Monthly US Crude Oil Production Hit May 2016 High

The EIA reported that monthly US crude oil production rose by 60,000 bpd (barrels per day) to 8.8 MMbpd in January 2017—compared to the previous month.

Nov. 20 2020, Updated 11:27 a.m. ET

Monthly US crude oil production

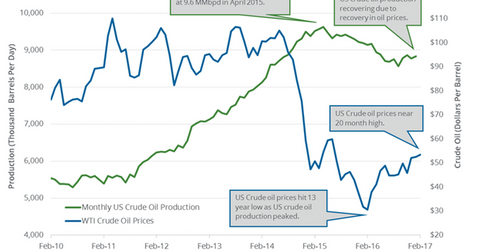

The EIA (U.S. Energy Information Administration) reported that monthly US crude oil production rose by 60,000 bpd (barrels per day) to 8.8 MMbpd (million barrels per day) in January 2017—compared to the previous month. Production rose 0.7% month-over-month, but fell 4% year-over-year. Production rose for the fourth time in the last six months. Production is at the highest level since May 2016. The rise in US crude oil production would pressure crude oil (XLE) (XOP) (DIG) prices. For more on crude oil prices, read Part 1 of the series. Read Why US Crude Oil Production Reached a 13-Month High for more on weekly US crude oil production.

Monthly US crude oil production: Peaks and lows

US crude oil production peaked at 9.6 MMbpd in April 2015. In July 2016, production hit 8.6 MMbpd—the lowest monthly level since April 2014. Since then, US crude oil production has risen ~2%.

Lower crude oil prices, higher break-even costs, and higher production costs for US shale oil producers compared to other oil producers led to the fall in US crude oil production.

However, the recovery in crude oil prices since early 2016 led to the rise in US crude oil drilling activity and US crude oil production in late 2016 and early 2017. The rise in US crude oil production impacts oil producers’ earnings like ExxonMobil (XOM), Synergy Resources (SYRG), Stone Energy (SGY), and Carrizo Oil & Gas (CRZO).

US crude oil production estimates

The EIA estimates that US crude oil production will average 9,210,000 bpd and 9,730,000 bpd in 2017 and 2018, respectively. The EIA estimates that US crude oil production will rise to a 48-year high in 2018. US crude oil production averaged 8,880,000 bpd in 2016.

US production could rise in 2017 due to the following factors:

- technological advances increased US drilling activity—even at lower crude oil prices

- higher crude oil prices in 2017

- implementation of President Trump’s proposed energy policies

The rise in production could pressure US crude oil (VDE) (IEZ) (IXC) prices. So, the US could be the main producer to offset a fall in the crude oil supply from major oil producers’ output cut deal.

Next, we’ll analyze Iran’s crude oil production.