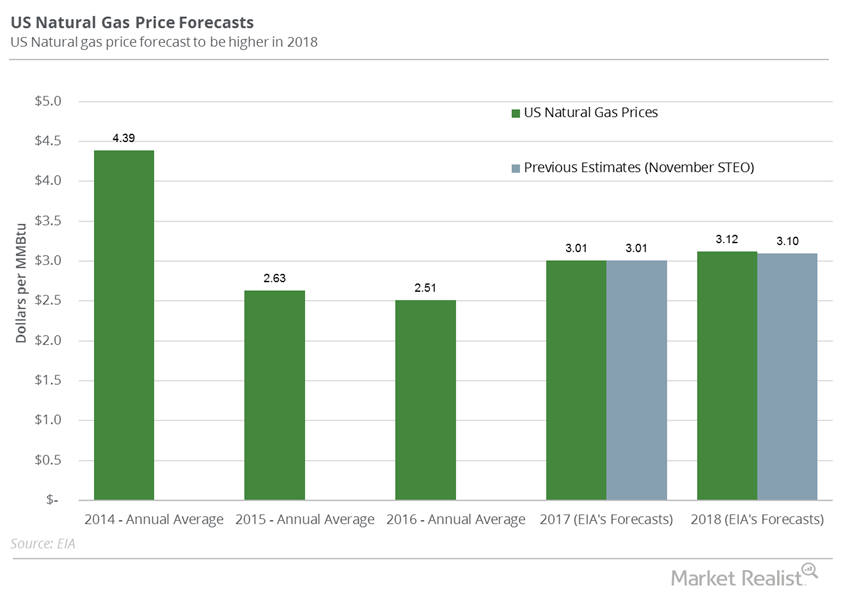

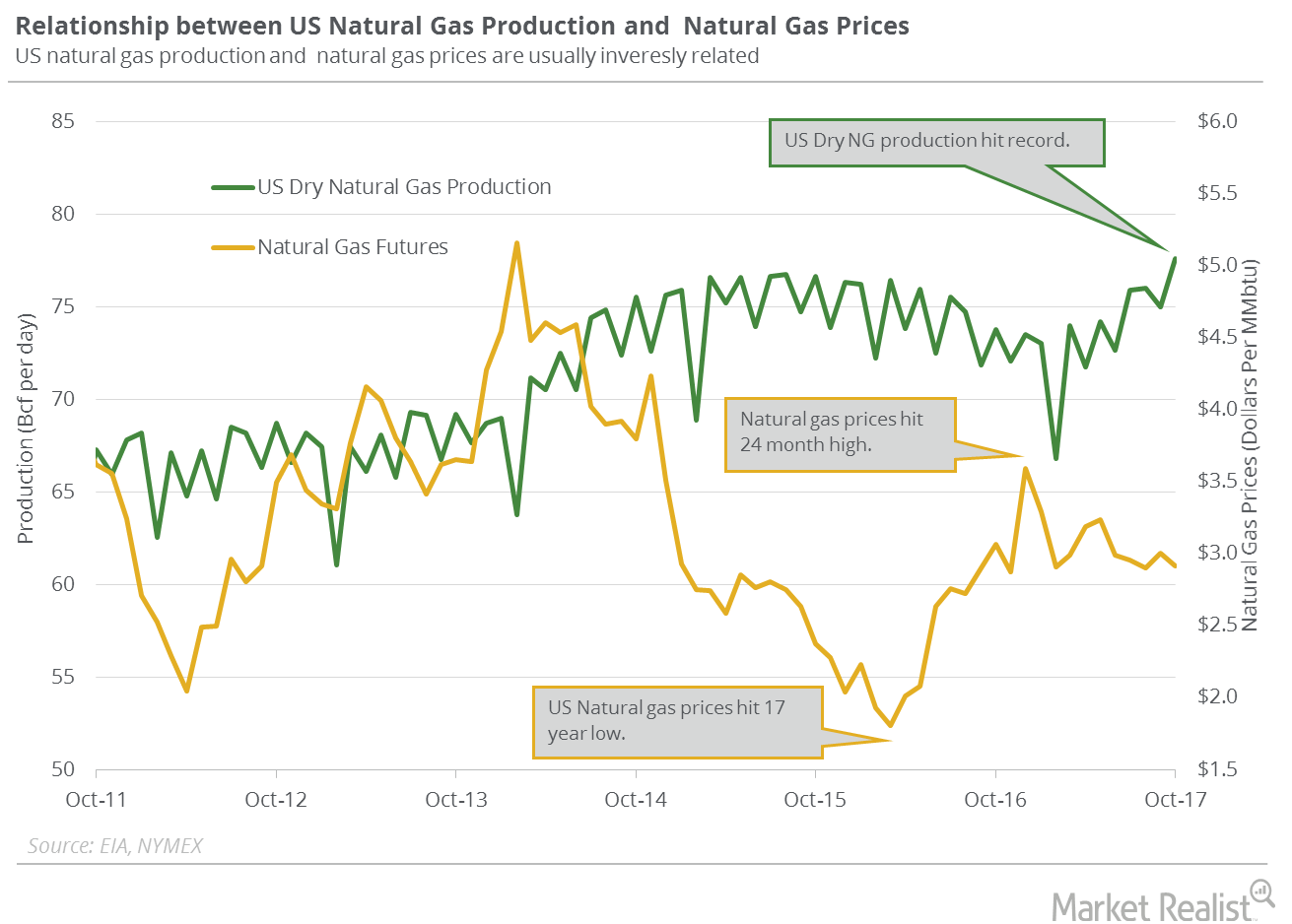

Will US Natural Gas Futures Fall More?

US natural gas (GASL) futures contracts for January delivery were below their 20-day, 50-day, and 100-day moving averages on December 14, 2017.

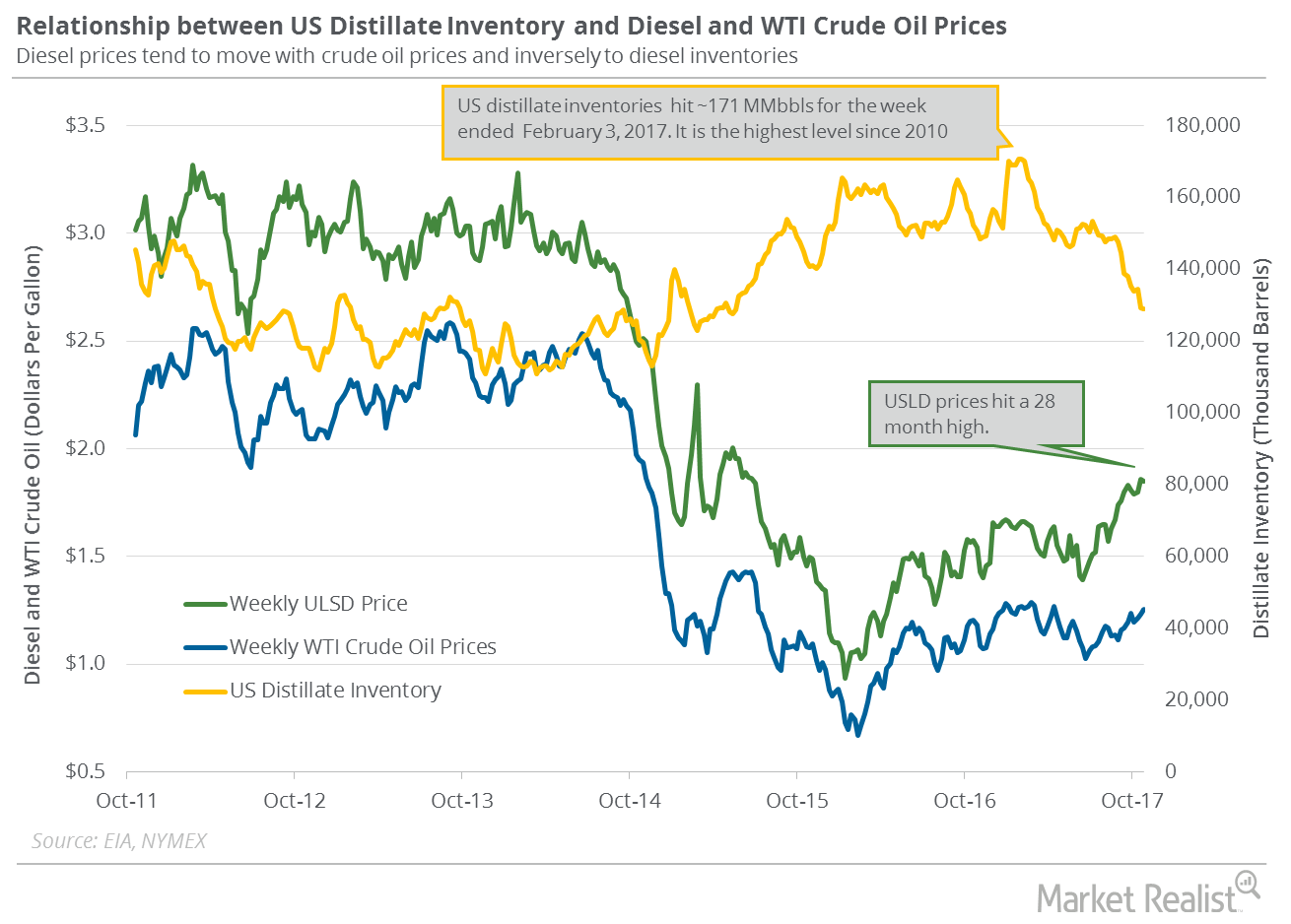

US Distillate Inventories Are near a 3-Year Low

US distillate inventories fell by 302,000 barrels to 128.9 MMbbls (million barrels) on October 20–27, 2017. It’s the lowest level since April 10, 2015.

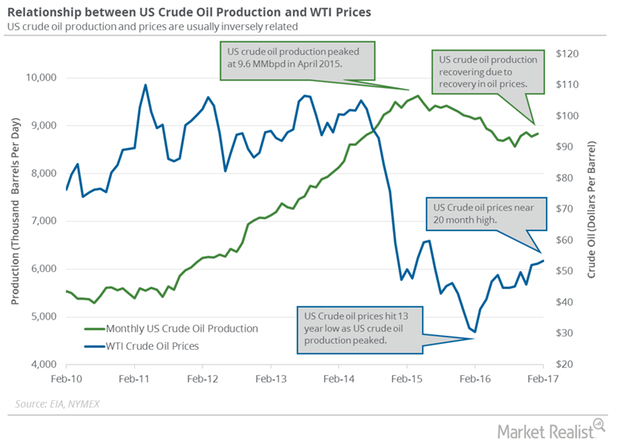

Monthly US Crude Oil Production Hit May 2016 High

The EIA reported that monthly US crude oil production rose by 60,000 bpd (barrels per day) to 8.8 MMbpd in January 2017—compared to the previous month.

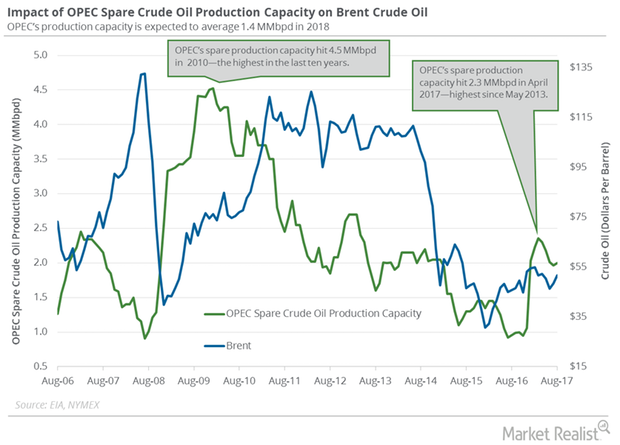

How OPEC’s Spare Crude Oil Production Capacity Is Recovering

The EIA estimates that OPEC’s spare crude oil production capacity rose 35,000 bpd (barrels per day) to 2 MMbpd (million barrels per day) in August 2017.

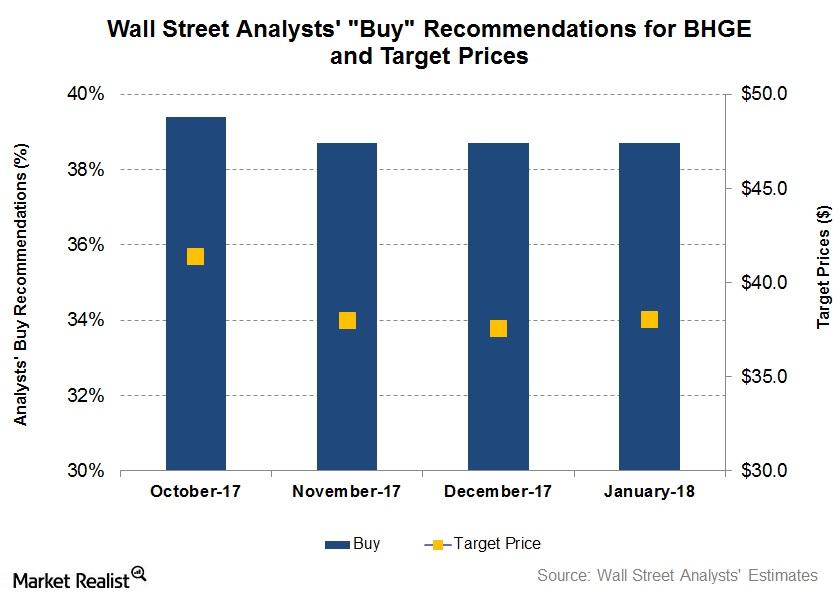

Wall Street’s Forecasts for Baker Hughes after Its 4Q17 Earnings

In this article, we’ll look at Wall Street analysts’ forecasts for shares of Baker Hughes, a GE company (BHGE) following its 4Q17 earnings release.

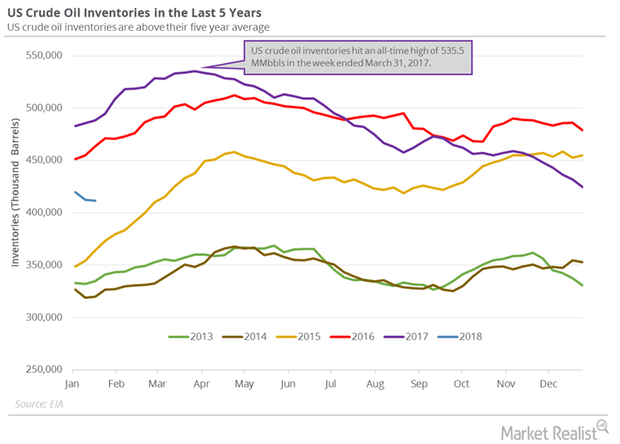

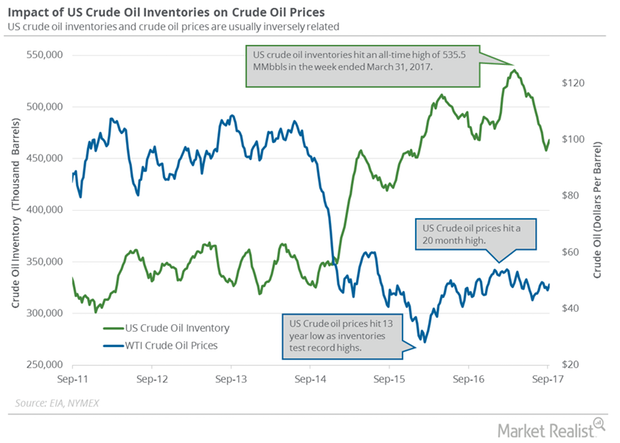

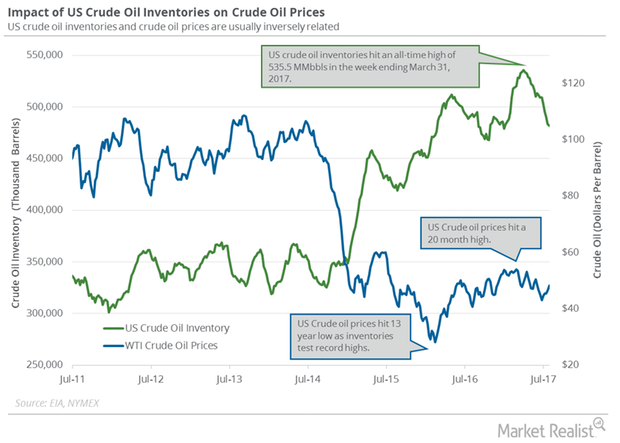

US Crude Oil Inventories Hit February 2015 Low

US crude oil inventories fell by 1.1 MMbbls (million barrels) to 411.6 MMbbls on January 12–19, 2018. Inventories decreased 0.3% week-over-week.

Will US Natural Gas Production Hit a Record in 2018 and 2019?

US dry natural gas production rose by 1.2 Bcf (billion cubic feet) per day or 1.6% to 74 Bcf per day on January 4–10, 2018, according to PointLogic.

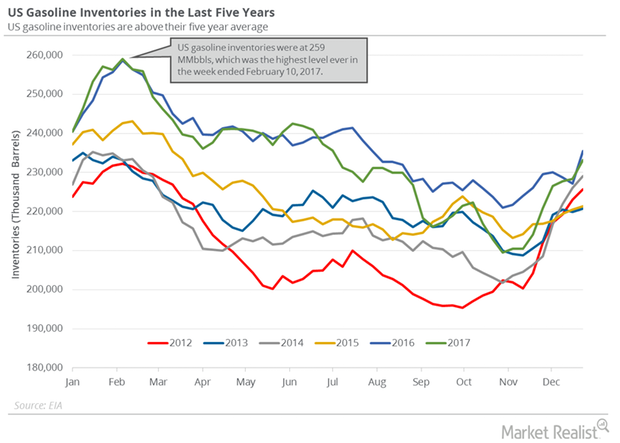

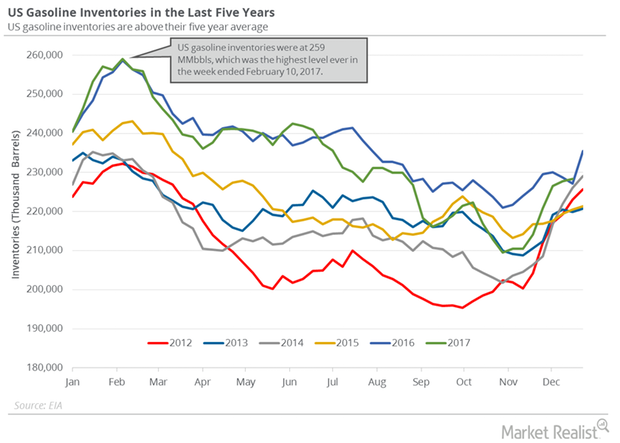

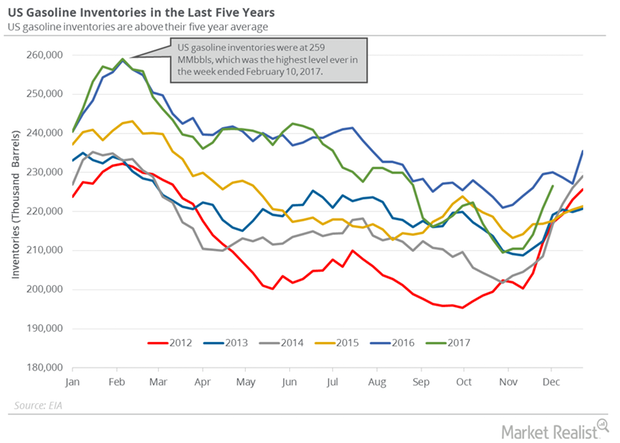

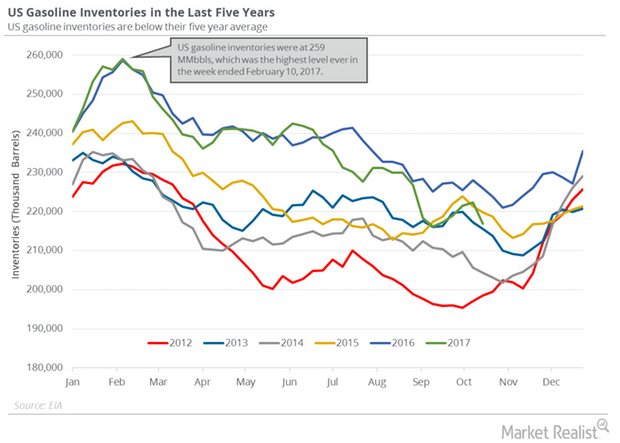

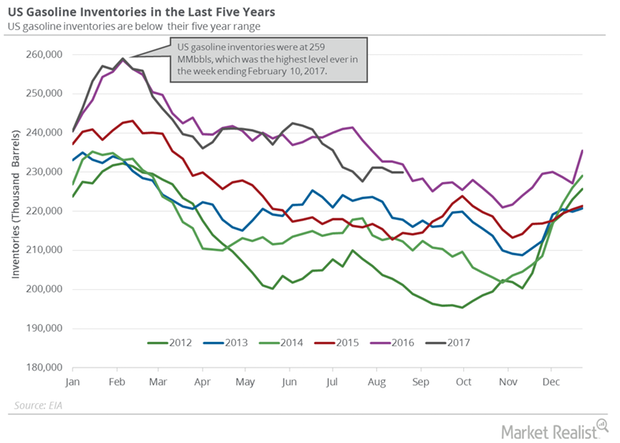

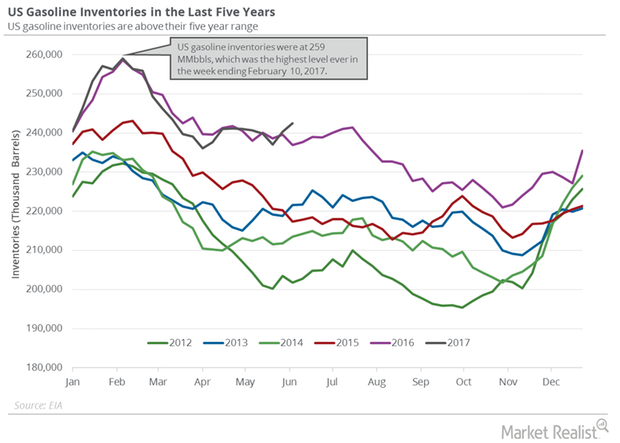

US Gasoline Inventories Could Pressure Crude Oil Prices

The EIA estimated that US gasoline inventories increased by 4.8 MMbbls (million barrels) or 2.1% to 233.1 MMbbls on December 22–29, 2017.

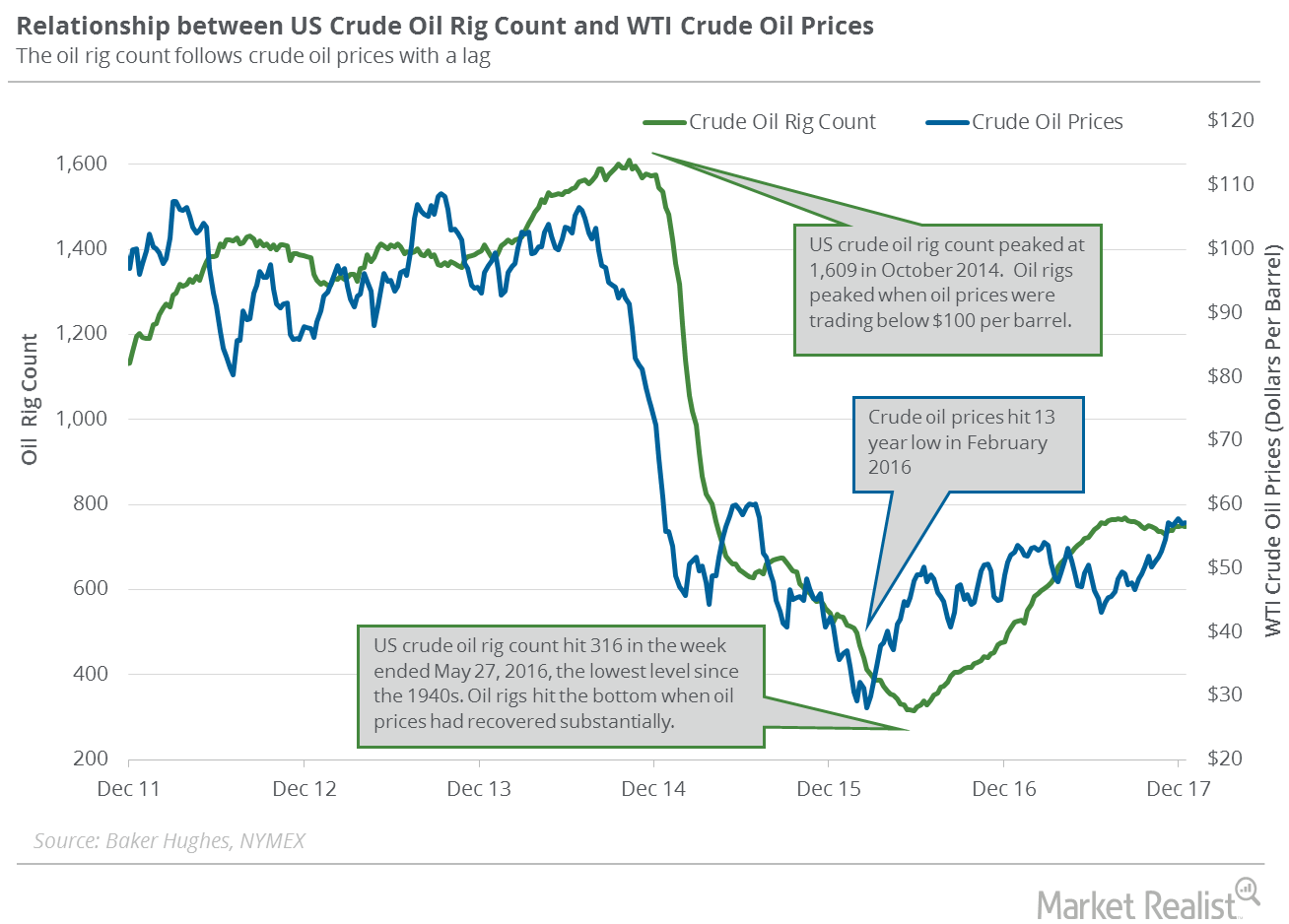

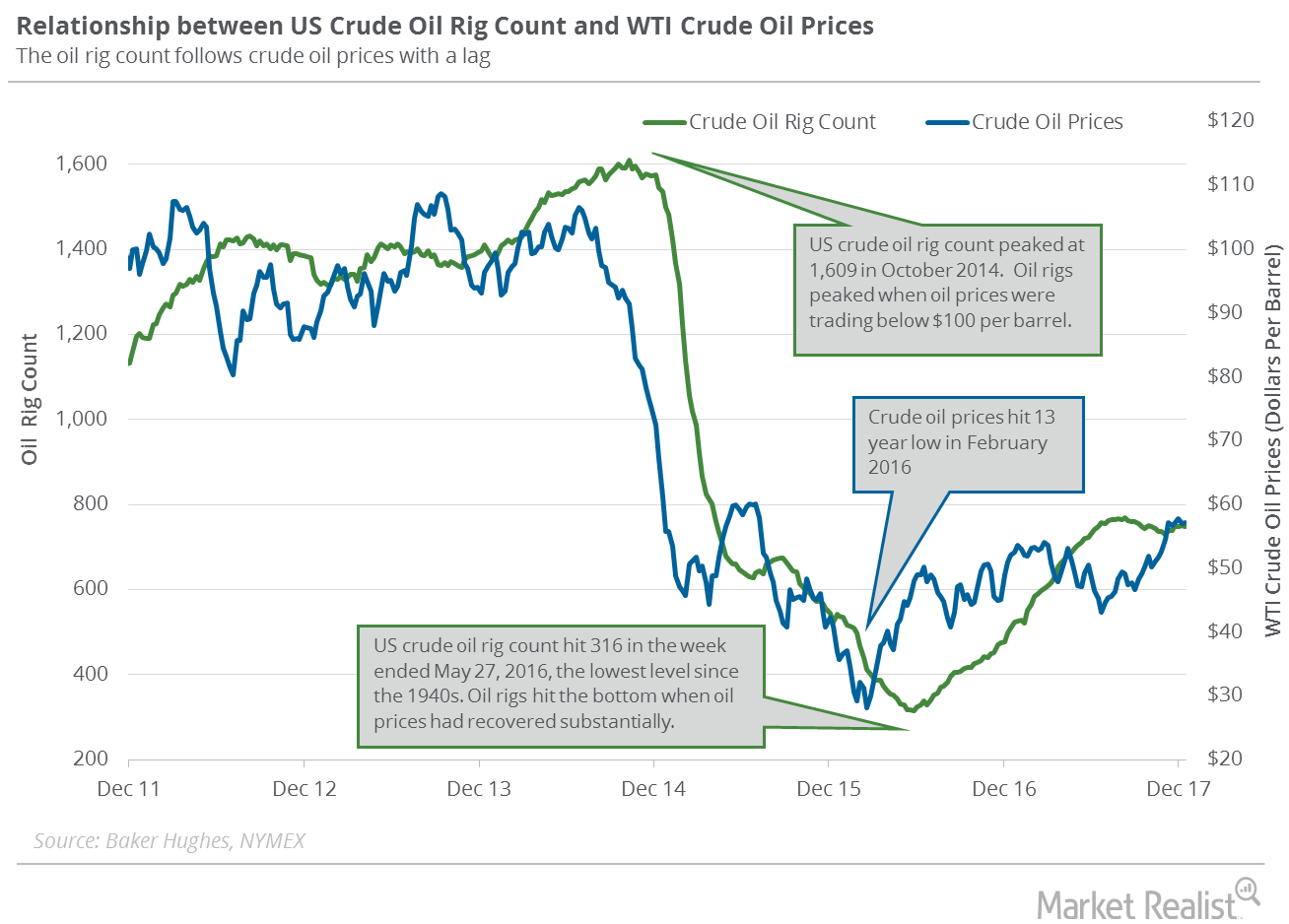

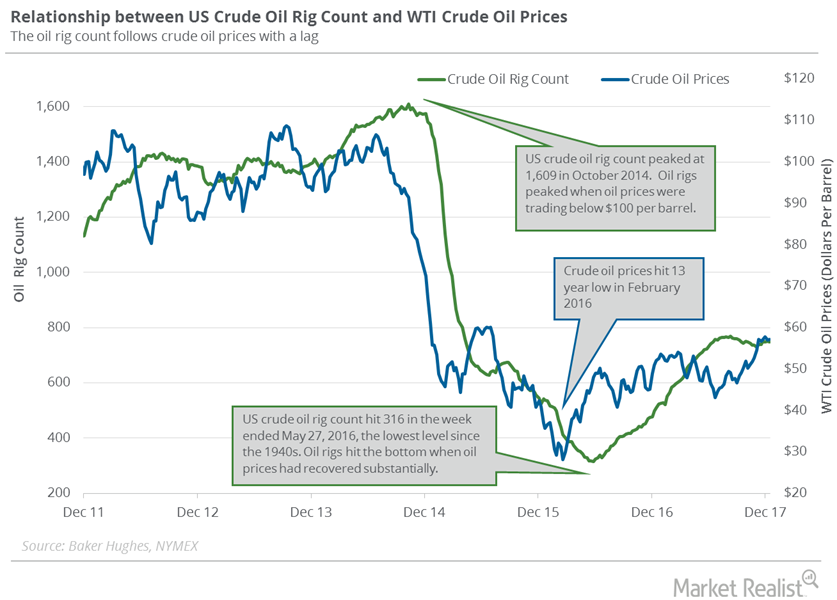

US Crude Oil Rigs Could Impact Crude Oil Prices in 2018

Baker Hughes released its US crude oil rig count report on December 29. It reported that US crude oil rigs were flat at 747 on December 22–29, 2017.

Why Oil Traders Are Tracking US Gasoline Inventories

US gasoline inventories rose by 0.5 MMbbls (million barrels) or 0.3% to 228.3 MMbbls from December 15 to 22, 2017, per the EIA.

US Crude Oil Rig Count: Almost Flat in the Last 5 Weeks

Baker Hughes published its US crude oil rig report on December 22, 2017. The US crude oil rig count was flat at 747 on December 15–22, 2017.

Analyzing the API’s Gasoline and Distillate Inventories

On December 19, 2017, the API released its crude oil inventory report. US gasoline inventories rose by 2 MMbbls (million barrels) on December 8–15, 2017.

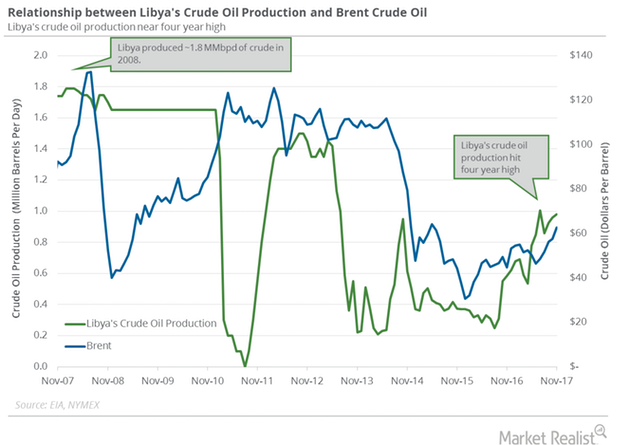

Libya’s Crude Oil Production Is near a 4-Year High

The EIA estimates that Libya’s crude oil production rose by 20,000 bpd (barrels per day) or 2.1% to 980,000 bpd in November 2017.

US Crude Oil Rigs Indicate Future US Crude Oil Production

Baker Hughes released its weekly US crude oil rig report on December 15, 2017. US crude oil rigs fell by four to 747 or 0.5% on December 8–15, 2017.

US Crude Oil Production Has Risen 16% since July 2016

US crude oil production rose by 73,000 bpd (barrels per day) to 9,780,000 bpd on December 1–8, 2017, according to the EIA.

How OPEC and Russia Are Helping US Crude Oil Producers

January West Texas Intermediate (or WTI) crude oil (USO) (SCO) futures contracts fell 0.65% and were trading at $57.98 per barrel at 1:10 AM EST on December 4, 2017.

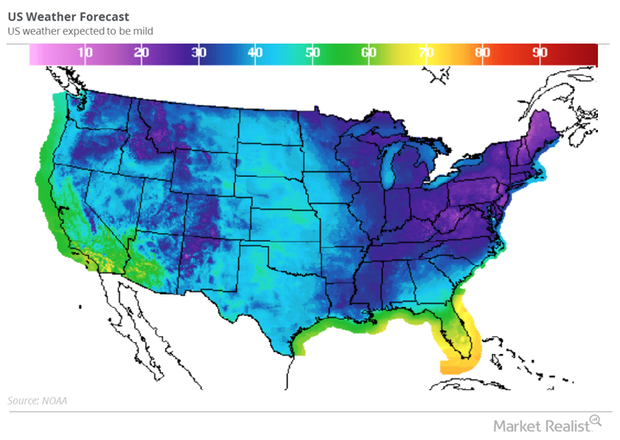

Weather Impacts the US Natural Gas Market

January US natural gas (DGAZ) (UNG) futures contracts fell 1.4% to $3.01 per MMBtu in electronic trading at 1:05 AM EST on November 24, 2017.

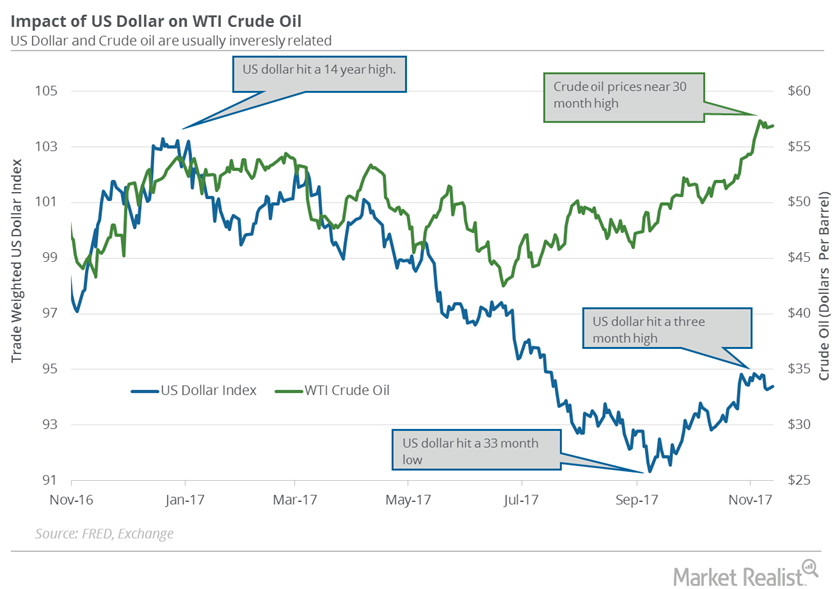

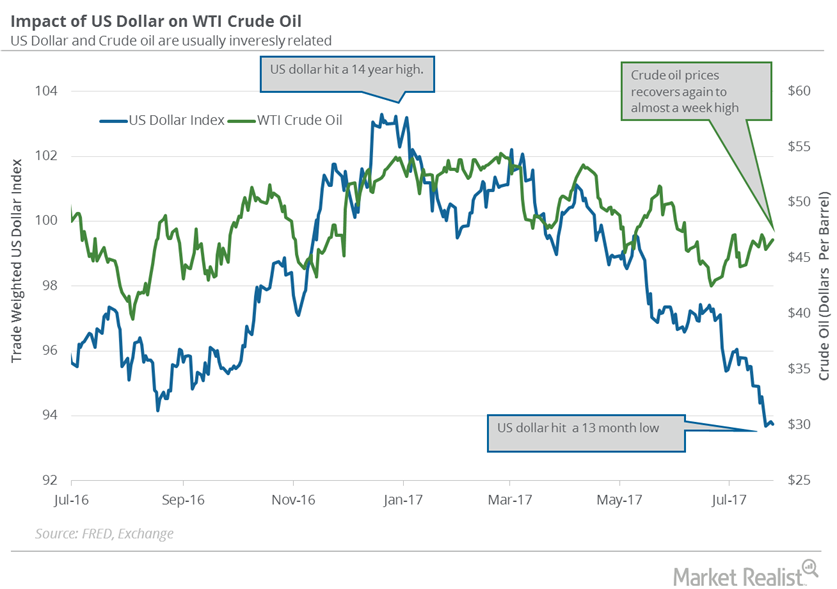

US Dollar Could Pressure Crude Oil Futures This Week

The US Dollar Index rose 0.13% to 94.4 on November 13, 2017. It limited the upside for US crude oil (UWT) (DWT) prices on the same day.

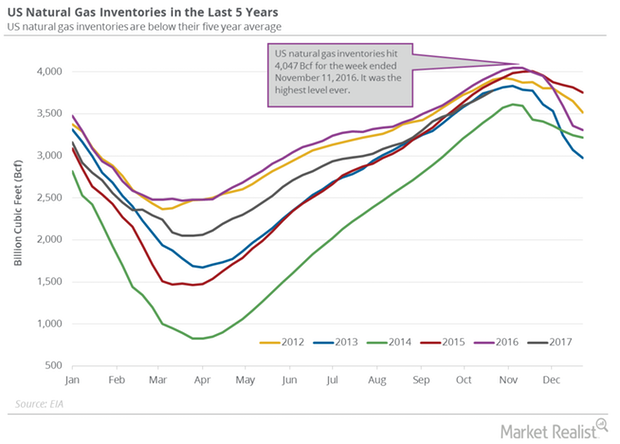

US Natural Gas Inventories Could Help Natural Gas Futures

The EIA reported that US natural gas inventories rose by 65 Bcf (billion cubic feet) to 3,775 Bcf on October 20–27, 2017.

Massive Fall in US Gasoline Inventories Drove Gasoline Futures

The EIA reported that US gasoline inventories fell by 5,465,000 barrels or 2.5% to 216.8 MMbbls (million barrels) on October 13–20, 2017.

Cushing Crude Oil Inventories Rose for the Fourth Week

Cushing crude oil inventories rose on September 15–22, 2017. A rise in Cushing crude oil inventories is bearish for crude oil (UWT) (DWT) (USO) prices.

US Crude Oil Production Near 4-Week High: Another Bearish Factor

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 157,000 bpd (barrels per day), or 1.7%, to 9,510,000 bpd between September 8, 2017, and September 15, 2017.

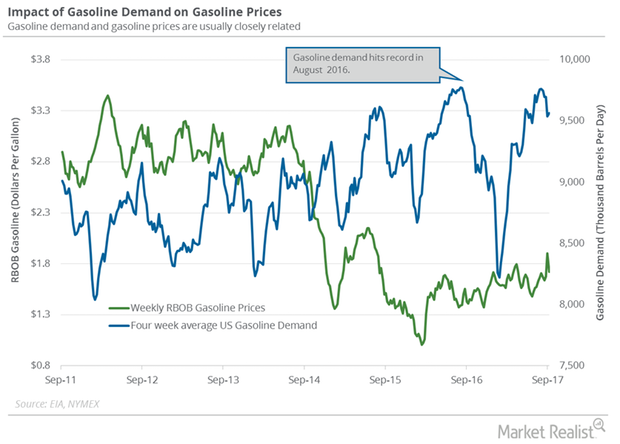

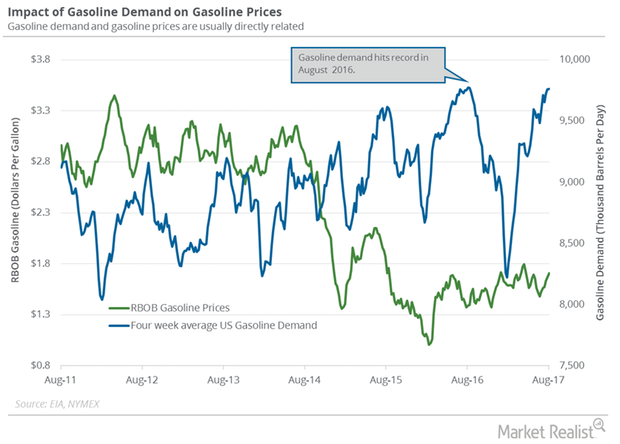

US Gasoline Demand Could Fall in 2018

The EIA estimates that weekly US gasoline demand rose by 456,000 bpd (barrels per day) to 9.6 MMbpd (million barrels per day) on September 1–8, 2017.

Are US Crude Oil Supply and Demand Tightening?

WTI (West Texas Intermediate) crude oil (XLE)(XOP)(USO) futures contracts for October delivery rose 2.2% to $49.3 per barrel on September 13.

US Gasoline Futures Hit 2-Year High despite Inventory Rise

US gasoline inventories The U.S. Energy Information Administration reported that US gasoline inventories rose 35,000 barrels to 229.9 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell 2.1 MMbbls, or 0.9%, from the same period in 2016. For the third time in five weeks, inventories rose. A market survey estimated that US gasoline […]

What to Expect from US Gasoline Demand

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand fell by 45,000 bpd (barrels per day), or 0.45%, to 9,797,000 bpd between July 28 and August 4, 2017.

EIA Upgrades US Crude Oil Production Estimates for 2017 and 2018

The EIA released its Short-Term Energy Outlook report on August 8, 2017. It estimates that US crude oil production could average 9.35 MMbpd in 2017.

Crude Oil Futures Fell despite OPEC’s Meeting and API Data

September US crude oil futures contracts fell 0.4% to $49.17 per barrel on August 8. Brent crude oil futures fell 0.4% to $52.14 per barrel on the same day.

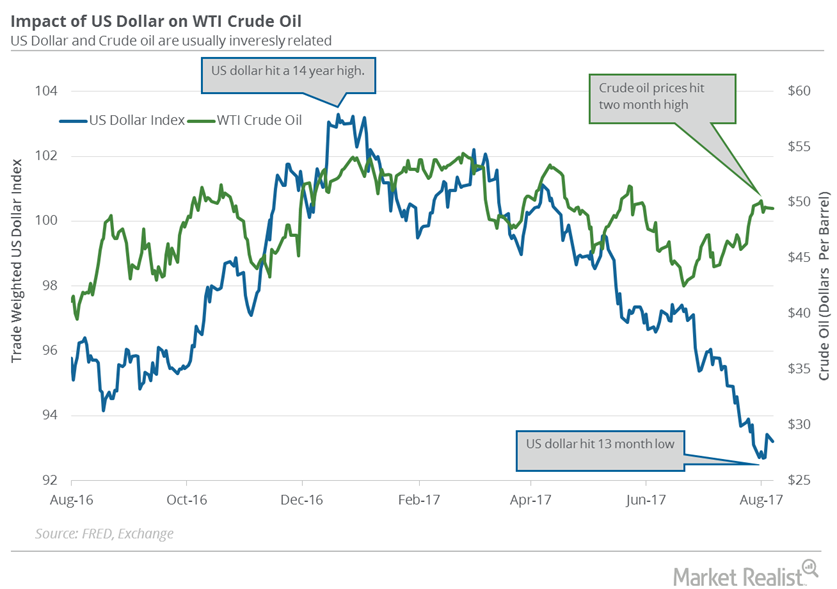

US Dollar Recovers from a 13-Month Low

The US Dollar Index rose 0.77% to 93.7 on August 4, 2017. The US dollar rose due to the better-than-expected rise in US unemployment data.

Will US Crude Oil Production Slow Down in 2018?

The EIA reported that US crude oil production fell by 19,000 bpd (barrels per day) to 9,410,000 bpd on July 14–21, 2017.

US Dollar Is near a 13-Month Low: What’s Next?

The US dollar hit 93.68 on July 21, 2017—the lowest level in 13 months. The US dollar has fallen more than 8% in 2017.

US Crude Oil Production: Biggest Weekly Fall since July 2016

The EIA (U.S. Energy Information Administration) reported that US crude oil production fell by 100,000 bpd to 9,250,000 bpd on June 16–23, 2017.

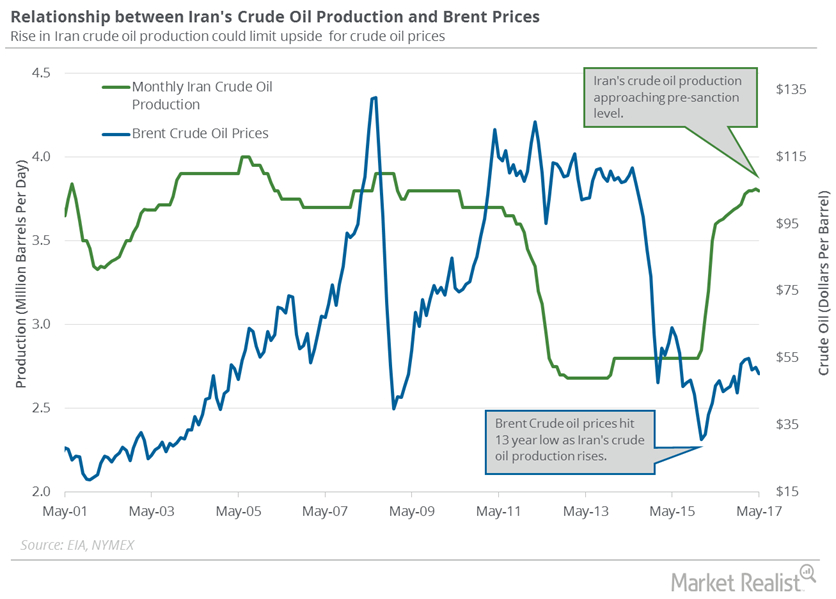

Analyzing Iran’s Crude Oil Production and Export Plans

Iran’s crude oil production is at a seven-year high. Iran was able to scale up production after the US lifted sanctions on the country in January 2016.

Analyzing US Gasoline Inventories and Gasoline Demand

US gasoline inventories rose by 2.1 MMbbls to 242.3 MMbbls on June 2–9, 2017. Inventories rose 0.9% week-over-week and 2.3% year-over-year.

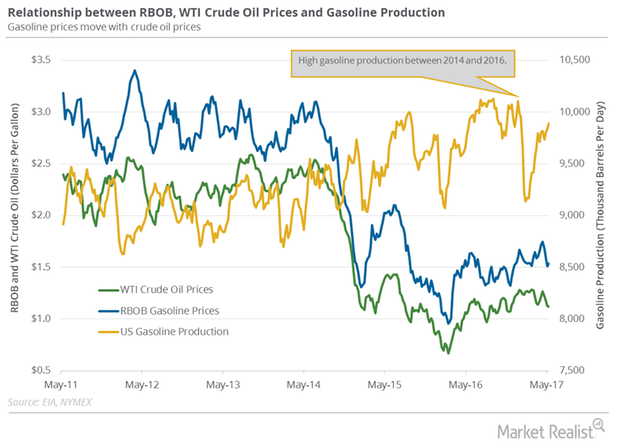

WTI Crude Oil and Gasoline Futures Diverge

US gasoline futures contracts for June delivery fell 0.1% to $1.60 per gallon on May 17, 2017. Prices fell due to a lower fall in US gasoline inventories.

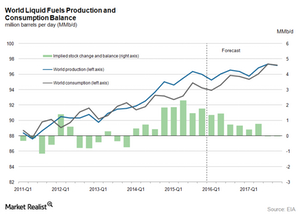

Crude Oil Supply and Demand Gap: Will It Narrow or Widen?

The consensus of slowing US crude oil production will continue to narrow the supply and demand gap as long as demand stays steady.